Review of Major Events in the Cryptocurrency Market in the Past Year

Looking back at the major events in the cryptocurrency market over the past year, the collapse of FTX last year led to a tightening of cryptocurrency regulation, the emphasis on the importance of compliance licenses for fund deposits and withdrawals in Hong Kong, and the SEC's lawsuits against centralized exchange giants Binance and Coinbase. Governments around the world are continuously strengthening their focus on and implementing strict regulations for fiat currency fund deposits and withdrawals.

The purchase of cryptocurrencies with fiat currency is the first step for most users to enter the Web3 world. Regardless of the category of fund deposit method used, users' funds and accounts should be secure, and the trading methods and platforms need to be legal and compliant. Project parties need to obtain remittance licenses locally and verify user identities in order to provide financial services such as fund deposits and withdrawals.

This article will focus on the types of projects for cryptocurrency fund deposits and withdrawals, regional legal regulatory requirements, and the situation of obtaining regulatory licenses for large exchanges.

Types of Fund Deposit and Withdrawal Projects

In general, the channels for buying and selling cryptocurrencies for users are divided into over-the-counter (OTC) trading and on-exchange trading.

The first difference is the location. On-exchange trading generally takes place on a centralized exchange as the venue for trading, similar to traditional stock exchanges. OTC trading, on the other hand, does not occur in a centralized fixed location but rather takes place in various venues, such as through face-to-face transactions or via messaging apps like WeChat.

The second difference is the target of fund deposits and withdrawals. For on-exchange trading, the target of fund deposits and withdrawals is the exchange itself. Users deposit fiat currency to the exchange, known as fund deposit, and withdraw fiat currency from the exchange, known as fund withdrawal. In OTC trading, the targets of fund deposits and withdrawals are other users. User A deposits fiat currency to another user, User B, as a fund deposit, and User A receives fiat currency from another user, User C, as a fund withdrawal.

1. Over-the-Counter (OTC) Trading

Over-the-counter (OTC) fiat currency fund deposit and withdrawal projects allow direct trading between buyers and sellers, bypassing intermediaries. However, OTC trading is also a high-incidence area for fraud, and there are two main modes:

OTC Desks, such as Kraken OTC. In the OTC desk mode, the trading parties are the clients in need of trading services and the OTC desk acting as the counterparty. This mode of fund deposit and withdrawal has three main advantages:

- No slippage: By providing fixed quotes for large trades to avoid losses from slippage, the OTC desk takes on the risk for clients and has the potential to profit from better-than-quoted execution.

- More liquidity: OTC desks can execute trades at the best prices across multiple liquidity platforms.

- High privacy: By trading directly with the OTC desk, clients can protect their privacy and avoid their trading information appearing in public order books.

