Written by: Changan, Biteye Content Team

Previously, AI was like an intern who could only talk; now, OpenClaw is like an experienced driver who can take charge directly.

In the past, if you asked AI how to book tickets, it would give you a guide; now, if you tell it "I want to go to Shanghai," it directly helps you compare prices, place orders, and select seats. Similar to the automated takeaway ordering feature showcased by Qianwen, AI has begun executing results across apps.

This transformation is quietly draining the wallets of many companies, leading to a decline in valuations.

This article will analyze the asset repricing logic triggered by this productivity revolution from the following dimensions:

Value Collapse: Analyzing which old assets relying on human premiums and information asymmetry are losing their competitive edge.

Value Migration: Exploring how funds are flowing towards computing power, energy, crypto settlement protocols, and embodied intelligent hardware.

Practical Guide: Providing individuals with coping strategies based on cutting-edge product experiences.

I. Value Collapse: Which old assets are losing their competitive edge?

1. Stocks of SaaS Software Companies

The software industry is undergoing a transformation from functionality-oriented to execution-oriented. Previously, users paid for software primarily to utilize its UI to lower operational difficulty, completing tasks by clicking a mouse.

However, when AI agents are capable of directly driving underlying logic and delivering results, the value of traditional software as an operational entry point begins to crumble. Users no longer need complex software interfaces; they simply give commands, and the agents can complete tasks at the underlying level.

Editor’s practical experience: Gemini's Nano Banana photo editing feature is more user-friendly than Meitu Xiuxiu.

This shift in logic has already triggered panic in the capital markets. Recently, the US software sector has experienced significant valuation corrections:

Sector Crash: In late January 2026, the S&P North America Software Index plummeted approximately 15% in one month, marking the largest single-month decline since the 2008 financial crisis.

Giant Shrinkage: In just a few recent trading days, the market capitalization of the US software sector has evaporated by more than $800 billion.

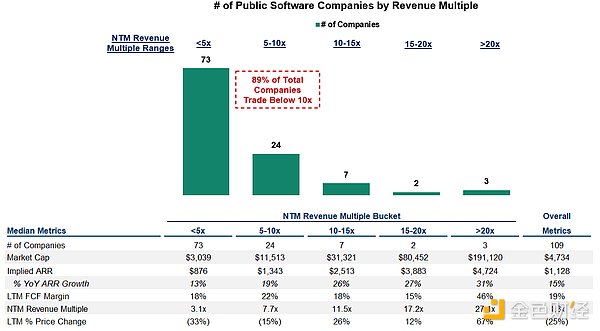

Investors have realized that SaaS companies that only provide simple functions and lack core data moats are being diminished by AI. Currently, 89% of publicly listed software companies worldwide have valuations below 10 times earnings, with an average stock price decline of up to 33%.

2. Stocks of Basic Intermediary Platforms

In traditional business models, aggregation platforms profited by consolidating scattered information, leveraging information asymmetry, and controlling traffic entry points. They charged commissions to merchants and displayed ads to users, essentially acting as intermediaries.

However, platforms like OpenClaw have completely disrupted this pattern:

Bypassing the Middle Layer: When agents are capable of automatic bargaining and direct ordering, they no longer need to operate through the interface of intermediary platforms. Agents can interface directly with the underlying service providers (such as airline and hotel websites), bypassing the commission taken by intermediary platforms.

Advertising Model Failure: Merchants used to purchase traffic for visibility, but agents do not view advertisements. Garbage information that relied on paid placements will completely lose its audience.

Case Comparison: Currently, there is a severe phenomenon of different prices for the same product across e-commerce platforms. The same item can be more expensive on Xiaohongshu or Douyin due to video ad premiums compared to Pinduoduo. However, in the AI era, agents will directly lock in the lowest price across the internet with absolute rationality, leading to rapid zeroing out of premium space for platforms surviving on high premiums due to information discrepancies.

As Goldman Sachs stated in the "2026 Global Internet Revaluation Report": 2026 is the turning point for intermediary platforms degenerating from aggregators to data suppliers.

Goldman Sachs Chief Information Officer Marco Argenti pointed out that because AI agents can penetrate traditional traffic to make decisions directly, platforms relying on purchased positions for customer acquisition are losing their competitive edge in Take Rate.

