According to the 2026 predictions report from Finder, a panel of 21 industry experts forecasts bitcoin averaging $133,688 by the end of 2026. While bullish sentiment remains intact, expectations have cooled slightly compared with the prior quarter, signaling a market that may be maturing rather than overheating.

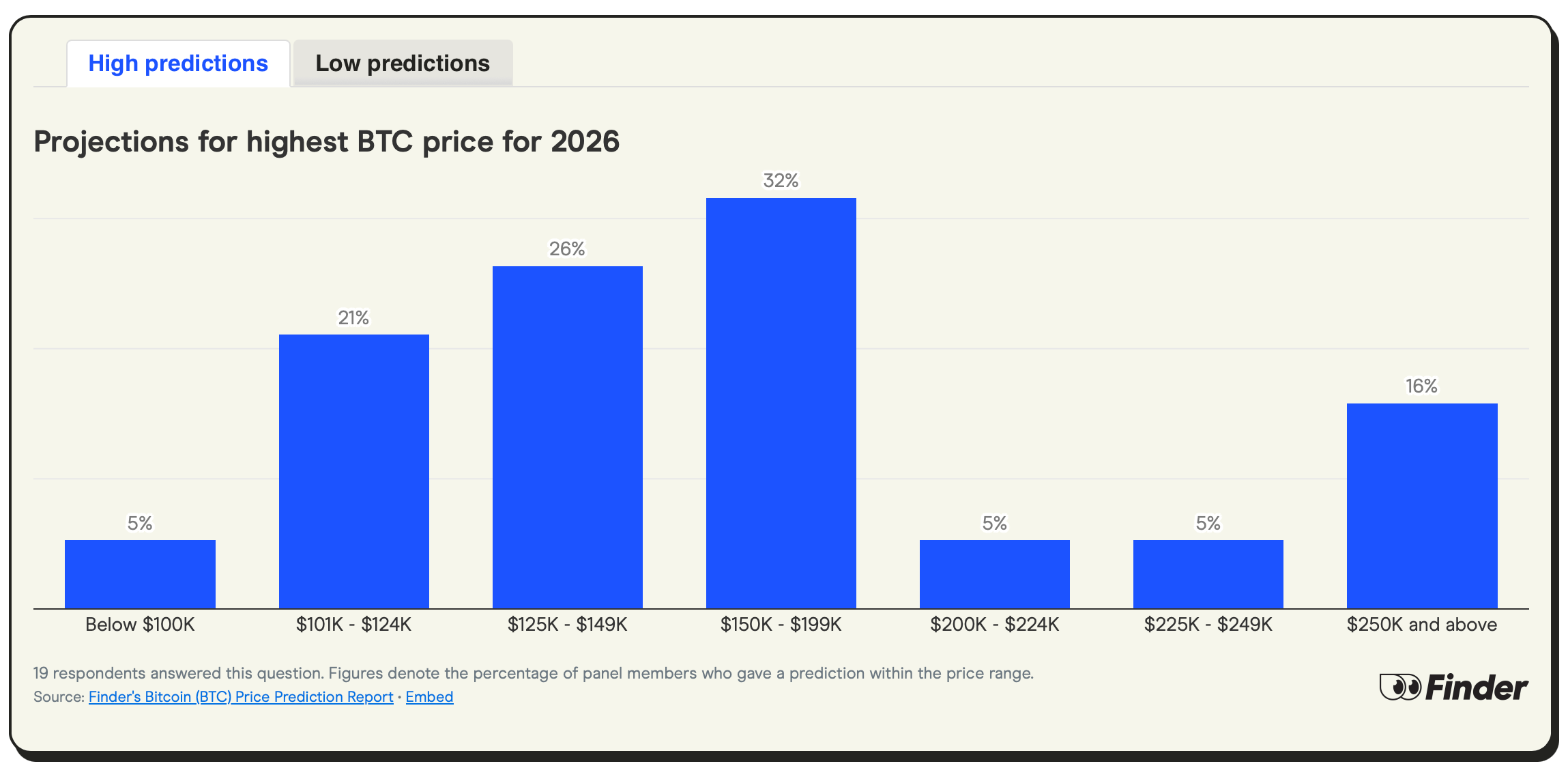

The panel’s outlook allows for wide price swings. On average, respondents expect bitcoin to peak around $163,588 at some point in 2026, while the projected low sits at $73,324. The range underscores lingering uncertainty even as institutional capital continues to flow into regulated crypto products.

Source: Finder’s 2026 Bitcoin Price Prediction Survey.

