Introduction

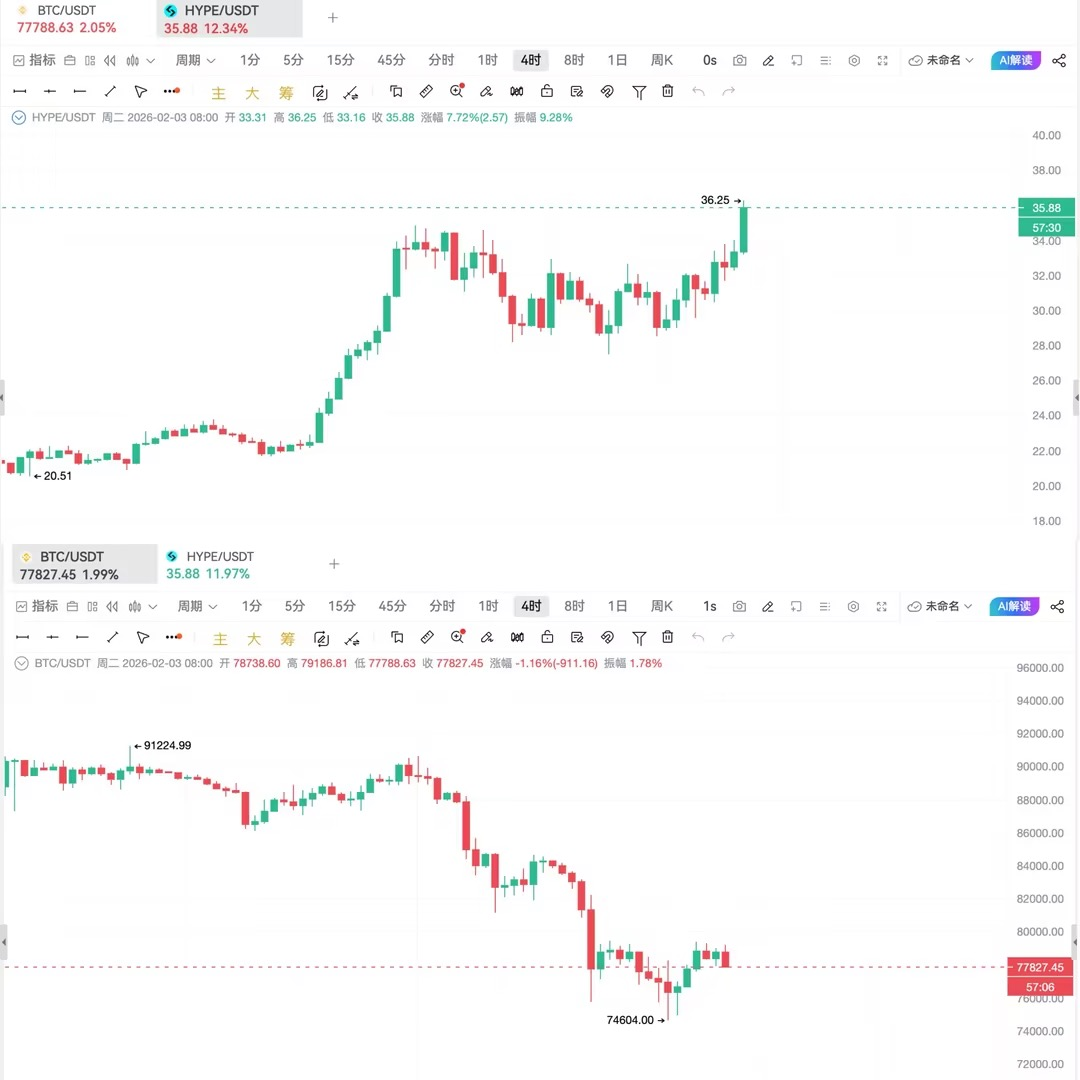

Recently, the overall cryptocurrency market has been sluggish, with both mainstream coins and small to mid-cap tokens experiencing a general decline in price and trading volume, indicating a clear decrease in market risk appetite.

In this context, Hyper (HYPE) has shown relatively strong performance, consistently outperforming the market and maintaining high levels. This resilience is not driven by short-term news or speculation, but rather persists in an environment of weak market sentiment.

Based on this, this article will systematically analyze the price resilience of Hyper from ten dimensions: performance, liquidity, economic model, chip distribution, regulatory dividends, and more.

Why are funds still willing to stay in Hyper when the overall market is weakening?

Figure 1: Comparison of Hype and BTC prices (Data source: AiCoin)

1. Underlying Performance: Self-Developed Public Chain Architecture Comparable to CEX Smoothness

The biggest difference between Hyperliquid and the vast majority of DEX projects is that it chose to develop a high-performance public chain from the very beginning, rather than "layering an application" on existing L1/L2.

HyperCore is a core matching and clearing layer customized for high-frequency trading scenarios, using a centralized exchange-level order book model, but operating on a fully on-chain state machine. This design significantly outperforms DEXs based on AMM or general chains in terms of latency, throughput, and clearing efficiency, achieving "sub-second confirmation" and a smoothness comparable to CEXs. For professional traders, slippage, latency, and liquidation execution speed are often more important than "whether it is completely permissionless," and HyperCore precisely meets this demand.

On top of this, Hyperliquid has launched HyperEVM as a fully EVM-compatible smart contract layer, primarily used to host strategy contracts, asset management, and third-party applications. It does not participate in the matching process but provides composability and expansion space for the ecosystem.

This design, which decouples trading from applications, allows Hyper to maintain DeFi ecosystem expansion capabilities without sacrificing performance. All of this makes it a high-performance public chain born for trading, laying a technical foundation for subsequent user scale, trading volume, and real income.

Figure 2: Hyperliquid Logo (Source: Hyperliquid Official Website)

2. Real and Concentrated Liquidity: Not a "False Prosperity" After Airdrops

A recurring phenomenon in DeFi history is:

After the airdrop ends, TVL quickly declines, and liquidity disappears with the subsidies.

The liquidity of many DEX projects essentially comes from incentives rather than real trading demand. However, the situation with Hyperliquid is clearly different.

From on-chain behavior and public data, Hyper's liquidity comes more from continuous trading by large holders and professional accounts. Founder Jeff has publicly stated that some market depth of Hyperliquid is already comparable to, or even exceeds, certain leading CEXs. Meanwhile, from clearing data, it can be seen that current large liquidations are mainly concentrated on Hyperliquid—although some centralized exchanges may disclose related data less, it can at least be confirmed that Hyper has become an important battleground for high-leverage funds.

Figure 3: Founder Jeff's post about liquidity on Hyperliquid (left is Binance and right is Hyperliquid's order book)

More importantly, liquidity has a strong Matthew effect.

