Original | Odaily Planet Daily

Author | Xiaofei

Despite the fierce competition in the environment of numerous old L1s, emerging new L1s, and multiple L2 horse races, Sei Network has never lacked traffic.

To be honest, when it comes to technical innovation, ecological projects, on-chain data, and financing scale, Sei may not be considered outstanding at the moment. However, in terms of "marketing its own popularity" and "managing airdrop expectations," Sei can be said to have its own merits. A series of combinations have made the community both love and hate it.

In the past year, how did Sei often "make headlines" in the news, and how did it once again rise to the forefront of the wave of popularity in the launch of Binance Launchpool, sweeping the encryption community with a belated "sunshine" airdrop?

Controversy and Popularity Before Launch

In August 2022, Sei launched an incentive test network and announced that 1% of the total supply of SEI would be used to reward participants in the test network. At that time, Sei's interaction tutorial was already widespread in the community, and everyone couldn't help but feel that the interaction steps of this test network were quite cumbersome. Not only did it require multiple interactions and completing five major tasks, but it also required filling out forms multiple times and KYC to receive rewards. However, the "laborious" studio, in line with the principle of "the more troublesome, the more it should be done," still actively participated in the interaction.

On May 27, 2023, Sei officially announced that the Discord upgrade of the project had been completed, and users can now obtain the "Verified Seilor" role through Humanode facial recognition verification. It is reported that "Verified Seilor" is a badge of authenticity for users, proving that they are real people on the Internet.

As soon as this news came out, the community exploded with criticism, accusing it of violating the spirit of Web3 by requiring facial recognition to receive airdrops.

However, on June 15, Sei Foundation clarified in a tweet that the so-called "Sei test network incentives or airdrops require facial recognition" was a misunderstanding. Participation in Sei's test network incentives or airdrops does not require facial recognition or KYC. After receiving feedback about a large number of bot attacks on Sei's Discord, a third-party facial recognition tool was added to Discord. Sei will not adopt any form of facial recognition or KYC. Sei is an open-source, permissionless Layer 1.

Although there was no actual change in the back and forth, Sei still earned a lot of attention and popularity in the discussions on media and social media.

Schrodinger's Airdrop and Anxious Community

After that, there were rumors circulating in the community that Sei was about to be listed on Binance, until on August 1, Binance announced that Sei would be listed on Binance Launchpool and would be listed on August 15 at 20:00 (UTC+8). The token details are as follows: Total supply: 10,000,000,000 SEI; Initial circulation: 1,800,000,000 SEI (18% of the total token supply); Total mining: 300,000,000 SEI (3% of the total token supply).

What made the community dissatisfied was that even though the Launchpool listing was confirmed, Sei had not yet announced the airdrop rules and quantity, only a brief economic model was announced. In response to the questions from community members, the Mods only replied, "There is an airdrop plan, all subject to official announcements."

On August 11, the Sei Foundation stated: The mission of the Sei Foundation is to support the decentralization of the Sei blockchain from the beginning. The mainnet includes Sei airdrops and incentive test network rewards. The first major token distribution is intended to identify loyalty and enhance the global impact of Sei blockchain as the best place to build Web3 applications.

At this point, many in the community noticed that in Sei's official statement, airdrops and test network incentives were always separate, and they did not seem to be equivalent.

It wasn't until the eve of the launch that Sei finally announced the detailed token economics: 48% of the tokens are allocated to the ecosystem; 20% of the tokens are allocated to the team; 20% of the tokens are allocated to investors; 9% of the tokens are allocated to the foundation; 3% of the tokens are allocated to Launchpool; of the 48% of the tokens allocated to the ecosystem, they are divided into three parts for staking rewards, ecological initiatives, and Sei airdrops and incentives. Season 1 airdrop will distribute 3% of the SEI token supply to reward community users.

However, the specific rules for the airdrop were still not announced.

Cross-Chain Blind Box Airdrop Ignites the Community Again

Even on the day SEI was listed on Binance and trading began, the airdrop rules were announced unexpectedly late, igniting another round of community discussions and topics.

