Author: Frank, PANews

On February 18, 2026, Polymarket announced that starting on this day, the platform will pilot charging market order fees in the sports market. The first wave of covered events is American college basketball (NCAA) and Serie A league, and will gradually expand to all sports events in the future.

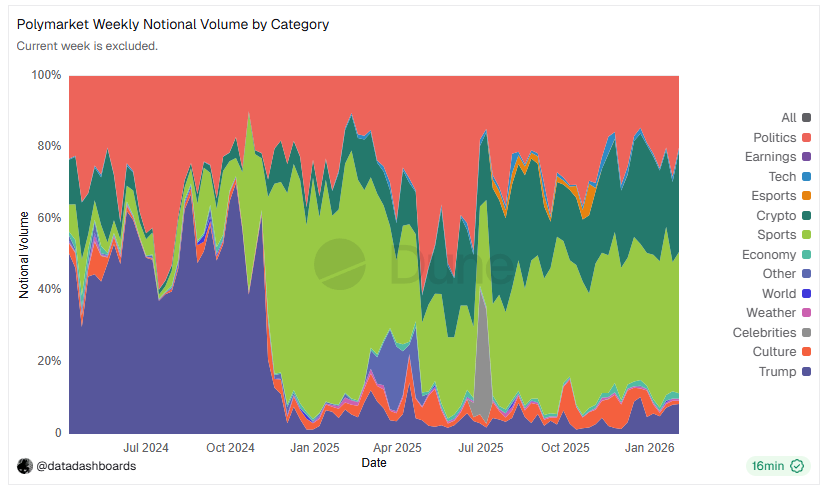

Previously, based solely on the fees from cryptocurrency's 15-minute rise and fall markets, Polymarket's recent weekly revenue has exceeded $1.08 million. According to on-chain data, the sports market accounts for nearly 40% of the platform's total trading activity. When converted to annual income, the cryptocurrency market fees alone can contribute approximately $56 million in annual revenue. Therefore, when the larger share of the sports market also begins to charge fees, Polymarket may become the largest money printer in the cryptocurrency field.

PANews conducted an in-depth analysis of Polymarket's fee mechanism, revenue model, competitive benchmarking, and token airdrop expectations.

From "zero revenue" to weekly million, the $9 billion giant is eager to make money

For a long time, Polymarket operated with nearly "zero revenue," with the vast majority of markets not charging any transaction fees. This free strategy has brought it astonishing growth: the total trading volume for the whole year of 2025 reached $21.5 billion, accounting for nearly half of the global prediction market's total trading volume ($44 billion); in January 2026, the monthly trading volume even set a record by surpassing $12 billion.