Traders naturally gravitate towards platforms with lower slippage, better depth, and more stable execution. Once a positive feedback loop is formed, liquidity itself becomes a moat, rather than a "temporary phenomenon" maintained by subsidies.

This is also a key reason why Hyper is more likely to retain core users when the market weakens.

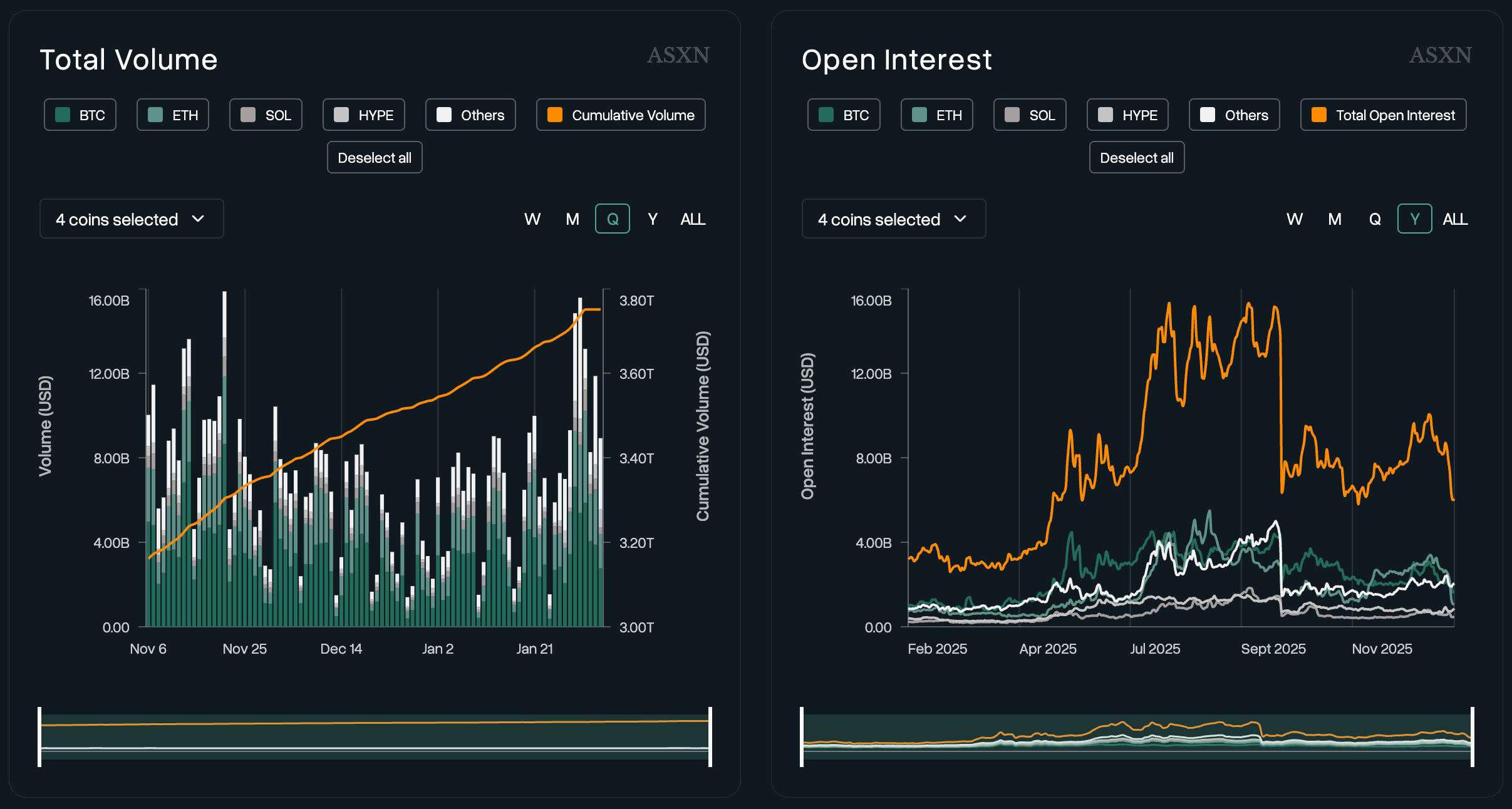

Figure 4: Hyperliquid's total trading volume shows linear growth (Data source: https://hyperscreener.asxn.xyz/home)

3. Buyback Agreement and Token Model: Directly Feedbacking Income to HYPE

In terms of token economic design, Hyperliquid has chosen a relatively aggressive but logically clear route.

Up to 97% of the platform fees are used to buy back and burn HYPE. This means that as long as trading continues, the protocol layer will continuously create real buy orders in the secondary market, rather than relying on "storytelling" value expectations.

Unlike many DEX projects, Hyperliquid is already a machine that can definitely make money. Last year, the platform achieved approximately $840 million in revenue, which is extremely rare in the current cryptocurrency industry. Binding this cash flow directly to token buybacks makes HYPE's valuation logic closer to that of "equity-type assets," rather than merely a functional token.

Figure 5: Reports related to Hyperliquid's revenue

As a result, HYPE's price performance resembles trading a low PE high-growth platform, rather than a meme coin highly dependent on market sentiment.

4. HYPE's Ecological Positioning: Not a "Reward Token," but a System Stabilizer

On HyperEVM, it serves as the native gas token; at the network level, it also plays roles in staking and governance. Holding HYPE means being able to directly participate in network security and share real income from trading fees and on-chain activities.

A very key but often overlooked design is: Unreleased HYPE can also participate in staking.

This is not to create short-term gains, but to convert potential selling pressure into a part of network security in advance. The larger the staking scale, the more stable the node operation, and the system's performance under high trading volume approaches that of centralized exchanges.

