Today, the veDAO Research Institute will share insights on a concept familiar to all cryptocurrency investors - "crypto wallets." Crypto wallets are the primary access point for the Web3 economy, and their importance has grown with the development of the Web3 economy and the widespread adoption of Web3 applications. They need to match the progress of Web3, meet a variety of user needs, and incorporate new technologies and innovations. This presents both challenges and opportunities in the market. This article will explore the development of crypto wallets, focusing on trends and innovative directions, and share wallet projects with innovative highlights.

Basic Concepts of Crypto Wallets

The function of traditional electronic wallets is to store assets and facilitate mobile payments. In addition to these functions, crypto wallets incorporate identity verification, which serves as the entry and authentication point for users in various DApps within Web3. There are various forms of crypto wallets in the current market, each with different levels of security and convenience. They can be classified into two main categories:

Based on connectivity, they are categorized as cold wallets and hot wallets:

Cold Wallet (Offline Wallet): Keys are stored in hardware devices, including "paper wallets" safeguarded by mnemonic phrases, offline mobile phones, hardware wallets, etc., and are only connected when you want to use cryptocurrency.

Hot Wallet (Online Wallet): Keys are stored in applications or software, and the private key needs to be connected to the network for transaction signing. This category includes commonly used wallet apps, web plugin wallets, etc.

Based on self-control of private keys, they are categorized as custodial wallets and non-custodial wallets:

Custodial Wallet (Centralized Wallet): Private keys are held by trusted third parties and securely store digital assets on the blockchain. This means that users do not have complete control over their funds. This type of wallet is mainly provided by cryptocurrency exchanges or professional custody services, such as Binance, Huobi, and other trading platforms.

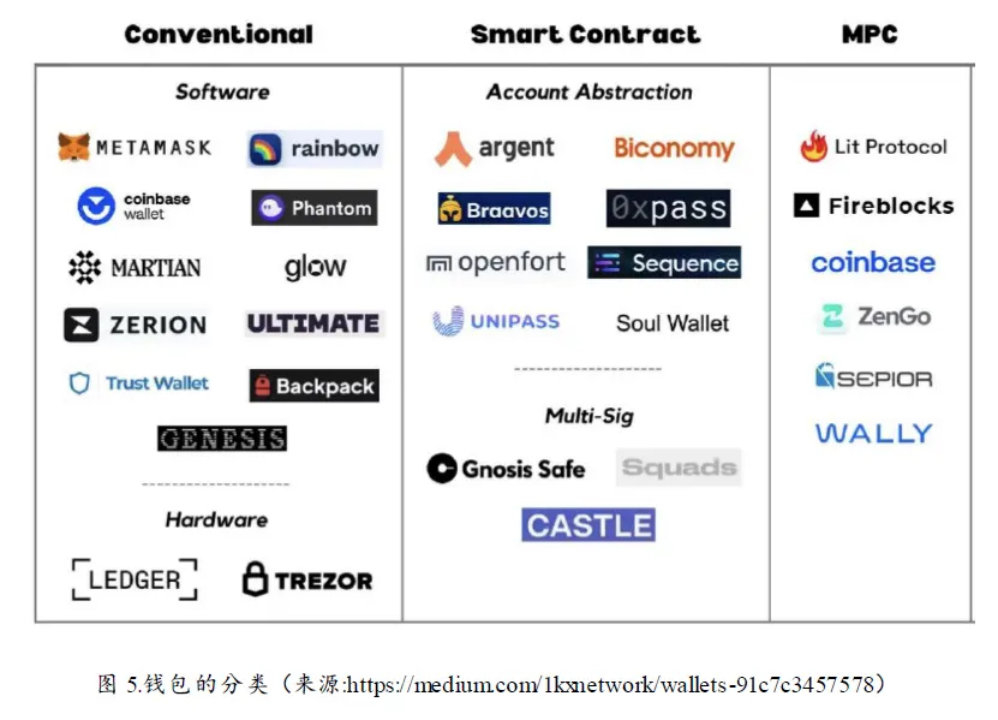

Non-Custodial Wallet (Decentralized Wallet): This type of wallet allows users to have complete control over their keys and funds. Non-custodial wallets can be based on browsers, software, or hardware, such as MetaMask, TokenPocket, imToken, etc. Non-custodial wallets can be further divided into three categories:

External Owned Account (EOA) Wallet: EOA wallets are the most common digital wallets for storing and managing cryptocurrencies. They are usually provided by centralized exchanges or wallet providers and require users to hold their own private keys. Examples include Metamask, Backpack, Phantom, Rabby, and Rainbow.

