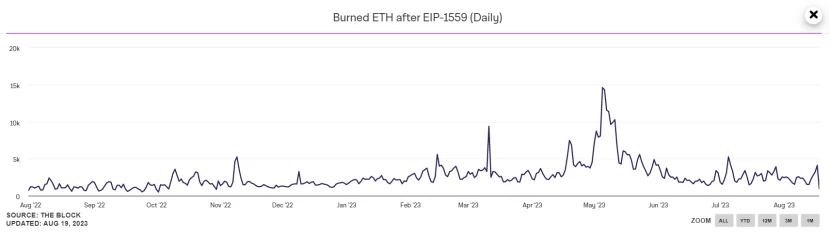

The daily destruction of ETH hits a new low for the year

Since the London upgrade in August 2021, the Ethereum blockchain has implemented the ETH burning mechanism to optimize transaction fees. EIP-1559 divides the gas fees that users need to pay to miners on the Ethereum network into two parts: base fee and miner tip. The base fee is the mandatory fee that users must pay, and it is burned rather than going to the miners; the miner tip is a dynamic fee used to incentivize miners to prioritize packing users' transactions during congested periods.

According to data from The Block, on August 18, 2023, the daily destruction of ETH reached 946.63 ETH, marking a new low for the year and also a relatively low level two years after the implementation of EIP-1559.

The decrease in recent ETH destruction indicates a weakening of Ethereum L1 activity, as ETH is burned when transactions occur on the ETH mainnet. This is because market participants have shifted their focus to more scalable L2 solutions. The on-chain activities of Base and the diversion to L2 solutions like Optimism are important reasons for the recent decrease in ETH destruction. Additionally, projects in the development stage such as zkSync and StarkNet indirectly contribute to the reduction in ETH destruction.

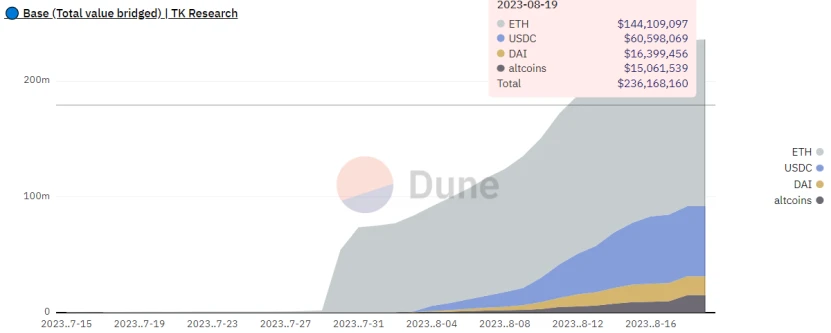

Coinbase's launch of Base L2 has been well-received by the crypto community. Since its launch, crypto assets worth $236 million have been transferred to Base, including $144 million worth of ETH.

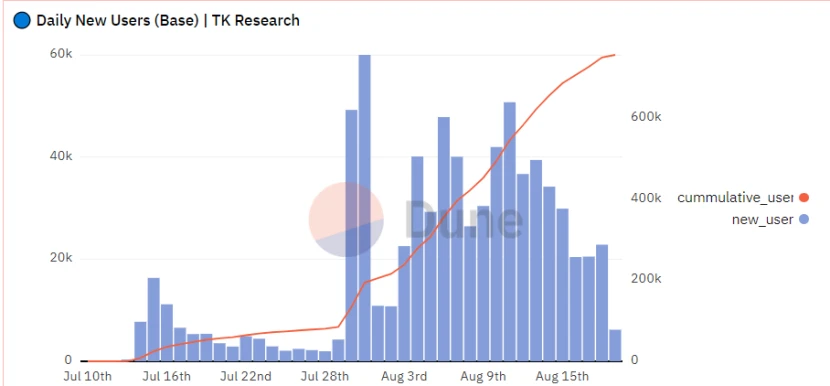

On August 9, Base launched over 100 Dapps, reaching a level comparable to other mainstream Ethereum L2 networks. According to statistics from Dune Analytics, the number of daily active users on Base exceeded 136,000 on August 10, surpassing Optimism's 114,700 during the same period.

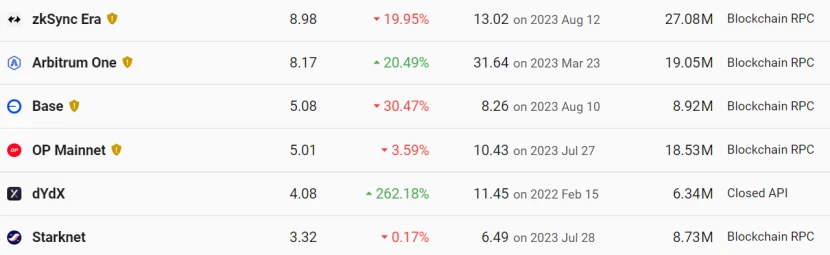

According to data from L2Beat, Base currently processes an average of 5 transactions per second, without congestion, far from reaching its peak. This data is comparable to Optimism and is only surpassed by Zksync ERA and Arbitrum One in the L2 space.

Two other L2 solutions that have diverted from the Ethereum mainnet include zkSync and StarkNet, both of which are in the development stage. zkSync uses zero-knowledge technology to make transactions on Ethereum faster and cheaper, while StarkNet is a permissionless decentralized zero-knowledge rollup designed to scale decentralized applications on the Ethereum blockchain. These two projects have garnered attention because they may incentivize early users through airdrops upon their official launch. As a result, both zkSync and StarkNet have seen a surge in active users on their respective testnets.