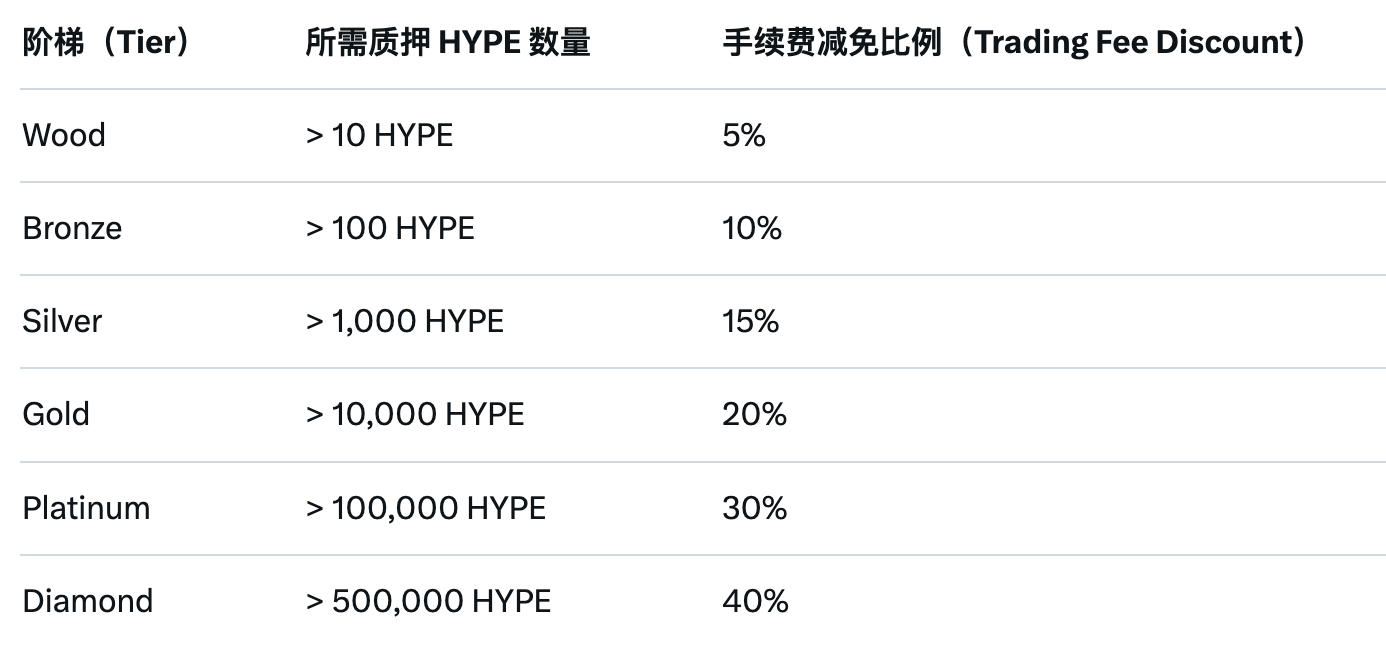

As the platform's trading volume continues to expand, staking rewards and fee reductions begin to naturally link.

For high-frequency and large-volume traders, holding and staking HYPE is not just about "participating in the ecosystem," but genuinely reducing trading costs. This cost advantage does not rely on subsidies but comes from the revenue-generating ability of the protocol layer itself.

Figure 6: Table of Hyperliquid staking quantity and fee reduction ratio (compiled from Hyperliquid Official Website)

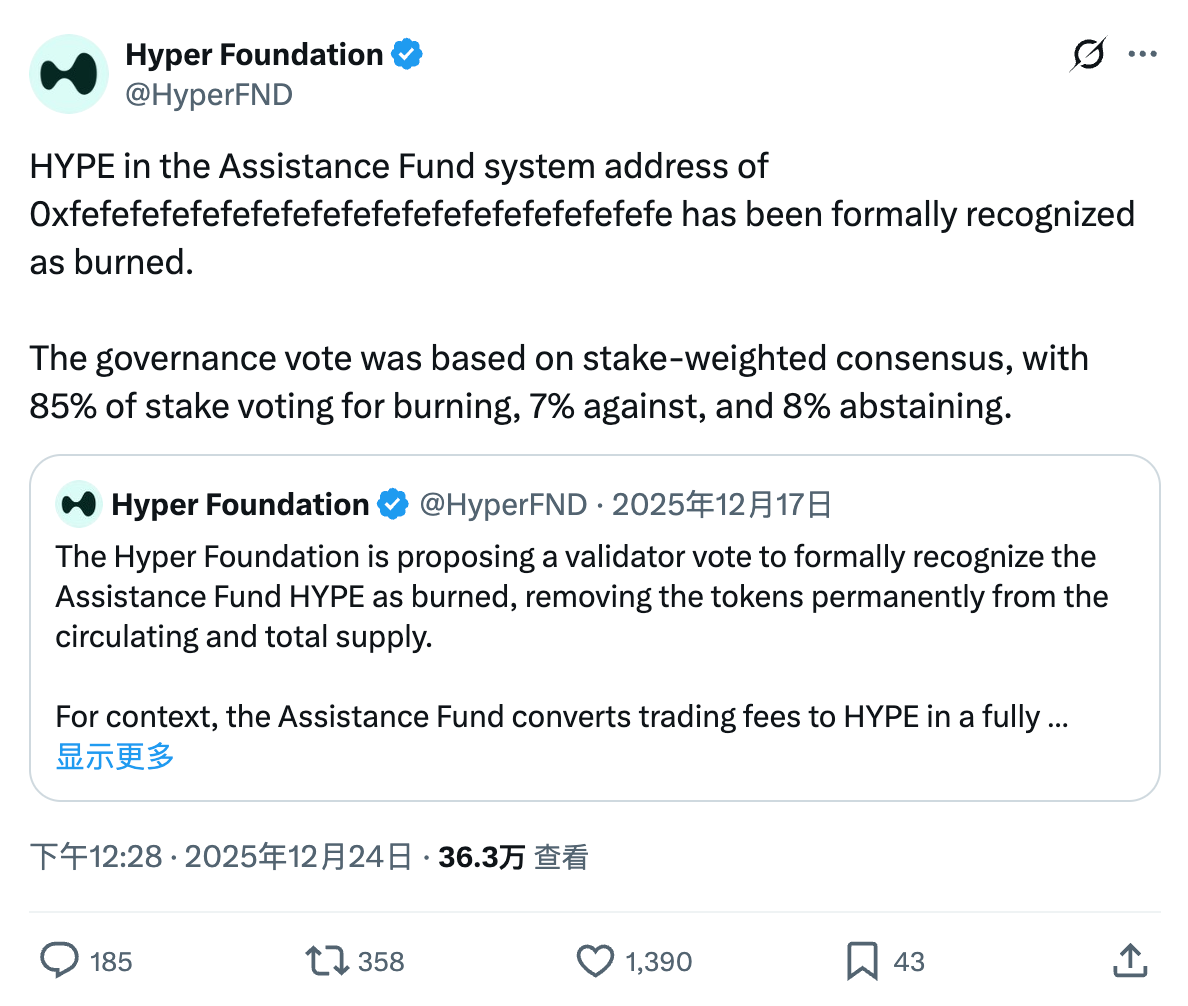

Meanwhile, HYPE is also the foundation of Hyperliquid community governance.

Protocol parameter adjustments, system upgrades, and voting rights for HIP are all directly related to token holdings. As the functions of HyperCore and HyperEVM continue to expand, governance itself is becoming an important part of influencing the trading experience.

