Preface

As a Layer 2 public chain, Mantle faces extremely fierce competition in the track it operates in. Established "four big players" include Optimism and Arbitrum, which use fraud proof, as well as Zksync and Starknet, which use Zk proof. Even the new players have impressive backgrounds, such as Base built on OP Stack by Coinbase, Linea launched by Consensys as an EVM-compatible chain, and Zk-EVM introduced by Polygon. How can Mantle stand out from the numerous L2 public chains?

Mantle is built on the core of Optimistic rollup and is complemented by the EigerLayer using modular components of the DA layer. It introduces MPC multi-party computation and a more decentralized sequencer to achieve higher TPS and lower costs. These features not only enhance the security of Mantle but also improve its scalability, helping the network achieve faster speeds and lower transaction costs.

Mantle was initially incubated by BitDAO, which has a treasury with over $30 billion in funds, making Mantle relatively well-funded. Conversely, due to the close ties between BitDAO and the centralized exchange Bybit, there are some concerns about the decentralization and independence of Mantle.

As a public chain, how can Mantle ensure its independence through technology and better utilize its financial advantage to build its ecosystem? This article will delve into Mantle's historical background, technical features, current operation, and plans.

01 Historical Background of Mantle

Mantle is an L2 network incubated and managed by the original BitDAO. The background, resources, vision, and BitDAO are closely linked to Mantle's establishment. To understand the historical background of Mantle, we need to start with BitDAO.

BitDAO is one of the largest DAO organizations to date, and its DAO treasury manages assets worth approximately $35 billion, mainly composed of BIT, MNT, ETH, USDC, and USDT. BitDAO was created by the large Singapore-based crypto derivatives exchange Bybit in 2021, and the treasury assets come from fundraising and donations. In June 2021, BitDAO raised $230 million for the first time, with supporters including cryptocurrency exchanges such as Bybit, venture capitalists Peter Thiel, Dragonfly, Pantera Capital, and Polygon. In August of the same year, BitDAO completed an auction through the BIT-ETH pool on SushiSwap's MISO platform, issuing 200 million BIT and raising 112,670 ETH (worth $360 million at the time).

As the biggest supporter of BitDAO, Bybit pledged to donate 0.025% of its futures contract trading volume to the BitDAO treasury on a regular basis. According to estimates provided by Bybit's official data in 2021, the annual donations would exceed $1 billion. A governance proposal in March 2023 showed that Bybit had donated over $600 million worth of USDC/USDT and 177,000 ETH (currently valued at $325 million) to the BitDAO treasury.

BitDAO gains investment income by exchanging treasury assets for token investment projects. From this perspective, Mantle is the largest "investment" of BitDAO, inheriting BitDAO's massive assets and carrying almost all of BitDAO's development vision. The initial conceptual prototype of Mantle was proposed by Bybit's CEO Ben Zhou and other well-known members of the crypto community, including Sreeram from EigenLayer, Dow Jones, and Cooper Midroni. Mantle was initially funded by Bybit and changed to be funded by the Mantle budget managed by BitDAO after the BIP-19 proposal was approved.

In May of this year, through the BIP-21 proposal, the BitDAO brand was upgraded to the MANTLE ecosystem, and the BitDAO token BIT was exchanged for the MNT token. The MANTLE ecosystem will inherit BitDAO's vision and provide support for the development, operation, and ecosystem of the Mantle network.

From the historical background, it can be seen that Mantle has the backing of the massive treasury of the DAO, carrying BitDAO's vision to support DeFi and decentralized tokenized economies. Behind this is the exploration of decentralization by the centralized exchange Bybit, which is powerful in terms of both motivation and resources.

02 Why Are Major Platforms Competing for L2

Platforms with a large number of users have been making layouts in L2 this year: Binance's opBNB, Coinbase's Base, Mantle supported by Bybit, and Linea by Metamask.

With the continuous rise of DEX, the trend of cryptocurrency trading volume shifting from CEX to DEX is evident. Coinbase's second-quarter financial report also confirms this, as its non-trading revenue exceeded trading revenue for the first time, and both year-on-year and quarter-on-quarter trading revenue began to decline. Base, as a Coinbase-launched L2, is a manifestation of its product moving towards decentralization. Binance's L2 layout is more of a strategic intent. For an L2 network to remain active, it needs enough users to use and contribute liquidity. Binance, with the largest global user base of any exchange platform, and with BNBchain having a high level of user activity, can use its large user base to force or incentivize them to use its own Layer 2, thereby helping the network grow rapidly. Users are the moat for the current development of blockchain networks.

