Bitcoin Derivatives Snapshot: $45B in Futures, Calls Dominate

According to coinglass.com stats, global bitcoin futures open interest stands at 671,140 BTC, currently valued at $45.97 billion. Over the past 24 hours, open interest has increased 1.44%, even as shorter-term changes show a modest 0.39% dip over four hours and a slight 0.07% gain in the last hour, signaling repositioning rather than retreat.

The Chicago Mercantile Exchange (CME) leads the futures pack with 122,470 BTC in open interest, worth $8.38 billion, accounting for 18.23% of the market. Binance follows closely with 116,190 BTC, or $7.96 billion, while OKX holds 46,600 BTC valued at $3.19 billion. Bybit, Gate, and MEXC round out the top tier, each commanding multibillion-dollar positions.

Market action this week suggests steady leverage appetite. Binance posted a 2.03% increase in open interest over 24 hours, OKX gained 2.35%, and Bybit rose 2.22%. Gate added 4.57% during the same period, while MEXC recorded a 10.75% jump. In contrast, BingX saw a 36.39% decline over 24 hours, a sharp outlier in an otherwise expanding field.

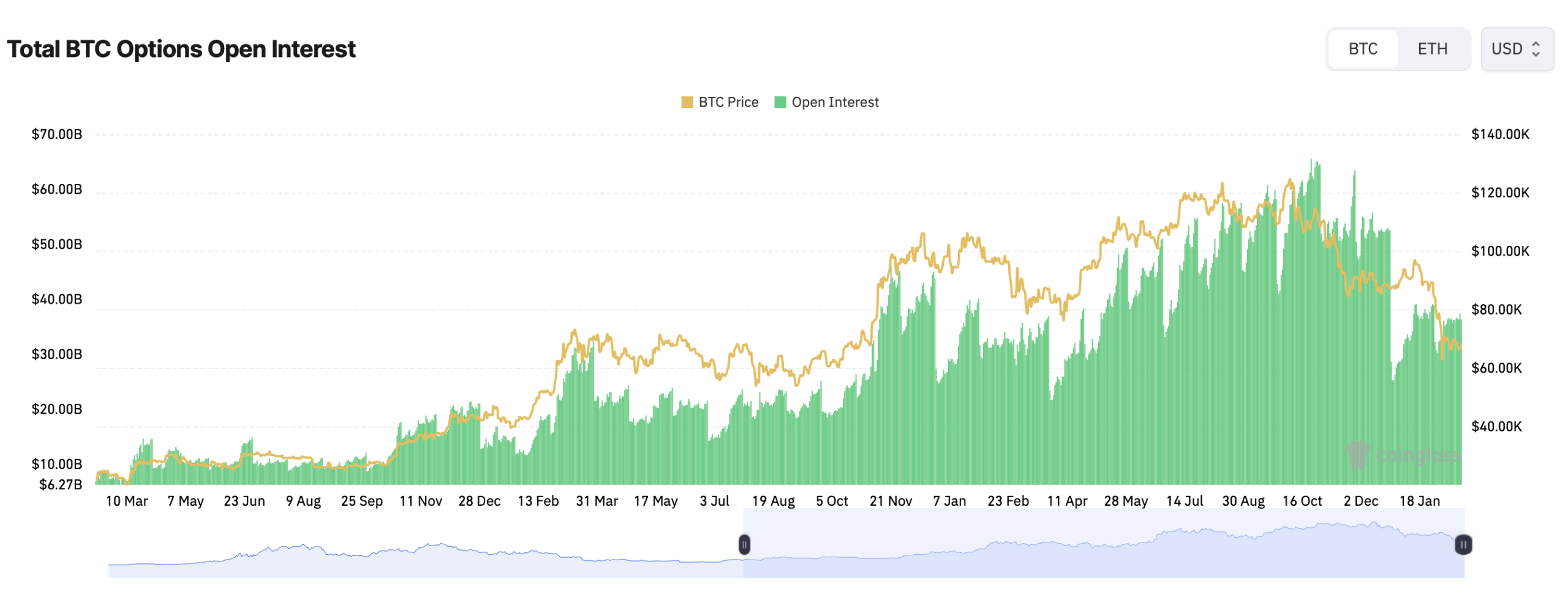

On the options side, total bitcoin options open interest has mirrored the broader derivatives buildout. CME’s options open interest chart shows layered expirations stretching from one month out to contracts beyond six months, with notable concentrations in the two- to three-month and three- to four-month windows. The stacking by expiration illustrates a market not merely chasing weekly volatility, but positioning further down the curve.

Stacked by position, CME data show puts and calls rising in tandem, yet calls consistently outpace puts. Overall options open interest stands at 283,456.92 BTC in calls versus 219,725.98 BTC in puts, giving calls a 56.33% share. In 24-hour volume terms, calls represent 55.91%, compared with 44.09% for puts. The tilt suggests traders are leaning bullish, though not recklessly so.