Figure 7: Hype holders voting to approve the destruction of 13% of the repurchased tokens in circulation

These use cases are not built on short-term incentives but naturally extend after continuous trading behavior occurs.

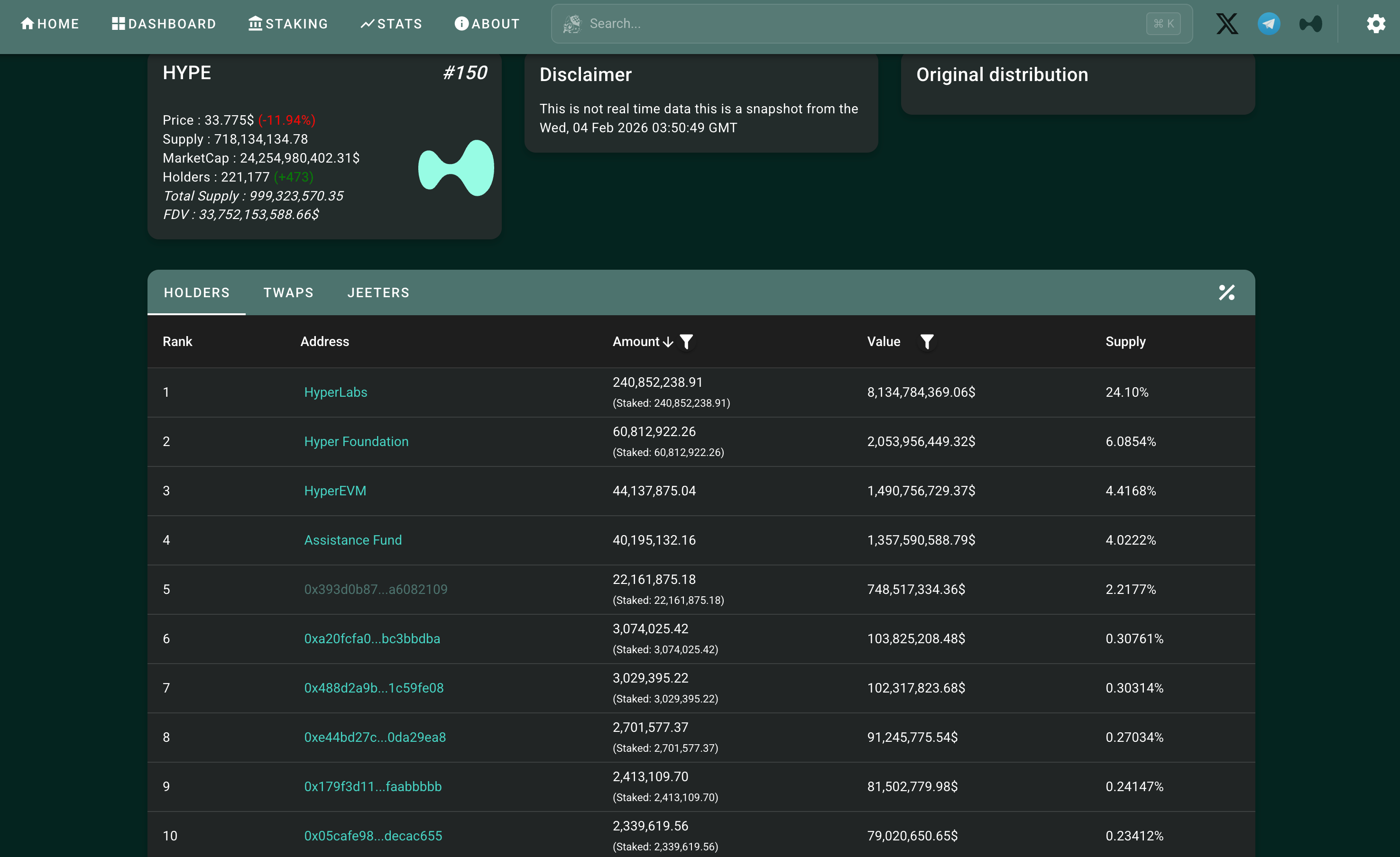

5. Financing Structure and Chip Distribution: Community-Oriented + No VC Model + No Centralized Holdings

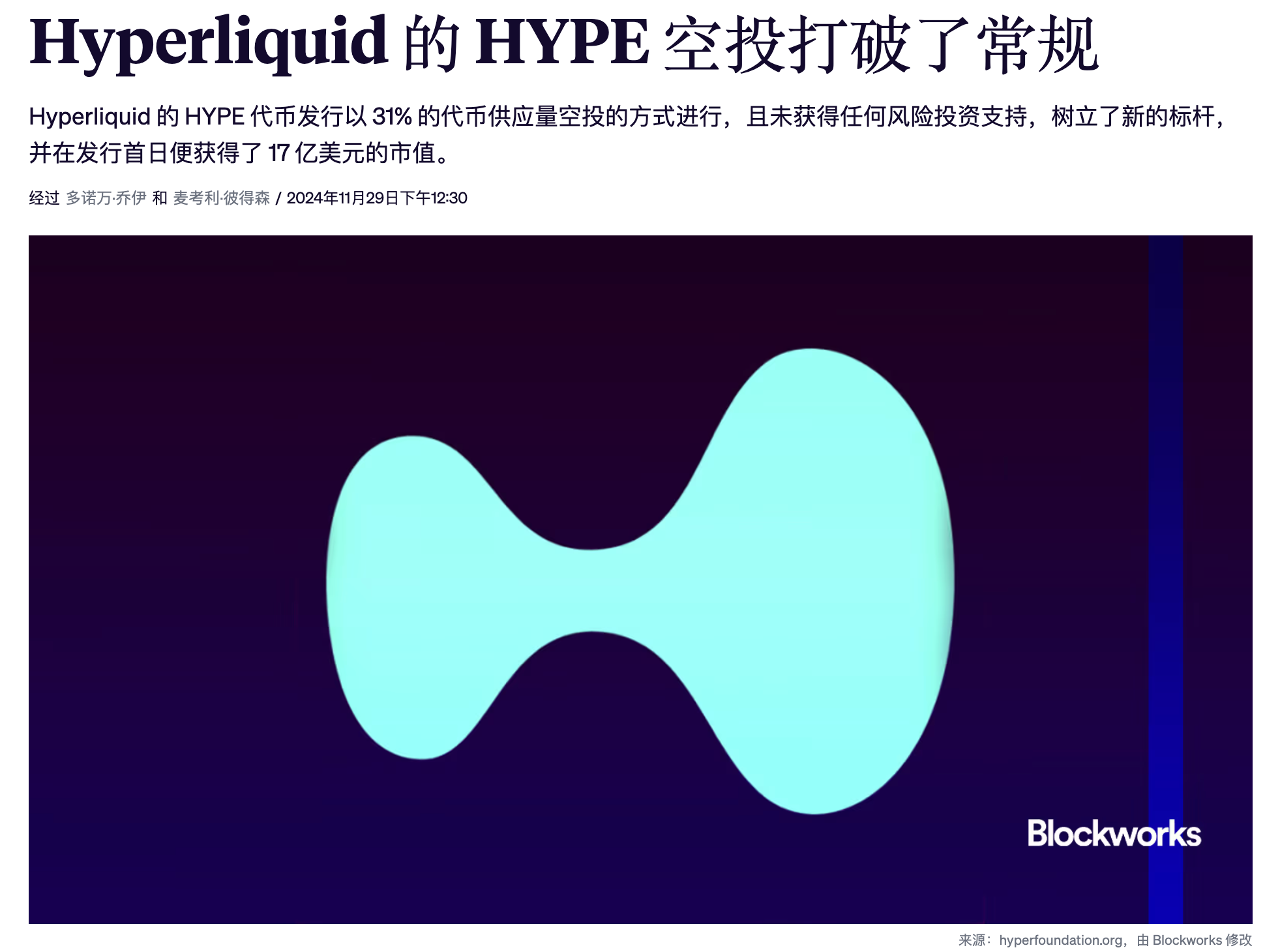

Hyperliquid's chip structure also reflects its long-termism. In the early stages of the project, approximately 31% of HYPE was directly distributed to real users through airdrops, quickly forming a preliminary active base in the community. This approach not only rapidly established a user base but also ensured that the tokens were more in the hands of those who actually use the platform from the very beginning, rather than institutions or speculative accounts.

Figure 8: Airdrop report at the launch of Hyper

Hyper did not introduce traditional VC funding; early research and development and launch mainly relied on the founder's self-funded capital accumulated from previous entrepreneurial ventures. This model means there is no pressure for market value management, allowing the team to focus on technical development and product optimization rather than dealing with the exit or cash-out rhythm of institutional investors.