Sei announced that it would conduct a "cross-chain" airdrop to active users of six major ecosystems when the Pacific-1 mainnet is launched. The specific rules are as follows: Users active on chains such as Solana, Ethereum, Arbitrum, Polygon, BNB Chain, and Osmosis have the opportunity to be selected for the whitelist for the airdrop. To claim the airdrop, they need to create a Sei wallet and bridge the specified assets to the Sei network after the mainnet is launched.

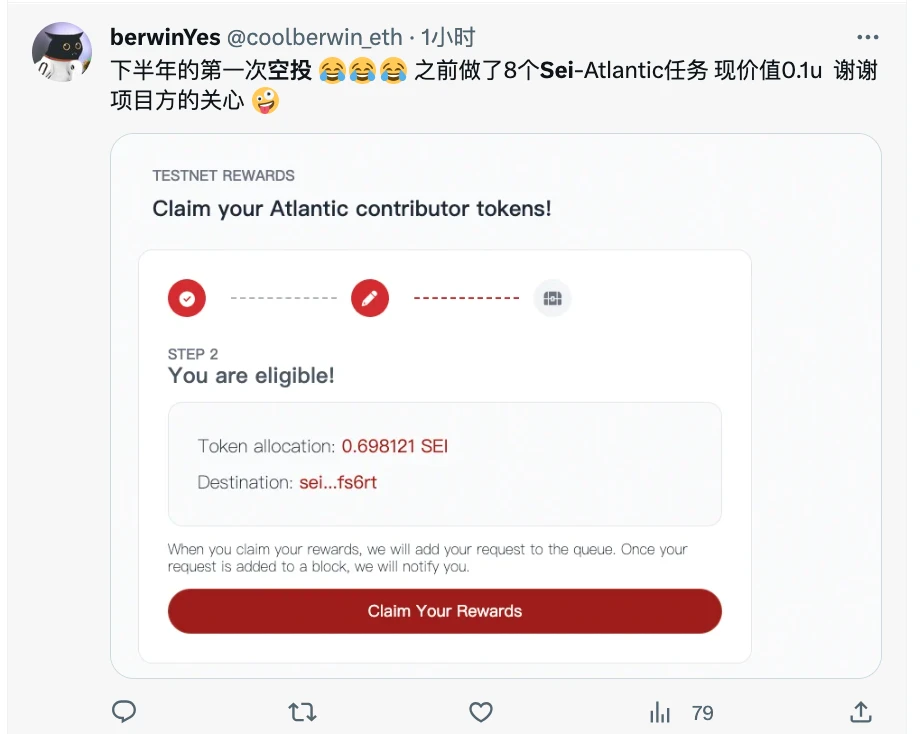

Those who participated in Sei's Atlantic 2 test network and/or ambassador program have different reward rules, and it was not referred to as an "airdrop."

This seemingly "sunshine" airdrop rule caused a stir in the community. However, some users also expressed that this set of rules is similar to the cross-chain operations of Cosmos, similar to the airdrop of evmos in the past. Although such public chain airdrop rules are not common, Sei's team itself comes from Cosmos, so it is not surprising.

Community testing found that when claiming the SEI airdrop, users can choose to claim from the "Airdrop Box" or the "Cross-Chain Box." Users who choose the "Cross-Chain Box" will receive at least $500 worth of assets such as ETH or USDC when bridged to the Sei network, and will receive a certain amount of SEI based on the value of the bridged assets.

This approach of opening a whitelist for active addresses on multiple chains and using a random airdrop quantity has sparked a frenzy of discussions in the community on how to receive more airdrops. The conclusion drawn was that basically, the more the amount of money involved in the whitelist address for cross-chain, the more airdrop they will receive. Some people even posted screenshots of receiving over 10,000 SEI in airdrops, which prompted many others to rush in and engage in cross-chain transactions.

Subsequently, Sei announced that due to high demand, the Sei Foundation would increase the number of eligible wallets for the cross-chain airdrop from 500,000 to 1.5 million, allowing more people to participate. Because many people chose the relatively niche Osmosis for cross-chain transactions and had to exceed 500U to receive the airdrop, it briefly pushed up the price of OSMO.

Of course, except for a few large holders, most people only received a "pittance" from the airdrop, but Sei's cross-chain data soared.

