“If you are lucky enough to have lived in Paris as a young man, then wherever you go for the rest of your life, it stays with you, for Paris is a moveable feast.” --- "A Moveable Feast"

This essay by Hemingway, in the encrypted world, can roughly be transformed into:

“If you are lucky enough to have lived in the cryptocurrency world as a young person, then wherever you go for the rest of your life, speculation will follow you, for speculation is a moveable feast.”

Recently, it has flowed to friend.tech.

In the dull and torturous bear market, an innovative and speculative FOMO-inducing project easily attracts all the attention.

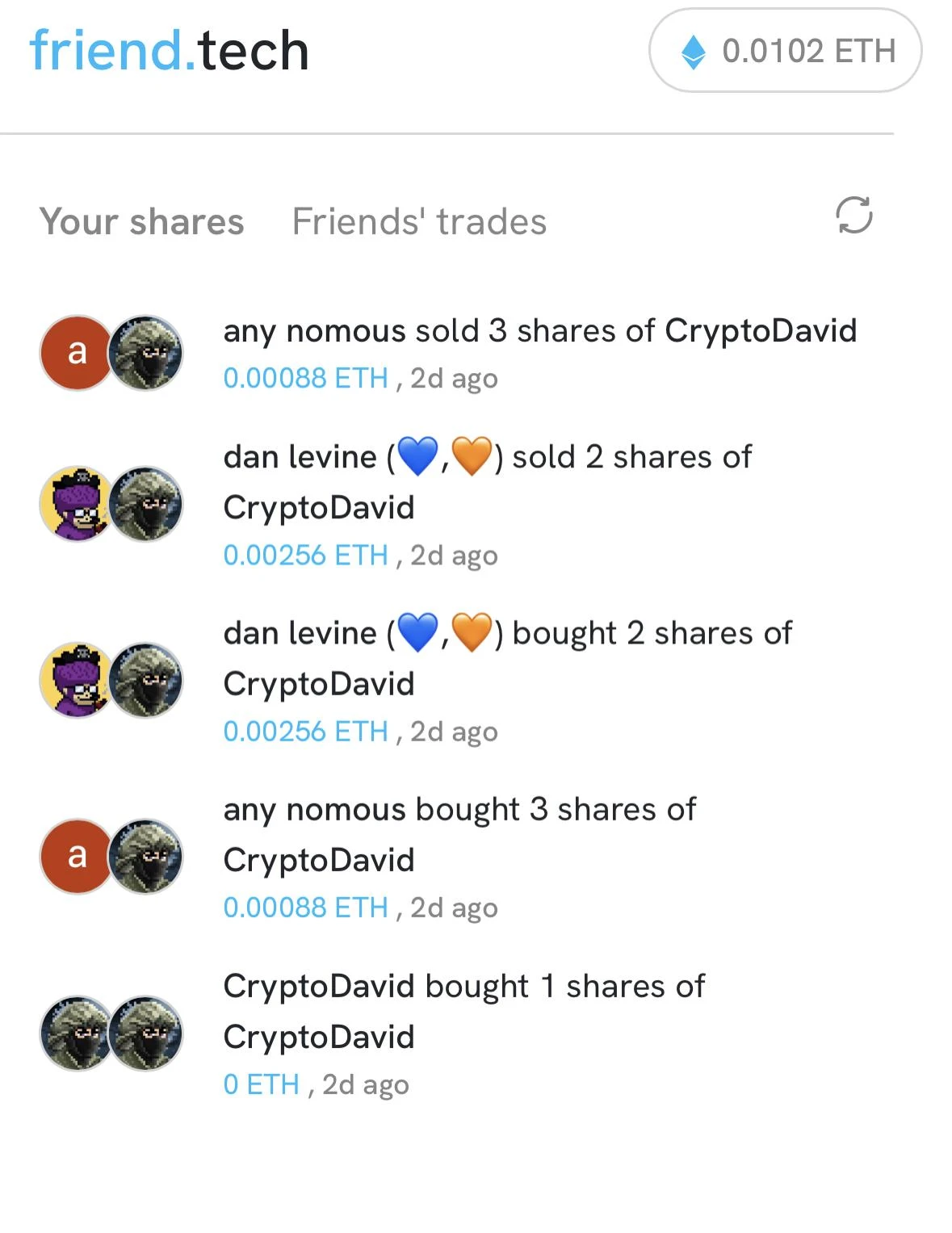

Brands, airdrop expectations, funding news, and buying and selling shares… friend.tech seems to be focused on social, but fundamentally it's still finance. Let's be honest, did everyone download this app for the purpose of socializing? Obviously not.

