Glassnode analysts recently stated on social media that the realized volatility of Bitcoin has dropped to a historic low since March 2020. Cryptocurrencies, which have lost their high volatility characteristics of the past, are fading from investors' view. Meanwhile, Binance, one of the world's largest cryptocurrency exchanges, announced the launch of the Sei ($SEI) and CyberConnect ($CYBER) projects on its Launchpool platform, once again attracting attention.

One of the main reasons why Binance Launchpool has attracted attention is that both Sei and CyberConnect are star projects in the industry, with a large number of users participating and paying attention.

Sei is a Layer1 project characterized by scalability and speed, and has received investments from well-known institutions such as Multicoin, Coinbase, and Jump Capital. Before becoming a Binance Launchpool project, over 4 million users participated in the Sei testnet, with a total of over 100 million transactions on the testnet.

CyberConnect is a Web3 social network that allows users to have their own digital identity, content, connections, and interactions. According to Dune Analytics data, CyberConnect's peak daily active users (DAU) once exceeded 200,000, and the current DAU is 62,000. After the announcement of the launch on Binance Launchpool, CyberConnect's weekly active accounts increased by 30%.

However, there are still many criticisms in the market, believing that Launchpool cannot bring sufficient returns to users. The logic of participating in Binance Launchpool is different from Binance Launchpad. Binance Launchpool is more inclined towards financial products for BNB and some stablecoin holders, with a longer cycle and relatively fixed returns, suitable for users who already hold BNB and those with a preference for low risk. Additionally, Binance also provides stablecoin pool mining, allowing users to obtain new coin returns without risk. Therefore, BlockBeats will analyze the real return rate of Binance Launchpool and how to participate to obtain the best return.

Binance Launchpool financial product, with a cumulative return of approximately 15.37% over the past three years

In fact, the difference between Binance Launchpad and Binance Launchpool can be clearly seen from the number of projects launched. As of now, Binance Launchpad has launched 32 projects, while Binance Launchpool has launched 37 projects. In 2023, Binance Launchpool launched 6 projects, twice the number of projects launched on Binance Launchpad.