L2 itself is also rapidly developing and iterating. The Ethereum Cancun upgrade planned for November will significantly reduce the storage costs of L2. Lower transaction fees and faster user experiences will undoubtedly give rise to more diverse application scenarios.

On the other hand, compliance is also an important issue in the current crypto world. The SEC has debated multiple times whether cryptocurrencies are securities, which may also be the reason why both the Base and Linea teams have stated that they have no plans to issue tokens. In fact, L2 can operate without issuing tokens, and its revenue sources can be simply summarized as gas and MEV income, which are executed by the sequencers of L2. The two largest L2 solutions, Arbitrum and OP, currently use an officially centralized operating mode for their sequencers, and the profits naturally go to the treasury. Coupled with modular infrastructure like OP Stack, L2 will be rapidly deployed under compliance conditions, making L2 almost a deterministic future.

Returning to Mantle, with the tightening of global regulations, cryptocurrency derivative trading platforms are facing transformation: one is to follow the compliance path to cater to regulations, and the other is to take the decentralized path through DAO. Binance chose the former, while Bybit chose the latter. According to Decrypt, the CEO of Bybit expressed a preference for decentralized trading and DAO: "We are really powerless in the face of regulation, but this also shows the importance of decentralized trading. If we want to turn our business from billions to trillions, we cannot exist as a company, but as a 'social phenomenon'." It is in this context that BitDAO emerged, and developing its own L2 network and ecosystem is a step forward for BitDAO.

03 The Predicament of L2 and Mantle's Technical Architecture

The two major technical solutions of Rollup, OP fraud proof and ZK zero-knowledge proof, each have their own advantages and challenges to face. The storage cost of CallData in OP is high, and the computational cost of ZK is also high. In addition, the current mainstream solutions all use centralized sequencers, posing a certain risk of single point of failure. Mantle is a protocol based on Optimistic Rollup, and unlike other Rollups, the modular architecture of Mantle can improve performance in various aspects such as computation and execution. The transaction execution, data availability, and transaction confirmation of the Mantle network all use independent modules, which can effectively improve data availability without affecting network security, optimize the Mantle network journey, and allow developers to deploy contracts in a relatively low-cost and more efficient ecosystem.

3.1 Mantle introduces a modular data availability layer, making it possible to significantly reduce transaction costs

In the current blockchain architecture, Optimistic Rollup requires a high CallData cost to submit a large amount of transaction data to Ethereum's data availability layer. With the growth of transaction volume, this part of the cost accounts for 80-95% of the total cost, severely restricting the cost efficiency of Rollups.

Mantle, as an emerging Layer 2 solution, has successfully reduced operating costs by introducing the modular EigenLayer as an independent data availability layer. EigenLayer is a low-cost, efficient off-chain data availability network that allows Mantle to submit only the necessary state roots to the Ethereum mainnet, with a large amount of transaction data stored in EigenLayer.

As the first data availability module, EigenLayer's organic integration with Ethereum ensures that Mantle can guarantee security while achieving ultra-low transaction fees. This breakthrough addresses the technical challenge of "high security and low scalability" in current Layer 2 solutions. EigenLayer also provides a mechanism for "repeated staking of ETH," which outputs the security of Ethereum's collateral assets to external protocols, potentially providing Mantle with security guarantees in the tens of billions of dollars. This significantly lowers the threshold and cost for Layer 2 networks like Mantle to establish their own security models. Overall, EigenLayer's modular data availability layer can separate the high cost of storing and submitting data from the Ethereum mainnet, significantly reducing transaction costs for Mantle while ensuring security, potentially increasing throughput by several orders of magnitude.

Additionally, EigenLayer supports dual staking, allowing $MNT and $ETH to operate as staking tokens together. Through dual staking, $MNT can be used by validators as collateral to provide security and data availability for the network, while also being used as gas.

3.2 Mantle Shortens Fraud Proof Time and Improves Transaction Speed with MPC Nodes

For the OP solution, improving transaction finality and fraud proof speed is key to achieving low latency and high throughput. The validation nodes in Mantle use multi-party computation (MPC) technology. MPC nodes require staking of $MNT tokens, and violations will result in penalties and token deductions, ensuring the compliance of the nodes.