Smart Contract Wallet: Smart contract wallets are decentralized wallets that use smart contracts to manage assets. They are more secure and flexible than EOA wallets, supporting advanced features such as social recovery and multi-signature. Examples include Argent, Safe, and Sequence.

Multi-Party Computation (MPC) Wallet: MPC wallets use a technology called threshold encryption to enhance security. The private keys required for authorized transactions are divided into multiple parts and distributed to multiple parties, ensuring that no single party can independently access the keys. This significantly reduces the risk of single point of failure or attacks, making it more difficult for hackers to steal funds. Examples include Fireblocks, ZenGo, Coinbase MPC, and Particle Network.

Image Source: Huobi Research Institute

Image Source: Huobi Research Institute

Current Market Status & Pain Points

The current market development of crypto wallets has several characteristics:

Link: https://www.blockchain.com/

The user base continues to grow, and market share is rising simultaneously. According to data from Blockchain.com, the average ownership rate of crypto tokens in 2022 was 3.9%, with over 300 million people globally using crypto assets. The number of users with crypto wallets reached 68.42 million in 2021, and by July 2022, the number had reached 81 million, showing exponential growth. The development of the Web3 economy and the rise of digital assets have driven traditional funds into the Web3 world, increasing the market demand for secure storage of digital assets and on-chain activities. This has created a development opportunity for the digital wallet industry, attracting a large number of developers and capital inflows.

As a fundamental infrastructure of Web3, crypto wallets are favored by investment institutions. Crypto wallets are one of the main investment tracks chosen by institutions. Data shows that the total investment amount in the wallet field has been steadily increasing over the past five years. In the first half of 2022, the total financing amount in the wallet field far exceeded other fields, reaching as high as $400 million.