After all, in the cryptocurrency world, any social behavior not driven by economic interests is just playing rogue.

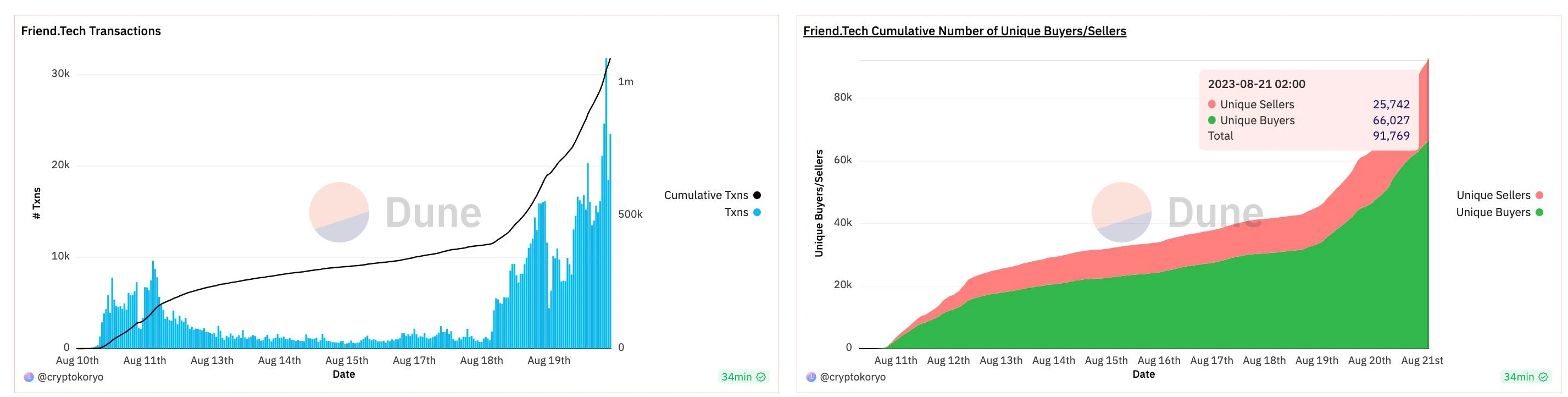

However, in another grand speculative feast, will you be the one feasting? As of the time of writing, the total trading volume of shares in friend.tech has exceeded 1 million, with over 66,000 independent buyers and 25,000 independent sellers.

Is it still not too late for me to get in? Before asking this question, it is more important to understand "what it is" and "where it is going."

The Seven Deadly Sins and the Old Tricks

Was friend.tech's sudden rise a coincidence? Yes and no.

From an external perspective, there are indeed reasons for the lack of hotspots in the bear market. But more importantly, it is due to the product design itself.

In fact, from the perspectives of psychology and communication, a social (or social-veiled) product that can quickly become popular owes much to its insight into human nature. In terms of human weaknesses, the classic seven deadly sins in Catholicism are: pride, envy, wrath, sloth, greed, gluttony, and lust.