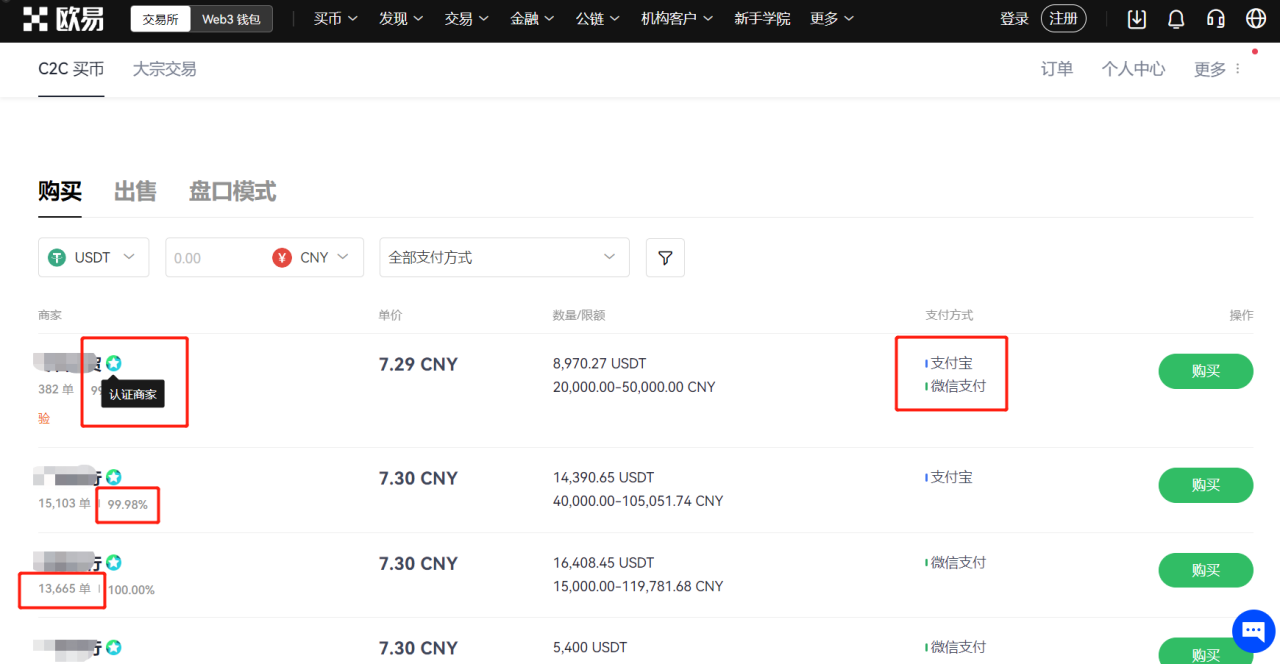

Customer-to-customer (C2C), such as OKX C2C Trading. This refers to direct trading between individuals for fiat currency fund deposits and withdrawals without intermediaries or third parties. OKX holds the digital asset of the buyer/seller until the payment is confirmed by the other party. The platform recommends users to trade with certified merchants, as all certified merchants have undergone thorough scrutiny by OKX. The advantages of C2C trading are as follows:

- Support for multiple payment methods: Buyers and sellers can define any payment method, and the trade can be completed once the actual transaction occurs and the payment is confirmed.

- Low trust cost: Both trading parties must pass the platform's identity verification, and even stricter merchant certification review. The platform also publicly discloses users' trading information for credit reference, but it cannot avoid the risk of some counterparties delaying or canceling orders.

- High privacy: In many countries (such as India), banks prohibit users from engaging in cryptocurrency transactions to avoid potential policy risks in the future. With C2C trading, users can conceal the purpose of the transfer from the bank, thereby bypassing the bank's restrictions.

However, this type of trading, except for the introduction of third-party platforms, is completely matched by individuals to avoid high intermediary fees. Due to the imperfect trust mechanism and information asymmetry, such private transactions between users often carry high risks.

2. Cryptocurrency ATMs

As physical machines, cryptocurrency ATMs have higher operating and maintenance costs, resulting in high exchange fees, some of which can even reach 20%. Cryptocurrency ATM operators purchase liquidity from third-party suppliers and transfer it to users' self-custody wallets, thus requiring a remittance license.

The main advantage of cryptocurrency ATMs is anonymity and privacy, as users can purchase cryptocurrencies with cash, often without KYC processes, although sometimes identification documents may be required, without the need for proof of residence or facial recognition.

However, they support a limited range of cryptocurrencies, mainly BTC and ETH, and most ATMs do not offer fund withdrawal services. Along with the high fees, they are often considered the least efficient way to purchase cryptocurrencies.

3. Centralized Exchanges (CEX)

Centralized exchanges are the most commonly used platforms for fiat currency fund deposits and withdrawals. Exchanges naturally have licensing advantages, lower fees, diverse support for cryptocurrencies, and are the largest liquidity providers in the ecosystem. Retail users can freely deposit and withdraw funds using self-custody wallets, while merchants often deploy transactions and transfers through APIs and SDKs. As intermediaries for liquidity, centralized exchanges profit from the spread between buying and selling liquidity and user fees.

When merchants and their clients use wallets hosted by the same exchange, transactions do not incur any fees, as the funds are transferred between different accounts within the same hosted wallet. However, if transfers are made to self-custody wallets, corresponding blockchain network fees are charged.

4. Independent Fund Deposit and Withdrawal Projects

Independent fund deposit and withdrawal projects, such as Moonpay, operate similarly to small exchanges but mainly provide fiat currency fund deposit and withdrawal services. They also need to register for remittance licenses in each operating region. Due to their relatively small scale and limited legal and technical resources, these types of projects are more specialized and mainly focus on fiat currency fund deposits and withdrawals, catering to specific areas of use.