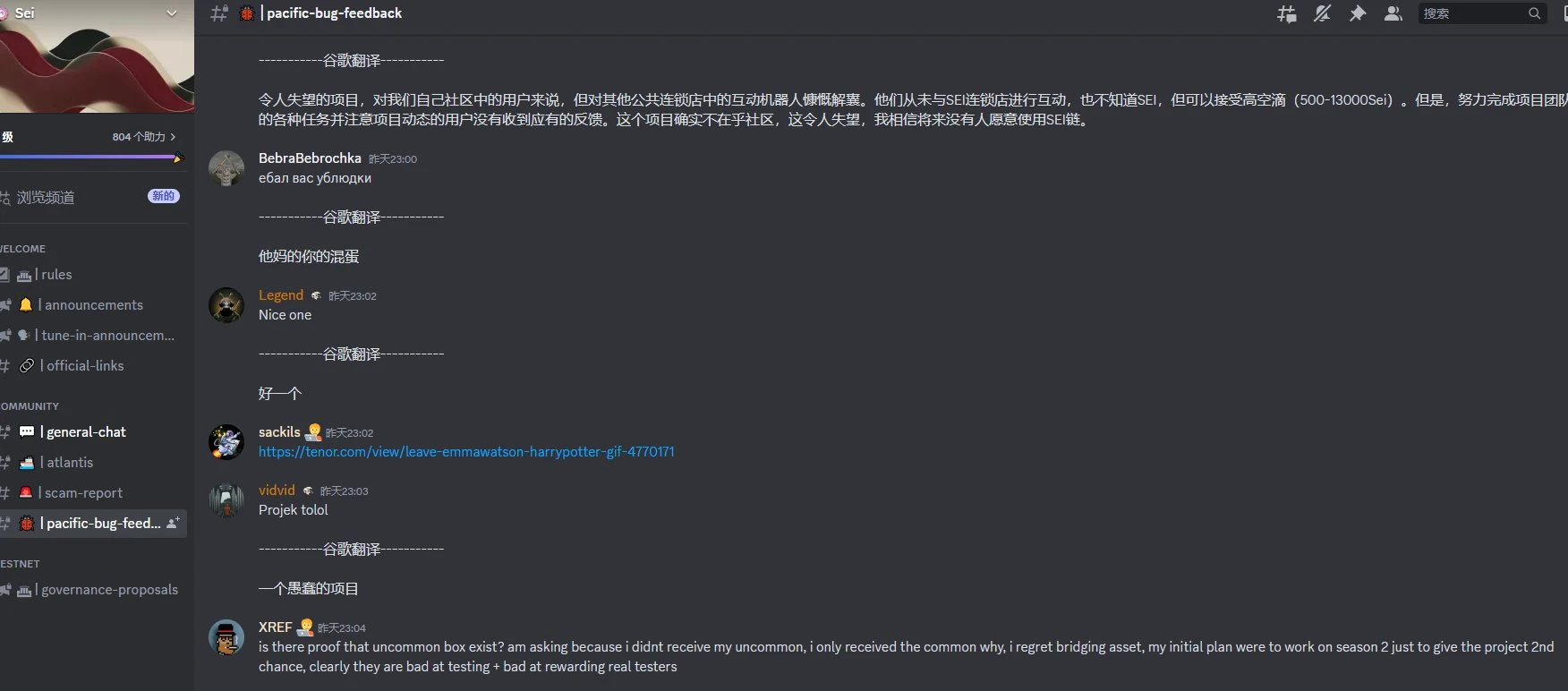

Many people praised Sei for its careful planning and innovative mechanisms, but it also caused dissatisfaction among others. Some users who had completed complex incentive tasks in the test network felt that their efforts were not as valuable as those of the big holders who easily crossed chains, and that the project did not value the community. There were also users who complained that although they had a significant amount of cross-chain transactions, they received very little reward, and the blind box was unreliable, leading to dissatisfaction expressed in Discord.