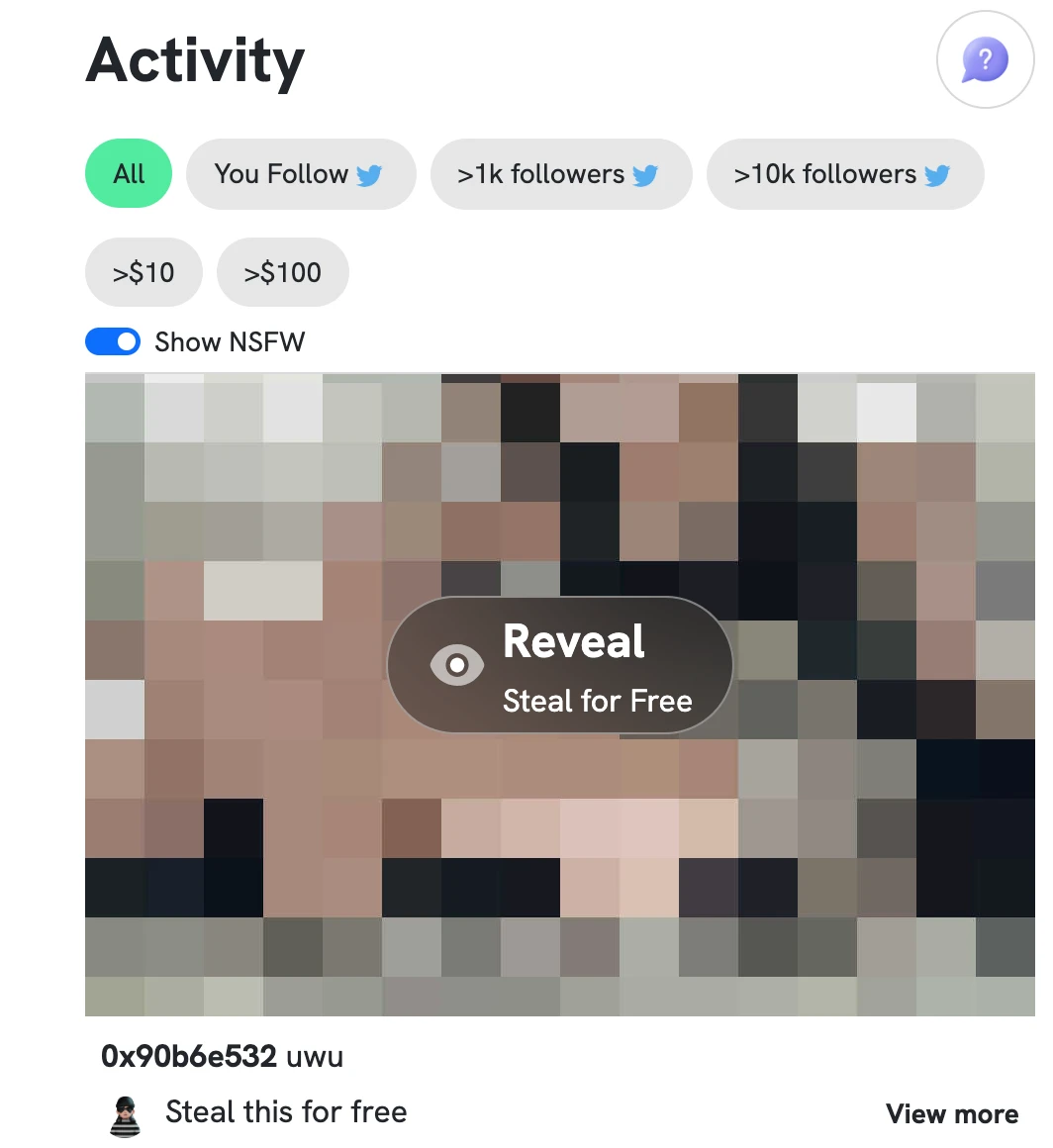

Before friend.tech, in March, the image-sharing dapp Stealcam from Arbitrum had already staged a play about "lust" or rather, "voyeurism":

Users can upload an image, but the image itself is blurred. Others can pay to "steal" (view) the original image, but this action requires payment in ETH. Each image can be stolen an unlimited number of times, with each steal increasing by 10% based on the previous steal price and adding 0.001 ETH.

Does this "buy more, increase in value" and "buy equals ownership rights" design have a bit of a taste of buying and selling shares in friend.tech?

To be fair, although not explicitly stated, what types of images do you think are most likely to be circulated under such product design and interface?

But the characteristics of Web3, resistance to censorship, and rapid asset movement, made Stealcam popular at the time. In less than two weeks, with no airdrops or tokens, it accumulated a trading volume of over 313 ETH through natural growth.

Human weaknesses should not be underestimated.

But is this "pay to view blurred images" model something new? Clearly not. Web2 social applications have long understood this.

In China, QQ has had a feature called "flash photo" for a long time, where a photo can only be viewed for a few seconds before being deleted, and other social apps for strangers also have features such as rewarding to view blurred images and read-and-burn.

Similarly, friend.tech is actually an old trick with a new twist, and in a sense, it leverages "greed." But its entire product is more reasonable in terms of design, dissemination, and trading:

First, let's look at the trading design.

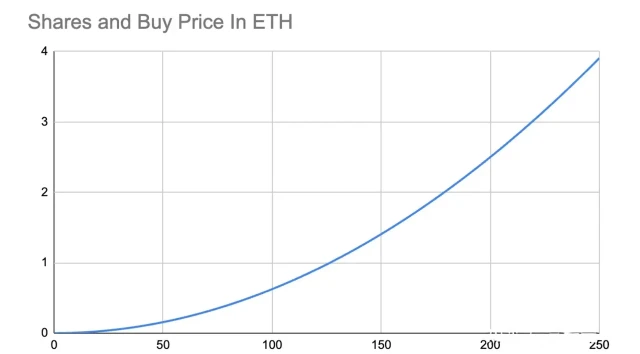

Similar to buying blurred images, you can directly buy shares of a user, buying an image implies the right to view it, while buying shares implies the right to have a private conversation with that user. At the same time, popular images will become more expensive to buy, and the shares of popular users (KOLs/big shots/wealth password experts) will inevitably become more expensive.

