"Weekly Editor's Picks" is a "functional" section of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, the Planet Daily also publishes many high-quality in-depth analysis content, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some high-quality articles worth reading and collecting from the content published in the past 7 days every Saturday, bringing new inspiration to you in the encrypted world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read together:

Investment and Entrepreneurship

X-explore: In-depth Study of Airdrop Masters' Behavior Patterns, What Can We Learn from Them?

The author has selected 5 projects with "more than 100,000 airdrop addresses" and "total airdrop value exceeding $140 million," which are Uniswap, ENS, Optimism, Blur, and Arbitrum, in order to find airdrop masters and their subsequent targets.

Airdrop hunters' trading volume on DEX and NFT far exceeds that of ordinary users, most of whom are early Ethereum users. Well-designed airdrop rules can have a positive impact on airdrop hunters. Most hunters tend to choose projects with widespread influence and visibility in their field, and they clearly prefer to choose Layer 2 projects. Their next targets may be:

DeFi: Uniswap, SushiSwap, 0x, Metamask Swap, Balancer, 1inch, Paraswap, Aave, Rarible, InstaDApp, dydx, Compound;

NFT: Opensea, Blur, LooksRare, X2Y2, Foundation;

Layer 2 solutions and cross-chain protocols: Arbitrum, Polygon, ZkSync lite, Optimism, HOP, ZkSync Era, Starknet;

DApp: DeBank.

If BNB holders participate in Binance Launchpool without fail starting from 2021, and exchange the tokens for BNB each period, the amount of BNB will increase by approximately 13.87%. At the same time, one of Binance's financial products—BNB yield pool—has an annualized return of about 0.5%, which will automatically invest users' money in Launchpool. In addition to enjoying a fixed return of 0.5%, there is also additional Launchpool income, totaling 13.87% + 1.5% = 15.37% over three years.

Compared to Binance Launchpad projects, participating in Binance Launchpool does not require spending funds, so it is more suitable for users who already hold BNB and stablecoins for various reasons. Buying on the first day and selling on the next day may be the best solution for Binance Launchpool. Timing the bottom of Binance Launchpool projects may also require judgment on the trend of BTC. Binance Launchpool is a stable financial lottery for BNB holders. Binance is leveraging its industry position and influence to empower BNB holders.

In the bear market, venture capital interest in cryptocurrencies has significantly slowed down. 10T Holdings, a well-known cryptocurrency investment institution with 3 funds, is currently "out of ammo," managing $1.2 billion in assets and can only wait for the next bull market or further opening up of IPOs for cryptocurrency institutions. However, the two founders behind it are currently raising funds for their new funds and will continue to focus on the cryptocurrency industry.

Portfolio representative

The population dividend has unleashed the growth potential of the Vietnamese cryptocurrency market, with cryptocurrency adoption ranking first for two consecutive years. Vietnam has a high mobile internet penetration rate, and the cost for users to learn Web3 is relatively low. Currently, the Vietnamese government does not have a clear regulatory legal framework for cryptocurrencies, so such asset trading is still in a gray area.

Mainstream international exchanges that have early layouts in Vietnam include: Binance's C2C supports trading cryptocurrencies with Vietnamese Dong (VND) using credit cards, OKX supports Vietnamese users to trade with VND, MEXC is known for its diverse asset types in Vietnam, Bybit's trading volume in the Vietnamese market doubled in 2022, Huobi has quietly cultivated the Vietnamese market, and BingX has established a foothold in the local market through cooperation with the Vietnamese community KOL. Local Vietnamese trading platforms are mostly OTC, such as Remitano, a peer-to-peer trading platform, and BitcoinVN, a Vietnamese OTC trading platform. The pattern of cryptocurrency trading in Vietnam is dominated by overseas platforms, and users prefer large platforms with high security. In Vietnam, Binance has the largest market share, followed by Bybit, OKX, MEXC, and local platform Remitano.

Entering Vietnam is still a good opportunity, and operational strategies need to be tailored to local conditions.

In-Depth Analysis: How Did Blockchain Data Tool Dune Rise Rapidly?

The magic of Dune lies in the fact that they did not adopt common methods in Web3, such as airdrops, "paying attention" for community growth, or using their own tokens for earning models (they did not issue tokens). They relied on many traditional public relations and brand awareness strategies, which easily dominate search engine result pages, all stemming from the way they built their product. Most of their traffic comes from direct visits, with very little from Google searches.

