原文标题:Why BTC and ETH Haven』t Rallied with Other Risk Assets

原文作者:@GarrettBullish

编译:Peggy,BlockBeats

编者按:在多类资产上涨的背景下,BTC 与 ETH 的阶段性滞涨,常被简单归因于「风险资产属性」。本文认为,问题的核心并不在宏观,而在加密市场自身的去杠杆阶段与市场结构。

随着杠杆出清接近尾声、交易活跃度降至低位,存量资金难以对抗由高杠杆散户、被动资金与投机性交易共同放大的短期波动。在新增资金与 FOMO 情绪尚未回归之前,市场对负面叙事更为敏感,属于结构性结果。

历史类比表明,这种表现更可能是长期周期中的阶段性调整,而非基本面失效。本文试图跳出短期涨跌,从周期与结构出发,重新理解 BTC 与 ETH 当前所处的位置。

以下为原文:

比特币(BTC)和以太坊(ETH)近期明显跑输其他风险资产。

我们认为,造成这一现象的主要原因包括:交易周期所处阶段、市场微观结构,以及部分交易所、做市商或投机基金对市场的操纵行为。

市场背景

首先,自去年 10 月开始的去杠杆式下跌,对高杠杆参与者,尤其是散户交易者,造成了沉重打击。大量投机性资金被清洗出局,导致市场整体变得脆弱且趋于避险。

与此同时,中国、日本、韩国以及美国的 AI 相关股票出现了极为激进的上涨行情;贵金属市场也经历了一轮由 FOMO(错失恐惧)情绪驱动、近似「meme 行情」的暴涨。这些资产的上涨吸收了大量散户资金——而这点尤为关键,因为亚洲和美国的散户投资者,仍然是加密市场中最主要的交易力量。

另一个结构性问题在于:加密资产尚未真正融入传统金融体系。在传统金融体系中,大宗商品、股票和外汇可以在同一个账户中交易,资产配置切换几乎没有摩擦;但在现实中,从 TradFi 向加密市场转移资金,仍然面临监管、操作流程以及心理层面的多重障碍。

此外,加密市场中专业机构投资者的占比依然有限。多数参与者并非专业投资人,缺乏独立的分析框架,容易受到投机资金或兼具做市角色的交易所影响,从而被情绪和叙事牵引。诸如「四年周期」「圣诞魔咒」等叙事被反复渲染,尽管它们既缺乏严密逻辑,也没有扎实的数据支撑。

市场中普遍存在过于线性的思维方式,例如直接将 BTC 的价格波动归因于 2024 年 7 月日元升值等单一事件,而缺乏更深入的分析。这类叙事往往被迅速传播,并对价格形成直接影响。