3. Real Estate Funds and Stocks (Especially Commercial Real Estate)

The carrier of productivity is shifting from humans to code. Humans require physical office spaces and residences, but agents only need data centers, electricity, and hardware. This restructuring of production relations is causing a displacement of the value logic of traditional real estate assets.

(1) Shrinking Demand for Office Space

In the past, the main purpose for large enterprises renting offices in prime locations was to house employees. As AI agents enter large-scale commercial applications by 2026, the demand for physical workspaces by companies has begun a sharp decline.

Goldman Sachs predicts that influenced by AI, the US will see a reduction of about 20,000 traditional administrative and professional service positions each month by 2026.

(2) Capital Migration: From Commercial Locations to Energy and Computing Power

Funds are flowing from properties in bustling areas to data center assets with low electricity costs, stable power grids, and high cooling efficiency.

Morgan Stanley highlighted in a report at the start of 2026 that energy supply has replaced chips as the primary bottleneck for AI expansion. This means that land value is no longer determined by its distance from commercial centers but by its ability to access cheap electricity and fiber backbone networks.

By early 2026, the average price of office buildings in urban areas across the US had dropped by about 50% from previous peaks. This decline reflects the market’s final pricing in response to the dual impacts of remote work and AI automation.

The overall vacancy rate for office space in the US had already risen above 20% by the end of 2024, breaking historical records from 1986 and 1991. In regions where technology and administrative positions have been hit hardest, this figure is approaching the warning line of 35%.

4. Human Resource Service Companies (Outsourcing and Consulting Assets)

The valuation logic of these companies was previously based on employee scale equaling productivity. However, as agents can replace junior analysts, programmers, and legal assistants at very low cost, the large number of employees is transforming from an asset into a significant operating liability.

Funds are rapidly withdrawing from labor-intensive professional service sectors like Accenture (ACN) and Infosys (INFY). These companies rely on large numbers of junior programmers to sustain their business, but AI can now accomplish most standardized coding tasks.

Media Fury once conducted research in Kenya on the local paper writing outsourcing industry. This industry, which once supported hundreds of thousands of locals, is facing a devastating blow from AI:

Sharp Drop in Orders: Local practitioners stated in a video that due to students turning to AI for essay generation, the volume of writing orders experienced a cliff-like drop. Jobs that once required payments of hundreds of dollars to African writers can now be completed at almost zero cost through AI.

Value of Skills Approaching Zero: Being good at English and capable of writing papers used to be a core competency, but this primary intellectual labor has rapidly lost its value against AI. This is not just a crisis for individual writers but poses a common adverse effect for platforms like Upwork and Fiverr that rely on individual labor for commission extraction.

The capital market no longer views employee scale as a competitive barrier. If a company still relies on increasing headcount as its core growth engine, it faces the risk of being completely outpaced by AI in terms of productivity efficiency. The future high-value assets will be concentrated in lightweight entities capable of driving large-scale agent operations through code.

II. Where is the money flowing?

1. Reconstructing Production Factors: Demand for Computing Power and Energy Certainty

When the moats of old assets collapse, wealth does not disappear; it flows towards the underlying infrastructure that supports agent operations.

The operation of agents essentially involves the continuous consumption of electrical energy and computing power. Companies are reallocating costs that were originally used to house employees (such as office rents) to expenditures on computing power subscriptions and energy guarantees.

Token fees have become a core burden on corporate operations. Current top models (such as Claude Code/Seedance 2.0) incur high reasoning costs, with complex tasks costing thousands of dollars per instance. The high costs are forcing the industry into a competition of reasoning costs.

With the application of specialized reasoning chips and open-source models (such as DeepSeek and Kimi), the reasoning costs per instance are expected to decrease, making electricity quotas an irreplaceable scarce production factor.

In this wave of value transfer, hardware and energy assets with certainty of supply characteristics are becoming the biggest beneficiaries:

Core Computing Hardware: NVIDIA, AMD. They provide the foundational computing power needed for agent operations and are core suppliers of AI productivity.

Energy and Utilities: Vistra Corp, Constellation Energy. Companies that control stable power have been revalued from traditional defensive sectors to premium assets within the AI supply chain.

Digital Infrastructure REITs: Equinix, Digital Realty. Their IDC data centers are absorbing capital that previously flowed into traditional office buildings.