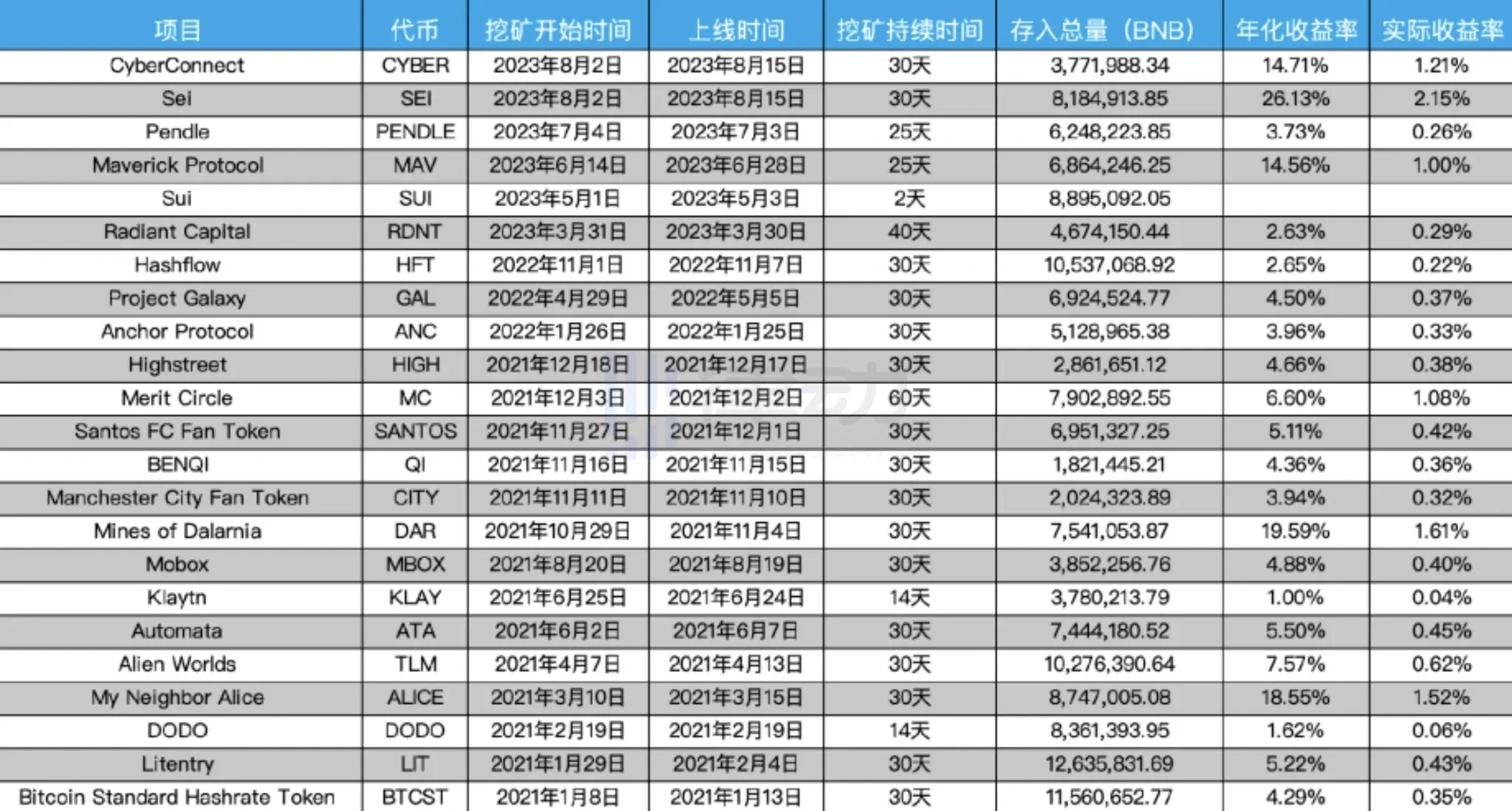

Since 2021, the average mining duration of Binance Launchpool projects has been 28.69 days, with 9 projects already listed on Binance before mining began. This also means that investors can better arbitrage based on the annualized return rate. To better measure the performance of projects, BlockBeats has calculated the actual return rate (annualized return rate/365*mining duration) of participating in the entire mining cycle based on the official annualized return rate of Binance (data for CYBER and SEI as of 8:00 on August 16).

Without considering the factors of overlapping mining periods and the fluctuation of BNB prices, the BNB-based return of Binance Launchpool over the past three years will reach 8.06%, 0.91%, and 4.9% (the actual data for SUI in 2023 will be higher than 4.9% due to the official undisclosed annualized return rate and a mining duration of only 2 days). This also means that if BNB holders participate in Binance Launchpool without fail from 2021 and convert the tokens into BNB, the quantity of BNB will increase by approximately 13.87%. Currently, for the 23 projects, there is no direct correlation between the quantity of BNB and the return rate of participating in Binance Launchpool.

At the same time, one of Binance's financial products, the BNB yield pool, has an annualized return of approximately 0.5%, automatically investing users' funds into Launchpool. In addition to the fixed return of 0.5%, there is also additional Launchpool income, totaling 13.87% + 1.5% = 15.37% over three years.

Compared to Binance Launchpad projects, participating in Binance Launchpool does not require spending funds, making it more suitable for users who already hold BNB and some stablecoins for various reasons. Additionally, since Binance Launchpool often has a longer duration, participation through collateralized borrowing and other methods often requires consideration of the actual project situation, rather than blindly participating as with Binance Launchpad projects.

For those with extremely low risk preferences, they can consider participating in stablecoin mining. The cumulative return over three years can also reach 13.16%. By storing stablecoins in a flexible stablecoin financial product, the return is 2.59%, and occasional activities can provide an additional 1% to 2% interest, averaging about 4.1%, for a total of 4.1% + 13.16% = 17.26%.

Buying at the close on the first day and selling on the next day may be the best strategy for Binance Launchpool

For many investors who may not want to hold BNB but still want to profit from Binance Launchpool, it is necessary to have a certain understanding of the projects in order to borrow BNB through collateralized borrowing and other methods. However, it is difficult to understand the projects in a short period of time. Perhaps we can infer the potential profitability of projects through Binance's rules.