接下来,我们将摆脱短期叙事,从独立思考的角度来分析这一问题。

时间维度至关重要

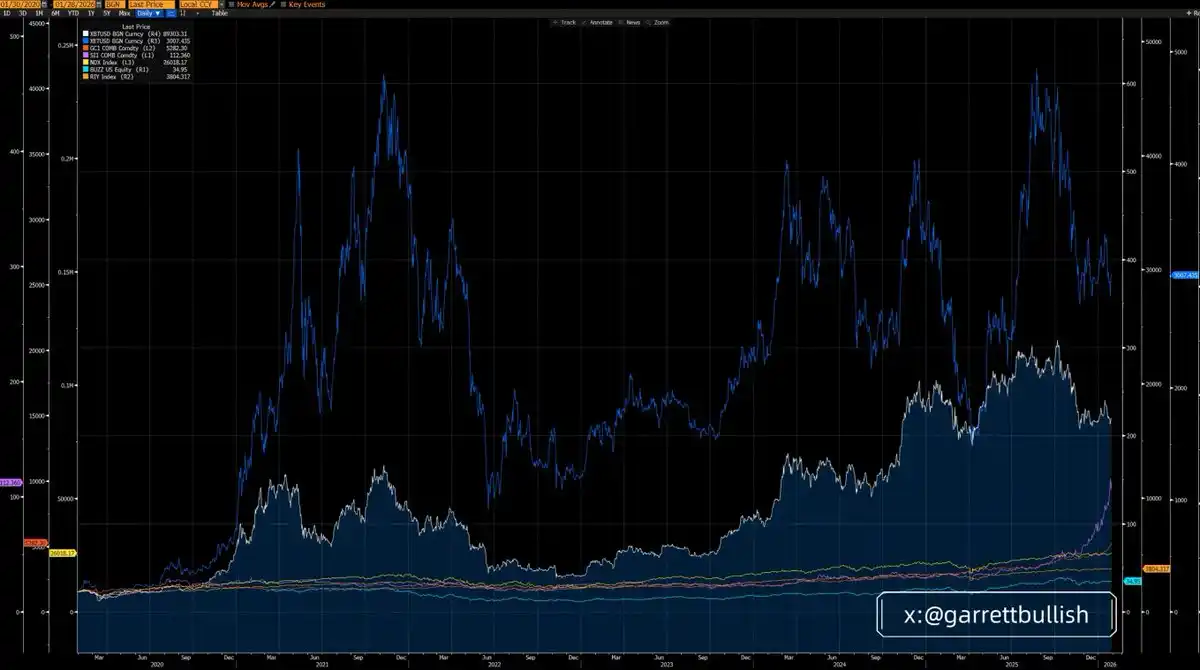

如果以 三年周期来看,BTC 和 ETH 的表现确实跑输多数主要资产,其中 ETH 表现最弱。

但如果拉长至 六年周期(自 2020 年 3 月 12 日以来),BTC 和 ETH 的表现则明显优于大多数资产,而 ETH 反而成为表现最强的资产。

从更长时间维度、并置于宏观背景下来看,当前所谓的「短期跑输」,本质上只是一个更长期历史周期中的均值回归过程。

忽视底层逻辑、只盯着短期价格波动,是投资分析中最常见、也最致命的错误之一。

轮动是正常现象

在去年 10 月银价出现逼空行情之前,白银同样是表现最差的一类风险资产之一;而如今,在三年周期维度下,白银已经成为表现最强的资产。

这一变化,与 BTC 和 ETH 当前的处境高度相似。尽管它们在短期内表现不佳,但在六年周期维度中,依然是最具优势的资产类别之一。

只要 BTC 作为「数字黄金」和价值储存工具的叙事尚未被根本性证伪,只要 ETH 仍在持续与 AI 浪潮融合,并作为 RWA(现实世界资产)趋势中的核心基础设施存在,就不存在任何理性依据认为它们会在长期中持续跑输其他资产。