Strike-level data reinforce that bias. Among the largest open interest contracts are Deribit’s Feb. 27, 2026 $75,000 calls at 8,342.9 BTC and $40,000 puts at 7,375.6 BTC. Longer-dated bets include December 2026 $120,000 calls and March 2026 $90,000 and $80,000 calls, underscoring that some participants are eyeing six-figure territory.

Max pain levels add another layer of intrigue. On Deribit, max pain hovers near $85,000, while Binance’s curve peaks closer to $120,000 before easing toward roughly $90,000 for later expirations. OKX’s max pain sits near the $80,000 to $85,000 range. With bitcoin trading below $70,000, these levels suggest a theoretical gravitational pull higher as expirations approach.

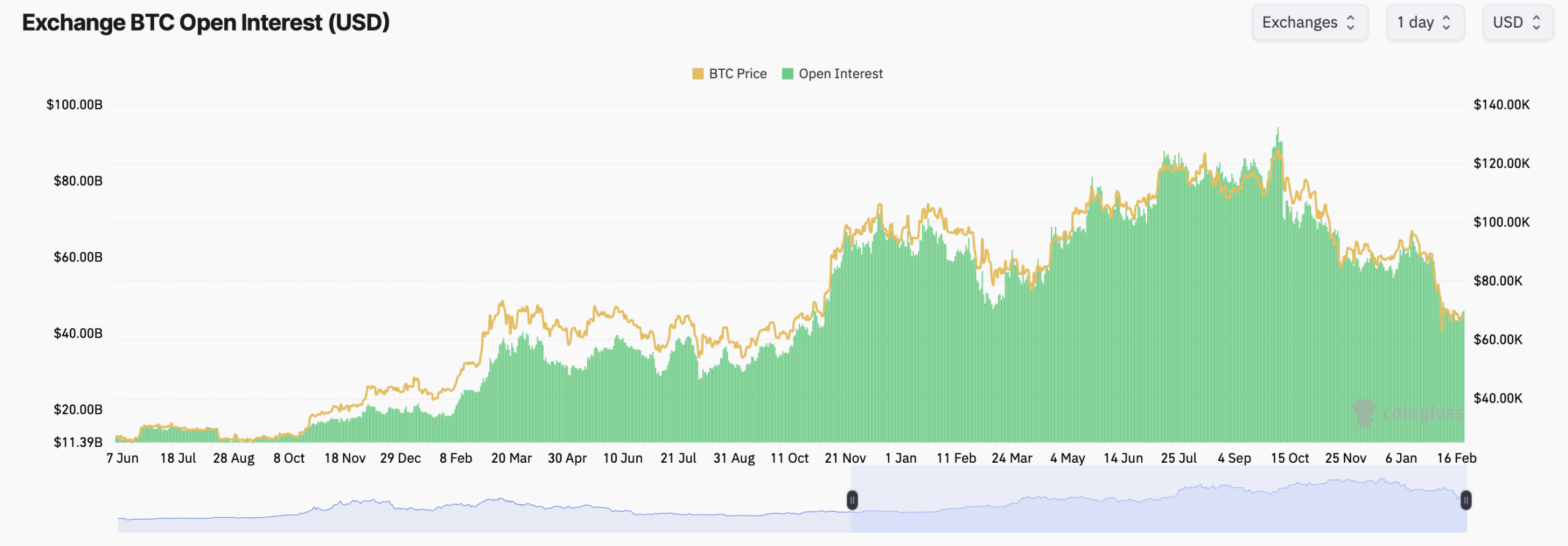

Exchange-wide bitcoin open interest, measured in U.S. dollars, peaked above $80 billion in late 2025 and now sits near $46 billion. The decline from those highs reflects deleveraging from prior peaks, yet current levels remain historically elevated, indicating derivatives markets remain central to price discovery.

In short, bitcoin at $68,485 is not drifting in isolation. Beneath the surface lies a $45.97 billion futures market and a call-heavy options complex stacked across CME, Binance and OKX. Whether price marches toward the $80,000-plus max pain clusters or retraces lower, one thing is clear: derivatives traders are firmly in the driver’s seat.

FAQ 🐻🐂

- What is total bitcoin futures open interest right now?

Global bitcoin futures open interest stands at 671,140 BTC, valued at $45.97 billion. - Are calls or puts dominating bitcoin options markets?

Calls lead with 56.33% of open interest compared with 43.67% for puts. - Which exchange has the largest bitcoin futures open interest?

CME leads with 122,470 BTC in open interest, worth $8.38 billion. - Where are current bitcoin max pain levels?

Max pain clusters near $80,000 to $85,000 on Deribit and OKX, and around $90,000 on Binance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。