Dune is helpful to both the supply and demand sides of blockchain data visualization—on the demand side, it supports content creators, enhancing public relations and visibility. On the supply side, Dune allows data scientists to create visual effects. Then, the supply and demand sides of blockchain data "freely marry." Dune helps data scientists gain attention and obtain paid work. Dune also helps those in need of analysis (venture capitalists and content creators) obtain detailed information about the entire industry.

Dune's profit model is to provide paid plans.

The areas that the author believes Dune has overlooked are: domains with high weight but very low organic traffic. To increase traffic, Dune should use the platform to create data outputs related to what people search for.

The success of Dune truly boils down to two key factors: having an excellent product that benefits multiple groups, and allowing people to use their product for free, thereby promoting free public relations.

DeFi

A New Narrative for DeFi? Smart Contract Security New Model without Oracles

The introduction of oracles creates a dependency on external data, which can bring potential risks. Building DeFi on un-upgradable source code (Primitives) means that, apart from the contracts deployed on the blockchain, it cannot depend on any external factors, such as governance, contract upgradability, and oracles. There are very few DeFi protocols that meet this basic definition, with the most representative being Uniswap V1. However, from a security perspective, even Uniswap V2 and V3 do not qualify, as they allow governance over certain functions, such as closing protocol fees and introducing fee tiers for pools.

Recently, many lending protocols without oracles have been discovered, such as Ajna, Ethereum Credit Guild, MetaStreet's Automated Tranche Maker, and the hybrid protocol Blend launched in collaboration with Blur and Paradig.

The FREI-PI (Function Requirements-Effects-Interactions + Protocol Invariants pattern) model is exemplified by dYdX's SoloMargin contract (source code), which is an excellent example of this pattern for early lending markets. This is the only lending market in the early lending market without any market-related vulnerabilities.

Shima Capital CTO: Reflecting on the Curve Incident, Why Do We Need Runtime Protection?

Runtime Protection is a security technology that protects software applications from malicious attacks during runtime. Its principle is to perform real-time detection during the actual execution of the code, analyzing the actual behavior of the program to protect it from malicious data and attacks.

One way is through Aspect programming, designed by Artela blockchain network, which can switch execution contexts during the lifecycle of any smart contract transaction to perform advanced checks on the real-time state of the program. Artela provides a unique design for runtime protection through Aspect and EVM compatibility, and it has the potential to become the future foundation of secure encrypted smart contracts.

GameFi

Mint Ventures: Top Game Guilds in the Bear Market, Some Growing Strong, Some Quietly Falling Behind

Game projects have only three demands: user acquisition, user engagement, and promoting in-game consumption. Web3 players have only two demands: a sense of companionship and initial capital.

Driven by the fact that every Ponzi scheme cannot replicate Axie's popularity and every game's demand for a sense of companionship cannot be strong enough to charge through methods like live streaming (the revenue source of traditional game guilds), guilds are transitioning from "serving players" to "serving game projects": on one hand, guilds hold a large number of player resources, and on the other hand, guilds have a large amount of funds in their treasury, which can be invested to enjoy the growth dividend of Web3 games.

Business data comparison: YGG and MC are still active, while GF has fallen behind in terms of volume; Financial situation comparison: MC has balanced financial and business development, YGG has strong business capabilities but lacks financial strength, GF's market value is less than the value of its holdings in blue-chip + stablecoin assets; DAO construction and governance capability comparison: Merit Circle is far stronger than its competitors.

Overall, business capabilities: MC has a more diverse business, YGG has a wider user base, GF is falling behind; External cooperation and investment capabilities: MC is in the lead, YGG is second in terms of scale and returns, GF has the smallest scale and unknown returns; Risk control capabilities: MC is in the lead, GF is second, YGG's performance is poor; Valuation comparison: MC has entered a high position, YGG is returning to normal, GF's weak business performance has led to the market value being stable coin + blue-chip total value.

SocialFi

The article chronicles the "project history" of SocialFi over time: from early platforms like Steemit, Peepeth, Rally, and other Roll+ social token platforms, to DeSo in 2021, and protocols like Subreddit, Farcaster, Lens Protocol, and Cyber Connect in 2022, and most recently, friend.tech.

