Ten years to sharpen a sword, there are reasons for the ups and downs; Bulls and bears do not love war, it is safe to put it in the bag.

Hello everyone, I am Tommy, a crypto economist, a trader rooted in the currency circle, and I have been studying Ethereum (ETH) for 6 years. First, let me talk about the three things I don't do in my trading: don't trade when tired, sleepy, or exhausted; don't trade when in a bad mood; don't trade when unable to understand the market trends. (In a bad state, it is impossible to perform at a normal level, so judgment of the market will result in significant errors.)

Follow the public account: K-line Life Tommy;

If you want to become a long-term profitable trading winner;

If you have enough experience, know what the advantage is, but find it difficult to trade with the advantage;

If your trading results are always fluctuating (making small profits, losing big money)

Then you need to realize how important it is to have a complete trading system. - Ensuring that assets do not shrink is more important than blindly pursuing profits.

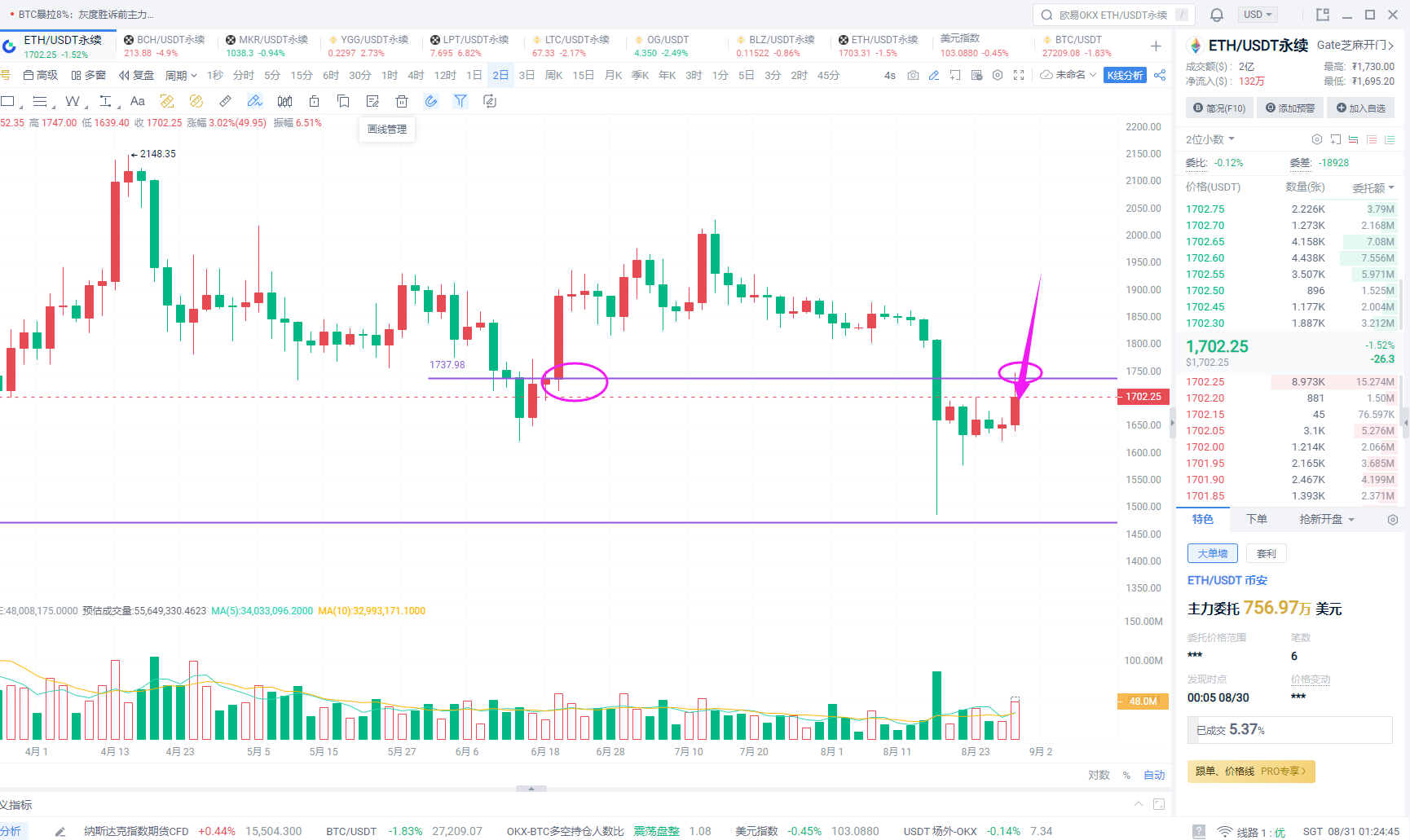

Market News: With the overall market benefiting from the growth of Q2 earnings of US stocks announced yesterday evening, coupled with the additional good news of Grayscale's victory, there was a strong rebound in the short term for US stocks, Bitcoin, and Ethereum. However, it did not show sustainability. Ethereum rose to a high of 1747, and Bitcoin rose to a high of 28100. It then entered into a period of consolidation and oscillation. It can be confirmed that the current long and short positions do not have strong manipulation, but will use market news to stimulate the market to achieve the purpose of selling and absorbing.

Market: After probing the low near 1580 on August 23, it rebounded to the strong support line near 1630, maintaining a range of 1630-1680 for a week. On the daily chart, it broke through the highest point of 1630 with volume and reached 1747. The price rose rapidly in the short term, but the trading volume did not surpass that of the 23rd. The upper pressure coincides with the bottom chip area of the long volume surge on June 20, indicating that there is still a large amount of selling pressure in the long area above. It is still very difficult for the bulls to re-enter the previous chip concentration area. The focus is still on the results of Thursday's PCE and non-farm data in making decisions. Aggressive traders can still enter short positions at high levels, with defense placed at 1750.

On the daily chart, it quickly fell back after entering the long area, and a double top signal appeared in the upper long pressure level. (If you don't understand the application and interpretation of the head pattern of the K-line, you can chat privately)

It will still face a second probe to build a bottom.

The strategies publicly disclosed this month have been perfectly concluded. For those who need to follow up with actual trading, please follow the public account: K-line Life Tommy

The disclosed profits are only for ETH and can be supervised by the entire network. Real-time guidance is the main focus of actual trading data. For details, follow the public account to learn more.

Mainly targeting spot, futures, BTC/ETH/ETC

Expertise: K-line trading

Original trading volume tactics.

Short-term band high and low, medium and long-term trend orders, daily extreme retracement, weekly K-line top prediction, monthly head prediction

Public account QR code

Friendly reminder: The only WeChat public account at the end of the article is created by the author himself!

Please be cautious in distinguishing between true and false, thank you for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。