Nakamoto Inc. (Nasdaq: NAKA) announced Feb. 17, 2026, that it has entered into definitive merger agreements to acquire BTC Inc., a bitcoin media and events company that manages the news publication known as Bitcoin Magazine, and UTXO Management GP LLC, an investment firm focused on private and public bitcoin companies.

The all-stock transaction is valued at approximately $107.3 million. The deal calls for the issuance of 363,589,816 shares of Nakamoto common stock at a fixed price of $1.12 per share under previously disclosed call options. BTC Inc. shareholders are set to receive 336,804,102 shares, while UTXO equityholders will receive 26,785,714 shares.

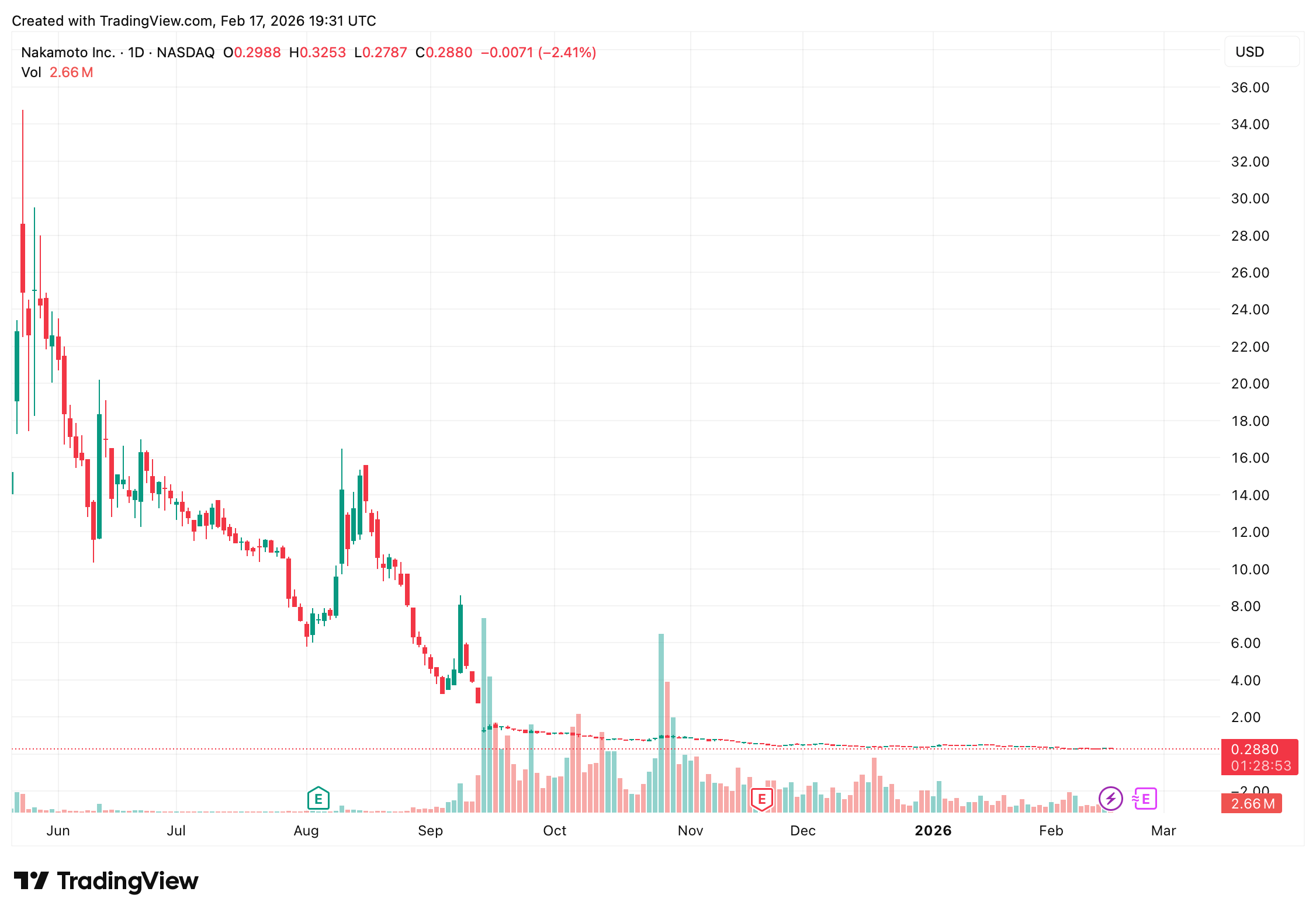

NAKA shares on Feb. 17, 2026.

The transaction exercises Nakamoto’s call option under a master marketing services agreement dated May 12, 2025, along with BTC Inc.’s concurrent call option on UTXO. The release notes that closing is expected in the first quarter of 2026, subject to customary conditions including regulatory clearance and lock-up agreements. No additional shareholder approval is required.

Nakamoto Chairman and CEO David Bailey said the acquisitions align with the company’s long-term plan to operate a portfolio spanning media, asset management and advisory services tied to BTC’s growth. The company describes the combined entity as an integrated “ bitcoin operating company” that connects BTC Inc.’s media brands and events with UTXO’s investment platform and advisory services.

While BTC Inc. publishes Bitcoin Magazine, it also produces The Bitcoin Conference series, which drew roughly 67,000 attendees in 2025 across multiple regions. UTXO serves as adviser to 210k Capital LP, a hedge fund investing in bitcoin-related securities and derivatives. Post-transaction, Brandon Green will become CEO of BTC Inc., while Bailey will focus on leading Nakamoto.

A special committee of independent directors reviewed the deal, with a fairness opinion provided by B. Riley, according to the filing’s disclosure. The company positions the move as a step toward diversifying beyond a pure bitcoin treasury model, combining operating businesses with balance sheet bitcoin exposure.

Nakamoto’s shares have struggled over the past month, surrendering 40% of their value against the U.S. dollar. At roughly $0.28 per share, NAKA now reflects cumulative losses exceeding 90% from its peak. In late December 2025, the company received a notice from Nasdaq after the stock fell below the $1 minimum bid threshold. The newly announced transaction offered little relief, with the shares slipping more than a percentage point during Tuesday’s trading session.

- What is the value of the Nakamoto acquisition?

The all-stock transaction is valued at approximately $107.3 million based on Nakamoto’s recent share price. - Who is being acquired?

Nakamoto is acquiring BTC Inc., a Bitcoin media company, and UTXO Management, a bitcoin-focused investment firm. - When is the deal expected to close?

Closing is anticipated in the first quarter of 2026, subject to regulatory and customary conditions. - Will Nakamoto shareholders vote again on the deal?

No additional shareholder approval is required because authorization for the share issuance was previously obtained.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。