Due to differences in liquidity sources and the requirement for clients to provide self-custody wallet addresses, these projects generally have higher fees compared to centralized exchanges, as they incur additional intermediary and network fees. Despite being smaller and generally having higher fees than centralized exchanges, independent fund deposit and withdrawal projects have the following advantages:

- Simple and user-friendly interface: The minimalistic interface directly displays the fiat currency amount and the corresponding cryptocurrency amount. Users only need to undergo identity verification for large transactions, making it user-friendly for small fund deposits and withdrawals.

- High privacy: Most projects only support self-custody wallets, eliminating the need to transfer cryptocurrency assets from hosted wallets and minimizing the use of other wallet information.

Most projects allow affiliate distributors to set up distribution bonuses using SDKs, giving distributors control over profits, unlike the less explicit profit-sharing on centralized exchanges.

5. Fund Deposit and Withdrawal Aggregators

Fund deposit and withdrawal aggregators, such as MetaMask's fiat currency fund deposit service, guide users to purchase and earn commissions by providing quotes from multiple independent fund deposit and withdrawal projects and centralized exchanges. This category essentially serves as an information intermediary, facilitating liquidity sharing through the aggregation of multiple exchanges and independent fund deposit and withdrawal projects. Fund deposit and withdrawal aggregators have three main characteristics:

- They only provide quotes as intermediaries, and all transactions are carried out through third-party suppliers.

- They do not require remittance licenses, as users undergo identity verification through third-party suppliers.

- In addition to fiat currency fund deposits and withdrawals, they can also provide DEX aggregators, liquidity staking, and NFT market functions. Fund deposit and withdrawal aggregators mainly target retail users and do not provide payment solutions for merchants.

6. Cryptocurrency Debit Cards

The main advantage of cryptocurrency debit cards is that they allow the use of cryptocurrencies for daily expenses. In traditional consumption scenarios, unless merchants directly accept cryptocurrencies, it is difficult to achieve this. Cryptocurrency debit cards are increasingly accepted by cryptocurrency users, allowing direct cryptocurrency spending or convenient conversion of cryptocurrencies into fiat currency within the card for global payments and consumption.

Cryptocurrency debit cards act as secondary accounts delegated by centralized exchanges and are one of the customer service offerings of centralized exchanges. The cryptocurrency-related aspects of fund deposit and withdrawal are handled by the centralized exchange (without the need for additional remittance licenses), while fiat currency payment processing is handled by payment network providers. The fees for cryptocurrency debit cards are often higher than those of centralized exchanges, as users need to pay additional exchange fees to payment network providers. By using cryptocurrency debit cards to pay merchants in fiat currency, they can only be used as a channel for fiat currency fund withdrawals. It is important to note that using cryptocurrency debit cards for payments may incur capital gains tax, and cryptocurrency must be pre-deposited into the card before use.

Using cryptocurrency debit cards also has the following advantages:

- Fund security: Funds deposited into the card are managed by the bank, eliminating concerns about fund sources and card freezing. Physical cards support ATM withdrawals. In actual consumption, fiat currency is directly spent, not cryptocurrency assets.

- Cross-border payments: Most cryptocurrency debit cards are Visa or Mastercard, supporting cross-border payments and can be used at millions of online and offline points worldwide.

- Cashback rewards: Most cryptocurrency debit cards offer cashback rewards in the form of cryptocurrencies.

Security and Compliance Issues

Having understood the common fund deposit and withdrawal methods, which one do you often use? Each type of fund deposit and withdrawal method has its advantages, but what we are more concerned about is the legal and secure handling of funds and transactions. Due to varying regulations among major countries, there is still room for non-compliant fund deposits and withdrawals in the market, with money laundering, tax evasion, fraud, and various other means being common occurrences. Users are often distressed and anxious due to being scammed or having their funds stolen, frozen bank accounts, and direct visits from relevant authorities.

To minimize the risks of fund deposits and withdrawals, users need to strengthen their security awareness, learn more about blockchain, and pay attention to the safekeeping of their property, private keys, and passwords. They should also try to conduct transactions on large platforms with licensing certifications. Large institutions such as exchanges should also strengthen their compliance management, cooperate with regulators, obtain the necessary compliance licenses, and provide security for user transactions. Next, let's take a look at the legal requirements for various financial licenses in different regions.