While the rise of L2 solutions may temporarily reduce the destruction of ETH, in the medium to long term, they are crucial for the scalability and support of the Ethereum ecosystem, especially after the implementation of EIP-4844, which will significantly reduce L2 costs, enabling greater adoption of the Ethereum network.

Changes in ETH staking data

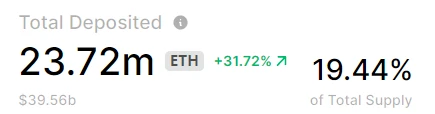

From the current staking data, the Shanghai upgrade has had a profound impact on the ETH staking field, with one of the most significant indicators being a substantial increase in the amount of ETH staked. According to data from Token Terminal, as of August 20, the amount of ETH staked reached 23.72 million, equivalent to approximately 19.44% of the total circulation.

Since the Shanghai upgrade (which opened up staking withdrawals), the net increase in the amount of ETH staked has reached 6.28 million, indicating that the Shanghai upgrade has dispelled doubts for investors staking ETH.

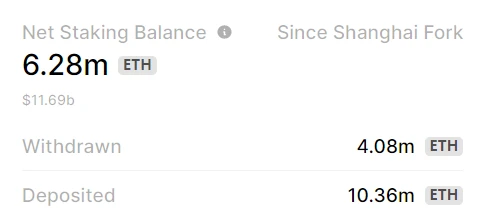

Data from Token Unlocks shows that the number of ETH validators has been steadily increasing, reaching 740,000, and the staking annual yield rate remains at 4.97%. It is worth noting that after the recent downturn in the crypto market, the daily withdrawal of ETH continues to decrease.

Ethereum development progress

On August 17, Ethereum developers held a meeting on this topic and announced that the new testnet, Holesky, will be launched next month. Holesky may provide over 1 billion testnet ETH, making it easier for developers to access the test network and operate based on testing objectives.

A testnet is defined as a cloned blockchain where developers can test applications and smart contracts before deploying them on the mainnet. Ethereum currently has two main test networks: Goerli and Sepolia. However, based on the details confirmed at the Ethereum developer meeting, it is expected that Holesky will soon replace the Goerli testnet. This means that Holesky will serve as the testnet for Ethereum staking, infrastructure, and protocol development, while Sepolia will continue to be used for testing Dapps, smart contracts, and other EVM functionalities.

Expectations for Ethereum futures ETF

On August 18, according to Bloomberg, the U.S. Securities and Exchange Commission (SEC) plans to approve the first Ethereum futures ETF for listing. It is currently not immediately clear which funds will be approved. According to sources, several ETFs may be listed before October. Previously, nearly 12 companies, including Volatility Shares, Bitwise, Roundhill, and ProShares, had applied to launch Ethereum futures ETFs.

In addition, according to The Wall Street Journal, the SEC may allow multiple Ethereum futures ETFs to be listed simultaneously. Asset management company Volatility Shares plans to launch an Ethereum futures ETF on October 12, becoming the first of its kind in the United States. Since submitting the application in July, the SEC has not requested the withdrawal of the application, indicating the possibility of launching such funds in the fall.

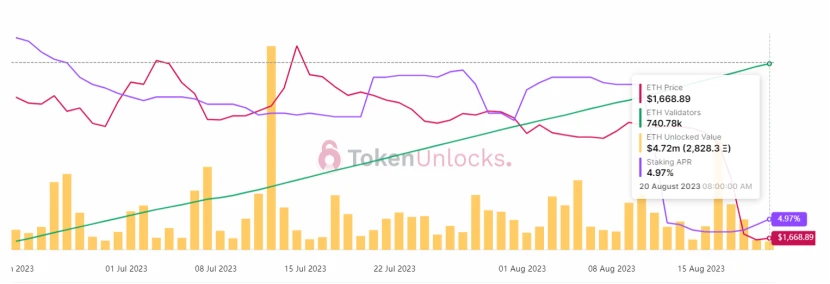

ETH whale selling

As shown in the above chart, since mid-July, Ethereum whales holding 10,000-100,000 ETH have shown significant selling behavior. Between July 14 and August 18, whale addresses reduced their ETH holdings by 1.12 million. Currently, on-chain data indicates that Ethereum whales have not made any purchases in anticipation of Ethereum futures ETFs. Despite some price rebounds after the strong sell-off of ETH on August 18, whales continue to reduce their holdings. The ETH holdings of whales decreased by 4% from July 14 to August 18, while the price of ETH also dropped by 18%.

Currently, the RSI indicator for ETH has dropped to below 30, indicating a technical oversold phase, which strategic investors may consider as a reference for starting to buy.

For example, after the market downturn, three addresses labeled as "smart whales" (with a history of buying low and selling high in previous ETH trading cycles) made purchases. One address woke up after a 5-month dormancy and spent $1.52 million to buy 907.4 ETH at a price of $1,680.

Another address starting with 0xee2 spent $11.15 million to purchase 5,120 WETH and 1,506 ETH at a price of $1,683. Before this purchase, the address had already invested in 6,676 ETH and 2,747 Steth, and borrowed $8 million from the decentralized lending platform AAVE.

The third address starting with 0x828 bought 2,600 ETH at an average price of $1,682, totaling $4.38 million. This address has made a profit of $14.17 million in the last two ETH trading cycles. Currently, the address holds a total of 22,601 ETH, worth $37.8 million.

Some analysts believe that these whales may be waiting for the formal approval of Ethereum futures ETFs by the SEC.

In summary, the upcoming London upgrade and the Ethereum futures ETF may make Ethereum's current trend slightly better than Bitcoin's, or could become an important support for Ethereum's trend.

Ebunker official website: https://www.ebunker.io

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。