Mantle does not directly submit transaction batches to Ethereum like traditional Optimistic Rollup. Instead, MPC nodes reach consensus, generate state roots with multisignatures, and then submit them to Ethereum. This effectively shortens the time for fraud proof:

- MPC nodes validate transactions to prevent erroneous transactions from entering the Rollup, reducing the frequency of fraud proofs.

- The MPC consensus mechanism reduces the challenge time for erroneous transactions in Rollup to 1-2 days, significantly improving finality.

Although MPC verification is not as reliable as zero-knowledge proof, its lower threshold makes it suitable as a transitional solution for Layer 2. It utilizes node staking and penalty mechanisms to ensure transaction correctness to a certain extent. Compared to traditional Rollup, Mantle better balances security, speed, and cost, significantly improving the throughput and transaction confirmation speed of the Ethereum ecosystem.

3.3 Benefits of Decentralized Sequencers in Mantle

In Layer 2 solutions, sequencers are responsible for collecting transactions, computing states, and generating blocks, making them crucial for the overall network security. Mantle's use of a decentralized sequencer cluster replaces the single centralized sequencer in traditional Rollup, providing the following benefits:

- Improved availability: Decentralized sequencers eliminate the single point of failure risk caused by central node failures. Mantle can continue to operate efficiently without incidents of chain downtime caused by centralized sequencer crashes.

- More reliable consensus: Centralized sequencers are susceptible to manipulation and scrutiny by operators. Mantle significantly reduces this risk by using a permissionless decentralized sequencer cluster, providing a fairer and more trustworthy consensus.

- Stronger incentive compatibility: Decentralized sequencers are driven by rewards, ensuring their long-term sustainability. In contrast, centralized sequencers face challenges in transitioning to public goods.

- System-level security enhancement: Decentralized sequencers increase the difficulty of attacks on the system. Additionally, their consensus process does not require trust, further enhancing overall security.

- Evolution towards complete decentralization: Decentralized sequencers are an important step for Mantle's future evolution towards a fully decentralized network. They provide the potential for community governance and drive the development direction of blockchain.

Overall, decentralized sequencers eliminate centralization risks, providing more efficient, reliable, and secure block generation. This is one of the significant advantages of Mantle compared to traditional Rollup and will be an important direction for the evolution of blockchain technology. It brings a more robust network and provides better security for users.

04 Current Operation and Roadmap of Mantle

4.1 Ecological Incentives of Mantle

Mantle has a strong ecological foundation, including over $2 billion in funds, including the BitDAO treasury, and a large user base, laying a solid foundation for the development of the Mantle ecosystem.

To better incentivize ecological development, Mantle has launched a series of ecological incentive programs. First is the $200 million ecological fund. The four main goals of this fund are to attract developers to the Mantle ecosystem, promote venture capital, support ecosystem prosperity, and achieve investment returns. Sufficient ecological funds can attract a large number of high-quality projects to deploy on Mantle, enriching its L2 ecosystem. Second is the collaboration with the exchange Bybit. High-quality projects in the Mantle ecosystem have the opportunity to be recommended for listing on Bybit, gaining a wider user base and liquidity, providing strong long-term development for the projects.

4.2 Planning in the LSD Field for Mantle

Mantle's treasury holds reserves of over 270,000 ETH, providing strong financial strength for its activities in the LSD field. Based on this strong financial backing, Mantle will strategically collaborate with several top LSD protocols to form a powerful ecological force, jointly promoting the research and application of LSD solutions based on the Mantle network, significantly increasing the user and asset scale of the Mantle network. This ecological collaboration not only generates synergistic network effects but also optimizes capital utilization efficiency. This will significantly increase the adoption rate and influence of the Mantle network.

First, Mantle plans to launch the Mantle LSD liquidity ETH deposit protocol, which will be a decentralized protocol based on the Ethereum mainnet. Users can deposit ETH into the protocol to obtain interest-bearing mntETH tokens. The token retains the price and liquidity of ETH while earning staking rewards. Mantle LSD can leverage the unique advantages of the Mantle ecosystem. Firstly, the Mantle treasury currently holds approximately 270,000 ETH, providing a huge initial deposit scale and liquidity advantage for Mantle LSD. The total market value of mntETH after issuance is expected to reach several billion dollars, making it a top-three protocol in the decentralized LSD field. This not only brings scale effects to Mantle LSD itself but also provides positive incentives for the use and circulation of mntETH on the second-layer network Mantle.