In summary, the power to price assets is shifting from landlords providing office space to suppliers providing computing energy.

2. AI's Automatic Payment System: Transitioning from Manual Confirmation to Code-Driven Settlement

As mentioned earlier, agents have made traditional intermediary platforms unviable through price comparison, but pricing is just the first step. Once the agent locks in the optimal price, it must have the ability to autonomously complete the transaction. Current limitations in traditional payment systems prevent closing this loop, prompting funds to migrate towards code-driven crypto protocols.

Take the recent display of "automatic bubble tea ordering" by Tongyi Qianwen as an example: AI is already able to perform cross-app purchasing and ordering operations, demonstrating the maturity of agents in decision-making and interaction. However, in practical implementations, the automation process often breaks down at the final payment step because traditional banking systems still require face recognition, SMS verification codes, or physical identity verification.

This disconnection where decisions can be made but payments cannot is precisely where the value of programmable trading protocols like X402 lies.

Beneficial assets:

Programmable Trading Protocols (such as X402): Provide agents with private key management and fund invocation capabilities, enabling them to bypass traditional payment interfaces and directly execute financial interactions through code.

Stablecoins (such as USDT and USDC): Provide a 24/7 online, no-human-review clearing environment and serve as a settlement benchmark for agent business activities.

High-Performance Public Blockchains (such as Kite AI): Layer 1 blockchain customized for agents, providing a low-latency execution environment. Its programmable governance and identity features offer agents legitimate identity and authority control, allowing them to evolve from isolated tools into economic agents capable of autonomous decision-making, collaboration, and profit-making. With the explosive growth of transactions by agents, Kite AI, as core collaborative infrastructure, has shown strong price performance in the recent market.

The current situation where agents can compare prices but cannot pay is driving the rise of crypto settlement systems. Protocols with automated payment interfaces will take over the flow of business that traditional financial intermediaries are losing.

3. Evolution of Productivity Forms: Embodied Intelligence and Physical Execution Hardware

Once AI resolves logical decision-making and software interaction issues, capital begins to flow towards physical entities that can carry this intelligence. Budgets originally allocated for purchasing "primary intellectual labor" are being repurposed to acquire hardware assets with physical execution capabilities.

As agent intelligence reaches a critical point, the only bottleneck limiting its performance lies in physical form. Funds are flowing into robotic hardware to address AI's execution shortfalls in the real world.

Extension of Work Scenarios: The application of agents is expanding from computer screens into physical spaces. Utilizing OpenClaw for logical control, AI can intervene in home management (such as cleaning monitoring, assisting with homework operations) and industrial production.

Capital Expenditure Substitution: Companies and households are undergoing cost transfers. Costs previously paid to human assistants and junior outsourced employees are now being transformed into fixed asset expenditures for purchasing embodied intelligent devices (such as home service robots and industrial robots).

Asset categories benefiting definitively:

Core Components of Embodied Intelligence: At the beginning of 2026, robotic joints (reducers, servo motors), tactile sensors, and other sectors have seen significant growth. These components form the hardware basis for agents transitioning from code to physical execution.

Programmable Automation Devices: Intelligent factory equipment and smart home terminals that allow open underlying interfaces, enabling agents to connect and control directly.

Goldman Sachs points out that the combination of agents and robots is triggering a generational shift in capital expenditure. As agents significantly enhance the return on investment for hardware, budgets that were previously directed toward human outsourcing are now transforming into purchase orders for robotic assets at an annual rate of 25%.

Agents imbue hardware with the ability to think, while hardware provides agents with a body to monetize. This complementarity dictates that the evolution of agents will inevitably bring about a reevaluation of the value of physical executors.

III. Summary of KOL Perspectives

Teddy@DeFiTeddy2020 (XHunt ranking: 1742) Perspective: The agency economy driven by OpenClaw will significantly lower the valuations of SaaS software stocks, intermediary platform stocks, and commercial real estate-related assets because AI agents call APIs directly, autonomously search for bargains, and do not require physical offices. Traditional assets that rely on human behavior will face systematic revaluation.

Haotian@tmel0211 (XHunt ranking: 1202)

Perspective: AI + Crypto will form a grand track that crosses the boundaries between web2 and web3, as this is an inevitable result of the development trend of the Agentic Economy track. Once AI moves toward decentralization, the trustworthy payments, identities, contracts, and other needs are precisely what Crypto excels at; it is worth looking forward to.

