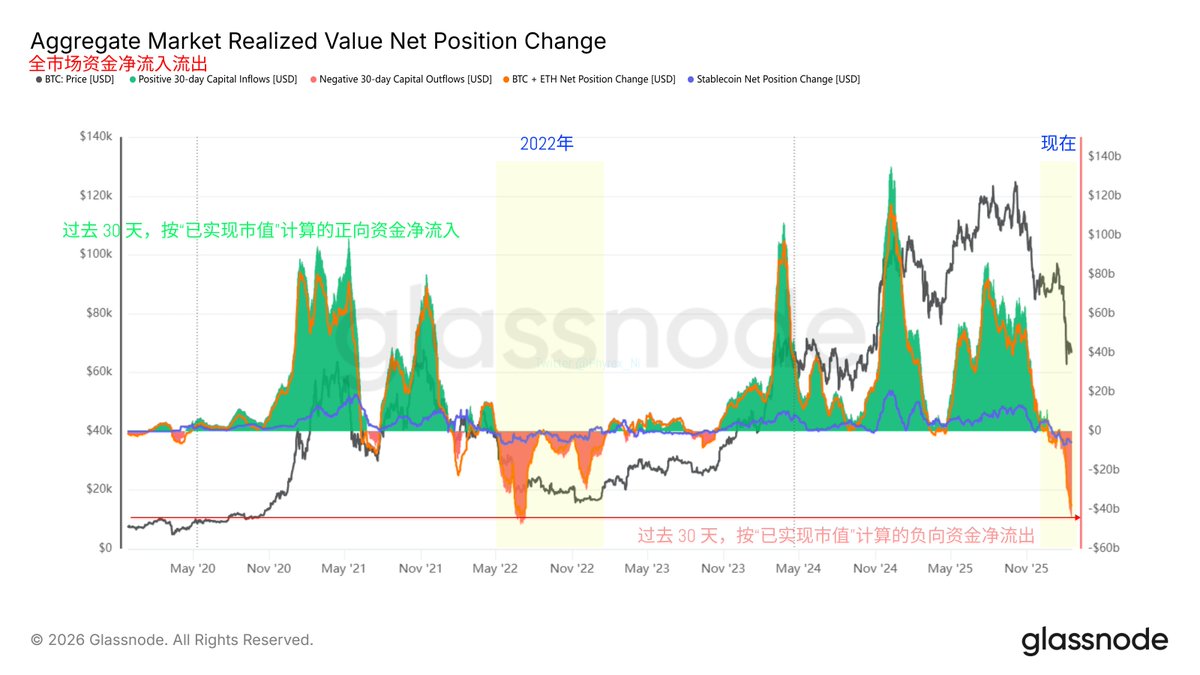

The first large-scale capital exodus since 2022 is happening!!

The primary reason for the unfavorable upward movement in the US stock market has been that institutions are out of cash, and in the cryptocurrency space, especially with $BTC and $ETH, not only has purchasing power decreased, but there has also been the largest outflow of funds since 2022. Starting at the end of January 2026, money has been crazily withdrawing from the crypto space, accompanied by sell-offs of BTC and ETH.

Compared to the 2022 bear market, this withdrawal is noticeably faster, more rapid, and resembles a systemic pullback where risk appetite is cut drastically, rather than a slowly developed emotional collapse. Interestingly, we have not seen early investors collapse yet; even those holding positions above 100,000 are currently still very stable.

The outflow of funds in 2022 was wave after wave, occasionally mixed with rebounds and breather periods, but this time, from the data, we see that a 30-day net outflow has directly hit deep red territory, indicating that the market is not merely transitioning but is in a net retreat.

Moreover, the structure of this capital exit is very unhealthy; the net positions of BTC and ETH (orange line) have clearly turned negative, indicating that core assets are being reduced, while the net positions of stablecoins (purple line) have not significantly strengthened, meaning that funds are not being reinvested but are directly withdrawn from the market.

This is why the sensation of this decline feels more direct; it isn't that there are buyers coming in as prices fall, but the buying funds are also shrinking. This situation directly impacts the subsequent rhythm; when net outflows enter this accelerated phase, the market will enter a typical negative feedback loop.

When prices decline, risk management triggers reductions in positions, resulting in worse liquidity, making prices easier to smash through, then continuing to trigger further position reductions.

So in the short term, it’s hard to see that after a significant drop, there should be a rebound; rather, with no new funds coming in, even occasional rebounds driven by good news will be treated as liquidity exits for fleeing.

Finally, I want to emphasize that if this outflow is merely a cryptocurrency issue, it typically would manifest as funds migrating within the chain, such as from altcoins back to BTC, from risk assets back to stablecoins, but the current signals seem more like a cross-market risk clearing.

On the US stock market side, institutions are out of cash, and on the crypto side, funds are directly leaving, indicating that liquidity is still retreating, and all risk assets are synchronously contracting. Perhaps only a small number of "safe-haven" assets can attract funds, while assets requiring high-risk appetite will be affected.

In this environment, determining a turning point is never solely about emotional recovery but about two things:

1. Whether the speed of capital outflow begins to slow down and shows signs of reversing.

2. Whether the net positions of stablecoins and core assets return to positive territory (funds returning to stablecoins).

@bitget VIP, lower fees, greater benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。