Wallet

Binance Research Abstract Report Interpretation: Development Status, Ecosystem Map, Key Use Cases

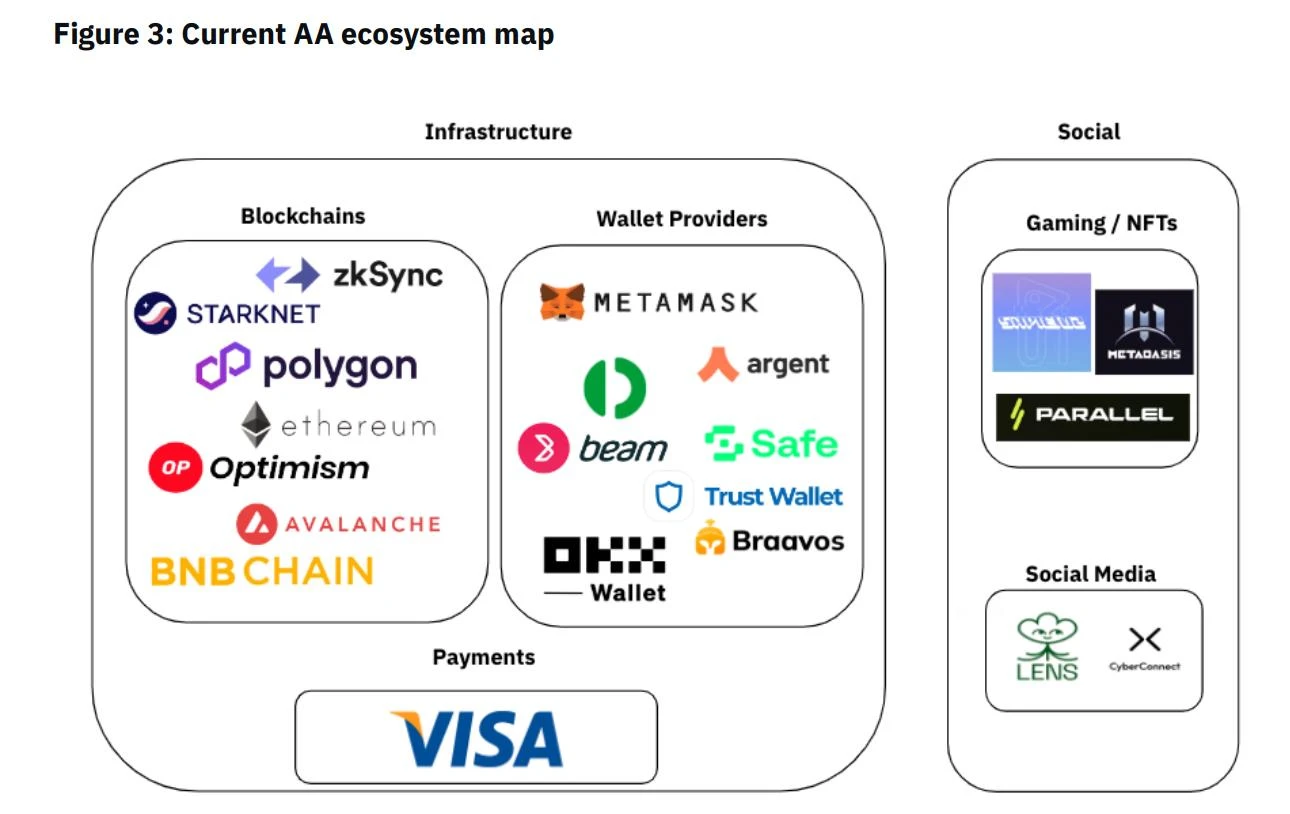

StarkNet and zkSync have launched native account abstraction solutions, and wallet providers like Argent and Bravoos are also seeking to provide these solutions.

Use cases such as traditional institution Visa are also pioneering in this area, and protocols like Lens Protocol and CyberConnect have also adopted account abstraction.