再次强调:忽视基本面,只挑选短期价格走势来下结论,是严重的分析错误。

市场结构与去杠杆

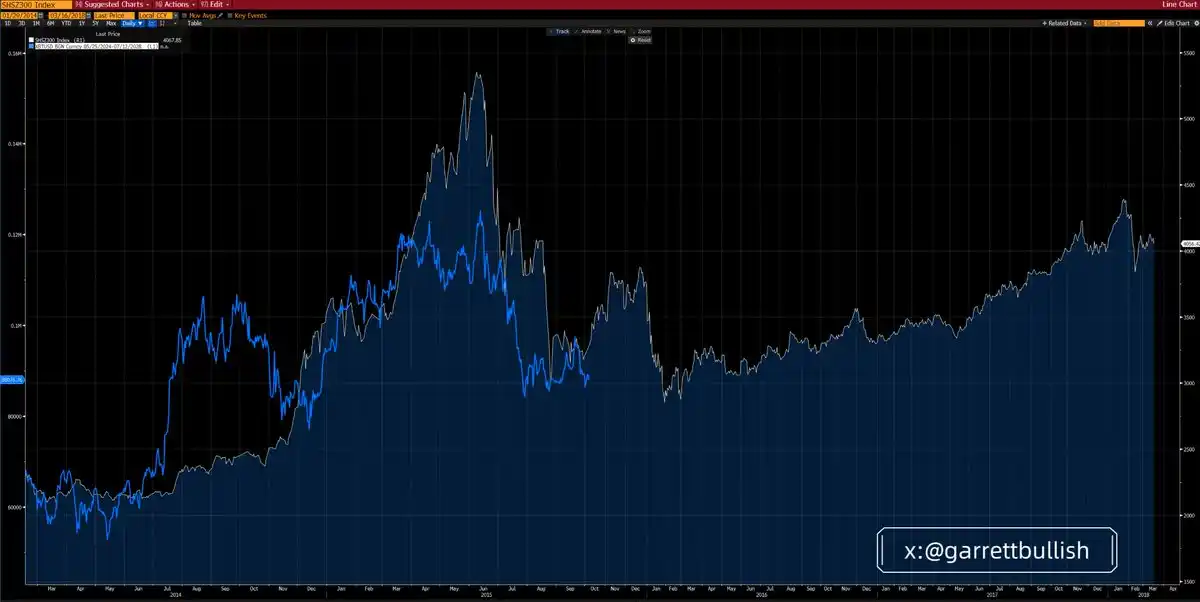

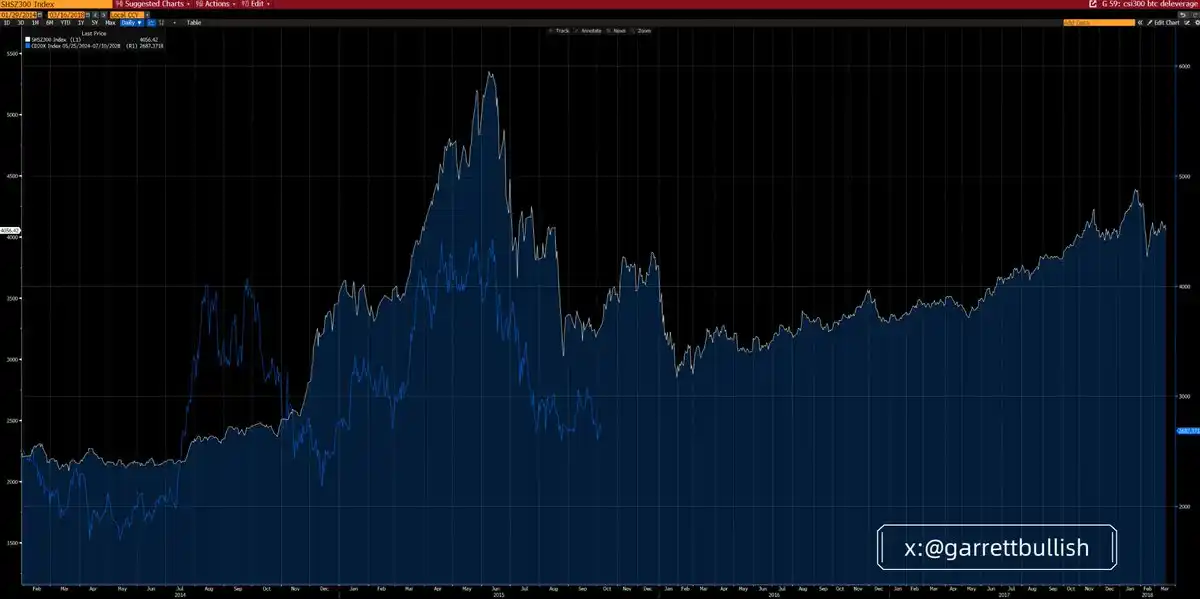

当前的加密市场,与 2015 年中国 A 股市场在高杠杆推动后进入去杠杆阶段的环境,呈现出惊人的相似性。

2015 年 6 月,在一轮由杠杆驱动的牛市停滞、估值泡沫破裂之后,A 股市场进入了一个符合艾略特波浪理论(Elliott Wave)的 A–B–C 三段式下跌结构。当 C 浪见底后,市场经历了数月的横盘整理,随后才逐步过渡到一轮持续多年的牛市。