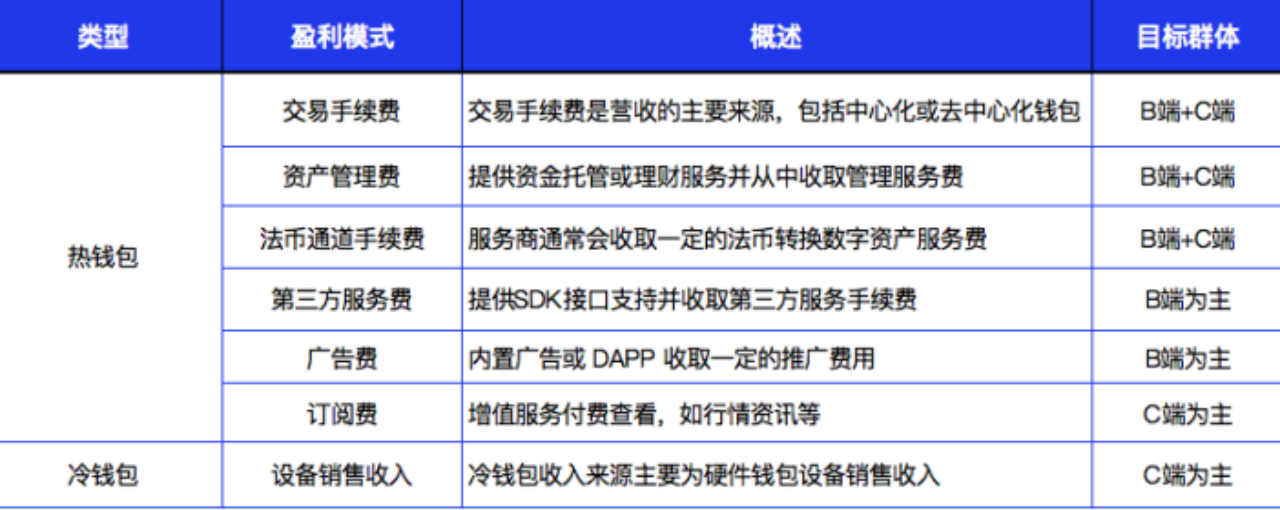

From B2C to B2B2C business, the crypto wallet market mainly consists of two types: B2B and B2C. Compared to the B2B field, the B2C field is the main source of profit for most crypto wallets. As trading volume increases with a more mature market, wallet merchants will begin to build economic moats and entry barriers, while also profiting from the traffic they generate. This increased bargaining power will make wallet products more attractive as B2B partners for other DApps and DEX protocols, transforming them into a B2B2C business model.

Image Source: 7OclockMedia

Image Source: 7OclockMedia

Although crypto wallets have made significant progress in recent years, there are still several challenges that need to be overcome to make them more user-friendly and accessible. Key challenges faced by decentralized crypto wallets currently include:

Security: The security of decentralized wallets is relatively high, but the biggest challenge lies in the safeguarding of users' private keys and preventing hacker attacks. The lack of user security knowledge and awareness, as well as poor operational habits, create excellent opportunities for hackers. For wallet developers, the underlying security of wallets also presents significant challenges. In addition to open-sourcing wallet code, developers need to conduct secure code audits for major updates and manage wallet private keys effectively.

Privacy and Regulation: Privacy and regulation are ongoing topics in the Web3 domain, and wallets face issues related to user data privacy and business compliance.

Usability: Every interaction with a wallet requires user intervention, necessitating a certain level of basic blockchain knowledge. Whether for beginners or experienced users, issues such as managing mnemonic phrases or the risk of mnemonic phrase theft can be frustrating. While centralized wallets have certain human-induced security risks, they are relatively easy to operate and have user-friendly interfaces. If decentralized wallets want to attract more users, they must address usability issues.

To address these challenges, wallet manufacturers are exploring new methods and technologies to create user-friendly and secure digital wallets that are more easily adopted by the mainstream. Innovation drives wallet development.

Multi-Party Computation (MPC)

MPC wallets share "secret information" with your device and one or more other devices, replacing traditional private keys. MPC wallets eliminate single points of failure by using threshold signature schemes (TSS). In this paradigm, private key shards are created and distributed, ensuring that no single person or machine can fully control the private key. This process is known as distributed key generation (DKG). Subsequently, key shards are merged to jointly generate public keys without exposing the key shards of each party, achieving the so-called sharing of "secret information."

Based on this feature, there are more derived functions, such as easier account recovery. Therefore, MPC wallets are similar to traditional EOA accounts with invisible private keys. Additionally, they support threshold setting, meaning that each transaction requires the participation of a threshold percentage of users to jointly generate a signature for the transaction to be effective.

