The bitcoin rout intensified Feb. 5 as the flagship digital asset breached the critical $66,000 psychological support level, caught in a maelstrom of aggressive forced selling. Market data reveals a volatile intraday plunge of 7%, sending prices spiraling to a low of $65,253 by midday. This precipitous drop has reignited bearish sentiment, with market participants increasingly concerned that a retreat to the $60,000 threshold—a scenario previously dismissed as an outlier—is now a distinct possibility.

This latest leg down has pushed bitcoin’s weekly deficit beyond 20%, representing a staggering 30% correction since its mid-January zenith of nearly $98,000. The carnage dragged bitcoin’s market capitalization down to $1.34 trillion, pulling the aggregate crypto economy’s valuation to $2.36 trillion.

Read more: Bitcoin Freefall: $70,000 Support Shatters as Bears Take ‘Firm Control’

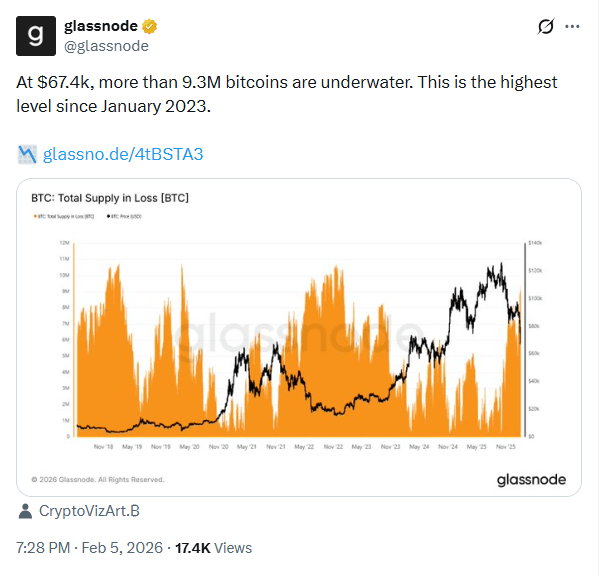

The speed of the market decline triggered a massive long squeeze, resulting in over $1.4 billion in liquidations across leveraged positions within a 24-hour window. Bitcoin-specific liquidations alone exceeded $714 million, with overleveraged long bets accounting for a lopsided $630 million of the wipeout. According to Glassnode, the breach of the $67,400 mark has plunged 9.3 million BTC into “underwater” status—meaning a significant portion of the circulating supply is now held at a loss—the highest such concentration of unrealized losses since the market lows of January 2023.

While the initial downward spiral was catalyzed by brewing geopolitical tensions and the nomination of Kevin Warsh as Federal Reserve chair, a deepening malaise in the tech sector has exacerbated the sell-off. The Nasdaq surrendered 280 points, or 1.26%, during the session, following a prior 500-point rout, as disappointing earnings from tech titans soured investor appetite.

Bitcoin’s tightening correlation with the Nasdaq Composite—juxtaposed against its decoupling from safe-haven assets like gold—suggests a massive capital rotation as investors flee speculative risk-on assets in favor of defensive postures.

While bitcoin’s previous sharp declines were often hailed as ‘buy-the-dip’ opportunities, that fervor is conspicuously absent from current social media discourse. In its place, fear and panic have taken hold as the market downturn effectively erases the gains spurred by Donald Trump’s 2024 Presidential election victory.

Remarking on the apparent lack of buyers, Mohamed A. El-Erian, a professor at the University of Pennsylvania’s Wharton School, noted the irony of the situation, expressing surprise that institutional players have yet to exploit this “market of lemons.” El-Erian emphasized that the current environment presents a unique opportunity to acquire “good” assets—fundamentally sound projects that are being discarded by distressed sellers merely to cover margin calls elsewhere.

Supporting this view, Deutsche Bank analysts Marion Laboure and Camilla Siazon suggested the slide is a healthy, albeit painful, recalibration. They argued that the retreat from the speculative excesses of the past two years is a necessary step in bitcoin’s maturation as a legitimate asset class.

- What happened to bitcoin on Feb. 5? Bitcoin plunged 7% intraday, breaking $66K support and hitting $65,350.

- How much value was lost? Its market cap fell to $1.34T, dragging the global crypto economy to $2.36T.

- What triggered the sell-off? Geopolitical tensions, Fed chair news, and tech sector weakness fueled forced selling.

- Why does this matter globally? Bitcoin’s correlation with Nasdaq shows capital fleeing risk assets, reshaping markets worldwide.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。