Just saw Bitwise's data, simply put, Bitwise believes that although the price of $BTC has sharply declined, there are no signs of a collapse in the holdings of Bitcoin spot ETFs, representing that this downturn is more of a "price drops first, flow maintains" structural mismatch, rather than a typical "ETF fund liquidation."

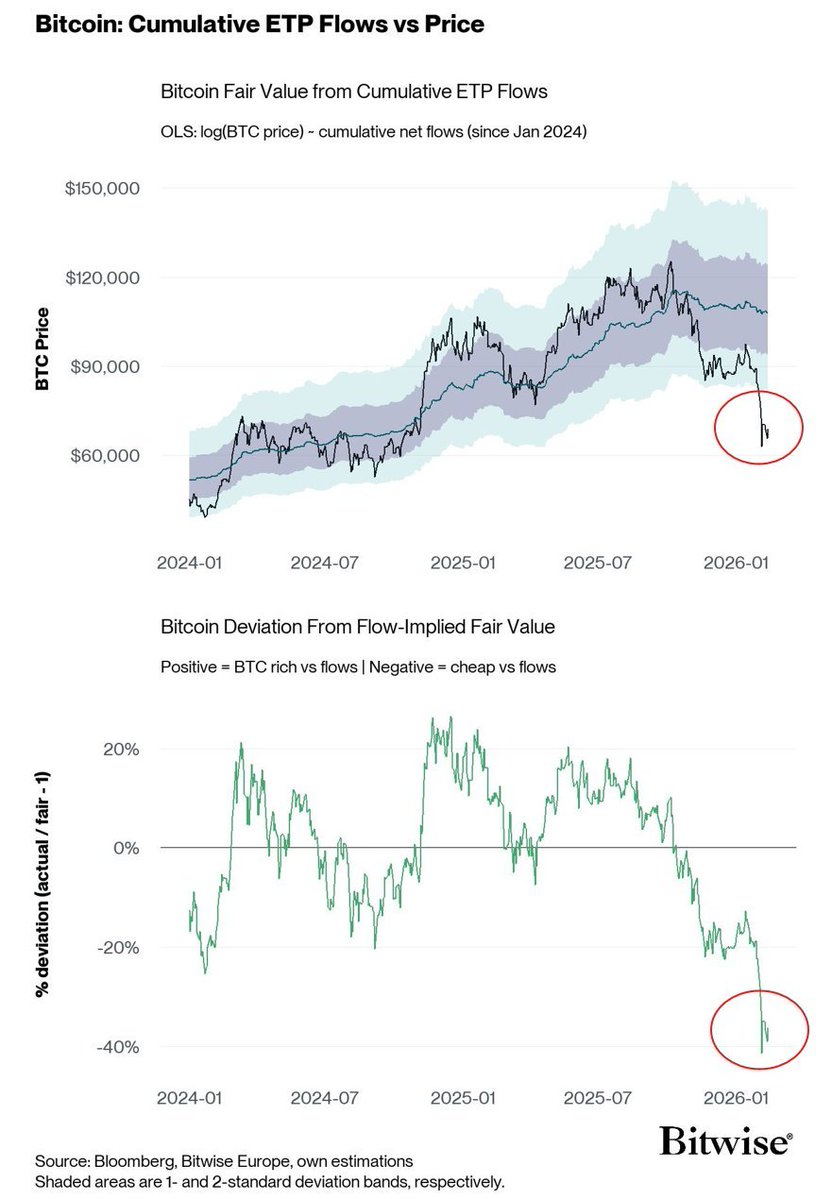

Bitwise recalibrated the net inflow of spot ETFs since January 2024 to the price of BTC, yielding a fair value implied by capital flow.

The results show that the current actual price of BTC (black line) has significantly dropped below this flow implied fair value, with the deviation once reaching an extreme range of -35% to -40% (close to/touching 2σ).

In simple terms, the cumulative capital flow of the ETF still represents real demand intensity, meaning BTC is currently in a position of "significantly discounted relative capital flow."

Therefore, the current trend is more likely a "price collapse" caused by leverage unwinding, derivatives forced liquidations, and a sudden drop in short-term risk appetite, rather than an ETF collapse causing this, which is consistent with what Robert Mitchnick, the Global Head of Digital Assets at BlackRock, stated at the Bitcoin Investor Week 2026 event.

@bitget VIP, lower rates, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。