Secondly, mntETH can be used directly within the Mantle network, and can even serve as the ETH version of the network. This will significantly expand the use cases of mntETH and enhance its stickiness within the Mantle ecosystem. This is a unique advantage compared to other LSD projects and can enhance user stickiness to the Mantle network. Furthermore, Mantle LSD can maximize the reuse of resources such as the established community, governance structure, and brand influence within Mantle, significantly reducing operational costs and risks, optimizing capital utilization efficiency. Additionally, Mantle LSD will operate within Mantle's overall governance framework, ensuring its long-term competitiveness and sustainability. Finally, from a technical perspective, Mantle LSD adopts a simple system architecture, reducing complexity risks and making it easy to be accessed and compatible with other applications and ecosystems, laying the foundation for cross-chain interoperability and ecosystem expansion.

In addition to issuing mntETH, Mantle will strategically collaborate with top DeFi protocols, such as the collaboration with Lido Finance to establish the stETH ecosystem on Mantle Layer 2. Mantle is also considering collaborations with protocols such as Pendle and StakeWise. Furthermore, Mantle is exploring direct staking and other income schemes, and has proposed the establishment of an economic committee as a sub-DAO to improve asset management efficiency.

Mantle has formulated a systematic LSD strategic plan through the issuance of mntETH, strategic collaborations with high-quality ecological resources, and leveraging its financial and governance advantages. This not only enriches its DeFi ecosystem but also brings more unique user stickiness to the Mantle network. Compared to other L2 solutions, Mantle has significant advantages in this regard, which will strongly drive the rapid growth and cross-chain interoperability of the Mantle network.

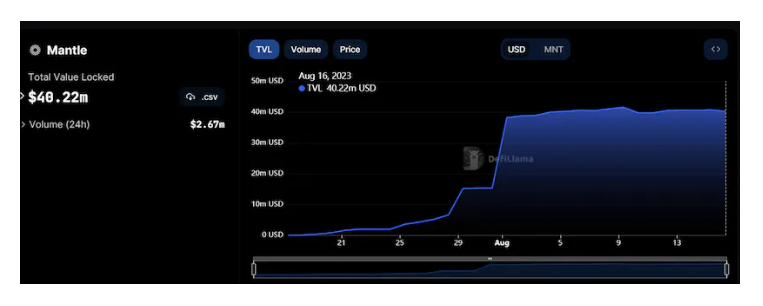

Currently, Mantle has reached a TVL of $40 million, and with the expansion of ecological incentives and strategic LSD collaborations, the ecological projects and TVL of Mantle are expected to grow rapidly.

05 Token Economics

5.1 Token Overview

The $MNT token will have a dual role in the future ecosystem of Mantle: it will serve as both a governance token and a utility token. This means that holders of $MNT can participate in ecosystem governance by holding the token and can also use the token for various interactions within the ecosystem.

The predecessor of the $MNT token is $BIT. After the governance proposal for rebranding to Mantle was approved, $BIT tokens were exchanged for $MNT tokens at a 1:1 ratio. The total supply of $BIT is 10 billion tokens, and it has already been fully issued. According to the 1:1 exchange ratio, the theoretical total supply of $MNT will also be 10 billion tokens. However, in the approved MIP-23 proposal, 3 billion $BIT tokens from the Mantle Treasury will not be exchanged and will be transferred directly to a burn address. Therefore, the theoretical total supply of $MNT tokens is currently 7 billion tokens.

Initial Token Allocation Structure

$BIT, as the governance token of BitDAO, has a total supply of 10 billion tokens, distributed as follows:

- 60% reserved for Bybit (45% released according to the ownership schedule)

- 30% for the BitDAO treasury

- 5% for startup partners

- 5% allocated through sales

With the approval of BIP-21 (rebranding to Mantle) and MIP-22 ($BIT 1:1 conversion to $MNT), $MNT has become the new governance token for BitDAO. Subsequently, the approved MIP-23 announced that the 3 billion $BIT held by the Mantle Treasury will not be converted to $MNT and will be sent to a specified burn address, resulting in a direct deflation of the $MNT token supply by 30% (reduced from the original 10 billion to 7 billion tokens).