On-chain data also confirms the robustness of this structure. It can be seen that the base of retail holders is large (over 220,000+ holders); while the core team/foundation portion is not small, effective measures such as staking and long-term locking have avoided short-term concentrated releases. The lack of pressure from large VC/institutional unlocks, combined with the continuous buyback mechanism of the Assistance Fund, has jointly supported the token's resilience and price stability in a bear market environment.

Figure 9: Hype holder addresses (Data source: https://hypurrscan.io)

In other words, this is not only a clean structure for funding sources but also a natural price stabilizer.

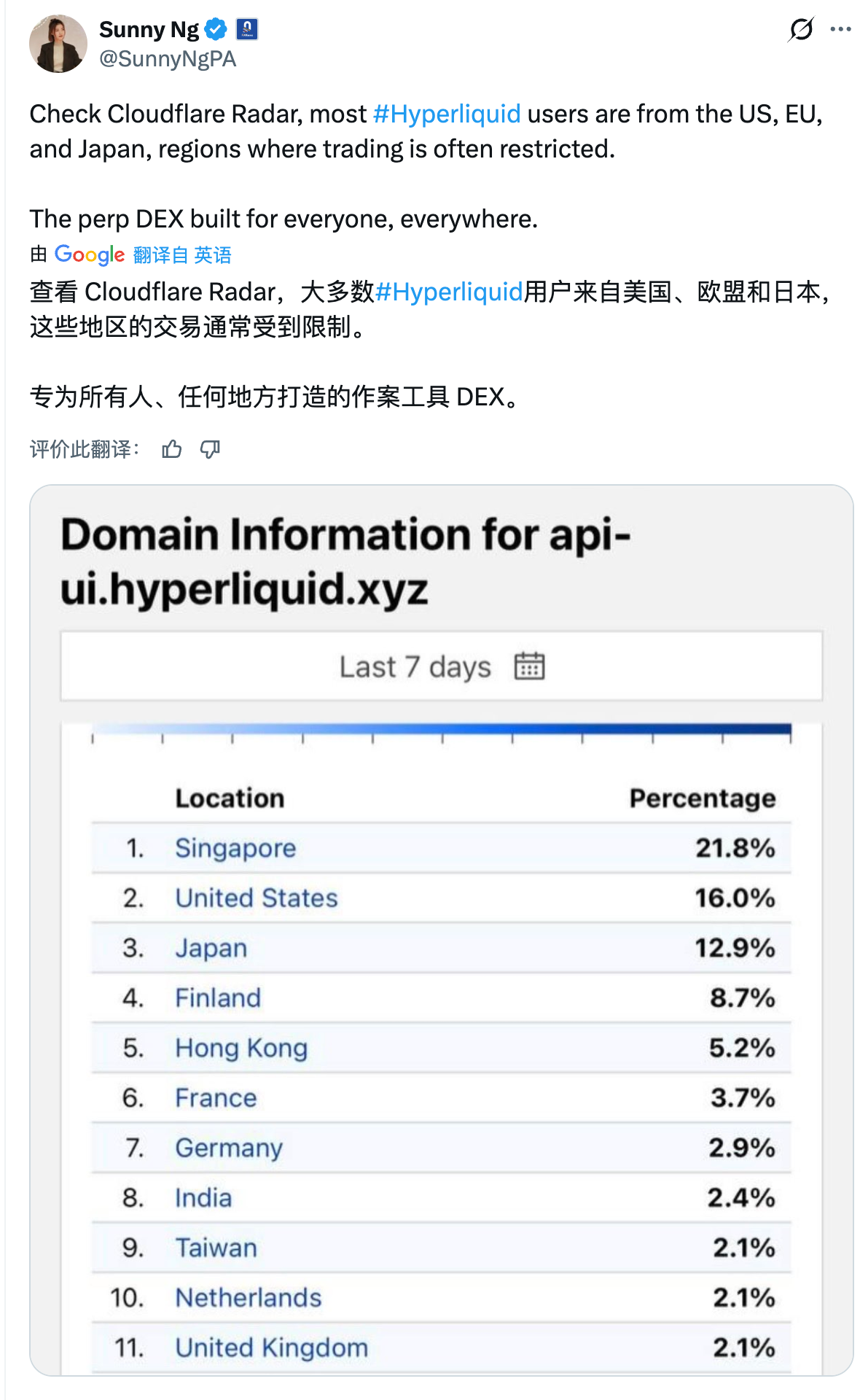

6. Structural Dividends Under Regulatory Realities: "Passive Migration" of European and American Users

As regulations tighten in Europe and the United States, offshore CEXs are increasingly restricting KYC and contract trading for local users. Some professional traders are beginning to seek alternative platforms, hoping to maintain asset control while still obtaining a high-performance trading experience. Hyperliquid perfectly meets this demand: the platform offers near CEX-level matching efficiency while retaining decentralized characteristics, allowing funds to remain non-custodial.