Legal Requirements in Different Regions

The unique innovation of cryptocurrencies makes it difficult to define their attributes, and most regions do not yet have comprehensive regulatory frameworks. The legal licenses related to fund deposits and withdrawals are broadly categorized into the following two types:

- Licenses focusing on payment and currency circulation, such as the Money Transmitter License (MTL) in the United States and VASP in the European Union.

- Professional virtual asset service provider licenses, which will be the future trend.

Entities eligible to apply for the Money Transmitter License (MTL) in the United States include international remittances, foreign exchange, currency trading/transfers, ICO issuance, prepaid projects, and issuance of traveler's checks, covering institutions related to currency services.

To apply for this license, fund deposit and withdrawal projects need to register with the Financial Crimes Enforcement Network (FinCEN) as money service businesses, and then apply for the Money Transmitter License in the operating state. The application is based on a registration and licensing system, and a re-examination is required every two years. Due to the ambiguous nature of cryptocurrencies, fund deposit and withdrawal projects are more or less subject to regulation by the U.S. Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

Compared to the United States, the regulatory systems for cryptocurrencies in the European Union and the United Kingdom are more comprehensive. Fund deposit and withdrawal projects need to obtain a Virtual Asset Service Provider (VASP) license. Additionally, all exchanges, mining pools, wallet providers, custodians, and decentralized applications in the EU are required to have this license. Registering for a VASP license in one EU country allows businesses to operate throughout the entire EU region. Lithuania, an EU member state, has the most lenient cryptocurrency regulatory policies in the EU. Licenses can be obtained in as quickly as one month, with no expiration, a minimum authorized capital of only 2,500 euros, and no specific requirements for local personnel. Many centralized service providers hold such licenses, including Binance, BIT, Huobi, and HyperBC.

In Hong Kong, cryptocurrencies are classified as security tokens and non-security tokens. Therefore, operating virtual currencies legally in Hong Kong requires applying for dual licenses. According to different regulatory authorizations, the Securities and Futures Commission of Hong Kong regulates security token transactions conducted by virtual asset exchanges under the Securities and Futures Ordinance (Type 1 + Type 7 licenses). Additionally, it also regulates non-security token transactions conducted by virtual asset exchanges under the Anti-Money Laundering Ordinance (VASP license). On August 3rd, HashKey and OSL obtained an upgraded license from the Hong Kong Securities and Futures Commission for Type 1 (securities trading) and Type 7 (providing automated trading services), allowing them to engage in retail cryptocurrency business in Hong Kong. They became the first batch of institutions to obtain licenses since the new regulatory requirements for retail digital asset trading in Hong Kong took effect on June 1, 2023.

Status of Obtaining Compliance Licenses for Fund Deposits and Withdrawals

In countries or regions with clear regulations on exchange supervision, obtaining a license means that an institution is under the supervision of the local government, can legally operate cryptocurrency businesses, and users can deposit funds using fiat payment methods, with their assets and information being highly protected. The number and quality of licenses also reflect the confidence and determination of institutions and exchanges to invest in the future, and play an important role in enhancing their publicity and consolidating user confidence based on the overall strength of the institutions and exchanges. From the current industry landscape, the following four mainstream exchanges are in the first tier in terms of the quality and quantity of licenses:

Binance

As the world's largest exchange, although its headquarters are not clearly defined, Binance has been making efforts in security and compliance to fill the gray areas and actively embrace regulation and compliance. In 2022, Binance made significant progress in compliance in the EU, the Middle East, and North America, obtaining compliance licenses and permits in three G7 countries (the United States, France, Italy) and three regions in the Middle East (Dubai, Abu Dhabi, Bahrain). However, overall, Binance focuses more on relatively remote areas and small countries, establishing local fiat exchanges and building good relationships with local regulatory authorities.

In 2023, it is worth noting that Binance obtained a digital asset operator license in Thailand, marking its first license in Southeast Asia and signaling its legalization in the region. Additionally, the legal battle between SEC and Binance US has caused significant turmoil in the cryptocurrency market, leading to strengthened cryptocurrency compliance and security regulation in the United States. Furthermore, Binance's global compliance has not met expectations, as it has not obtained a cryptocurrency operating license in Hong Kong, and its European expansion has been tightened by regulators following the FTX incident, leading to various issues in different regions.

