- XRP news: Bollinger Bands flag weakness for XRP price at $1.50

- Cardano news: Foundation votes "yes" on treasury withdrawal for DeFi Liquidity Budget

- Bitcoin news: "Rich Dad Poor Dad" author Kiyosaki reaffirms BTC accumulation plan

- What to watch next for XRP, ADA, BTC

Tuesday, Feb. 17, 2026: XRP remains capped below its $1.49794 daily Bollinger midband after Sunday’s $1.6711 spike, the Cardano Foundation confirms a YES vote on the first DeFi Liquidity Budget withdrawal and Robert Kiyosaki tells followers he is increasing Bitcoin exposure as BTC consolidates near $67,777, above the $60,000 support.

TL;DR

- XRP unable to secure acceptance from Bollinger Bands above $1.50.

- Cardano governance votes "Yes" for DeFi liquidity withdrawal worth 500,000 ADA.

- "Rich Dad Poor Dad" author Robert Kiyosaki reiterates "bullish" stance on Bitcoin as BTC holding above $60,000 after recent liquidity sweep.

XRP news: Bollinger Bands flag weakness for XRP price at $1.50

XRP’s weekend rally to $1.6711 briefly revived upside expectations, but buying momentum faded quickly. By Tuesday’s open, the token remained below the daily Bollinger midband at $1.49794, a level that has acted as resistance across three consecutive daily sessions.

HOT Stories Morning Crypto Report: XRP Not Ready for $1.50: Bollinger Bands, Cardano Foundation Votes 'Yes' on 500,000 ADA Withdrawal, Kiyosaki Details 'Rich Dad' Bitcoin Strategy Ripple CEO Sees Major Legal Victory Likely This Spring

The daily chart by TradingView with Bollinger Bands applied shows repeated attempts to stabilize above $1.50, failing to produce continuation. The midband, represented by the 20-day moving average, remains the technical pivot separating recovery from renewed downside pressure.

XRP/USD chart by TradingView with Bollinger Bands applied

With the price hovering beneath that threshold, attention turns to the lower Bollinger Band at $1.2311 as the next statistical reference point for XRP if weakness continues.

The development matters because Sunday’s spike was widely interpreted as a potential breakout attempt. As of Tuesday, that breakout has not materialized.

You Might Also Like

Tue, 02/17/2026 - 05:49 Ripple CEO Sees Major Legal Victory Likely This SpringByAlex Dovbnya

Cardano news: Foundation votes "yes" on treasury withdrawal for DeFi Liquidity Budget

Separately, the Cardano Foundation confirmed via X that it has voted "Yes" on Withdrawal 1 under the Cardano DeFi Liquidity Budget framework. According to the proposal, filed on Jan. 15, 2026, the sum of the withdrawal is 500,000 ADA.

The vote is publicly verifiable on-chain through Cardanoscan, reinforcing the network’s governance transparency.

In its rationale, the Cardano Foundation commended the team’s disclosure of risk management policies but emphasized the need for stronger reporting standards before additional withdrawals are approved. Recommendations include:

- Public dashboards tracking liquidity deployment.

- Expanded conflict-of-interest disclosures.

- Clearer operational rules for fund management.

- More accurate ADA price assumptions in budget modeling.

We have voted YES on the Cardano DeFi Liquidity Budget: Withdrawal 1. ✅

We commend the team’s disclosure of their risk management policies and recommend further refinements in transparency and reporting before subsequent withdrawals.

On-chain vote: https://t.co/1ixYNJeVUV?from=article-links pic.twitter.com/fhwDHPbl9z

Internal vote distribution showed four constitutional votes in favor, zero against, one abstention.

The approval activates treasury-backed DeFi liquidity for Cardano while simultaneously placing accountability requirements on execution.

Bitcoin news: "Rich Dad Poor Dad" author Kiyosaki reaffirms BTC accumulation plan

