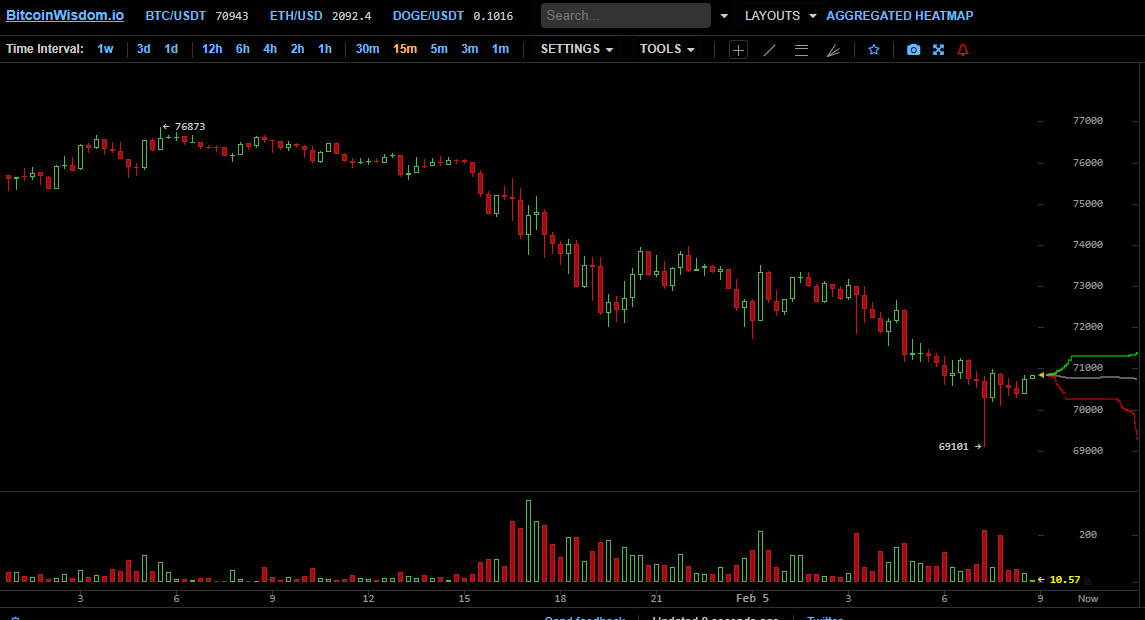

Bitcoin’s ongoing freefall has accelerated, with the cryptocurrency dipping below $70,000 for the first time since November. According to Bitstamp data, bitcoin shed over $2,000 in a matter of minutes, hitting a low of $69,101 around 11:15 p.m. EST. This 7% intraday decline briefly pushed bitcoin’s market capitalization below $1.4 trillion.

The bearish sentiment swept across the broader market, with altcoins like BNB and XRP posting near double-digit losses. Other major tokens logged declines between 2% and 8%, causing the total crypto market capitalization to tumble to $2.47 trillion.

Read more: Bitcoin Price Analysis: BTC Hits $74,532 as Global Markets Retreat

Interestingly, liquidation data suggests a shift in investor behavior. Only $62 million in long and short bets were wiped out in one hour—a sharp contrast to earlier in the week when an almost similar pullback triggered over $100 million in liquidations. This suggests investors are scaling back on leverage as the reality of a bear market sets in.

Since late January, bitcoin has shattered several key support levels. However, on Feb. 2, the price began flirting with levels well below $76,000, the so-called “Saylor Line.” At these prices, bitcoin treasury companies—most notably Michael Saylor’s Strategy—are technically underwater, sparking concerns regarding their long-term stability.

Experts like Stephan Lutz, CEO of BitMEX, warn that a sustained period below this threshold could trigger panic in boardrooms that mirrored the Strategy playbook. However, Lutz notes that the most telling signal isn’t on the crypto charts but in the growing divergence between bitcoin and gold.

“ Gold and silver have already bounced back from the shutdown scare, yet bitcoin is lagging,” Lutz observed. “This divergence suggests current weakness is due to crypto-specific structural scarring, rather than a reflection of BTC’s long-term value.”

Meanwhile, Nicholas Motz, CIO of Soil.co and CEO of ORQO.digital, attributes the compression to a trio of factors: commodity contagion, institutional caution and a market exhaustion phase.

“While retail is buying, institutional flows from ETF data have paused to reassess risk,” Motz explained. “The market is testing the resolve of the ‘Trump trade.’ If psychological support at $72,600 fails, we risk a deeper correction toward $67,000.”

Not everyone views the dip as a fundamental failure. Gil Rosen, co-founder of the Blockchain Builders Fund, argues that the 2025 rally to $120,000 was an unsustainable “straight-line move.” He views the current correction as a reset driven by geopolitics, tariffs and policy uncertainty rather than a crypto-led collapse.

Rosen remains optimistic for the medium term: “I expect the market to move away from the clean four-year cycle. We will likely see new highs in 2026, though they’ll be accompanied by volatility rather than pure euphoria.”

Conversely, Han Tan, chief market analyst at Bybit Learn, believes bears are now “firmly in control.” He points to the slump to late-2024 prices as evidence that retail traders are being wooed back to traditional mainstream assets, which currently offer more stable returns.

Onchain analyst Ananda Banerjee concurs with the bearish outlook, noting that investors are using minor rallies to exit positions rather than build exposure. Banerjee warns of further downside toward the $63,000 to $69,000 zone unless spot demand significantly returns.

- Why did bitcoin drop below $70K in the U.S.? Heavy selling pressure and fading ETF inflows triggered a sharp overnight decline.

- What’s the impact on bitcoin treasury companies? Treasury firms tied to the “Saylor Line” face renewed boardroom stress as BTC trades under $76K.

- How does this affect traders? Local traders are watching liquidity tighten, with reduced leverage signaling a cautious shift.

- Will bitcoin reach new highs in 2026? Industry experts like Gil Rosen expect bitcoin to hit fresh milestones by 2026 as the market recovers from current geopolitical and policy resets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。