那一轮长期牛市的核心驱动力,来自于蓝筹资产估值处于低位、宏观政策环境改善,以及货币条件的显著宽松。

比特币(BTC)及 CD20 指数,在本轮周期中几乎完整复刻了这一「加杠杆—去杠杆」的演化路径,无论是在时间节奏还是结构形态上都高度一致。

其底层相似性十分清晰:两种市场环境都具备以下特征——高杠杆、极端波动、由估值泡沫和群体行为推动的顶部、反复出现的去杠杆冲击、漫长而缓慢的下跌过程、波动率持续回落,以及期货市场长期处于正价差(contango)结构。

在当前市场中,这种正价差结构,体现为与数字资产金库(DAT)相关的上市公司股票价格(如 MSTR、BMNR)相对于其 mNAV(调整后净资产价值)存在折价。

与此同时,宏观环境正在逐步改善。监管层面的确定性正在增强,例如《Clarity Act》等立法推动持续推进;美国证监会(SEC)和商品期货交易委员会(CFTC)也在积极推动 美股上链交易(on-chain US equities)的发展。

货币条件同样趋于宽松:降息预期升温、量化紧缩(QT)接近尾声、回购市场流动性持续注入,以及市场对下一任美联储主席立场愈发鸽派的预期,都在共同改善整体流动性环境。

ETH 与特斯拉:一个有参考价值的类比

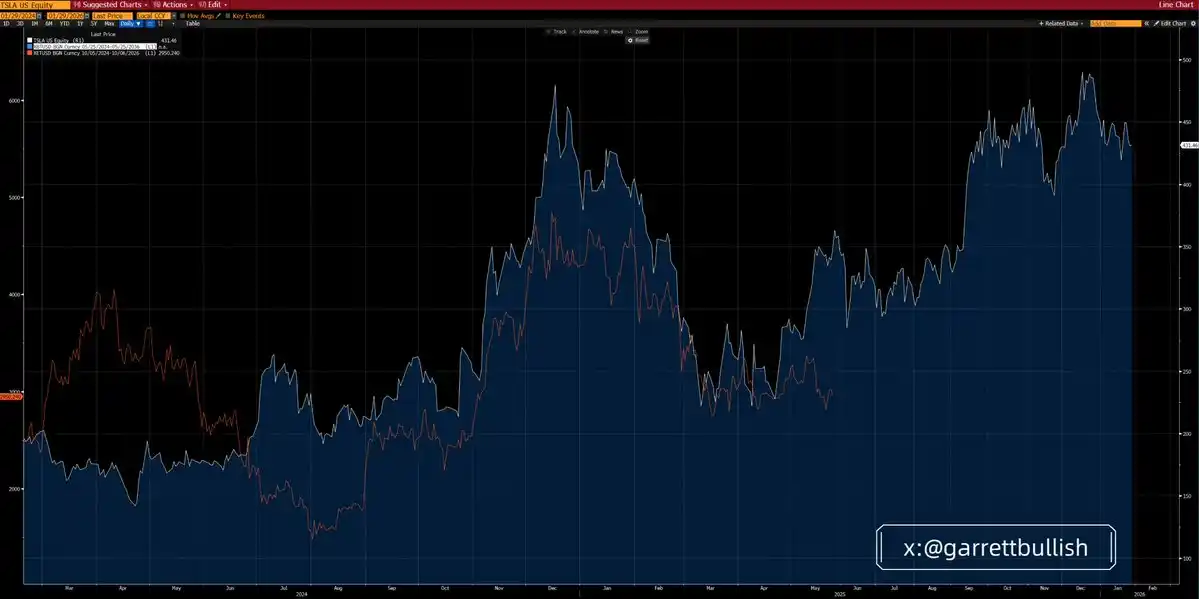

ETH 近期的价格走势,与 特斯拉(Tesla)在 2024 年的行情表现高度相似。

在当时,特斯拉股价先是形成了一个头肩底结构,随后出现反弹、横盘整理、再次上冲,接着进入较长时间的筑顶阶段,之后快速下跌,并在低位展开了长时间的横向整理。

