Cryptoquant Researchers See No Relief Yet for Bitcoin’s Bear Market

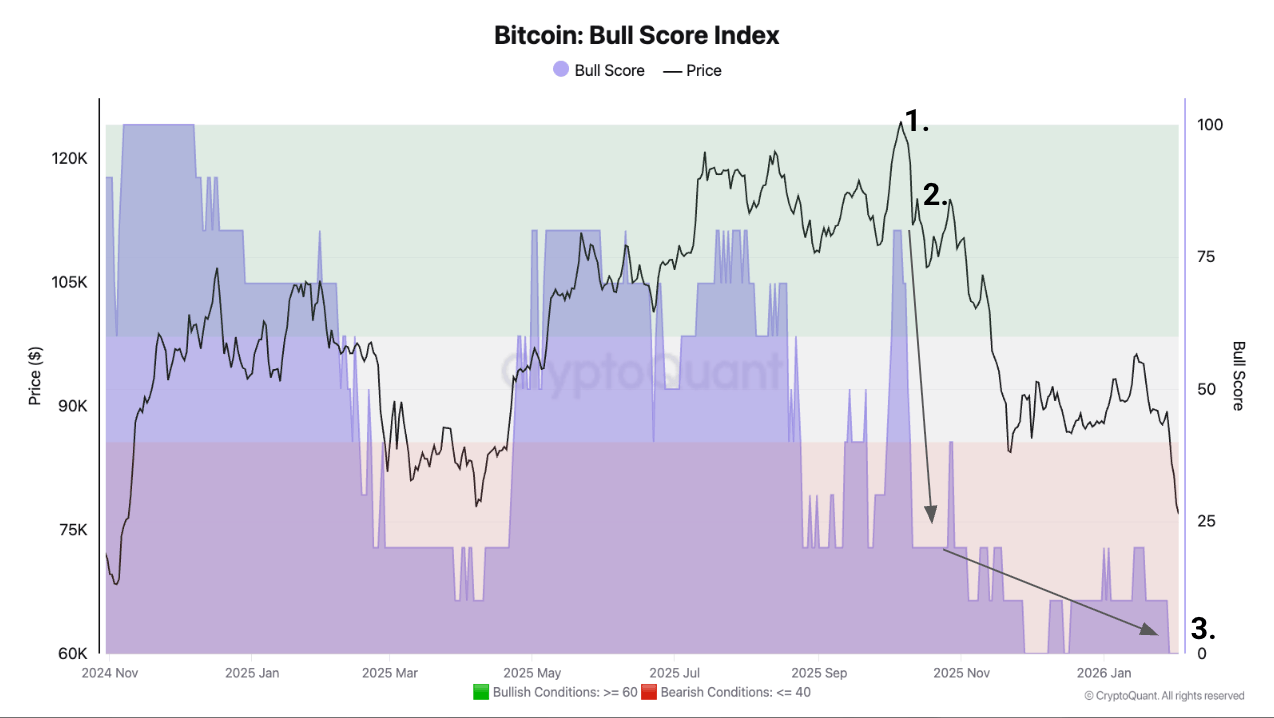

In its February “ Bear Market Assessment” report, Cryptoquant researchers report that bitcoin peaked near $126,000 in early October when the Bull Score Index stood firmly in bullish territory at 80, but conditions shifted sharply after the Oct. 10 liquidation event.

Since then, the index has slid to zero—its most bearish reading—while price hovers around much lower ranges, signaling broad structural weakness, according to cryptoquant.com data.

The report also points to a clear reversal in institutional behavior. U.S. spot bitcoin exchange-traded funds (ETFs), which had accumulated roughly 46,000 BTC at this point in 2025, have become net sellers in 2026, shedding about 10,600 BTC. That swing represents a 56,000 BTC demand gap year over year, a dynamic the researchers say is adding persistent selling pressure.

Despite lower prices, Cryptoquant notes that U.S. investors remain largely absent. The Coinbase Bitcoin Price Premium has stayed negative since mid-October, indicating weaker spot demand in the U.S. compared with global markets. Historically, the analysts say data shows sustained bull markets coincide with a positive U.S. premium—something notably missing this cycle.

Liquidity trends are also flashing warning signs. The market strategists report that the 60-day growth rate of Tether’s USDT market capitalization has turned negative, falling by $133 million. This marks the first contraction since October 2023 and follows a peak expansion of $15.9 billion in late October 2025, a pattern Cryptoquant analysts associate with bear market phases.

Longer-term demand metrics reinforce the bearish case. According to the researchers, apparent spot demand growth has collapsed by 93% over the past four months, dropping from 1.1 million BTC in early October to just 77,000 BTC today—evidence, researchers say, that most of this cycle’s demand has already passed.

Also read: Smacked Down, Still Swinging: Bitcoin’s Battle Beneath the Averages

From a technical perspective, the report highlights that bitcoin has broken below its 365-day moving average for the first time since March 2022. Prices are down significantly in the days since that breakdown, a steeper decline than seen at the start of the 2022 bear market, when losses totaled just 6% over the same period.

Finally, Cryptoquant’s analysis warns that bitcoin has lost several key onchain support levels, including repeated rejections at the Traders’ Onchain Realized Price. With price now below the lower band of that metric, Cryptoquant identifies the $60,000 range, a place where BTC tapped yesterday, as the next major support zone to watch.

FAQ ❓

- Is bitcoin officially in a bear market?

Cryptoquant researchers say multiple onchain indicators confirm a bear market regime. - Why are bitcoin prices under pressure?

Cryptoquant attributes the decline to weak demand, ETF selling, and contracting liquidity. - Are U.S. investors buying the dip?

Cryptoquant data shows U.S. spot demand remains weak, with a negative Coinbase premium. - How low could bitcoin go?

According to Cryptoquant, the next major support zone sits at $60,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。