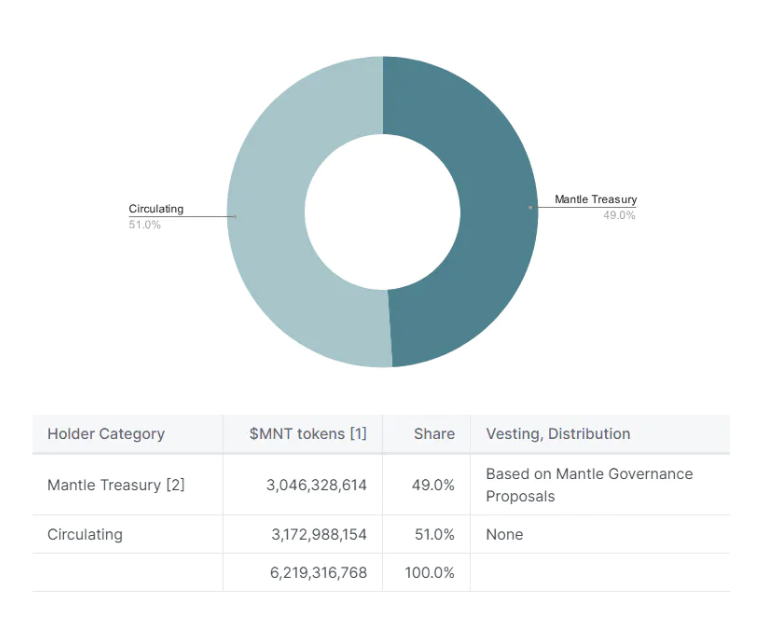

According to the official snapshot of the initial distribution of $MNT provided on July 7, 2023, the distribution of $MNT is as follows:

From the distribution chart, it can be seen that the Mantle Treasury holds nearly half of the $MNT tokens. The official project documentation also explains this: the $MNT held by the Mantle Treasury can be considered "non-circulating." The allocation of $MNT tokens in the Mantle Treasury must comply with the Mantle governance process, and the budget, fundraising, and allocation processes follow strict procedures.

After the initial allocation, the sources of $MNT in the Mantle Treasury include:

- Periodic donations from Bybit

- Mainnet gas fee revenue for Mantle

According to official documentation, the $MNT in the Mantle Treasury is expected to be primarily used for:

- User incentives

- Incentives for technical partners

- Core contributor teams and advisors

- Other purposes such as acquisitions, token swaps, inventory sales, and other transactions

5.2 Token Functions

Currently, $MNT is expected to serve two functions:

- Governance token

- Utility token

As a governance token, each $MNT token carries equal voting weight, allowing users to participate in project governance decisions and influence proposal decisions based on the amount of tokens held. The community aims to actively involve token holders in community governance to ensure decentralization and shape the future of the Mantle ecosystem.

As a utility token, $MNT will serve as the gas token on the Mantle network, requiring $MNT for all interaction actions on the network. Additionally, $MNT tokens can be used as collateral assets for Mantle network nodes, further incentivizing participation and contributions to the network's security and stability.

5.3 Valuation Analysis

Due to Mantle's mainnet being in the alpha stage and the infrastructure and application ecosystem still in development, there is insufficient data to conduct a valuation analysis. The following qualitative valuation analysis is based on token circulation.

- Mantle DAO treasury holds mainstream high-quality assets, providing strong market-making support

From the following image (top ten DAO organizations' fund holdings), it can be seen that although the treasury funds of Mantle rank third among all DAOs, compared to the top two DAOs (Arbitrum DAO and Uniswap), Mantle has a significant advantage. The treasury of Arbitrum and Optimism is almost 100% in their own governance tokens, while ETH, USDC, and USDT account for 22.1% of the BitDAO treasury. This indicates that the Mantle DAO will have stronger market-making capabilities compared to other DAOs and will have more high-quality assets to support ecosystem development, providing a more solid foundation for the valuation of the MNT token.

- Mantle network operations involve multiple token staking scenarios, effectively reducing token circulation

Unlike other L2 solutions that use ETH as the gas token, MNT is used as the gas token for the Mantle chain. As long as the ecosystem develops steadily and on-chain interactions are active, MNT will be steadily consumed without the need for other artificial controls.

There are several scenarios in Mantle network operations that can reduce the circulation of MNT:

- Staking MNT tokens to become Mantle DA nodes

- Staking MNT tokens to become sequencer nodes

- Staking MNT tokens to become multi-party computation (MPC) validators

Additionally, the planned LSD platform will also use MNT as the primary LP staking token.

- Mantle DAO has a long-term plan for the stability and appreciation mechanism of the MNT token

In April of this year, BitDAO passed the BIP-20 proposal, which modified the donation method for Bybit, changing from donating a floating amount of BIT based on the exchange ratio to donating a fixed amount of BIT monthly, with the amount halving every 12 months, lasting for 48 months. Donated BIT is retained in the DAO treasury and may be burned through proposals when necessary. This method makes the circulation of BIT more predictable and further reduces the concentration of BIT holdings, reducing the tendency for the market to view BIT as the Bybit exchange token.