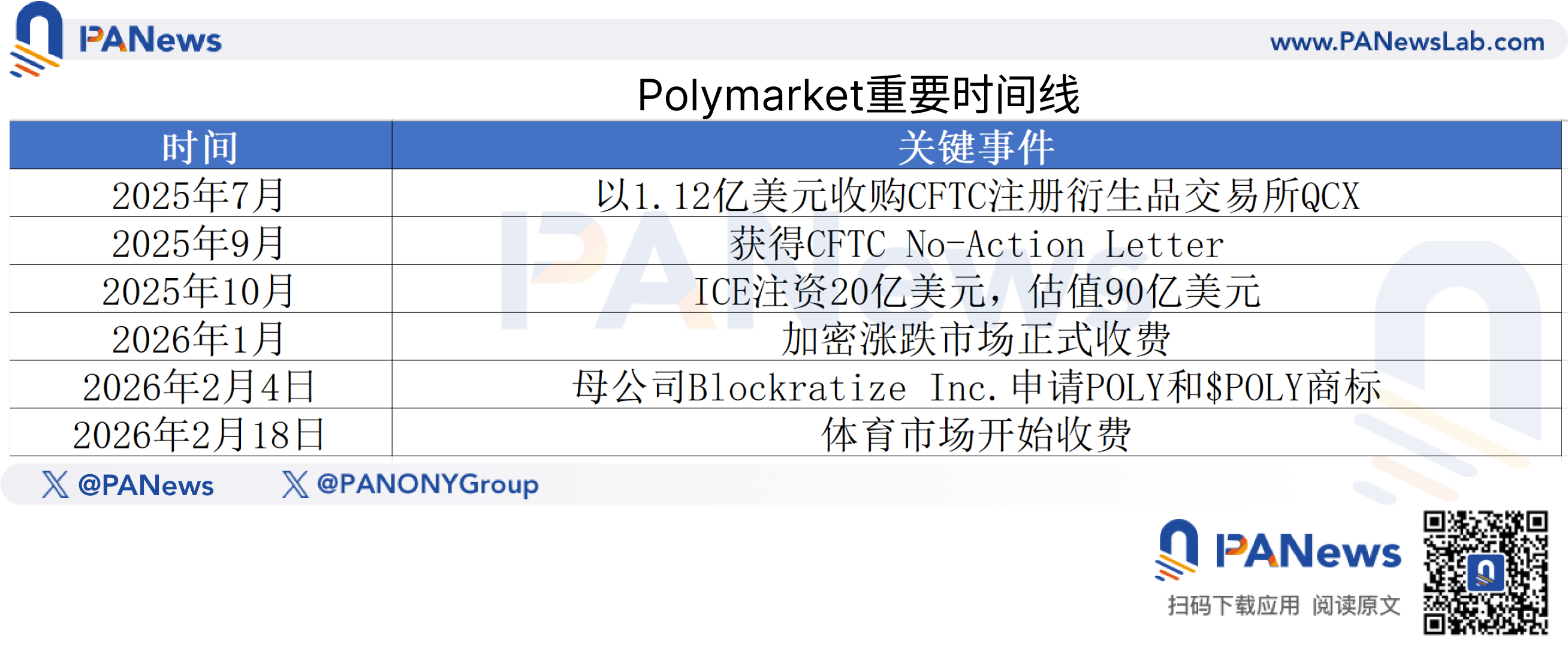

However, with the listing of coins approaching this year, the zero-revenue model is clearly inadequate to match its valuation. In the recent funding round, its valuation has reached $9 billion. In October 2025, the parent company of the New York Stock Exchange, Intercontinental Exchange (ICE), invested up to $2 billion in Polymarket. According to PM Insights data, as of January 19, 2026, the implied valuation of Polymarket’s equity in the secondary market has climbed to $11.6 billion, an increase of nearly 29% from the previous funding round. Reports suggest that the valuation for subsequent funding rounds may reach between $12 billion to $15 billion. Such a high valuation requires matching revenue to support it.

The turning point occurred in January 2026, when it was evident that Polymarket was getting anxious this year.

In January, Polymarket officially introduced the "Taker Fee" for its high-frequency trading product for the 15-minute cryptocurrency rise and fall market, with fees reaching as high as 3%. The data was immediate: by early February 2026, weekly fee revenue surpassed $1.08 million, with one week in January contributing $787,000 from the 15-minute rise and fall market alone, accounting for 28.4% of the total platform's prediction market fee revenue ($2.7 million) during the same period. To date, Polymarket has generated over $4.7 million in fees, ranking high on revenue charts.

The clever design behind 0.45%, a fee model not just for making money

The fee introduced by Polymarket for the sports market is a meticulously designed dynamic fee model.