OKX

The well-established cryptocurrency exchange OKX has reportedly obtained a Money Services Business (MSB) license in the United States, a virtual currency exchange license from the Philippine government, a cryptocurrency exchange platform license from Japan, a provisional license from VARA in Dubai, and a temporary virtual asset license in the UAE. It also holds legal operating licenses in France and the Bahamas.

OKX is headquartered in Seychelles, with its operating entity in Hong Kong. The team began preparing to apply for a legal operating license in Hong Kong a year ago and assembled a team of over 20 people to handle compliance procedures in Hong Kong. Lennix, the Global Chief Business Officer of OKX, stated that OKX is expected to submit audit results in September, but the specific approval and the time to obtain the license will depend on the response from the Hong Kong Securities and Futures Commission. However, this does not affect the smooth operation of OKX's business in Hong Kong until approval is obtained.

Coinbase

The leading US-based exchange Coinbase is the first licensed Bitcoin exchange in the United States. The team places great emphasis on compliance, maintains close contact with the government, and holds a BitLicense from the state of New York as well as a trust license. It also holds Money Transmitter Licenses (MTL) in various states in the United States and electronic money service licenses from the UK's FCA and the Central Bank of Ireland. Due to the need for compliance for listing, the company has not issued any platform tokens and has not engaged in higher-risk derivative businesses. Coinbase successfully went public on Nasdaq on April 14, 2021, marking a milestone in the development of Bitcoin and other digital assets and highlighting the dividends of focusing on compliance for other exchanges.

However, despite being known for its compliance focus as a US-based company, Coinbase was also sued by the SEC following Binance, accusing Coinbase of illegally operating as a national exchange, broker, or clearing agency. Just six months prior, Coinbase was fined $50 million by the New York State Department of Financial Services (NYDFS) for violating New York banking laws and the state's compliance program.

Huobi

Similarly, as an established exchange, Huobi has been continuously strengthening its compliance process since 2018. It holds an MSB license in the United States, a Distributed Ledger Technology (DLT) license in Gibraltar, a digital asset exchange license from the Thai Ministry of Finance, and its subsidiary BitTrade holds a legal license in Japan. It also holds a Virtual Asset Service Provider (VASP) license in Lithuania and operates exchanges in Dubai and Australia. Overall, its licenses are mainly concentrated in tax havens, focusing on quality over quantity.

Regarding the application for a license in Hong Kong, Huobi has been preparing for it, and in May, it launched a new exchange, Huobi Hong Kong. Sun Yuchen, a member of Huobi's Global Advisory Committee, stated that Huobi submitted a VASP application in late May, including an 18-month grace period. The regulatory agency can approve or reject the application, but Huobi may be able to obtain a cryptocurrency trading license in Hong Kong as early as the end of this year.

Conclusion

As the cryptocurrency market continues to grow and benefit from the impact of the FTX incident last year, global market regulatory efforts have significantly increased, and legal compliance is increasingly being introduced. The behavior of major exchanges in obtaining licenses for legal operations not only allows cryptocurrency economic activities to enter the public eye legally but also demonstrates the comprehensive strength of the exchanges and their determination and confidence in the future. However, the most important aspect is the protection provided to users for their transactions, becoming a solid cornerstone of confidence in the cryptocurrency market. We also hope to see that with the compliance of the cryptocurrency market, good practices will drive out bad practices, allowing us to go further and longer together.

Follow Us

veDAO is a decentralized investment and financing platform driven by DAO, committed to discovering the most valuable information in the industry and dedicated to exploring the underlying logic and cutting-edge tracks of the digital encryption field, allowing every role within the organization to fulfill their responsibilities and receive rewards.

Website: http://www.vedao.com/

Twitter: https://twitter.com/vedao_official

Facebook: bit.ly/3jmSJwN

Telegram: t.me/veDAO_zh

Discord: https://discord.gg/NEmEyrWfjV

🔴Investment carries risks, and the project is for reference only. Please bear the risks on your own🔴

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。