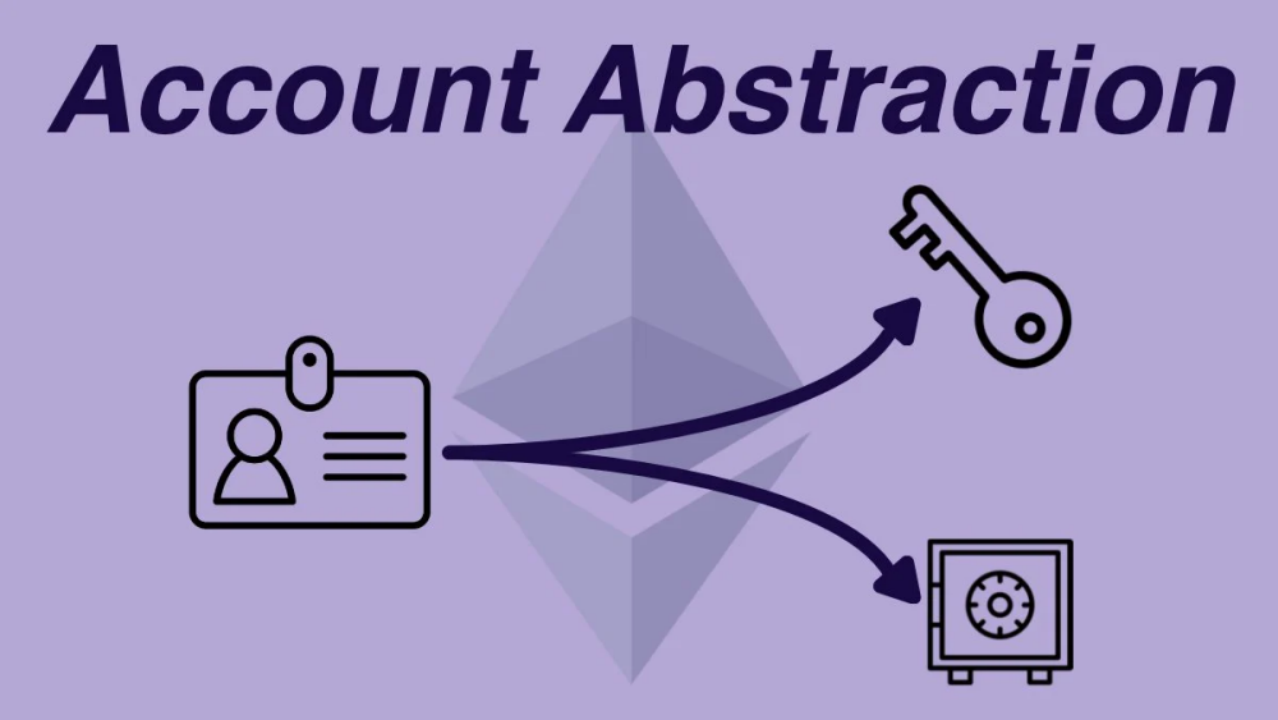

Abstract Account (AA)

An abstract account is a type of contract account that combines the advantages of current contract accounts and external owned accounts (EOA). Compared to MPC, it offers the advantages of flexible contract design, customizable logic, and being always online. AA wallets verify transactions through the contract at the entry point before proceeding to execute the transactions.

The emergence of abstract accounts has brought significant advancements to the development of Web3 wallets by introducing on-chain programmability through smart contracts, adding flexibility to Web3 wallets. It supports custom rules, allowing for the selection of signature algorithms other than the current ECDSA signature algorithm, such as BLS, EdDSA, etc., to better meet the needs of specific application scenarios. Through AA, it is even possible to have a separate signature authorization from the account, meaning that permissions and identities are isolated and have recoverable features. This not only addresses the embarrassing situation of "losing a private key equals losing an identity" but also brings convenience to DID design.