直到 2025 年 5 月,特斯拉才最终向上突破,正式开启新一轮牛市。其上涨动能主要来自 中国市场销量增长、特朗普当选概率上升,以及政治网络的商业化变现。

从当前阶段来看,ETH 无论在技术形态还是基本面背景上,都与当时的特斯拉呈现出高度相似性。

其底层逻辑同样具有可比性:两者都同时承载着技术叙事与 meme 属性,都曾吸引大量高杠杆资金,经历过剧烈波动,在群体行为推动的估值泡沫中见顶,随后进入反复去杠杆的调整周期。

随着时间推移,市场波动率逐步回落,而基本面与宏观环境则在持续改善之中。

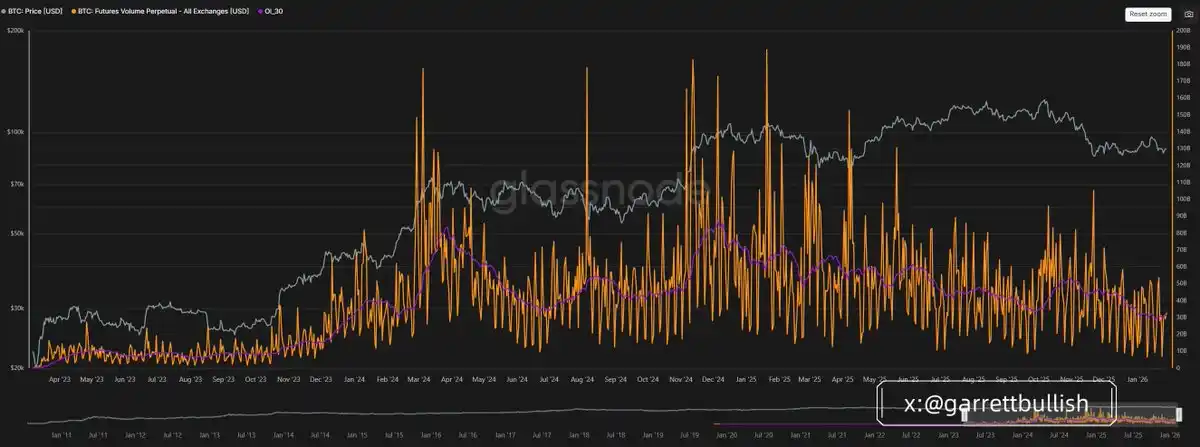

从期货交易量来看,BTC 和 ETH 的市场活跃度已经接近历史低位,这表明去杠杆过程正在接近尾声。

BTC 和 ETH 是「风险资产」吗?

近期,市场中出现了一种颇为奇怪的叙事:将 BTC 和 ETH 简单地定义为「风险资产」,并以此解释它们为何没有跟随美股、A 股、贵金属或基本金属的上涨。

从定义上看,风险资产通常具备高波动率和高贝塔特征。无论从行为金融学还是量化统计的角度,美国股市、A 股、基本金属、BTC 和 ETH 都符合这一标准,并且在「risk-on」环境中往往受益。

但 BTC 和 ETH 还具备额外的属性。由于 DeFi 生态和链上结算机制的存在,它们在特定情境下也呈现出类似贵金属的避险特征,尤其是在地缘政治压力上升时。

将 BTC 和 ETH 简单贴上「纯风险资产」的标签,并据此断言它们无法从宏观扩张中受益,本质上是一种选择性强调负面因素的叙事。

常被引用的例子包括:

