XRP showed signs of deteriorating holder profitability after on-chain data highlighted a breakdown in key cost basis levels, according to an analysis shared by the crypto analytics firm Glassnode on social media platform X on Feb. 9.

The analysis focused on changes in on-chain profitability metrics that track whether XRP holders are spending their tokens at a gain or a loss. Glassnode stated:

“ XRP lost its aggregate holder cost basis, triggering panic selling … Holders are realizing significant losses … On-chain profitability flipped negative.”

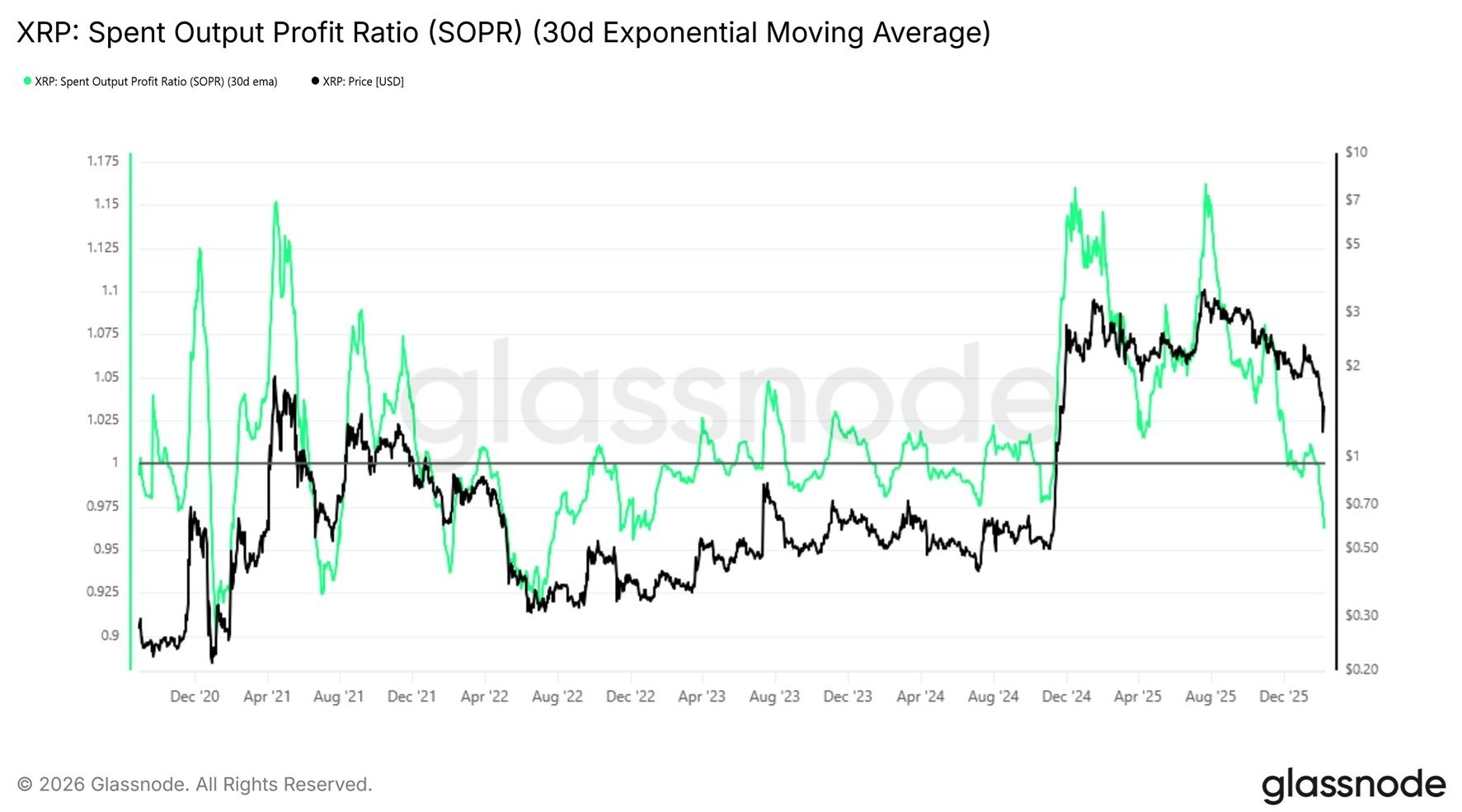

As part of that assessment, Glassnode referenced the Spent Output Profit Ratio, commonly known as SOPR, which measures the ratio between the price at which XRP is spent on-chain and the price at which it was originally acquired. When SOPR is above 1, holders are spending XRP at a profit, while readings below 1 indicate that losses are being realized. According to the firm, SOPR measured on a seven-day exponential moving average declined from 1.16 in July 2025 to 0.96 currently, signaling that the average XRP being moved across the network is now sold below its acquisition price.

The chart accompanying the analysis places this decline within a broader historical framework. Glassnode explained:

“This setup closely resembles the Sep 2021–May 2022 phase, where SOPR plunged to a <1 range for prolonged consolidation before stabilization.”

Read more: XRP Rebounds as Whale Accumulation and Network Activity Signal Price Reversal

That earlier period saw prolonged loss realization, reduced speculative activity, and sideways price action as selling pressure was absorbed. Using longer-term smoothing, the data emphasizes sustained behavioral trends rather than short-term moves, with SOPR hovering near or below breakeven. Historically, such phases reflect expectation resets as weaker positions exit and remaining holders endure losses. While sub-1 SOPR readings often signal holder stress, they have also occurred as markets work through excess supply and move toward balance. Glassnode’s analysis therefore presents SOPR as a behavioral indicator, showing how XRP holders are responding to current conditions rather than predicting price direction.

- Why is XRP SOPR below 1 important right now?

It shows XRP holders are selling at a loss, confirming widespread loss realization. - What did Glassnode say about XRP holder behavior?

Glassnode reported panic selling after XRP lost its aggregate holder cost basis. - How does the current XRP SOPR compare historically?

It mirrors the Sep 2021–May 2022 period marked by prolonged consolidation. - Can sub-1 SOPR signal anything beyond weakness?

Historically, it has also aligned with supply exhaustion and eventual stabilization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。