On-chain data shows that recent activity among European and American users has increased, with trading volume particularly concentrated in contracts and high-leverage liquidations, indicating that some funds are actively migrating from traditional CEXs to Hyperliquid. This migration not only boosts the platform's trading volume but also directly increases the demand for HYPE—more funds are used for staking and governance participation, while fee returns create continuous buy orders.

Figure 10: PANews CEO's post about Hyper user regions

This trend has structural characteristics: regulatory pressure is not a short-term phenomenon, and user groups pursuing efficiency and security may remain in Hyperliquid for the long term, providing robust underlying support for HYPE. This is also an important reason why Hyper can maintain price resilience during market downturns.

7. Founders and Team: A "Dream Team" of Long-Termism

Hyperliquid's founder, Jeff, graduated from Harvard with dual degrees in mathematics and computer science and successfully founded a crypto market maker in its early days, providing ample funding and mature experience for Hyperliquid's launch. He has a firm belief in decentralization, never pursuing short-term publicity; his Twitter content mainly focuses on functional updates and technical sharing rather than hype and marketing.

The team is also highly educated and experienced, praised by the community as a "dream team." Initially, there were only eleven core members, with no BD team, and the overall culture centered around engineering, focusing on system performance, trading matching efficiency, and underlying technology optimization. The linear unlocking design of HYPE and the longer lock-up period also reflect the team's long-termism philosophy, avoiding the selling pressure risk from early concentrated token releases.

Figure 11: News report about founder Jeff

This overall design, from the founder's philosophy and team structure to the token economy, emphasizes robust construction and continuous iteration rather than pursuing short-term growth or market hype. Because of this, Hyperliquid maintains high resilience amid market fluctuations, providing solid underlying support for HYPE's price and instilling confidence in users and investors regarding the team's long-term execution capability.

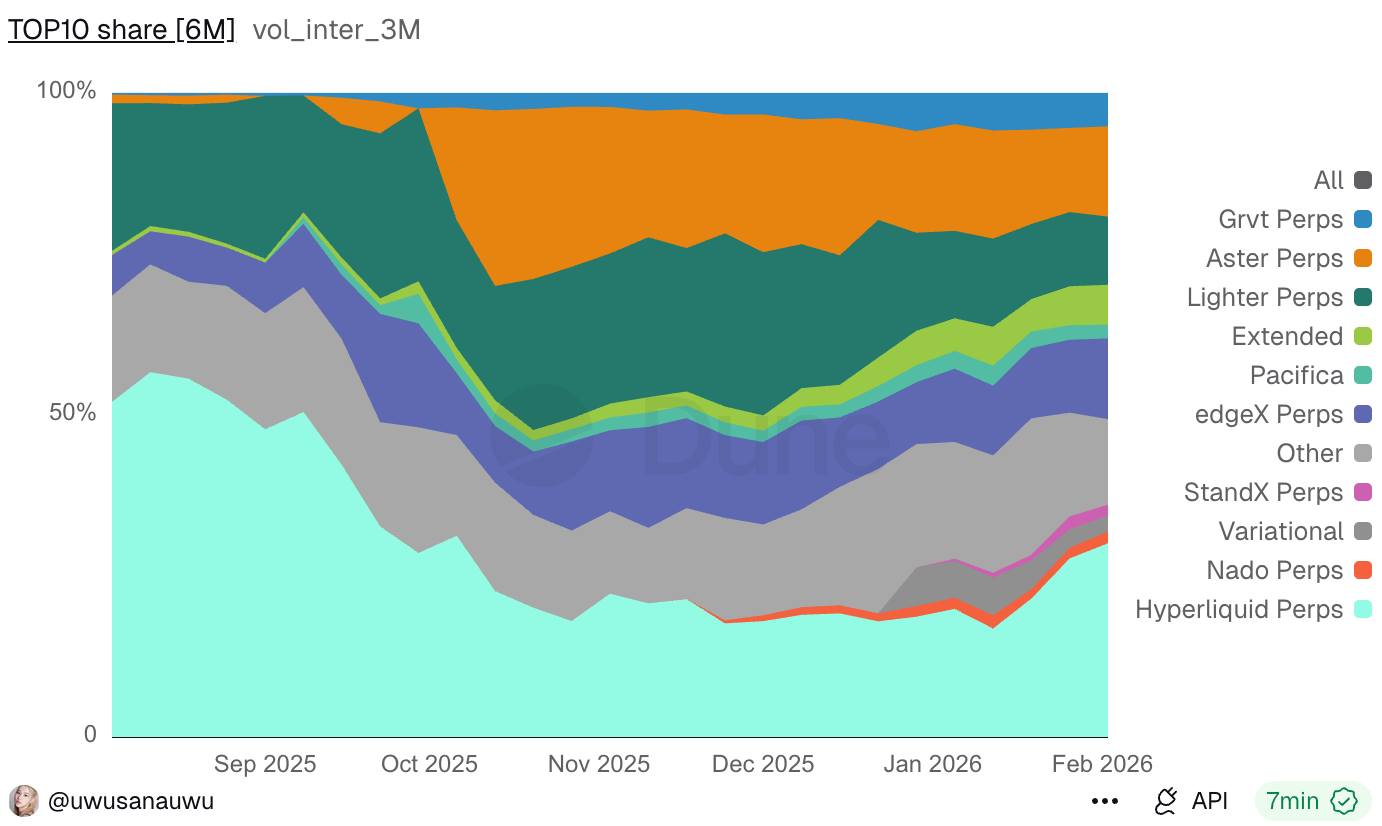

8. Successfully Resisting Competitive Pressure: A Moat Has Formed

During Hyperliquid's rise, it has not been without competitors. Projects like Aster and Lighter have attempted to pressure Hyper through performance, incentives, or product forms, especially during the airdrop period, where such platforms often manage to quickly boost TVL and trading volume.

However, the results show that this impact has largely remained at a short-term level, with recent trading volume proportions rebounding. As the airdrop activities ended, the TVL and trading volume of related platforms quickly declined, with user retention clearly insufficient, leading to a decrease in liquidity. This process has validated a fact: in the derivatives trading arena, incentives can bring traffic but are unlikely to attract long-term users.

Figure 12: Market share of the top ten DEXs (Data source: https://dune.com/uwusanauwu/perps)

In contrast, Hyperliquid's moat is gradually becoming apparent. First, there is liquidity that has already formed scale effects. The better the depth and the lower the slippage, the more concentrated the traders become, and the concentration of funds further reinforces the liquidity advantage, which is the most difficult positive feedback to replicate in derivatives trading.

