The Federal Reserve is mired in a $245 billion loss, global central banks are quietly increasing their gold reserves, and an era dominated by the dollar is crumbling. Gold prices firmly stand above the$5,000 mark per ounce, backed by a three-year-long rising trend — as of 2025, London spot gold has cumulatively risen by 71%, marking the highest annual increase since 1979.

Wall Street veteran investor Daniel Oliver asserts that this is just the beginning.

As the founder of Myrmikan Capital, he predicts that gold is about to enter the second phase of a bull market, with a reasonable value range between $8,395 and $12,595. Supporting this judgment are the increasingly severe policy dilemmas faced by the Federal Reserve and the upcoming expiration of $10 trillion in Treasury bonds.

1. Market Turning Point

The gold market is undergoing a quiet yet profound transformation. This asset, once considered a conservative investment, has now become the focus of global capital reallocation.

● On the surface, Tuesday’s market seemed calm — gold prices steadfastly remained at the $5,000 mark, with no dramatic fluctuations. But it is this very stability that conveys an important signal: confidence in the dollar and American assets is wavering.

● Price data shows that the London spot gold has increased by 71% in 2025. This figure marks the highest annual increase recorded since 1979, far surpassing the performance of major global stock indices during the same period.

● This round of rising gold prices has lasted a full three years, breaking the traditional stereotype that gold is merely a safe-haven asset.

2. Three-Phase Theory

Daniel Oliver has constructed a "three-phase theory" framework to explain how the gold bull market will unfold.

● The first phase began with the U.S. freezing Russian dollar assets in 2022. This action is viewed by seasoned investors as a destruction of the credit foundation of the dollar, prompting mature gold investors to reassess the safety of dollar assets.

● The second phase has yet to begin and will reflect the market's realization that the Federal Reserve cannot control interest rates without buying up the entire bond market.

● The third phase will occur when higher interest rates trigger a “government bond death spiral”: increasing rates lead to higher interest spending, worsening deficits, increased Treasury supply, and thus again raise rates, creating a vicious cycle.

3. Federal Reserve Trap

The Federal Reserve is facing an unprecedented policy dilemma. Oliver refers to the predicament facing Fed chairman nominee Waller as the “money printing trap.”

● Since 2022, the Federal Reserve has incurred an operating loss of $245 billion. The mechanism behind this staggering figure is that the interest paid on its reserves far exceeds the yield on the bonds it holds, leading to ever-expanding operational losses.

● According to Oliver's analysis, $10 trillion in Treasury bonds will mature over the next 12 months, forcing the government to roll over debt. Although Waller has publicly expressed dissatisfaction with the bonds on the Fed's balance sheet, facing such immense debt maturity pressures, he will have no choice but to turn to a new round of quantitative easing policies.

● This dilemma can be summarized as the impossible task of “lowering interest rates while shrinking the balance sheet.”

4. Dollar Confidence Crisis

● The wavering confidence in the dollar is reflected not only in the rising gold prices but also in the changes in global central banks' reserve asset allocations.

● The World Gold Council's survey shows that 76% of responding central banks indicated that the proportion of gold reserves will continue to rise modestly over the next five years. This trend is underpinned by growing concerns about the reliability of the dollar as a single reserve currency.

● If we take the initiation of deficit monetization by the U.S. in 2008 as the starting point, gold prices have increased by 5.7 times so far; if we start from the U.S. technical default on Russian foreign exchange reserves in 2022, gold prices have increased by 2.4 times so far. This ratio intuitively reflects the market's response level to the erosion of the dollar's credit.

5. Debt Death Spiral

● The U.S. government's debt problem is evolving into a self-reinforcing vicious cycle. The higher the interest rates, the larger the government's interest expenditures, the more serious the fiscal deficit becomes, which leads the government to issue more Treasury bonds.

● And the increase in Treasury supply will push up market interest rates, imposing a heavier interest burden on the government. This "debt death spiral" ultimately has only two possible outcomes: either the government defaults, or the central bank is forced to buy up all Treasury bonds, completely destroying the dollar's credit.

● Oliver specifically points out that the private equity industry may become the central link in the collapse of the dollar. A massive withdrawal of foreign capital will push up financing costs in the U.S., exposing the astonishing scale of debt held by American financial institutions.

