Gold plummeted by over $400 in a single day, U.S. Treasury yields surged in response, and the nomination of a former Federal Reserve governor led to an unexpected "tightening" storm in global financial markets. On January 30, 2026, local time, U.S. President Trump announced via social media the nomination of former Federal Reserve governor Kevin Warsh as the next Federal Reserve Chair.

Upon the announcement, the market reacted swiftly: major U.S. stock indices fell, Treasury yields rose significantly, the dollar strengthened, while assets like gold and silver saw a sharp decline.

This candidate, who possesses a background in Wall Street, political connections, and central bank experience, proposed a seemingly contradictory policy combination called "pragmatic monetarism"—advocating for "balance sheet reduction" to create space for "interest rate cuts."

1. Background of the Nomination

Warsh's nomination marks the impending end of the Powell era. Current Chair Powell's relationship with the Trump administration has deteriorated due to disagreements over the pace of interest rate cuts, and his term is set to end in May 2026.

● Unlike Powell, who has a background in law and financial investment, the 55-year-old Warsh has a more complex resume. He served as a Federal Reserve governor from 2006 to 2011, becoming the youngest governor at that time, and was deeply involved in the early response to the 2008 financial crisis.

● His career began in Morgan Stanley's mergers and acquisitions division, and he also worked in the National Economic Council under the George W. Bush administration. After leaving the Federal Reserve, he became active in academic institutions like the Hoover Institution at Stanford University.

● Warsh has close ties to Trump's camp. His father-in-law, billionaire Ronald Lauder, is a college classmate of Trump and a long-time political donor. This background has led to his nomination being interpreted as a key step by Trump to enhance influence over the Federal Reserve.

2. Core Proposition: "Pragmatic Monetarism" and the Contradictory Policy Puzzle

● Warsh's policy proposition centers around a theory known as "pragmatic monetarism." Its most striking feature is the proposal of a seemingly contradictory policy combination: "balance sheet reduction" (quantitative tightening, QT) alongside "interest rate cuts."

● Warsh believes that the root of current U.S. inflation lies in the excessive money supply resulting from the Federal Reserve's long-term "quantitative easing" (QE) policies following the financial crisis and the pandemic. He adheres to monetarist theory and has explicitly stated that "inflation is a choice."

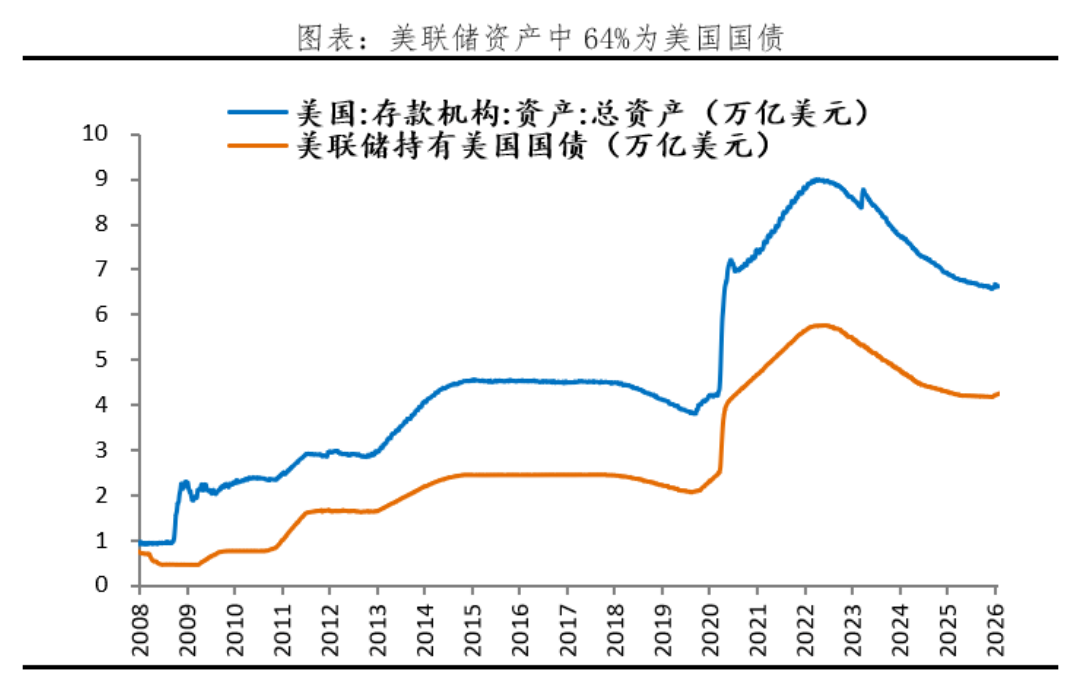

● In his view, the Federal Reserve's massive balance sheet (currently around $6.6 trillion) distorts the market, suppresses long-term interest rates, and fuels asset bubbles and fiscal deficits.