Second, there is the integrated architecture of the trading system and public chain. HyperCore and HyperEVM share security and liquidity, placing trading, asset issuance, and contract applications within the same system; this deep coupling cannot be achieved simply by forking.

Third, there is the user structure itself. Hyper's core users are high-frequency, professional traders who are highly sensitive to performance, stability, and costs. Once they form usage habits, the migration costs are extremely high. The trading volume brought by these users is also far more stable than that of "airdrop users."

Ultimately, intense competition has not weakened Hyper; rather, it has helped it undergo a market selection process. Those who remain after the incentives disappear are the true moat.

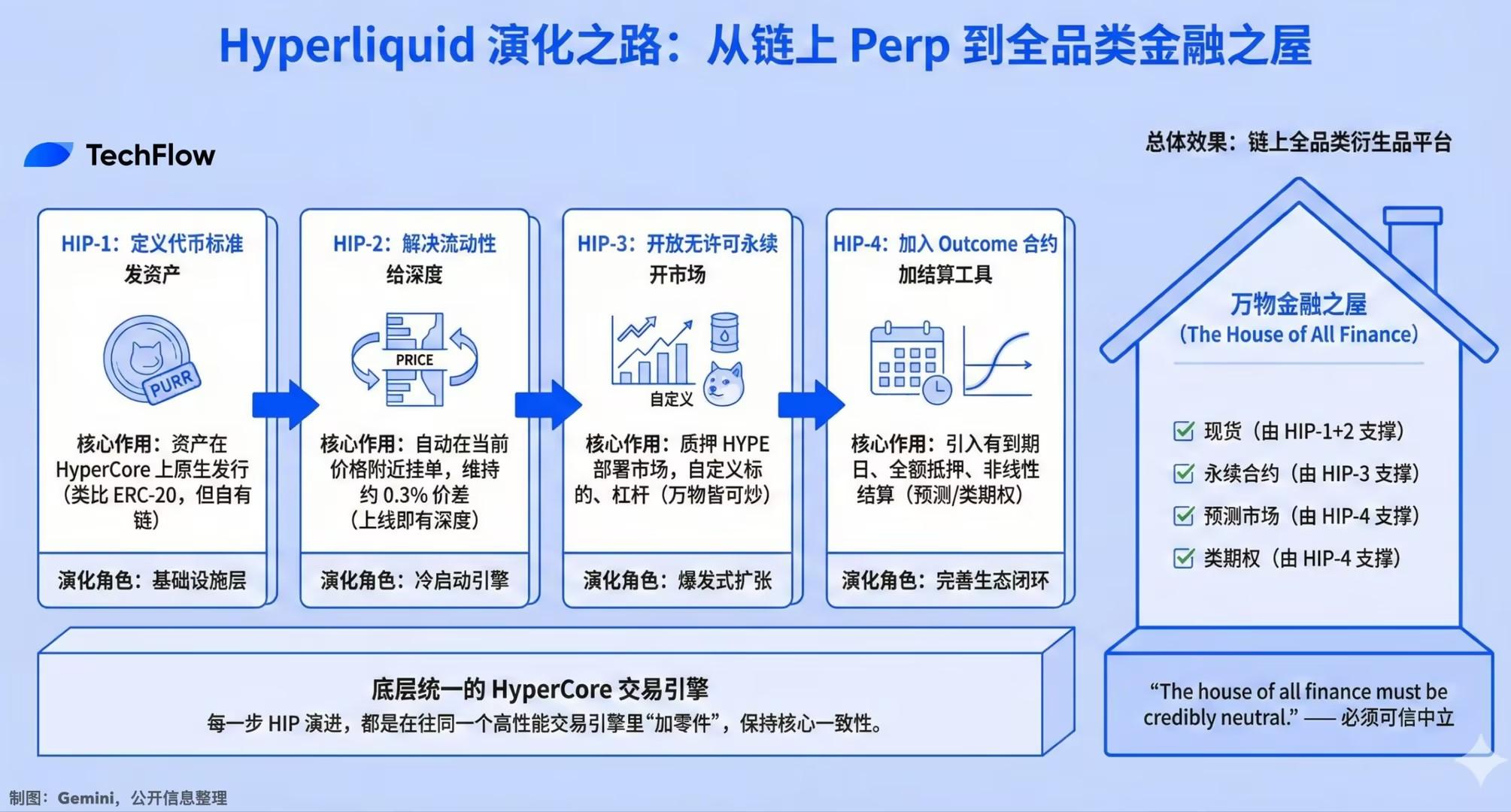

9. Continuous Technical Upgrades: Capability Expansion Driven by HIP Iterations

The technical evolution of Hyperliquid is not a one-time release but is continuously advanced through a series of HIPs (Hyperliquid Improvement Proposals) that push the boundaries of system capabilities. Each upgrade directly addresses key bottlenecks in the trading ecosystem.

HIP-1 defined the native token standard for Hyperliquid and is set to officially launch in 2024. This standard allows any asset to be natively issued on HyperCore, with the first token minted based on this standard being PURR. Its function is akin to Ethereum's ERC-20 but operates on Hyperliquid's self-developed public chain, directly coupling asset issuance with a high-performance trading system.

Building on this, HIP-2 further addresses the core issue of liquidity for new assets. This mechanism automatically places buy and sell orders near the current price of the token, maintaining a price spread of about 0.3%, ensuring that new tokens have basic depth from the first second of their launch without relying on external market makers. This design significantly lowers the barriers to asset launch and enhances the predictability of the trading experience.

