⚡️ Today I took some time to organize my finances and found that Spark @sparkdotfi is really stable—

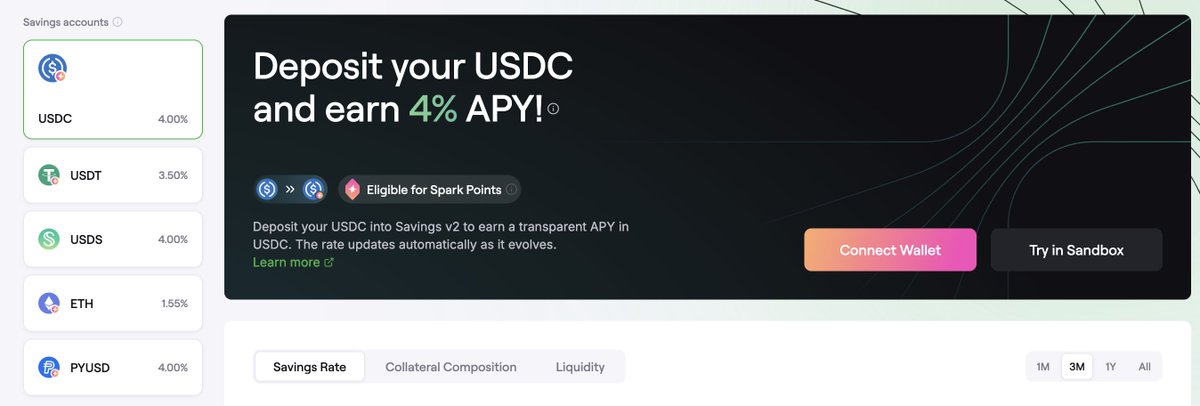

The annualized deposit rate for stablecoins on Spark Savings is about 3.5% to 4%, with low volatility.

Compared to the common savings rates for stablecoins at major exchanges, which are around 1%, that's nearly an additional 300 bps.

Over the past few years of dealing with stablecoin investments, I've experienced a significant change in perception:

The vast majority of people are actually using trader thinking for their finances, stacking up annualized returns with instantaneous gains, while the actual APY is halved.

The reason is that many pools offer you high yields, which essentially involve pre-selling the risks of future volatility, liquidity runs, and sudden parameter changes at a discount, leading to substantial instability premiums in long-term interest rates.

However, I believe that managing finances is fundamentally closer to asset-liability management.

So choosing to invest in Spark Savings represents a completely different philosophy—

Not pursuing extreme yields, but seeking low-risk products where the cost of funds, deployed returns, and interest rates are all within a predictable framework.

Although theoretically the fate of all pools is that as TVL increases, the yield per participant will be diluted,

based on current fee densities, even if the scale goes up a bit more, Spark can still maintain interest rates that are above those of exchange savings!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。