But unlike Stealcam, after viewing the blurred image, you need another person to act as the counterparty to buy that image; friend.tech does not have the concept of a "trading counterparty," you can directly sell the shares corresponding to a user without necessarily needing another person to buy. In other words, your selling behavior does not require liquidity as a prerequisite, you can buy and sell at will.

Why is it said that this product exploits human greed? The fundamental reason is:

Who has the most social influence, everyone's understanding of this matter is the same, but the speed of buying shares varies. Since it is linked to Twitter's social accounts and network, you can easily know who the big shots are; so the earlier you buy the shares of a big shot, the lower the price, which means that latecomers will need to buy at a higher price, and when you sell, you can make a hefty profit. Therefore, it is easy to generate FOMO emotions.

You can earn points just by using it, with airdrop expectations. When using friend.tech, the menu even directly opens an airdrop function, explicitly telling you that there is an airdrop for using the product and being active, but currently the airdrop is in points. As for what the points will be used for in the future, it's not clear yet. This easily makes you feel like you can get freebies.

Don't forget, this is different from just getting freebies. Social products have network effects, the more people who want to get freebies, the more the product can attract more people to use it, and the product experience itself will be better (finding more KOLs or big shots).

In addition, in terms of product launch:

friend.tech directly cuts into Twitter's social relationships, traffic, and account influence, without having to build a social network from scratch. Using shares as a hook, it parasitically uses Twitter for dissemination and user fission.

This means that in terms of dissemination, incoming users are happy to share this app, based on their existing social circle, to bring in more people, and ultimately, the people they bring in will raise their own shares and also benefit.

Wait a minute, doesn't this user fission strategy of friend.tech seem familiar?

In the early stages of its development, Pinduoduo fully utilized the huge traffic of WeChat and its existing social relationships, mobilizing friends and family to "slash prices," the more people who helped, the more quotas for bringing in people, and the closer they were to buying the desired goods at a discount.

Did Pinduoduo succeed? Yes. Why? Because no one dislikes a good deal, especially in lower-tier areas. In Web3, is there anyone who doesn't like a good deal? Otherwise, where would concepts like "pig's foot rice" come from?

Beyond the user fission strategy, friend.tech's business is actually similar to "paid subscriptions" or "knowledge payment." China's Web2 knowledge planets, Xiaomi Circle, and other private traffic plays have already gone through several rounds.

Therefore, from marketing methods, business mechanisms, and insights into human nature, friend.tech actually belongs to a solid old trick with a new twist, and at every step, you can find the shadow of mature Web2 businesses and previous Web3 products.

But with the economic incentive design of Web3 and the speculative atmosphere of the crypto circle, coupled with the fermentation of Paradigm's investment in the seed round, friend.tech has become a rare hit in the dull bear market.

When the gears of fate start turning, can you benefit from it?

Risks, Hard to Resist Enthusiasm

The more FOMO, the easier it is to overlook risks.

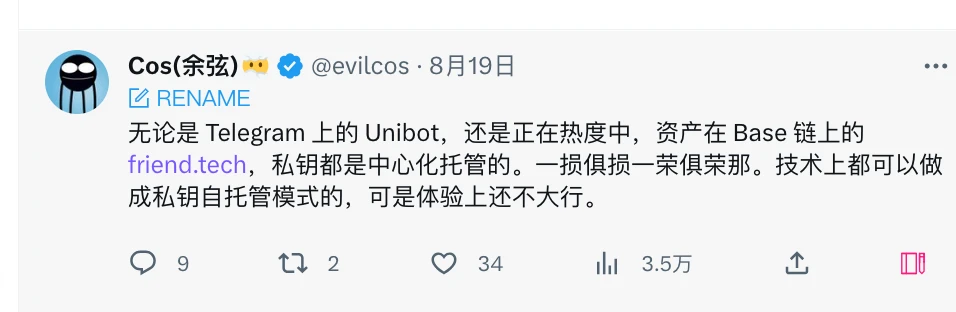

After analyzing the contract code of friend.tech, the security expert Yu Xian from SlowMist found that the contract owner is an EOA address, and the assets in the current contract have reached 2100 ETH and are continuously growing. (It is also the receiving address for protocol fees.) If the owner's permissions are leaked, the protocol fee may be modified, and users will bear the loss.