Highlighted Project Sharing

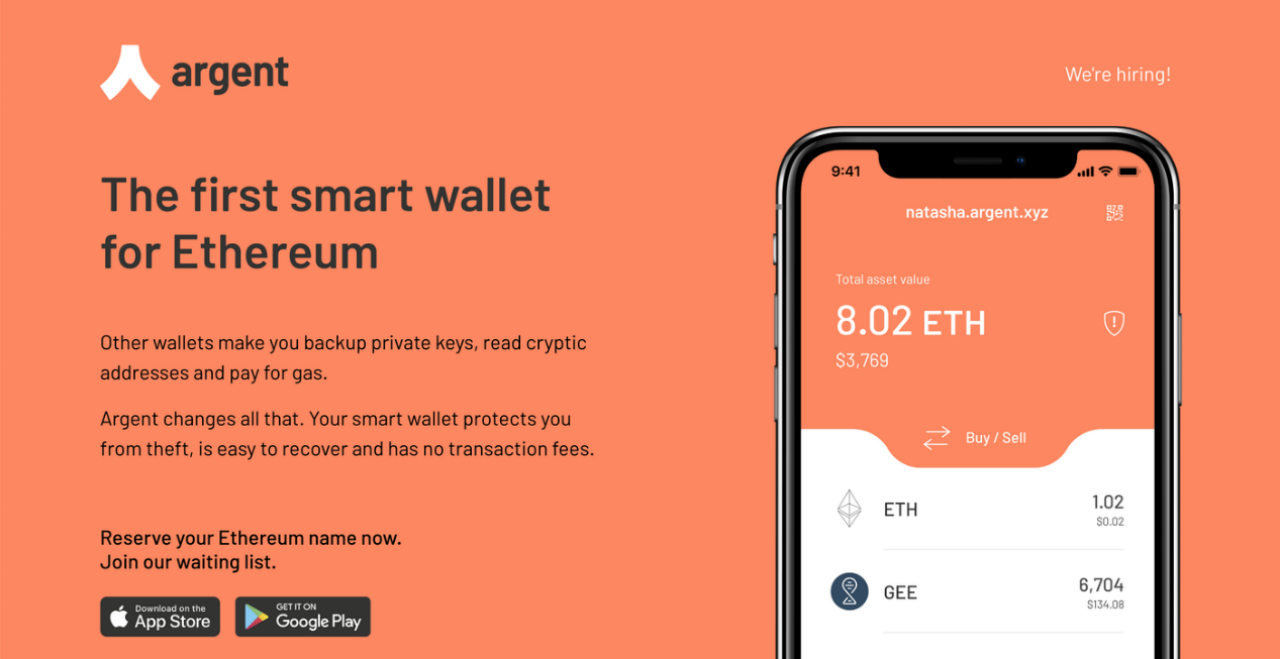

1. Argent

Argent is an active Layer2 wallet on the Ethereum blockchain, known for its ability to easily transfer assets from Layer2 to Layer1 with low costs and high speed. Its main features include:

Social Recovery: Argent's social recovery feature allows users to recover their wallets by establishing connections with trusted contacts, making it easier for users to recover their wallets without needing to remember complex mnemonic phrases or private keys.

No Need for ETH as Gas Fees: Argent uses MetaTransaction technology to enable users to send transactions without owning ETH. Specifically, Argent pays gas fees for users through the "Gas Station Network (GSN)" intermediate service and deducts the corresponding fees from the user's account.

Attack Detection: Argent wallet utilizes its self-developed "Guardians" smart contract to automatically detect and prevent phishing attacks, malware attacks, replay attacks, etc. For example, when a user receives an email or text message that appears to be from the Argent wallet, the Guardians contract will check if the information is from an official channel. If it detects that the information is not from an official channel, the Guardians contract will automatically block the user from executing any transactions related to that information.

In terms of funding, Argent has completed three rounds of financing totaling $56 million. In 2018, it completed a $4 million seed round with participation from Index Ventures, among others. In 2020, it completed a $12 million Series A round led by Paradigm. In April 2022, it completed a $40 million Series B round led by Fabric Ventures and Metaplanet.

Argent focuses on the most important aspect of security in crypto wallets, eliminating the concept of private keys and mnemonic phrases, and using features such as social recovery to ensure ownership of the wallet, thereby reducing the entry barrier for users. However, compared to other wallets, Argent users cannot easily switch between most commonly used EVM networks, which to some extent limits its use cases and makes it difficult to establish user stickiness. At present, the user base of the Argent wallet is relatively small, mainly due to the stability of the ZK network, lack of support for storing and trading multiple cryptocurrencies, and other reasons.

Related URL: https://app.vedao.com/projects/f6b1e727985306e0a486e5ce72b9f5c35608550508ea21652c47b014bba391fb

2. Unipass

UniPass is a crypto wallet that allows users to access their accounts without needing to remember mnemonic phrases. It is based on an email social recovery solution, making it easy for users to regain access in case of loss or threat. It aims to provide a familiar user experience from Web2 and better access to the Web3 world. Its features include:

ERC-4337 Compatibility: Users can activate ERC-4337 compatibility mode by adding the 4337 module transaction in the MainModule. After activation, users can submit transactions to the Bundler through standard ERC-4337 verification. Users can also sign UniPass transactions and submit them to the Relayer for on-chain processing.

Email Recovery: Users can set multiple internet email addresses as guardians of their accounts. By submitting an email to the on-chain smart contract, users can recover their wallet private keys. When users have more than two guardian email addresses (including the primary email), they can use these two emails to submit an account recovery email and immediately recover the account. When users have only one guardian email, they typically need to wait for a 48-hour lockout period to recover the account.

Gas Fee-Free Experience: UniPass provides a default relay node that accepts gas payments in native tokens and popular stablecoins.