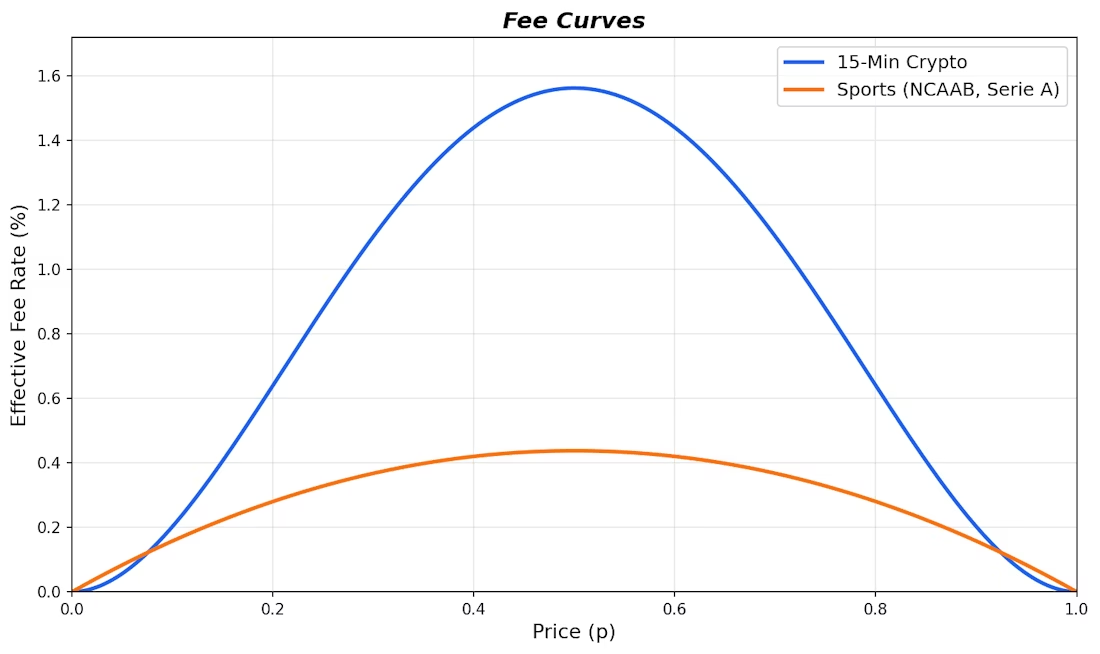

According to Polymarket's official documents and community analysis, the sports market fee is only charged for market orders (Takers), while limit orders (Makers) not only are free but also can earn a 25% rebate of the Taker fees. Similar to the fee model in the cryptocurrency market, the rate is not a fixed value but fluctuates with changes in event probabilities:

In simple terms, the more uncertain the market, the higher the charges; when the probability is 50%, the rate peaks at 0.44%, while it drops to only 0.13%-0.16% at 10% or 90% probabilities.

However, from a standard perspective, the charging standards of the sports market are far lower than the rates in the cryptocurrency market. Nevertheless, this does not affect the income potential of the sports market.

Data shows that current sports markets account for 39% of Polymarket's total trading activity, exceeding political markets (20%) and cryptocurrency markets (28%). More critically, according to previous analysis by PANews data, the average trading volume of short-term sports markets on Polymarket ($1.32 million) is 30 times that of the average trading volume of short-term cryptocurrency markets ($44,000). This means that if the sports market charges fees comprehensively, the income will see significant growth.

Taking the 2026 Super Bowl as an example, Polymarket's total trading volume in Super Bowl-related markets reached approximately $795 million, covering various sub-markets such as game outcomes, player performance, and halftime show predictions. A single week saw the total trading volume of prediction markets driven to exceed $6.3 billion by sports events.