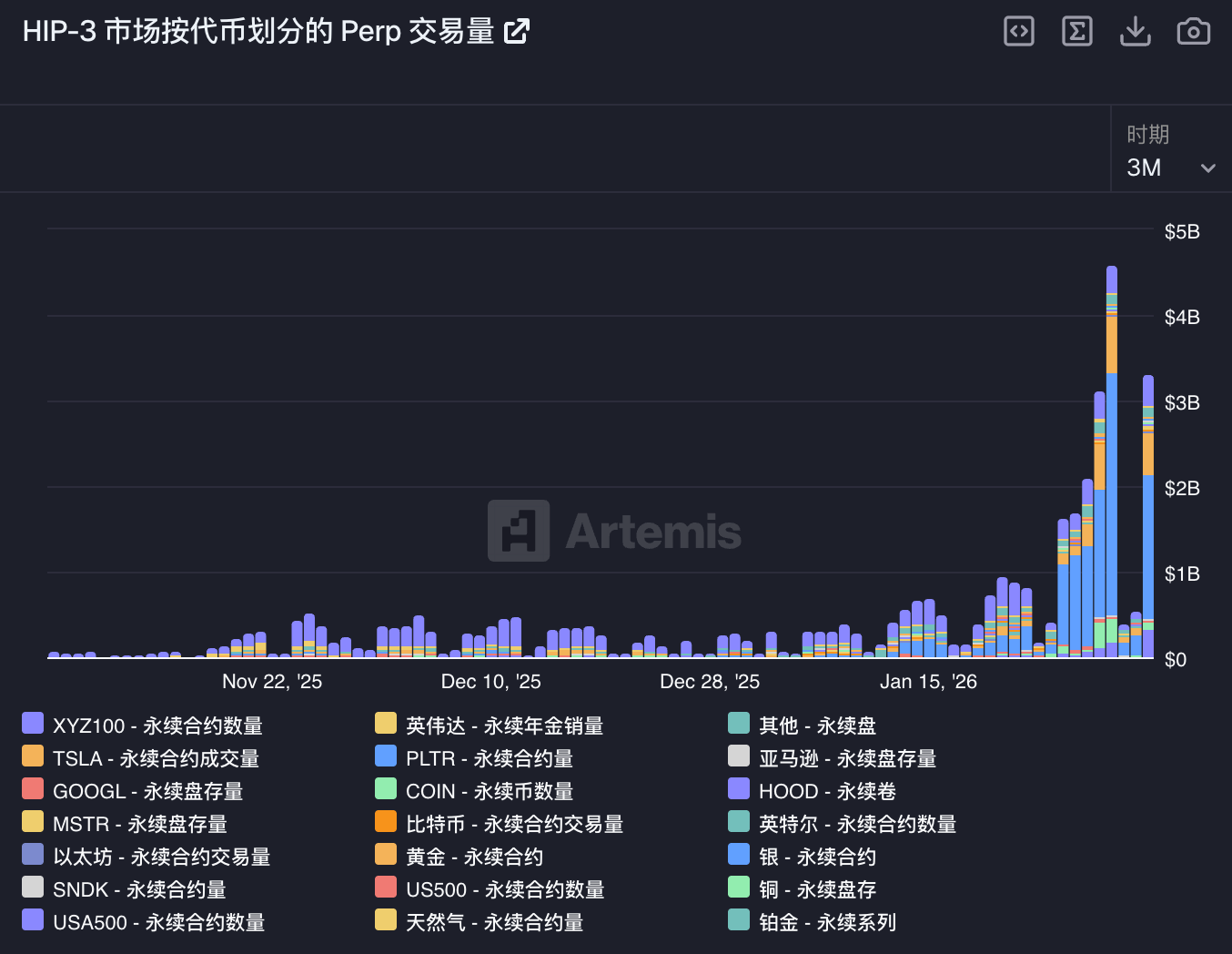

HIP-3 is a key step in the expansion of the Hyperliquid ecosystem, officially opening up permissionless perpetual contracts. Anyone can deploy their own perpetual contract market by staking 500,000 HYPE, customizing trading targets, oracles, leverage multiples, and collateral types. Since this feature went live, the cumulative trading volume has approached $42 billion, with open interest exceeding $1 billion, covering various assets such as stocks, commodities, and meme coins.

The latest HIP-4 introduces outcome contracts, a contract form with an expiration date, full collateralization, and non-linear settlement characteristics, opening up space for complex trading scenarios like prediction markets.

Overall, these four upgrades are not isolated functional additions but gradually build a complete trading system from asset issuance, liquidity, derivatives to prediction markets, further confirming Hyperliquid's path of growth driven by engineering iterations.

Figure 13: The evolution of Hyper upgrades (Data source: TechFlow)

10. Development Vision: Financial Engineering Infrastructure for the Future

If other designs address "how to improve trading," then Hyperliquid's true ambition is to become the infrastructure for on-chain financial engineering. It does not attempt to define itself with a single product but reserves space in its underlying structure for two complex financial forms: Trafi and prediction markets.

In the direction of Trafi, Hyperliquid has already demonstrated a significantly different carrying capacity compared to traditional DeFi. The current daily trading volume in the Trafi market on the platform remains at the level of several billion dollars, with a considerable portion coming from contract trading of real assets such as commodities and stocks. More importantly, after the HIP-3 upgrade, users only need to stake 500,000 HYPE to deploy their own contract markets, greatly facilitating the process of bringing real assets on-chain. Combined with high-performance matching, extremely low latency, and unified margin accounts, Hyperliquid is inherently suitable for large settlements and continuous risk management, rather than merely serving high-frequency speculation.

Figure 14: Trafi trading volume on Hyper (Data source: https://app.artemisanalytics.com/)

Prediction markets represent another piece of the puzzle with greater long-term imagination. The outcome contracts introduced by HIP-4 are not standalone "prediction applications" but can operate in synergy with perpetual contracts and spot positions under the same margin system. As described by DeFi researcher Ignas: traders can go long on ETH perpetuals while configuring an outcome contract that triggers payouts upon expiration, allowing the system to recognize the overall risk exposure decrease and release excess margin. This means that prediction markets are systematically integrated into risk management and structured design for the first time.

Figure 15: Original post by Ignas

When the real trading demand of Trafi combines with the event pricing capability of prediction markets on the same high-performance chain, Hyperliquid is no longer just a trading platform but is closer to the execution base of next-generation financial engineering. This is also the most essential distinction between it and most "functional DeFi projects."

Conclusion

Looking back at Hyper's performance, it can be seen that its price resilience does not stem from a single point of advantage but is the result of multiple structural factors overlapping. High performance and self-developed architecture enable it to carry real trading demands; the continuous depth and liquidity indicate that the platform is not a short-term use case that is "abandoned after airdrops"; the fee buyback and staking mechanism create a clear and sustainable interest binding between the token and protocol growth.

More importantly, Hyper has not positioned itself as a short-cycle DeFi product but has chosen a heavier, slower, yet more stable path between trading, public chains, and financial engineering infrastructure. Whether it is the permissionless deployment of markets, Trafi carrying capacity, or the risk hedging and structured space opened up by outcome contracts, all point to a system of long-term evolution rather than relying on valuation narratives driven by emotional fluctuations.

In a phase where the overall market is under pressure, whether the price can hold steady often does not depend on whether the narrative is new enough but on whether there are truly users, whether it can genuinely generate profits, and whether these profits ultimately flow back to the token itself. At least at the current stage, Hyper provides a clearer answer than most similar projects.

A faster, cheaper, and better way to use Hyperliquid with an exclusive link that saves 4% on trading costs:

AiCoin user exclusive link:

https://app.hyperliquid.xyz/join/AICOIN88

For a detailed tutorial on getting started with Hyperliquid from scratch, visit:

https://www.aicoin.com/zh-Hans/article/510225

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。