因格陵兰问题引发的 欧盟—美国潜在关税冲突

加拿大—美国关税争端

以及 美国—伊朗可能发生的军事冲突

这种论证方式,本质上是一种「挑选叙事」(cherry-picking)和双重标准。

从理论上讲,如果这些风险真的是系统性的,那么除了可能因战争需求受益的基本金属外,所有风险资产都应同步下跌。但现实情况是,这些风险并不具备升级为重大系统性冲击的基础。

AI 与高科技相关需求依然极为强劲,且在很大程度上不受地缘政治噪音影响,尤其是在中国和美国等核心经济体中。因此,股票市场并未对这些风险进行实质性定价。

更重要的是,这些担忧中的大多数已经被降级处理或被事实证伪。这也引出了一个关键问题:为什么 BTC 和 ETH 对负面叙事异常敏感,却对正面进展或负面因素的消退反应迟缓?

真正的原因

我们认为,原因主要来自加密市场自身的结构性问题。当前市场正处在去杠杆周期的尾声阶段,参与者整体情绪偏紧,对下行风险高度敏感。

加密市场仍以散户为主导,专业机构参与度有限。ETF 的资金流更多反映的是被动跟随情绪,而非基于基本面和判断的主动配置。

同样,多数 DAT(数字资产金库)的建仓方式也偏向被动——无论是直接操作,还是通过第三方被动型基金管理人,通常采用 VWAP、TWAP 等非激进的算法交易策略,核心目标是降低日内波动。

这与投机性基金形成了鲜明对比。后者的主要目标,恰恰是制造日内波动——而在当前阶段,这种波动更多体现在下行方向,用以操纵价格行为。

与此同时,散户交易者普遍使用 10–20 倍杠杆。这使得交易所、做市商或投机基金,更倾向于利用市场微观结构获利,而不是承受中长期的价格波动。

我们经常观察到,在流动性稀薄的时段出现集中性抛售,尤其是在亚洲或美国投资者处于睡眠状态时,例如亚洲时间凌晨 00:00–08:00。这类波动往往触发连锁反应,包括强平、追加保证金通知以及被动卖出,进一步放大下跌幅度。

在缺乏实质性新增资金流入、或 FOMO 情绪尚未回归之前,仅依靠现有存量资金,不足以对抗上述类型的市场行为。

风险资产的定义

风险资产(Risk Assets)是指具有一定风险特征的金融工具,包括股票、大宗商品、高收益债券、房地产以及货币等。

从广义上看,风险资产指的是任何不被视为「无风险」的金融证券或投资工具。这类资产的共同特征是,其价格具有波动性,价值可能随时间发生明显变化。

常见的风险资产类型包括:

股票(Equities / Stocks):

上市公司的股份,其价格会受到市场环境、公司经营状况等多种因素影响,波动幅度可能较大。

大宗商品(Commodities):

如原油、黄金、农产品等实物资产,价格主要受供需关系变化影响。

高收益债券(High-Yield Bonds):

由于信用评级较低而提供更高利率的债券,但同时也伴随着更高的违约风险。

房地产(Real Estate):

不动产投资,其价值会随市场周期、经济环境和政策变化而波动。

货币(Currencies):

外汇市场中的各类货币,其价格可能因地缘政治事件、宏观经济数据和政策变化而快速波动。

风险资产的主要特征

波动性(Volatility)

风险资产价格会频繁波动,既可能带来收益,也可能造成损失。

收益与风险并存(Investment Returns)

一般而言,资产风险越高,潜在回报越高,但与此同时,发生亏损的概率也更大。

对市场环境高度敏感(Market Sensitivity)

风险资产的价值会受到多种因素影响,包括利率变化、宏观经济状况以及投资者情绪等。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。