Ten years to sharpen a sword, there are reasons for the ups and downs; Bulls and bears do not love war, it is safe to put it in the bag.

Hello everyone, I am Tommy, a crypto economist, a trader rooted in the currency circle, and I have been studying Ethereum (ETH) for 6 years. First, let me talk about the three things I don't do in my trading: don't trade when tired, sleepy, or exhausted; don't trade when in a bad mood; don't trade when unable to understand the market trends. (In a bad state, it is impossible to perform at a normal level, so judgment of the market will be greatly erroneous.)

Follow K-line Life Tommy WeChat Official Account: Opportunities are created in segments every day, there is no need to rush for a moment. The original intention has never changed. While creating profits, focus on professional risk control, make investments valuable, go for the long term, and not disappoint the encounters and trust in the past. I am available 24 hours a day for real-time guidance. If you have any questions, you can leave a message. All strategy ideas are open and free, and the only designated official account to follow. Do not estimate the market with your own financial resources, and do not let the amount of profit or loss affect your determination! - Tommy

Review: Overnight, the A-share market triggered a major positive news. On August 27th, the Ministry of Finance announced that "the stamp duty on securities trading will be halved from August 28, 2023." Subsequently, the China Securities Regulatory Commission and the three major exchanges followed up with notices, including the phased tightening of IPOs, the implementation of pre-communication mechanisms for large-scale financing, further regulation of share reduction behaviors, and the reduction of financing margin ratios, to deliver a "combination blow" to invigorate the capital market and boost investor confidence.

===================================================================================================================================================

Last Friday, Federal Reserve Chairman Powell said that further rate hikes may be needed, and the market's expectation of another rate hike by the Federal Reserve within the year has increased, helping the dollar to briefly hit a near three-month high of around 104.44, which hindered the rebound of Bitcoin. However, Powell's hawkishness was slightly less than the market expected, and concerns about a global economic recession lingered, causing the overall market to enter a narrow range of fluctuations again. There are few economic data on this trading day, but this week will see the release of the US August PCE data and non-farm employment report, so position adjustments need to be made in advance.

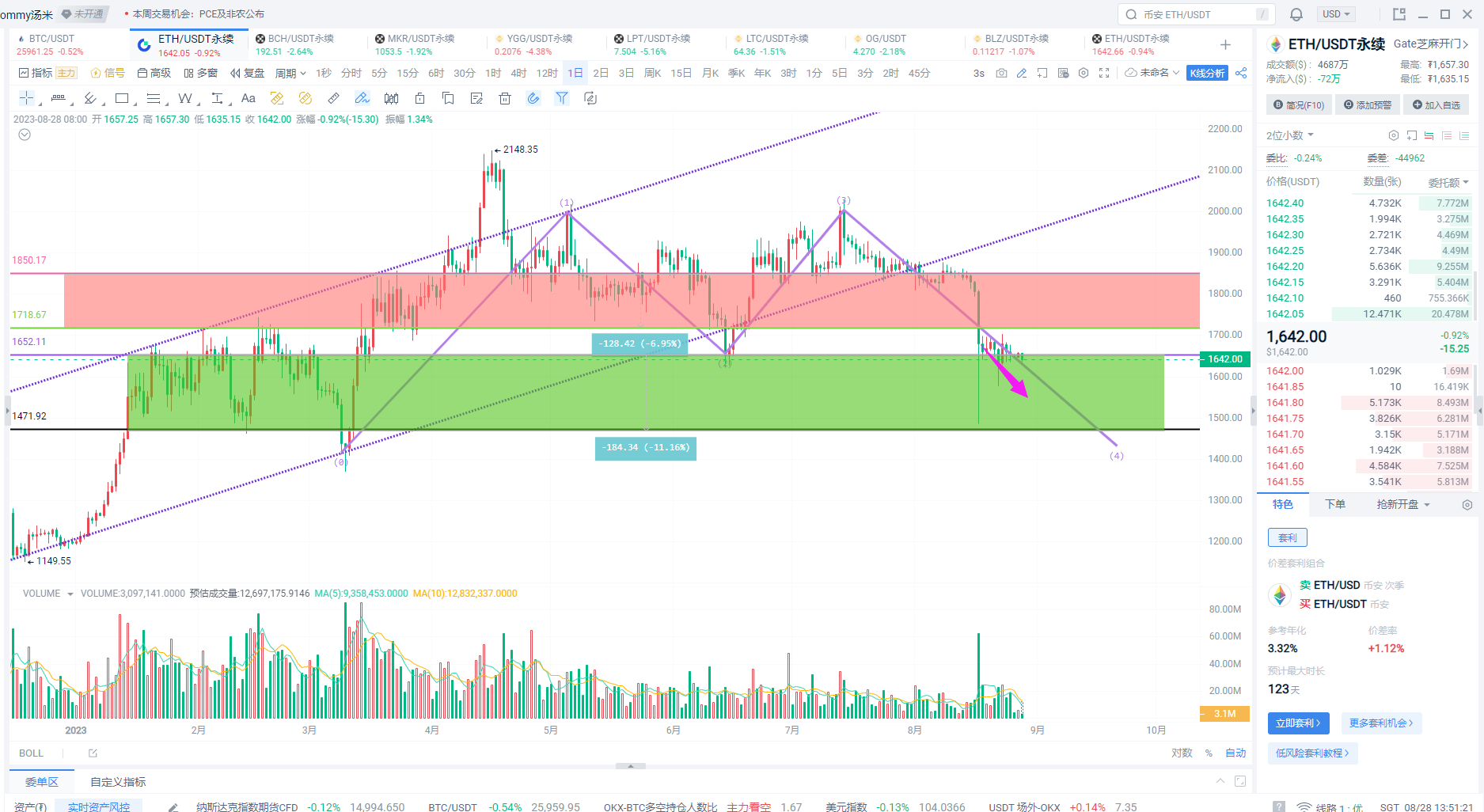

On the market: From August 23 to the present, Ethereum has continued to fluctuate in the range of 1680-1630, and there has been no significant increase in trading volume. The increase in market funds has clearly fled after the August 18th event, and there have been no new bottoming funds for the bulls in the short term. On the other hand, the stock market in the peripheral market has seen a concentration of positive news, and funds have temporarily shifted. The direction of the future still needs further confirmation, with a focus on Thursday's PCE and Friday's non-farm data.

The 1580 level below the weekly level will be the last straw for the short-term bulls to counterattack.

Once the second solid bullish candle enters the bearish area, the bears will accelerate their release below, and the bulls will also give up their short-term stabs. This is also an opportunity for us to enter the spot market.

The direction of the long and short positions needs to be confirmed within the short-term neckline range. If the breakthrough is 1680-1710, you can enter the long position, otherwise, if it breaks below 1630-1600, you can enter the short position and look at the strong support at 1580-1560 below.

The short-term bears gradually probe the strong bearish area, and once the volume is confirmed, the market will accelerate its decline for the second time.

The strategies disclosed this month have been perfectly concluded. Those who need to follow up with actual trading can follow the WeChat Official Account: K-line Life Tommy

The disclosed profits are only for ETH and can be checked online. Real-time guidance is the main focus of actual trading data. For details, follow the WeChat Official Account to add and understand.

Mainly targeting spot, futures, BTC/ETH/ETC

Expertise: Candlestick trading!

Original trading volume battle tactics.

Short-term swing high and low, medium and long-term trend orders, daily extreme retracement, weekly K-line top prediction, monthly head prediction

WeChat Official Account QR Code

Friendly reminder: The WeChat Official Account at the end of the article is created by the author himself!

Please be cautious in distinguishing between true and false. Thank you for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。