From the BIP-22 proposal, it can be seen that the DAO has been considering mechanisms for the stability and appreciation of the MNT token, including:

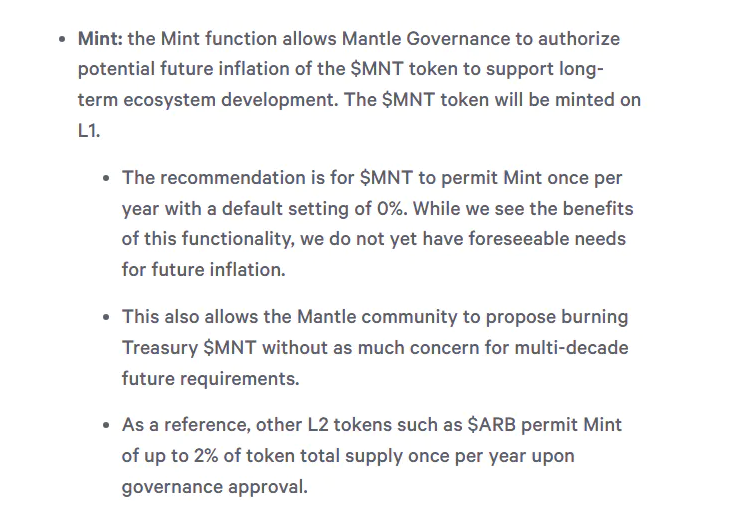

- Controlling potential inflation by potentially destroying MNT tokens in the treasury

- Controlling the annual minting of new MNT tokens, not exceeding 2% of the total supply, similar to the ARB token model

06 Risk Warning

Centralization Risk

From the distribution of token holdings, both the initial $BIT and the current $MNT tokens have a relatively high level of concentration, which is a common concern in the market. However, the MantleDAO is actively addressing market concerns, as seen in the BIP-20 proposal, which clearly outlines "Bybit's future 4-year donation of BIT tokens" (BIT has been converted to MNT). The donated BIT tokens from Bybit are in a state of pending destruction and are considered non-circulating, gradually reducing Bybit's token holding proportion. In terms of the number of holders, there are already 70,000 MNT token holding addresses (including L1 and L2). In terms of liquidity, MNT is listed on multiple DEXs such as Uniswap, with liquidity in the tens of millions of dollars, providing ample liquidity options for MNT holders.

Community Governance Risk

Currently, the Mantle Treasury holds approximately 49% of the total $MNT tokens. The official documentation states, "These tokens can be considered non-circulating" and "these tokens will be used to support ecosystem development and application construction." With the recent approval of the MIP-24 and MIP-25 proposals, the DAO has established a dedicated economic committee and LSD strategy proposal, indicating the DAO's efforts in optimizing community governance.

Additionally, according to information from the official source, the Mantle Treasury is managed by Mantle Governance and, at the current stage, is partially managed as DAO assets, with usage decisions established by the DAO through proposals. Currently, the Mantle Treasury does not participate in Mantle governance voting.

Technical Security Risk

Mantle is an L2 protocol based on Fraud Proofs (Optimistic Verification), and the current Mainnet Alpha version of Fraud Proofs is still under development.

The Data Availability layer, MantleDA, is a core technical component of the Mantle Network, rewritten from Fork EigenDA. Currently, MantleDA is the version of Mantle before integration into the EigenDA mainnet and will be migrated to EigenDA after the EigenDA mainnet goes live.

The Mainnet Alpha stage has already implemented a Threshold Signature Scheme (TSS) with a Slashing mechanism. There are clear settings for two types of misbehavior: if a node verification is absent or if there is malicious signing behavior, it will be recorded by the TSS administrator. In the case of increased instances of node verification absence, the TSS administrator will submit a proposal to slash the staked portion of that node, subject to agreement by the majority of other nodes (based on staking ratio). Similarly, if a TSS node submits fraudulent data to the network, it will be recorded by other nodes and reported to the TSS administrator, who will then submit a penalty proposal to slash the staked portion of that node, subject to agreement by the majority of other nodes (based on staking ratio).

However, according to L2Beat, the fraud proof system in the Mantle network is currently disabled, and the slashing conditions in Mantle DA are also disabled.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。