Bitcoin’s price slid to roughly $60,000 on Feb. 5, marking a peak-to-trough decline of more than 50% before a partial rebound. According to report author Zach Pandl, the drop coincided with weakness in high-growth software stocks and other early-stage technology equities, suggesting macro risk reduction — not a crypto-specific breakdown — was the primary driver.

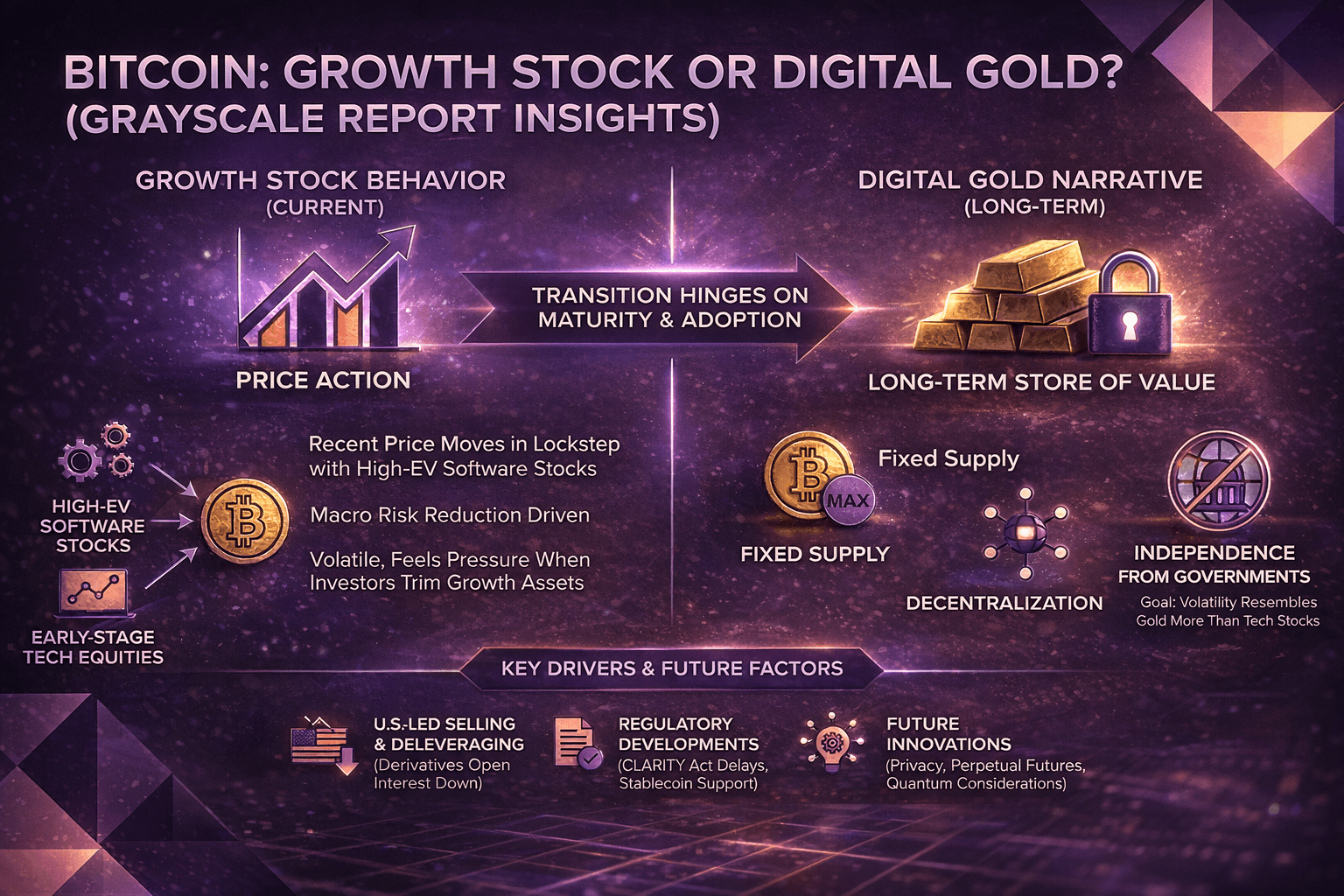

For at least the past year, bitcoin’s price has moved closely with early-stage U.S. software stocks that trade at high enterprise value-to-sales ratios. In short, when investors trim exposure to growth assets, bitcoin has felt the pressure alongside them.

That dynamic complicates bitcoin’s long-standing narrative as “digital gold.” Grayscale maintains that bitcoin’s fixed supply, decentralization, and independence from governments support its role as a long-term store of value. But in the short term, its correlation profile has looked more Silicon Valley than Fort Knox.

Pandl frames the issue plainly: bitcoin is both a store of value and a growth asset. The asset’s investment case hinges on adoption — if bitcoin matures into a dominant digital monetary asset, its volatility and equity correlation could eventually resemble gold more than tech stocks.

Recent selling also appears to have been concentrated in the United States. The price of bitcoin on Coinbase traded below Binance, pointing to U.S.-based sellers driving activity. Since the start of February, U.S.-listed spot bitcoin exchange-traded products recorded about $318 million in net outflows.

Notably, onchain indicators showed no significant liquidation from long-term holders, often referred to as “OG whales.” Instead, derivatives markets showed heavy deleveraging, with aggregate open interest on major perpetual futures exchanges falling by more than half since October. Funding rates turned negative, and options skew reached extreme levels, conditions that can coincide with local bottoms.

Beyond price charts, regulatory developments may shape the next phase. Pandl noted that delays around the CLARITY Act in the U.S. Senate likely weighed on valuations, though broader regulatory shifts — including the bipartisan GENIUS Act and agency-level changes — continue to support institutional engagement with stablecoins and tokenized assets.

Looking further out, the report highlights innovation in privacy, perpetual futures and prediction markets, while flagging quantum computing as a long-term consideration for bitcoin’s cryptographic foundations. If bitcoin clears those hurdles and adoption expands, Grayscale argues its behavior could ultimately align more closely with gold — though today, it is still trading like a growth bet.

- Why did bitcoin fall to $60,000 in February 2026?

The report links the decline to broad derisking in high-growth technology equities rather than a crypto-specific shock. - Does Grayscale still consider bitcoin a store of value?

Yes, citing its fixed supply, decentralization and resilience. - Who appeared to be selling during the downturn?

Price discounts on Coinbase and ETP outflows suggest U.S.-based sellers played a major role. - What signals a possible local bottom?

Sharp derivatives deleveraging, negative funding rates, and extreme options skew.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。