AA Ecosystem Map

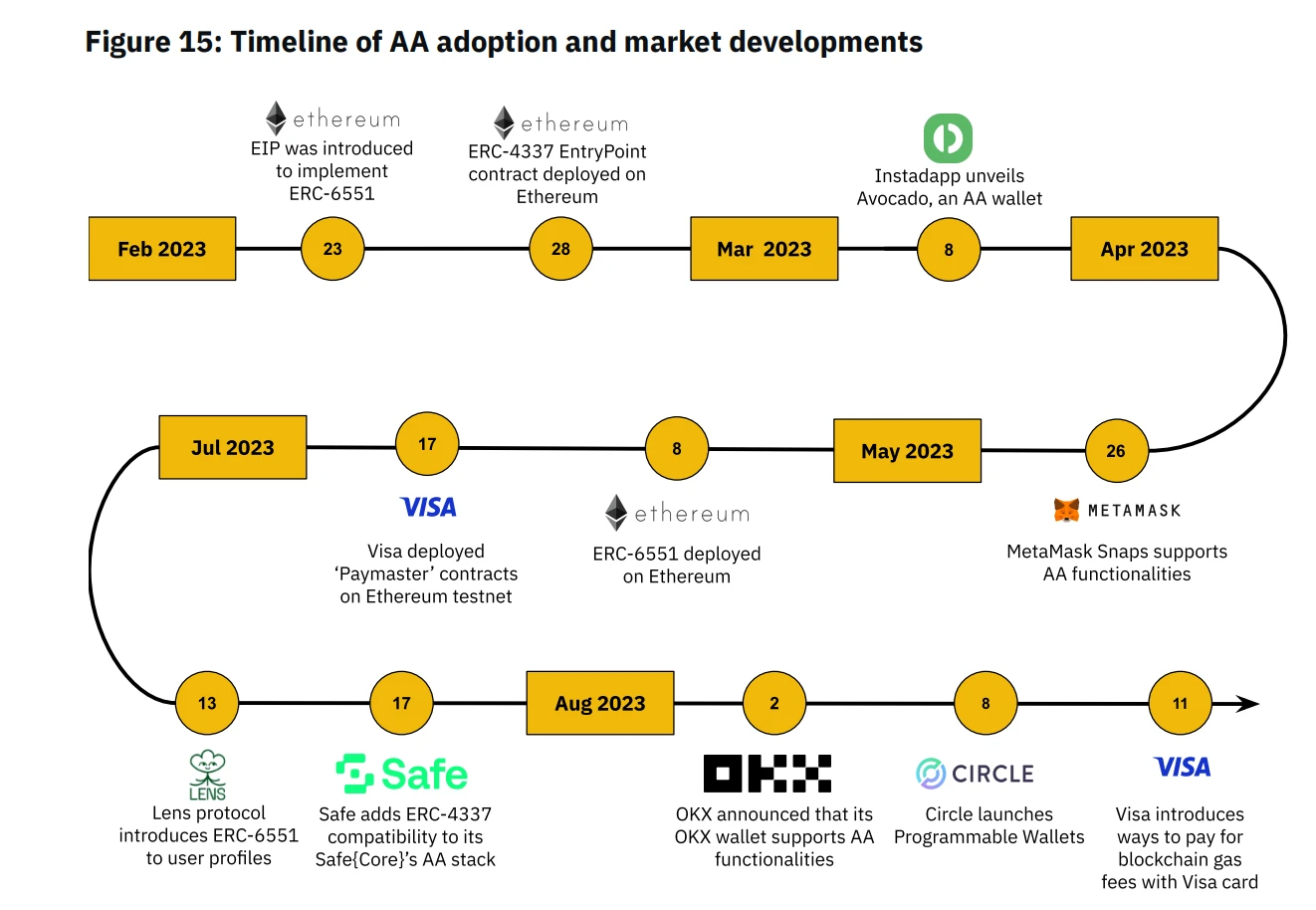

A summary of key events in the six months from AA's proposal to adoption

Storage

EthStorage is the first Layer 2 solution that provides programmable dynamic storage based on Ethereum data availability, which can extend programmable storage to hundreds of TB or even PB at 1/100 to 1/1000 of the cost.

Its technical features include: highly integrated with ETH, L2 decentralized solution based on the DA layer, dynamic storage capability, and creation of Ethereum network access protocols.

Through EthStorage, decentralized storage can be used as the underlying layer to re-enable internet applications (many current Dapps still use centralized methods to store data), such as dynamic NFTs, on-chain music NFTs, personal websites, hostless wallets, Dapps, and Deweb, among others.

