A new market assessment signals heightened downside risk as bitcoin moves into a vulnerable phase. Blockchain analytics firm Cryptoquant shared an analysis on Feb. 2 indicating that bitcoin may be entering a danger zone as medium-term holders turn unprofitable en masse based on realized price and supply behavior.

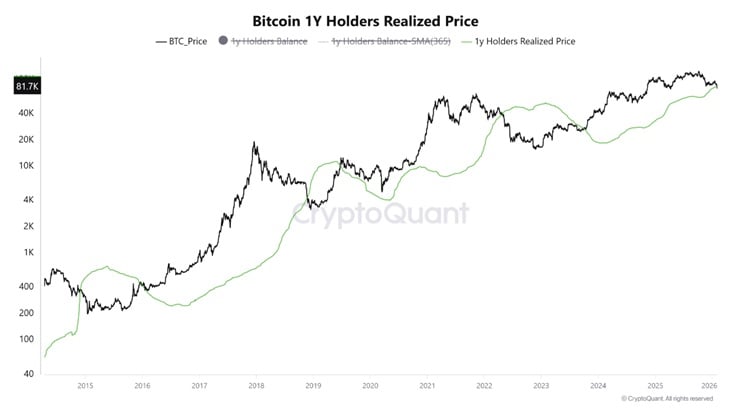

The analysis centers on realized price dynamics and the behavior of the 12–18 month UTXO age band, a cohort often associated with cycle stability and conviction. Chart data shows bitcoin trading near $81,700 while remaining below the realized price of longer-held coins, a level that has trended upward toward the mid-$80,000 range and has placed much of this cohort below its aggregate cost basis at the same time. Historically, this realized price has acted as a structural pivot, and the analysis underscores the significance of the current positioning, stating:

“Historically, when price breaks and sustains below this cost basis, market behavior transitions from normal corrections into structural bearish regimes, not short-term pullbacks.”

The first chart included in the analysis illustrates multiple prior cycles where extended periods below realized price aligned with prolonged drawdowns rather than brief retracements, reinforcing its role as a critical cost basis.

Read more: Bitcoin Slides to $78K as Macro Stress and ETF Outflows Hit at the Same Time

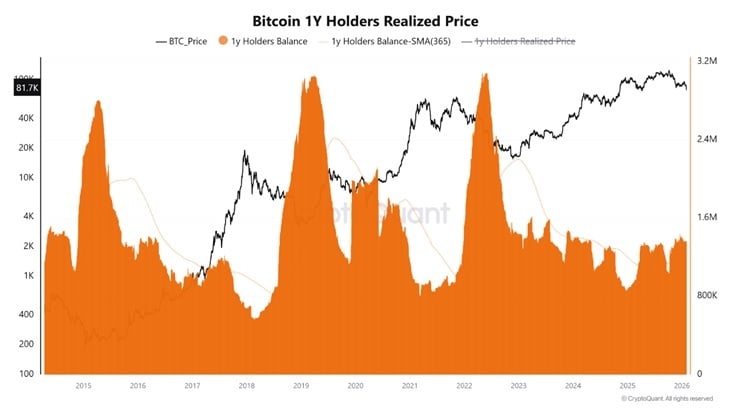

Further insight comes from the second chart, which tracks the balance of 12–18 month holders alongside a 365-day moving average. The data shows this cohort still controlling a substantial share of circulating supply, with balances historically ranging between roughly 1.6 million and more than 3 million bitcoin. While the 30-day balance change remains positive, the slope of accumulation has flattened, indicating that buying pressure from medium-term holders is weakening.

The analysis characterizes this shift, noting:

“This deceleration is critical: it signals weakening marginal conviction rather than aggressive dip buying. In previous cycles, this pattern has often preceded broader distribution phases.”

At the same time, the realized price itself remains relatively stable, reinforcing its role as overhead resistance when spot price trades below it and rallies encounter selling pressure from holders seeking breakeven exits.

From a broader cycle perspective, the report concludes, “From a cycle perspective, the combination of price below realized cost, negative unrealized profitability, and slowing balance growth has historically aligned with extended bearish phases. Until Bitcoin reclaims this realized price level with renewed accumulation momentum, market structure continues to favor consolidation, fragile rebounds, and elevated downside risk rather than confirmed recovery.” Together, the price and supply signals suggest bitcoin has entered a danger zone defined by widespread medium-term losses rather than a short-lived pullback.

- Why is bitcoin considered to be entering a danger zone for investors?

Bitcoin has fallen below the realized price of key medium-term holders, a condition that historically signals structural bearish phases rather than short-term corrections. - What role do 12–18 month bitcoin holders play in market stability?

This cohort typically represents high-conviction capital, and when their aggregate cost basis turns unprofitable, it often precedes prolonged drawdowns and weaker price support. - How does slowing accumulation from medium-term holders affect bitcoin’s outlook?

Flattening balance growth suggests weakening conviction and reduced dip-buying, a pattern that has historically led to broader distribution and downside pressure. - What should investors watch for to confirm a bitcoin recovery?

A sustained reclaim of the realized price with renewed accumulation momentum is needed to shift market structure away from consolidation and elevated downside risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。