Related URL: https://app.vedao.com/projects/c2ab33d4aefdf9e6e26c0562cadc0893d9bd08b4813e472081c555f6cf6ff472

3. ZenGo

ZenGo is the first keyless cryptocurrency app wallet, with advanced security and biometric technology. Unlike other cryptocurrency wallets, ZenGo eliminates technical barriers and allows users to log in without a key - only an email address and fingerprint lock are required to set up the wallet.

ZenGo operates as a keyless non-custodial wallet using various security tools, including biometric encryption, three-factor authentication, and multi-party computation encryption. This keyless security system ensures there are no single points of failure, and even if one of the multi-party computation encrypted shares encounters an issue, the user's encrypted assets remain secure.

In terms of funding, in February 2023, ZenGo completed a $10 million Series A expansion financing through the issuance of convertible bonds and plans to conduct a Series B financing later this year. After the Series A expansion financing, ZenGo's valuation was $100 million, the same as after the Series A financing two years ago. In April 2021, ZenGo completed a $20 million Series A financing, with investors including Insight Partners, Austin Rief Ventures, and Samsung Next.

However, the lack of private keys is a major source of controversy for some traders, and ZenGo's features are not globally available, as functions such as third-party payment providers are specific to certain regions.

Related URL: https://app.vedao.com/projects/c17fefd234405be1094f947e0cd8cf1909ce2e72b69aabf0841cffec15971b20

4. OKX Web3 Wallet

OKX Web3 Wallet has made notable technological advancements, launching the MPC keyless wallet in April and the AA smart contract wallet this month. Jason Lau, Chief Innovation Officer of OKX, stated that OKX aims to provide users with the most convenient, secure, and powerful Web3 platform, and the OKX MPC keyless wallet and AA smart contract wallet will play a crucial role in achieving this goal.

The OKX MPC wallet has significant security advantages, including resistance to hacker attacks, decentralized asset storage, excellent private key security, and convenient fund recovery. The OKX AA smart contract wallet simplifies the complexity of blockchain transactions, streamlining steps such as token exchange and reducing the need for technical terms like "Gas Fees" and "Gwei."

The OKX Web3 Wallet is not only the first wallet to support account abstraction technology on seven major public chains, including Ethereum, Polygon, Arbitrum, Optimism, BNB Chain, Avalanche, and OKTChain, but also the first wallet to support MPC technology on 37 public chains. This technology splits user private keys into three parts, eliminating the need for traditional written records of private keys and mnemonic phrases, significantly enhancing security and eliminating single points of failure.

Related URL: https://www.okx.com/cn/web3

5. Hyperpay

Hyperpay is the world's first multi-ecosystem digital asset wallet that combines custodial finance wallets, decentralized self-managed wallets, HyperMate hardware wallets, and co-managed wallets, providing users with one-stop services for asset custody, financial management, value-added services, and payment. To date, HyperPay wallet supports 57 public chains for custodial wallets, 34 public chains for self-managed wallets, and 17 public chains for HyperMate hardware wallets. The HyperPay wallet has over a million users, with asset management exceeding $1 billion and over 310 million transfers.

HyperPay primarily ensures the security of user assets from four dimensions, including the security of the wallet itself, user security during usage, server security, and the security of technical developers. The custodial service provider for the HyperPay wallet, HyperBC, has obtained a cryptocurrency custody license in Lithuania, and funds held in the HyperBC platform will be regulated by financial institutions.

Related URL: https://app.vedao.com/projects/0827e11fbebe1be45ac403e1cdf5de0b9dabfb73c7b4bc2c79947d4ffefe3a20

Follow Us

veDAO is a decentralized investment and financing platform led by DAO, committed to discovering the most valuable information in the industry and exploring the underlying logic and cutting-edge tracks in the digital encryption field, allowing every role within the organization to fulfill their responsibilities and receive rewards.

Website: http://www.vedao.com/

Twitter: https://twitter.com/vedao_official

Facebook: bit.ly/3jmSJwN

Telegram: t.me/veDAO_zh

Discord: https://discord.gg/NEmEyrWfjV

🔴Investment carries risks, and the projects are for reference only. Please bear the risks on your own🔴

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。