6. Mining Stock Opportunities

Gold mining stocks provide another avenue to participate in the gold bull market, but there is a clear lack of attention from the market towards this sector.

● For example, the issuance of the VanEck Junior Gold Miners ETF has decreased by one-third between 2024 and 2026, indicating that capital inflow is still insufficient. This lack of interest suggests that the gold bull market may still be in its early stages.

● Institutional and domestic holdings of gold remain extremely low. As gold prices rise, large mining companies perform well, but junior miners have greater elasticity, especially when their projects become highly attractive.

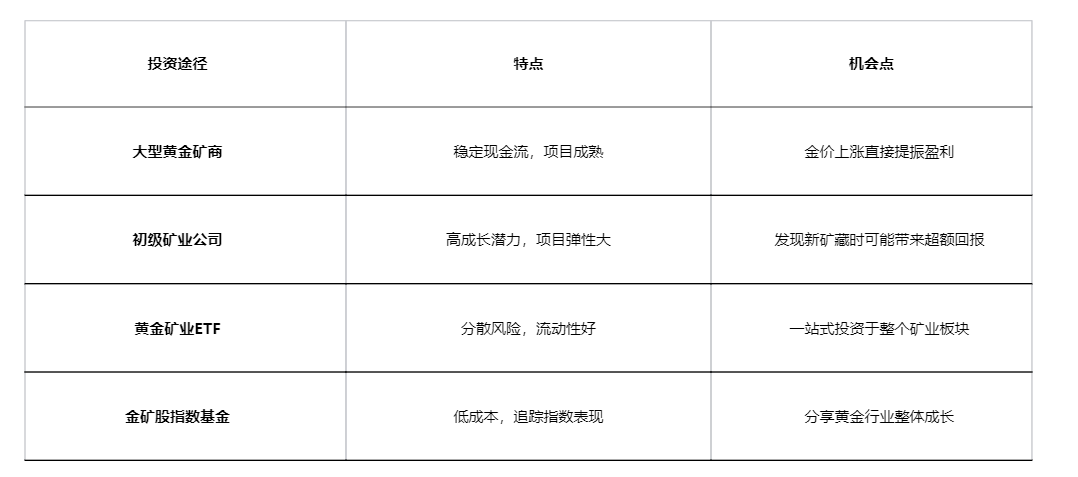

The following table compares the characteristics and opportunities of different gold mining investment avenues:

7. Investment Strategy

● In the context of a gold bull market, how should investors allocate their assets? Wall Street has begun discussing the “equity-bond-gold 60/20/20” asset allocation scheme. This allocation scheme raises the weight of gold to 20%, reflecting that gold is transitioning from a fringe asset to a core component of mainstream portfolios.

● Observing the “pullback periods” in the gold bull market since 2022, it is clear to feel the pace slowing and the amplitude narrowing, behind which the market is gradually forming a new perception. Each pullback becomes an opportunity for new capital to enter.

● Oliver believes that even after a strong rally, mining companies are still undervalued. He anticipates that as gold prices continue to rise, the value of these companies will be reassessed by the market.

8. Historical Reference

● Reviewing the great bull markets in gold history helps to understand the current market's position. During the gold bull market of the 1970s, gold prices rose over sevenfold from 1976’s low. If calculated from 2022 as the starting point for the current bull market, the increase so far is about 2.4 times, far from reaching the magnitude of historical bull markets.

● The historical reference proposed by Oliver is that the market once forced central banks to maintain gold reserves between one-third and one-half of their balance sheets. According to this standard, gold prices should be between $8,395 and $12,595 per ounce.

● Due to the actual value of long-term Treasury bonds being lower than market pricing, once panic occurs, the proportion of gold reserves may temporarily shoot up to 100%.

In the trading halls of New York and London, traders constantly monitor every move of the Federal Reserve, while also keeping an eye on the technical signals of gold breaking through various key price levels. Meanwhile, the trading volume of the Shanghai Gold Exchange is constantly breaking historical records, and Eastern and Western investors seem to be forming a tacit understanding — jointly seeking a “value anchor” outside the dollar.

The first phase of the gold bull market has confirmed the vulnerability of the dollar; the second phase will test the Federal Reserve's policy wisdom; while the third phase may reshape the landscape of the global monetary system.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Welfare Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Welfare Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。