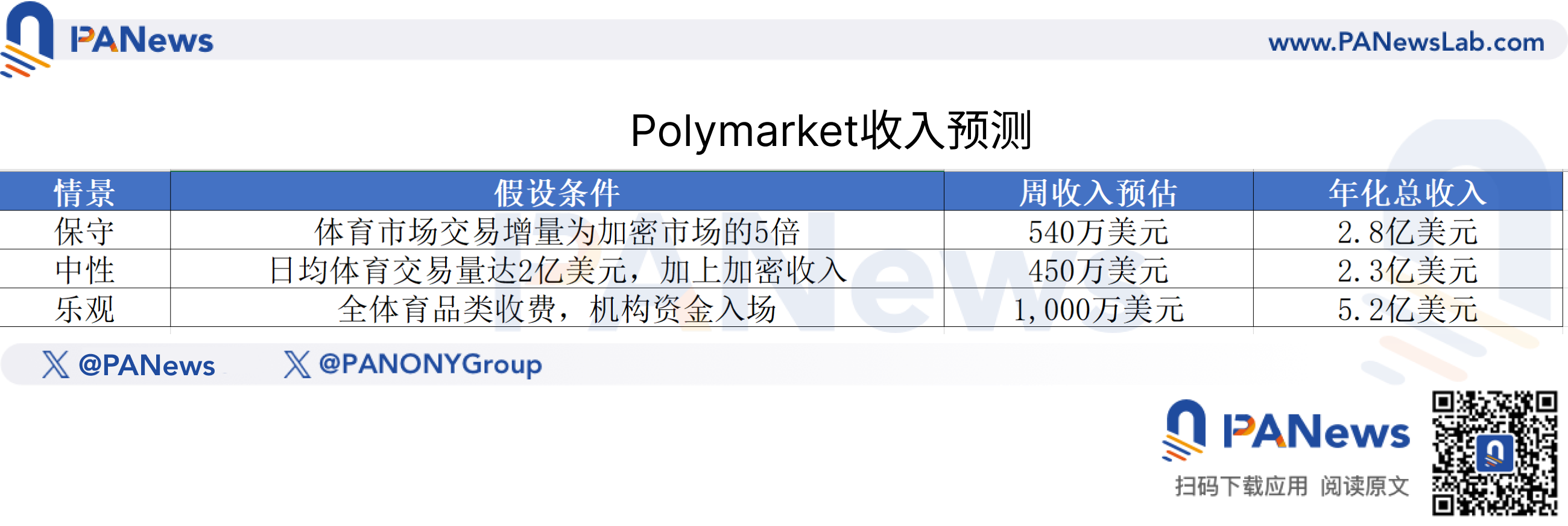

Based on existing data, PANews constructed three profit prediction scenarios (assuming the average effective fee rate for the sports market is 0.25%, considering probability distributions and free limit orders):

Even with the most conservative estimates, Polymarket's annualized revenue after comprehensive fees will exceed $200 million, which is enough to place it among the highest income protocols in the Web3 space.

While surpassing Tether's government bond interest income or Ethereum's mainnet gas fees is unrealistic, at the application layer, Polymarket clearly has the potential to compete for the title of "most profitable dApp." Especially considering its user retention rate reaches 85%, far exceeding that of typical DeFi protocols, such high stickiness translates into higher quality revenue.

POLY token and airdrop, a "wealth feast" worth hundreds of millions?

Polymarket's high valuation and large user base have made its token airdrop one of the most anticipated events of 2026.

Polymarket's Chief Marketing Officer, Matthew Modabber, has made it clear: “There will be tokens, and there will be airdrops.” The market predicts that the probability of Polymarket issuing tokens by December 31, 2026, is as high as 62%-70%. Considering the pace of resuming operations in the U.S., the Token Generation Event (TGE) is likely to be completed in mid-2026.

On February 4, 2026, its parent company Blockratize Inc. applied for the "POLY" and "$POLY" trademarks, which is also seen as an important milestone for the TGE. According to general trends in the crypto industry, it usually takes 3-6 months from trademark registration to TGE.