Moreover, centralized custody of private keys is also a time bomb. In theory, one can only hope for proper management. But for a mature social app, if there are hidden dangers in the part involving user assets, as the network effect expands, the impact on users after an incident will be wider.

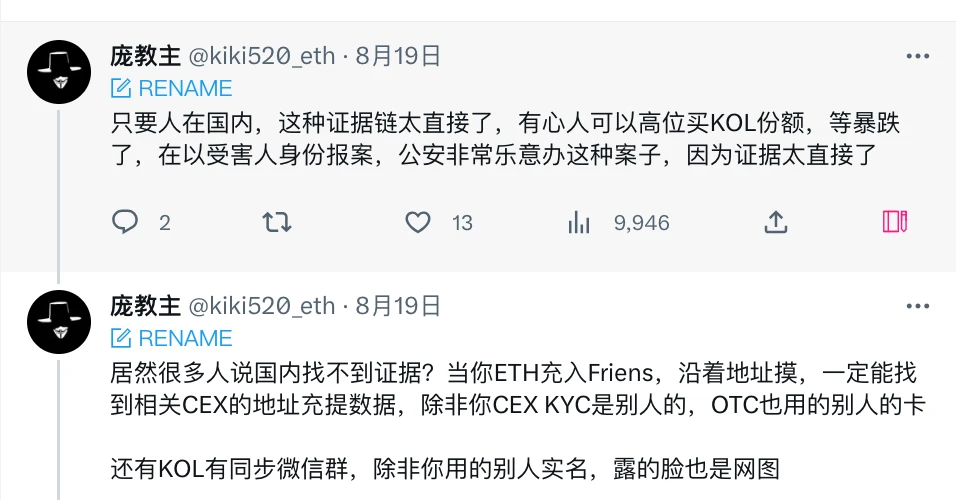

In addition, some KOLs also expressed that the model of friend.tech is prone to ethical risks: for example, if a certain KOL joins the product, the other party can maliciously buy a high position in someone's shares, and then wait to accuse or report them when there is a sharp drop.

Although this description may be a bit far-fetched, it actually reflects the ethical dilemma faced by influential users who join friend.tech — not joining may result in a loss of income and potential opportunities; if they join and cannot consistently provide correct and valuable content, they are likely to be discredited. After all, the decline in shares is easily associated with a fall from grace and a collapse of trust.

But as the saying goes, we should not just listen to what a person says, but also look at what they do. We have seen from some English-speaking crypto Twitter influencers that, after a rational analysis of the pros and cons of friend.tech, they often still include their own referral codes.

"I warned about the risks, but you can still give it a try."

After all, everyone is willing to pursue profits and try new projects, so there's nothing wrong with doing so. In the crypto world, there are no completely foolproof projects, and many are willing to take risks.

Taking risks for big gains is the creed of most people in the crypto world.

Ponzi Scheme is the Pass for Ponzi Schemers

Has friend.tech changed anything?

It seems to have changed the conversation mode of Twitter direct messages, but in reality, it seems like nothing has changed at all.

First of all, current data statistics show that those with the highest shareholding are still the big shots in the crypto circle, such as Cobie and Zhusu. Their existing authority and influence seem to have been simply replicated in friend.tech.

If you buy shares of Cobie and Zhusu, will they really have a conversation with you?

Furthermore, the structure of the product remains Ponzi-like. Early entrants have extremely high returns, and it depends on later entrants reaching a consensus on the user's value to buy shares, thereby further raising the value of the same user shares they hold.

For those smart people who entered the scene more than ten days ago, they may have already used their scientific skills to develop scripts, collect and organize various big shots into a database, and monitor whether these big shots have joined friend.tech. Once someone joins, they can buy shares from these influential big shots at a small cost.

The pattern remains the same, but the enthusiasm seems undiminished.

As public opinion ferments, more and more people are joining in. For example, today's entry of the President of Y Combinator, and the public expression of appreciation for friend.tech by the co-founders of Multicoin…

Therefore, it seems that we cannot cautiously and seriously compare and criticize a social product in web3 with mature web2 products, and express disdain for its Ponzi-like structure.

The audiences, purposes, development stages, and scope of influence of the two are different. Instead of nitpicking and criticizing, it may be better to selectively participate. Questioning the pattern, understanding the pattern, and participating in the pattern is probably the journey of all crypto people.

In the crypto world, a Ponzi scheme is the pass for Ponzi schemers, and caution may be the epitaph of the cautious.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。