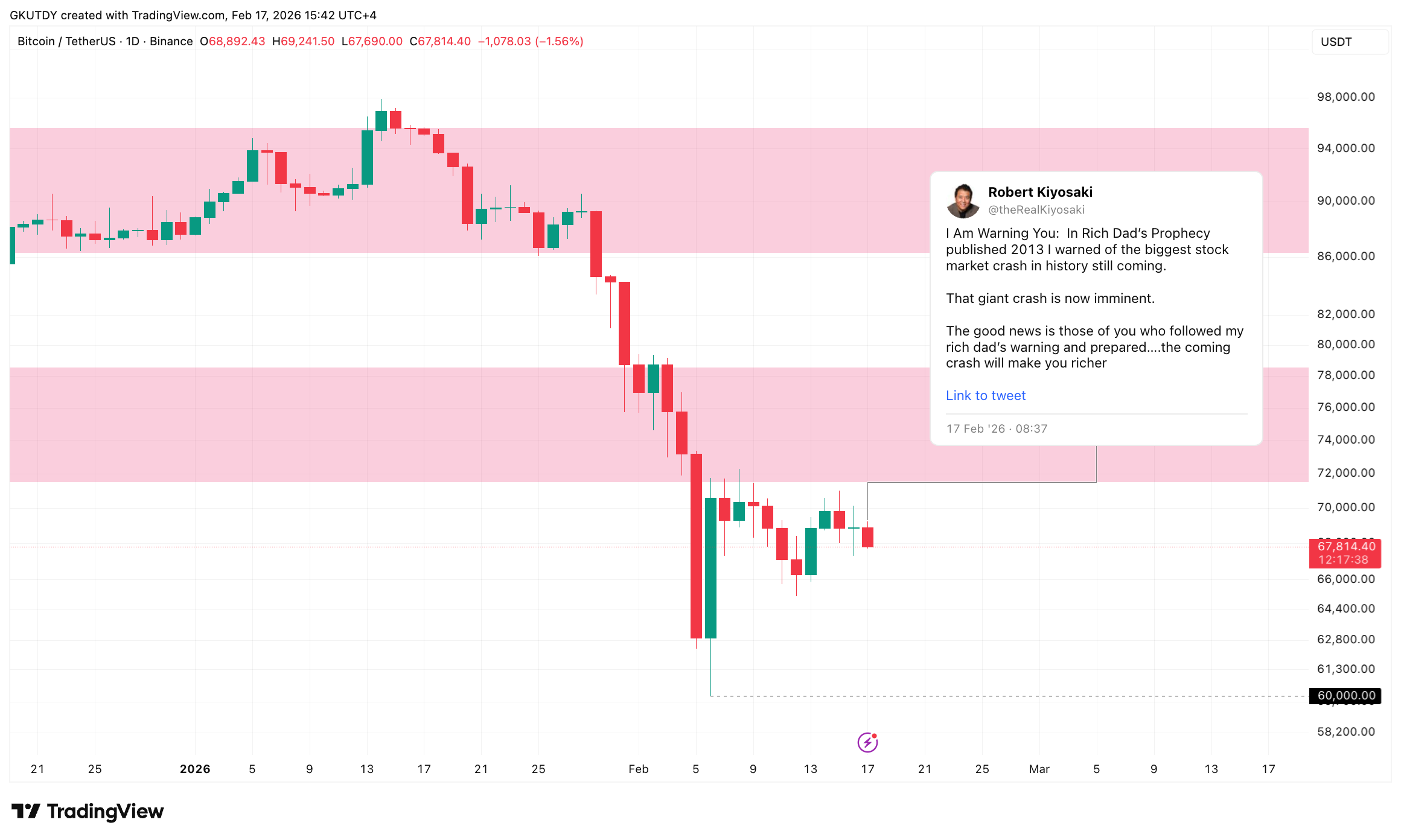

In a Tuesday post on X, "Rich Dad Poor Dad" author Robert Kiyosaki warned that a major stock market crash is imminent and reiterated that he is buying more Bitcoin during price pullbacks.

He cited Bitcoin’s 21 million supply cap and stated that nearly all coins are already in circulation, reinforcing his long-standing scarcity argument. Kiyosaki said he holds gold, silver, Ethereum and Bitcoin and intends to accumulate more BTC as markets weaken.

BTC/USD chart by TradingView with Robert Kiyosaki's X post

His comments come as Bitcoin consolidates near $67,777 following a move earlier this month that briefly pushed the price toward $60,000. That level now serves as structural support, while the $73,00-$75,000 region remains overhead supply.

Importantly, Kiyosaki's stance is not new. He has consistently framed Bitcoin as a hedge against systemic instability. What changes is context: current price compression and volatility expansion patterns mean accumulation strategies now sit against a backdrop of heightened risk sensitivity.

What to watch next for XRP, ADA, BTC

- XRP: Daily close above $1.49794 required to confirm recovery above $1.50. Continued rejection keeps $1.2311 in play.

- Cardano (ADA): Testing $0.27-$0.29 support zone as market focus shifts to transparency execution after Treasury Withdrawal 1 approval.

- Bitcoin (BTC): $60,000 remains key structural support. A break above $73,000 would mark a renewed expansion phase. Until then a chop sideways in the $60,000-$70,000 range is the most probable scenario.

You Might Also Like

Tue, 02/17/2026 - 03:00 Crypto Market Review: Shiba Inu (SHIB) Recovery Ends Abruptly, Ethereum (ETH) Uptrend Is In, Is Bitcoin (BTC) Close to Breaking $70,000?ByArman Shirinyan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。