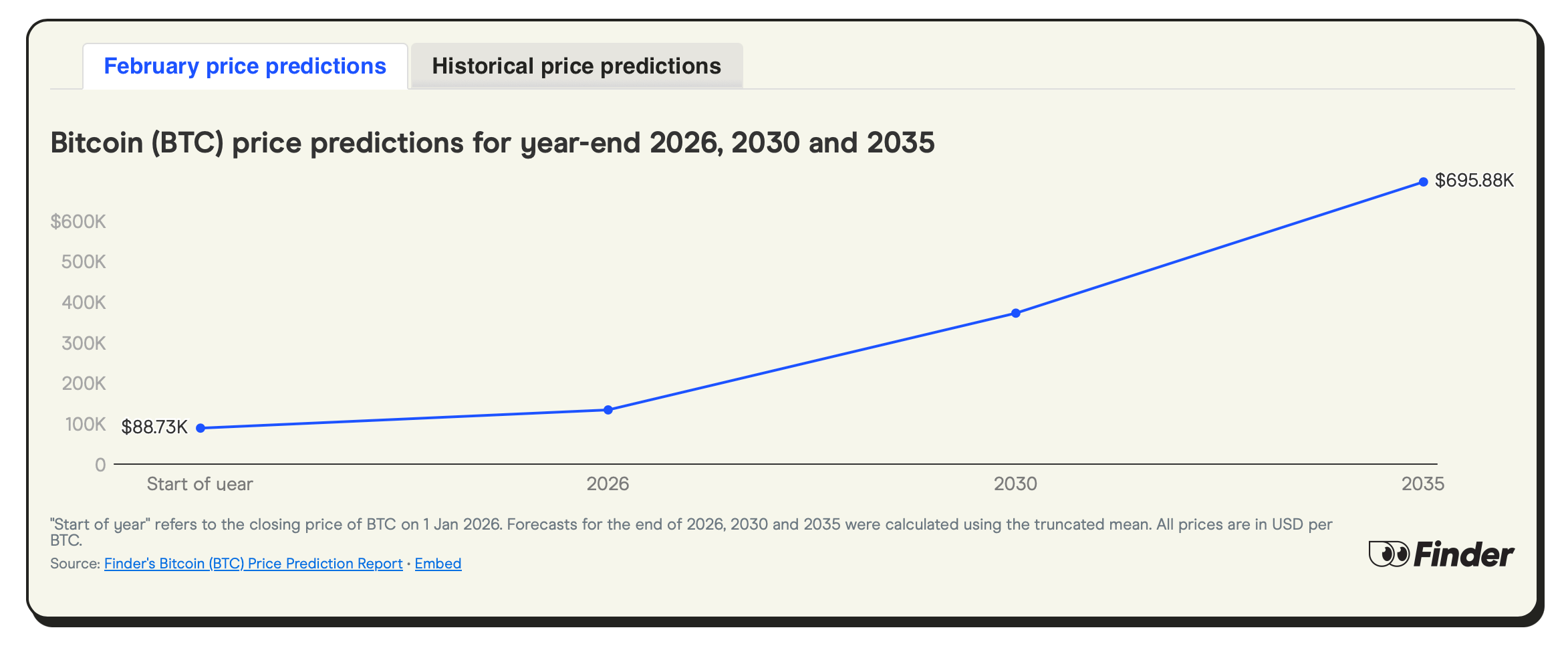

Looking further ahead, Finder’s panelists remain confident in bitcoin’s long-term trajectory. The average forecast calls for BTC to reach $372,235 by the end of 2030 and $695,882 by 2035, though both figures are modestly lower than last quarter’s estimates, reflecting tempered enthusiasm rather than outright skepticism.

Despite bitcoin trading below the $100,000 mark at the time of the survey, sentiment remains constructive. Fifty-seven percent of panelists believe BTC is currently underpriced, while 43% say now is a good time to buy. Another 38% favor holding, and just 19% recommend selling, suggesting most experts see downside risk as manageable.

Some panelists argue that bitcoin is being revalued in real time. Sathvik Vishwanath, CEO of Unocoin Technologies, said:

“Bottom line: Bitcoin is no longer priced as a future asset — it is being repriced as a present-day monetary alternative, and the market has not fully absorbed that yet.”

Others frame the bull case in macro terms. Josh Fraser, cofounder of Origin Protocol, tied bitcoin’s long-term potential to its relative size compared with traditional assets, stating:

“ Bitcoin clearing $200,000 in 2026 and moving toward $1 million before 2035 comes down to simple math and macro reality.”

Institutional participation is a recurring theme throughout the report. Nicole DeCicco, CEO of Cryptoconsultz, described bitcoin’s evolution bluntly: “ Bitcoin has become a macro asset, not just a speculative one.” She added that growing allocations from major financial firms are lifting bitcoin’s long-term price floor.

Source: Finder’s 2026 Bitcoin Price Prediction Survey.

Not everyone is convinced the upside is unlimited. Ruadhan O, founder of Seasonal Tokens, argued that institutional involvement has reduced bitcoin’s explosive upside, saying the era of rapid 5x or 10x annual gains is likely over as the asset matures into a lower- volatility vehicle for long-term investors.

Skeptics remain on the panel as well. John Hawkins, head of the University of Canberra School of Government, maintained that bitcoin remains fundamentally speculative, noting its limited success as a mainstream payment instrument despite growing financial support.

Also read: Bitcoin’s $70,000 Line Breaks—and the Crypto Debate Erupts

Still, a strong majority of the panel believes the market structure itself is changing. Seventy-one percent of respondents say bitcoin is entering a structurally different, institution-led adoption phase, even as many caution that exchange-traded fund (ETF) flows suggest institutions may still be trading momentum rather than committing as long-term stabilizers.

The report also touches on emerging risks, including the potential impact of quantum computing on bitcoin’s cryptographic security. While not viewed as an immediate threat, the issue adds another layer to an increasingly complex investment narrative.

For now, Finder’s January 2026 panel suggests bitcoin’s bull case is intact—just less euphoric, more institutional, and increasingly shaped by macro forces rather than retail frenzy.

- What is Finder’s bitcoin price prediction for 2026?

Finder’s panel forecasts an average year-end 2026 price of $133,688 for bitcoin. - How high and low could bitcoin trade in 2026?

Panelists estimate a peak near $163,588 and a low around $73,324 during the year. - Do experts think bitcoin is underpriced right now?

Yes, 57% of the panel believes bitcoin is currently undervalued. - Is institutional adoption changing bitcoin’s market structure?

Seventy-one percent of panelists say bitcoin is entering a structurally different, institution-led phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。