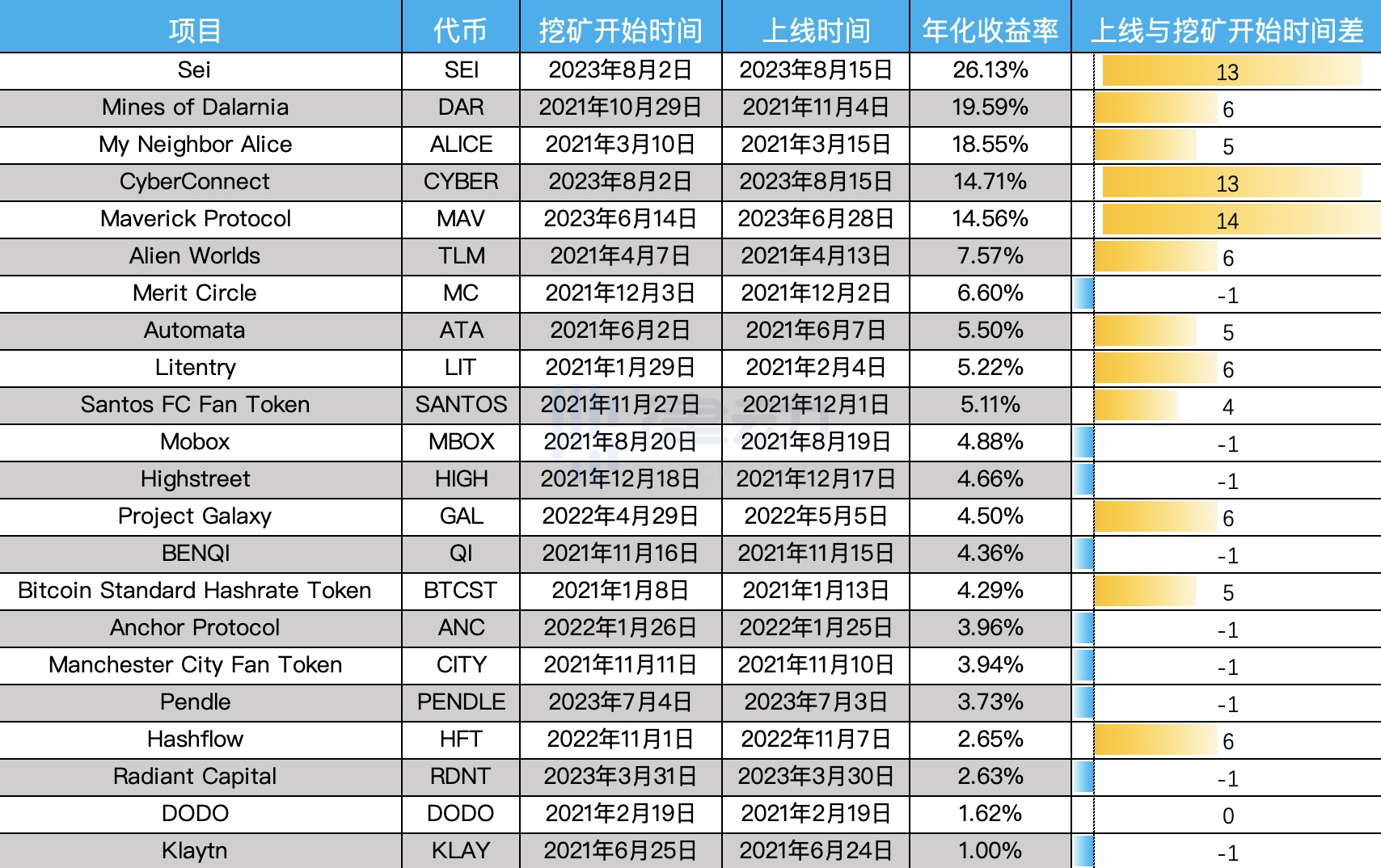

There is a time difference between the start of mining for Binance Launchpool projects and their listing on Binance. By analyzing this time difference, it can be observed that projects that start mining and are listed on Binance after a period of time (referred to as "blind mining") have a higher probability of performing better. When investors are not long-term holders of BNB and some stablecoins, choosing to participate in projects with a longer time difference between listing and the start of mining may also be a more profitable choice.

Of course, there are also investors who do not participate in Binance Launchpool but invest in the secondary market. After excluding two delisted projects, Bitcoin Standard Hashrate Token and Anchor Protocol, as well as the short-term listed Sei and CyberConnect, BlockBeats has analyzed 19 projects from 2021 to the present.

After excluding short-term fluctuations caused by liquidity and market sentiment on the first day, using the closing price on the first day as the buying time point, all projects have been profitable, with an average return rate of 76.95%. However, 9 out of the 19 projects reached their historical highs on the next day. This also means that selling on the next day may be the best strategy for Binance Launchpool.

The reasons for the rise of Binance Launchpool projects are different, but the decline is greatly influenced by BTC. Two projects among the 19 reached their historical lows on May 12, 2022, when BTC briefly fell below the $27,000 mark for the first time since December 29, 2020. Eight projects reached their historical lows on June 10, 2023, also a day of BTC decline, reaching a nearly 3-month low. Therefore, bottom-fishing Binance Launchpool projects may also require judgment on the trend of BTC.

Binance Launchpool empowers BNB

After analyzing the projects on Binance Launchpool since 2021, it is not difficult to conclude that Binance Launchpool is a stable financial lottery for BNB holders. Binance is using its industry position and influence to empower BNB holders.

In the ranking of cryptocurrency market capitalization, BNB currently has a total market value of approximately $36 billion, ranking fourth. In February 2021, BNB experienced its largest monthly increase in history, with the price rising from $44.3 to $210.2, an increase of 374.2%, reaching a peak of $348.7. There are many explanations for how it has grown to such a behemoth, but undoubtedly, Binance Launchpool is an indispensable part of it.

Unlike the empowerment of many projects, the empowerment of BNB by Binance Launchpool is direct and fierce. In the first two months of 2021, Binance launched 5 Binance Launchpool projects in just 10 days, with the project with the highest annualized return rate reaching 26.96%.

Of course, it is now difficult for BNB to experience a huge monthly increase. However, with Binance recently launching the star projects Sei and CyberConnect, it seems that there is reason to look forward to it again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。