Dov@dov_wo (XHunt ranking: 1843)

Perspective: The great inflection point era has arrived, with stock price collapses in SaaS and software companies, exemplified by Chegg being crushed by GPT-4; ClaudeCode and OpenClaw will render high-paying jobs such as Wall Street analysts and lawyers unemployed, cutting more than half of positions within three years, making traditional education obsolete, as AI will replace students at ten times the efficiency and double the effectiveness. This represents a wealth and meaning plunder from the new generation against the old; while humans need rest, AI continues inexpensively, and everything will come to an end; humans should avoid engaging with documents like Notion and turn instead to AI to connect the new and old worlds.

BuccoCapital Bloke@buccocapital (XHunt ranking: 3935)

Perspective: While "internal building" is no longer the primary bear market reason for SaaS (since many companies still rely on ready-made SaaS), the AI agent economy will still bring multiple structural pressures, leading SaaS companies to face prolonged pressure or even revaluation: platform differentiation approaches zero (with significant increases in customer acquisition costs), value transfers to the agency layer, native AI startups provide better outcome-based solutions that erode LTV, revenue models collapse, shifting from "charging by seat" to "charging by outcome" is difficult, pricing power and gross margins deteriorate, organic traffic diminishes, further increasing CAC, and competition for AI talent intensifies operational costs. Investors must have a clear judgment on the intensity and time window of these bear market factors.

Alex Clayton@afc (XHunt ranking: 31467)

Perspective: Current public software company valuations are bleak, with 89% of over 100 companies trading below 10 times NTM revenue, and only 3 exceeding 20 times; most companies are stagnating in revenue growth, with median ARR growth at only 15%, significantly lagging behind AI newcomers like Anthropic. While AI may replace some budgets, it is not the root cause; the real issue is that most SaaS vendors have not developed AI products that customers are willing to pay for; if they cannot innovate and demonstrate the traction of AI, these traditional companies will continue to experience low growth, low valuation, and gradual decline. This is a critical period for their transformation toward AI.

IV. Summary: What Should Ordinary People Do?

In the face of asset repricing, the most effective way for ordinary people to participate is by deeply experiencing cutting-edge products and sensing changes in productivity boundaries.

1. Master Vibe Coding: Achieve an Iteration of Development Paradigms

Tools such as Claude Code 2.0 have changed the underlying logic of software development.

The focus of development has shifted from writing line-by-line code to optimizing the macro architecture. If a functionality that once required a team collaboration for a week can now be completed by an individual with AI assistance within hours, it means that traditional software outsourcing assets that rely on human scale for profit face a revaluation of their logic.

By attempting to transform the time saved by AI into a surplus return on personal productivity.

2. Identify Cost Inflection Points in Video Production: Taking Seedance 2.0 as an Example

The popularity of video generation models such as Seedance 2.0 marks a structural decrease in the cost of visual content production.

Assess Risks of Physical Assets: By generating complex advertising storyboards, it can be found that when the fidelity of AI-generated images approaches that of live shooting, the asset values of rental companies with expensive shooting equipment and traditional film studio parks will depreciate.

Identify Industry Shifts: By experiencing highly integrated generation tools, it is possible to discern which tracks are in the clearing stage and which are gaining increment due to technological empowerment.

3. Find the Missing Points in Business Closed Loops: Viewing Transaction Protocols from Payment Bottlenecks

The performance of Tongyi Qianwen in scenarios like automatic bubble tea ordering reveals the disconnection between agent decision-making and execution.

Identify Growth Opportunities: In daily operations, seek out those breaking points where AI can make decisions but cannot complete transactions; these segments will be the core growth areas of the future.

Validate On-Chain Settlement Logic: When the agent cannot complete payments through traditional banking systems, funds must flow to programmable on-chain protocols. This proves that X402 and its related infrastructure are not speculative assets but essential components to close the agent's business loops.

Core Recommendation: By continuously applying advanced tools in work and life, maintain sensitivity to changes in productivity. In 2026, the most resilient asset will be an individual's ability to integrate across fields and a deep understanding of the core nodes in the AI supply chain (energy, computing power, settlement, execution).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。