Ethereum and Scaling

Expelling Validium? Reinterpreting Layer 2 from the Perspective of Danksharding's Proponents

According to ethereum.org and the majority of the Ethereum community, Layer 2 is an "independent blockchain that scales Ethereum + inherits Ethereum security." Further discussion of the security of Layer 2 also needs to consider many extreme cases. For example, if the L2 project team runs away, the sequencer malfunctions, or the off-chain DA layer goes down, can users safely withdraw their funds from L2 to L1 in these extreme events?

Dankrad Feist, the proponent of Danksharding and a researcher at the Ethereum Foundation, pointed out that a modular blockchain that does not use ETH as the DA layer is not a Rollup, and it is also not an Ethereum Layer 2. According to Dankrad, Arbitrum Nova, Immutable X, and Mantle should be "expelled" from the Layer 2 list, as they only disclose transaction data outside of ETH (they have built their own off-chain DA network called DAC).

Difference in security between Validium and Plasma: After the sequencer of Validium releases the Stateroot, as long as the Validity Proof and DAC multisig are immediately released, it can be made legitimate and become the latest legitimate Stateroot; if users and honest L2 nodes encounter data withholding attacks, they cannot construct a Merkle Proof corresponding to the current legitimate Stateroot, and thus cannot withdraw to L1. When Plasma submits a new Stateroot, it must wait for the window period to end to become legitimate, at which point the legitimate Stateroot is the one submitted in the past. Because there is a window period (3 days for ARB, 7 days for OP), even if the DA data of the newly submitted Stateroot is not available, users have the DA data of the current legitimate Stateroot (the legitimate root was submitted in the past) and enough time to force a withdrawal to L1.

Most Layer 2 projects will provide a server port to keep L2 nodes in sync with the sequencer, so Dankrad's concerns are often theoretical rather than practical.

New Ecosystem

friend.tech Ignites the Base Ecosystem, These Ten Projects Are Worth Paying Attention To

Overview of the Base Ecosystem Map: Traffic Fission Carnival and Inventory of 100+ Projects

Overview of the Scroll Ecosystem Map: Looking for the "Vanguard" of zkEVM

Weekly Hot Topics Recap

Over the past week, friend.tech's popularity has continued (special topic), Balancer: Multiple V2 pools have vulnerabilities, users are advised to immediately withdraw affected LP, affecting Pendle pools, Exactly Protocol suffers cross-chain bridge attack, with losses reaching $12.04 million;

In addition, in terms of policies and macro markets, the Hong Kong Monetary Authority: Will collaborate with the industry to promote the issuance of tokenized bonds, Is studying the establishment of a regulatory framework for digital Hong Kong dollars or stablecoins to promote the tokenization of bank deposits;

In terms of opinions and voices, SBF denies allegations of fraud and money laundering related to FTX's bankruptcy, Curve founder: CRV OTC buyers who violate the cooperation agreement have no negative impact, but we believe they will comply with the six-month lock-up commitment;

Institutions, large companies, and leading projects: ARK Invest and 21Shares jointly submit two Ethereum futures ETF applications, Hong Kong-listed company Victory Securities launches virtual asset trading app, Coinbase announces five major neutral principles for Base, including chain rules, user custody of keys, and free withdrawals, Base and Optimism announce governance and revenue sharing framework, Base can receive up to 118 million OP in 6 years, MakerDAO passes a proposal to adjust EDSR and stability fees, reducing DSR from 8% to 5%, Aave: Suspends GHO new coin minting due to technical issues with V3 GHO pool integration, Starknet 0.12.1 version goes live on the mainnet, "quantum leap" has ended;

In the NFT and GameFi fields, Yuga Labs: Will gradually stop supporting all upgradeable contracts and new series on OpenSea SeaPort, several NFT lending platforms liquidate some blue-chip NFTs, including BAYC, Azuki, and other series, OpenSea Pro will start charging a 0.5% platform fee for all listings and offers from August 31, Rarible: Permanently supports royalties, will no longer aggregate orders from OpenSea, LooksRare, and X2Y2 after September 30, Eric Wall: Willing to provide double refunds to all users who purchased Taproot Wizards NFT … Well, it's been another eventful week.

Attached is the "Weekly Editor's Picks" series link.

Until next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。