Russian banks are prepared to take a step forward in including digital assets as part of the national financial system.

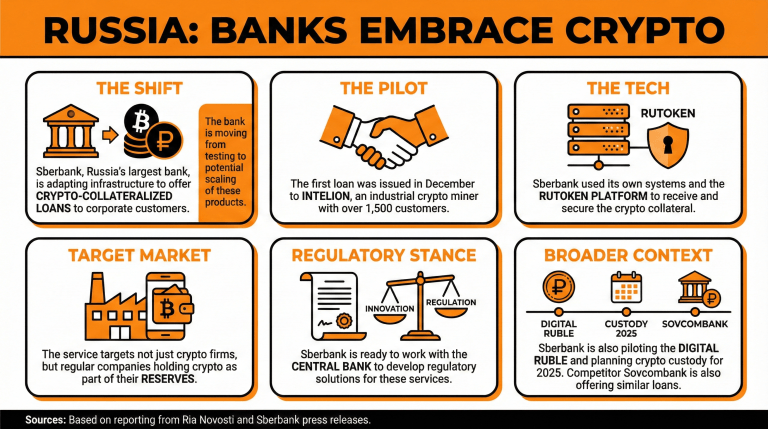

According to Reuters, Sberbank, Russia’s largest banking institution, is adapting its infrastructure to offer crypto-collateralized loan options to corporate customers.

Sberbank was one of the pioneers in offering this kind of lending service in Russia, issuing the first of such loans in December as part of a pilot program. The loan was issued to Intelion, an industrial cryptocurrency miner with over 1,500 customers, for an undisclosed amount.

At that time, Sberbank used the bank’s system and the Rutoken platform to receive and secure the crypto collateral for the loan. In a press release, the bank referred to this development, stating that “its main goal was to test the technological aspects of working with this type of collateral.”

Furthermore, the bank stressed that it was “currently analyzing its results and finalizing the necessary infrastructure and methodology for the potential scaling of such products.”

Sberbank announced that this rollout was not only focused on companies in the crypto sector but also on regular companies holding crypto as part of their reserves.

Reaffirming its compliance-first approach, Sberbank stated:

“We are ready to work with the Central Bank to develop appropriate regulatory solutions for the launch of such services.”

Sberbank has been involved in several key cryptocurrency developments in Russia, participating in the digital ruble pilot and proposing to launch Russian crypto custody services in 2025.

The announcement comes after another bank, Sovcombank, revealed that it was also offering crypto-backed lending services to any entity meeting its requirements.

Read more: Sberbank Issues First Crypto Backed Loan in Russia

What recent development is occurring in Russian banking regarding digital assets?

Russian banks are moving to incorporate digital assets into the national financial system, with Sberbank leading the way by offering crypto-collateralized loans.What was Sberbank’s first step in providing crypto loans?

Sberbank issued its first crypto-collateralized loan to Intelion, an industrial cryptocurrency miner, in December as part of a pilot program.How does Sberbank secure the crypto collateral for these loans?

The bank utilizes its own systems and the Rutoken platform to receive and secure the crypto collateral for loans, ensuring compliance with regulatory standards.What are Sberbank’s plans for expanding its digital asset services?

Sberbank is finalizing its infrastructure and methodologies for scaling crypto-backed products and is collaborating with the Central Bank to develop regulatory solutions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。