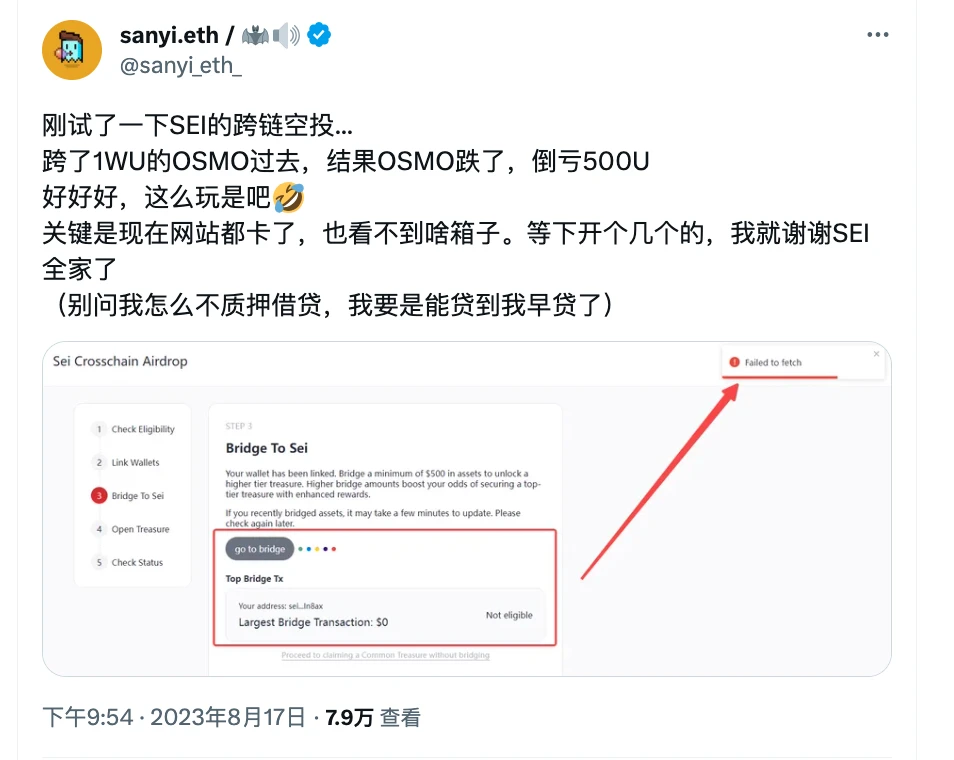

Last Night, perhaps due to the overly enthusiastic airdrop claims, the network became congested, and many community users reported being stuck on the third step of claiming the cross-chain airdrop on the Pacific-1 webpage for a long time, unable to complete the claim smoothly.

To make matters worse, in the early hours of today, after a period of consolidation, Bitcoin plummeted, dropping nearly $40,000 in a short time, and other tokens naturally followed suit. Some users on social media expressed that they had engaged in cross-chain transactions to claim Sei's airdrop, but while they were stuck on one end, they suffered liquidation on the other end. Even for those who were not liquidated, the airdrop they received may not cover the price drop…

In Conclusion

In any case, Sei's case seems to be a "success" in one dimension, with innovative mechanism design and full of topics. However, in the long run, it may also be a kind of consumption and overdraft in another dimension. In addition, it also requires follow-up operations to keep up.

Whether the project should airdrop and how to set rules and standards has long been a topic of discussion in the crypto industry.

Originally, airdrops were intended to incentivize active users and complete cold starts, but under the incentive of wealth creation myths, countless "laborious" enthusiasts have harbored dreams of getting rich, and many studios have emerged, making project teams wary and gradually falling into a dilemma of mutual PUA, tug-of-war, and love-hate relationships. In the current market downturn and with project teams tightening their belts, "getting rich through airdrops" is becoming increasingly difficult, leading to a frenzy. Recently, according to media reports, many "laborious" studios have been unable to make ends meet and have closed down.

Indeed, this is the result of industry reshuffling and iteration. DeFi OG Mindao once stated on Twitter: Nowadays, airdrop farmers have industrialized, and airdrop rules are so predictable that witch resistance is simply impossible. Forgive me for saying this, it's best to completely give up airdrops, or after TGE, allocate more tokens to ordinary liquidity mining.

However, to date, there has been no convincing conclusion to this discussion. Perhaps we can only hope for the market to turn for the better and for new traffic to enter the industry, forming a healthy ecological cycle.

Additional Reading

[Sei Airdrop Complete Guide: Cross-chain airdrops covering six major public chains users](http://Sei Airdrop Complete Guide: Cross-chain airdrops covering six major public chains users)

Delphi Digital: Why we are bullish on Sei Network?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。