Airdrop size may exceed Hyperliquid; the era of volume inflation has ended

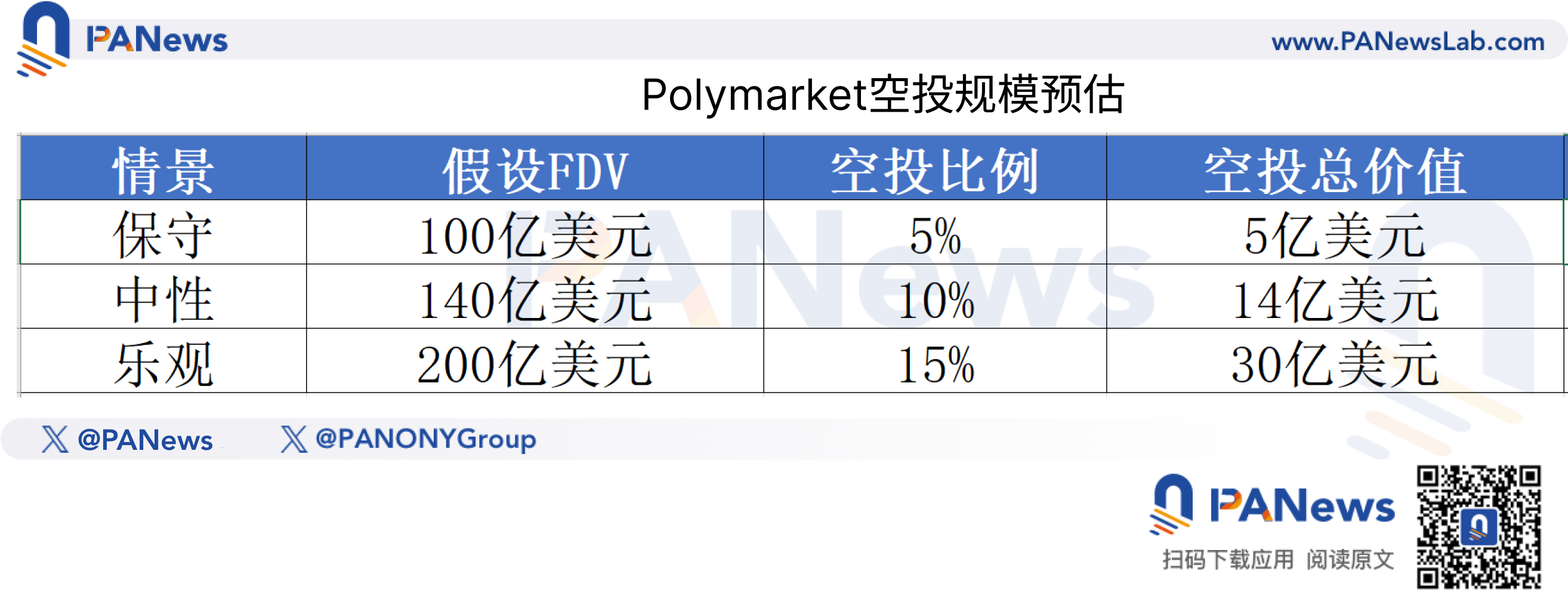

Referring to recent top projects (Arbitrum, Jupiter, Hyperliquid) airdrop ratios, community shares typically range from 5%-15% of total supply. PANews calculated according to different valuation assumptions:

If the total amount of airdrops is $1.4 billion, assuming the number of eligible active addresses is 500,000, the average airdrop value per account could reach about $2,800. However, according to the "80/20 rule," top users' earnings could be as high as hundreds of thousands or even millions of dollars, while ordinary retail investors need to manage their expectations reasonably.

It is particularly noteworthy that as Polymarket begins charging fees, it also introduced a 4% annualized holding reward (Holding Rewards), calculated with hourly snapshots and distributed daily. This mechanism reveals the project party's clear preference: the duration of fund retention is far more important than the frequency of transactions.

Moats and concerns: Where are the risks of this "money printer"?

Charging means users will need to incur additional costs, so what reason does Polymarket have to maintain its fees?

Three clear moats can be observed: First, the platform has unmatched liquidity depth in the prediction market, which is crucial for large traders; Second, compared to traditional gambling's 5%-10% rake and Kalshi's 1%-3.5%, a peak fee rate of 0.45% still has a significant cost advantage; Third, ICE's entry not only brings funding but also data distribution capabilities, as ICE plans to connect Polymarket's real-time prediction data to global institutional clients, creating a "second growth curve" beyond trading fees.

However, risks cannot be ignored:

Short-term fluctuations in trading volume: Polymarket's monthly trading volume fell from a peak of $1.026 billion in November 2025 to $543 million in December. Will charging exacerbate this trend? However, referencing the positive effects of increased market depth and reduced spreads after the introduction of Maker Rebates, long-term trading volumes may actually increase.

Competitive landscape: Kalshi occupies a first-mover advantage in the regulated U.S. market (with a revenue of about $260 million in 2025), Hyperliquid is attempting to enter the prediction market track through "Outcome Trading" (with an FDV of about $16 billion), while Predict.fun attracts users with DeFi yield integration.

Regulatory uncertainty: Although it has received a No-Action Letter from the CFTC and acquired a compliant exchange QCX, changes in the U.S. regulatory environment remain a sword of Damocles hanging over the prediction market.

Postscript

From free to charged, from cryptocurrency rise and fall markets to global sports events, Polymarket is completing a meticulously planned upgrade of its business model. Relying on the cryptocurrency market alone can achieve weekly revenues of millions, while in the sports market—accounting for nearly 40% of trading volume and with liquidity 30 times that of the cryptocurrency market—charging has only just begun. Polymarket's story provides a thought-provoking model: the true value of a platform may lie not in how much it earns at this moment, but in its confidence that it can charge whenever it wants. When the cake is large enough and the moat is deep enough, opening the gates to charging is just a matter of time.

And this "money printer" that is warming up, only pressed the start button on February 18.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。