● Therefore, his "prescription" is to first aggressively "reduce the balance sheet" to directly withdraw excess liquidity and restore the central bank's credibility in curbing inflation; once inflation expectations are firmly anchored, it will open a safe space for meaningful and sustainable interest rate cuts.

● In short, he attempts to exchange "tight credit" from "balance sheet reduction" for "loose monetary policy" from "interest rate cuts." Theoretically, this combination aims to cater to Trump's demand for interest rate cuts while addressing market concerns about inflation.

3. The Crisis of Federal Reserve Independence Under Balancing Act

Trump's choice of Warsh is the result of a meticulous political calculation.

● On one hand, Warsh's recent public support for interest rate cuts aligns with Trump's urgent need to lower rates to stimulate the economy and alleviate debt pressure. Trump has repeatedly criticized Powell as "Mr. Too Late."

● On the other hand, Warsh's "hawkish" reputation on inflation and balance sheet issues makes him more credible in the eyes of financial markets than a purely "dovish" figure. This credibility may actually be more beneficial in stabilizing long-term inflation expectations, thereby achieving a genuinely low-interest-rate environment.

● More importantly, Warsh has long criticized the Federal Reserve's existing policy framework and its massive bureaucratic system, advocating for "institutional adjustments." This aligns with Trump's political narrative of "breaking the old to establish the new" and suggests that the Federal Reserve may shift from being "Wall Street's central bank" more towards "Main Street" (the real economy).

● However, Warsh's close ties to the Trump family have raised deep concerns about the Federal Reserve's independence. Trump has previously made it clear that he wants the Federal Reserve Chair to support low rates and consult him in policy-making.

Some members of Congress have expressed opposition or concern regarding the nomination, viewing it as a dangerous signal of political interference in the central bank. The independence of the Federal Reserve is facing its most severe test in decades.

4. The Game of "Tightening Trade" and "Policy Credibility"

The market's reaction to Warsh's nomination was swift and intense, exhibiting typical characteristics of a "tightening trade."

Specifically, after the nomination was announced:

● The dollar index rose by about 0.5%, as the market feared a more tightening Federal Reserve policy.

● The 10-year Treasury yield increased by about 4 basis points, reflecting market expectations for tightening policies.

● Gold prices plummeted significantly; as a tool for hedging against dollar depreciation, its price decline indicates expectations of monetary tightening.

● Major U.S. stock indices weakened overall, with technology and growth stocks experiencing more pronounced pullbacks; Bitcoin crashed, with over 700 million in liquidations.

Before the nomination, the market reactions during the leading periods of different candidates were starkly different:

● During the Hassett probability surge, the market worried about "independence," exhibiting a mini-version of a "triple kill" in stocks, bonds, and currencies.

● During the Reed probability increase, the market displayed a "loose-goldilocks" trade.

● During the Warsh probability surge, the market traded on medium to long-term "policy credibility."

5. Market Impact and Policy Outlook: The Prelude to Uncertainty

Warsh's nomination has already delivered an immediate shock to global markets, and his policy ideas signal a profound transformation, but the path ahead is fraught with uncertainty.

● From an asset impact perspective, the market reaction post-nomination reveals initial logic:

○ The dollar strengthened due to expectations of tightening monetary policy and credibility premium;

○ Gold and other non-yielding assets came under pressure due to expectations of rising real interest rates;

○ U.S. stocks need to find a new balance between tightening liquidity and economic growth expectations.

● Regarding the interest rate path, in the short term (first half of 2026), policies are likely to continue under Powell's framework, with a cautious pace of interest rate cuts. In the medium to long term, Warsh places more emphasis on the "quality of interest rate cuts" rather than speed, and his opposition to forward guidance may make future interest rate paths harder to predict.

● The fundamental challenge lies in Warsh's attempt to walk a tightrope between conflicting goals: responding to political pressure for interest rate cuts while restoring anti-inflation credibility through balance sheet reduction; supporting "America First" industrial policies while avoiding unlimited financing of fiscal deficits.

● His true goal may be to promote a "new agreement" similar to the 1951 "Federal Reserve-Treasury Agreement," redefining the boundaries between monetary policy and fiscal policy, and reshaping a "scarcer but more stable" dollar system in the "America First" era.

The dollar index rose by 0.5%, while gold prices experienced a waterfall decline. Traders held their breath, watching the numbers on the screen, trying to decipher where this "moderate reformer with a hawkish undertone" would lead the Federal Reserve.

Warsh faces an almost impossible balancing act: on the left is the political tightrope of the White House demanding interest rate cuts, on the right is the market's trust cliff wary of inflation, and beneath him lies the thin ice of a balance sheet exceeding $6.6 trillion.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。