Author: Bootly

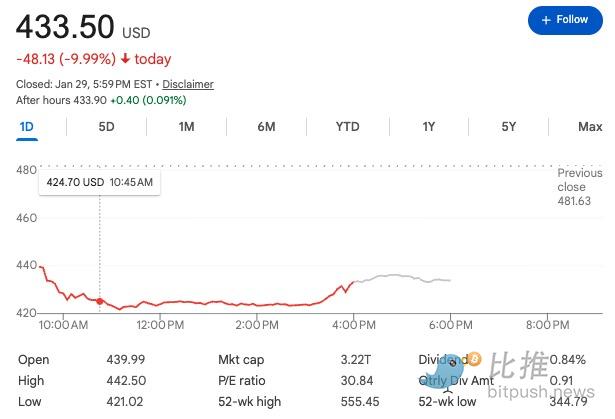

After releasing a financial report that exceeded market expectations, Microsoft faced the most severe market sell-off of the year.

On Thursday, the software giant Microsoft plummeted 7% in pre-market trading, with a single-day market value evaporating by $357 billion—an amount equivalent to the entire Coca-Cola company disappearing from the planet. Yet on the same day, Microsoft delivered an almost perfect report card: profits rose by nearly a quarter, and revenue hit an all-time high.

Profits are rising, but stock prices are crashing. Behind Wall Street's vote with their feet lies an unspoken fear: the calculations around AI are becoming increasingly alarming; has the growth story reached its end? When all the giants are crowded onto the same track, who can truly make money?

Beautiful "Facade" and Cracked "Substance"

From the first line of the financial statements, Microsoft's performance can be described as strong:

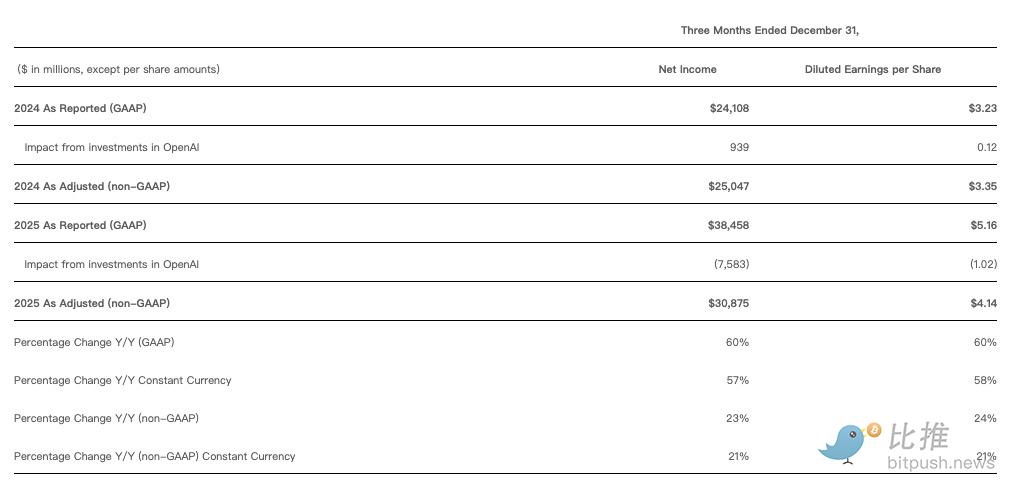

- Net Profit: Adjusted net profit grew by 23% to $30.9 billion, exceeding analysts' expectations of $28.9 billion.

- Revenue: Grew by 17% to $81.3 billion, also surpassing the expected $80.3 billion.

- Cloud Business: Quarterly revenue surpassed $50 billion for the first time.

However, the market's attention quickly shifted to two details: the growth pace of Azure and the speed of capital expenditure expansion.

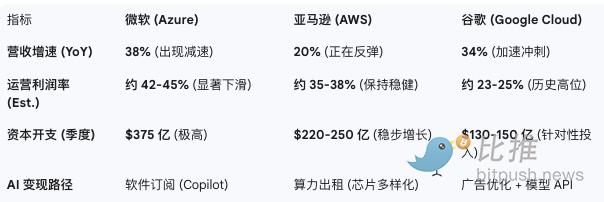

The financial report showed that Azure's year-over-year growth rate was 38%, which, while still strong, declined by one percentage point from the previous quarter's 39%.

In the context of historically high valuations, this 1% slowdown is seen as a signal of "growth peaking." Barclays analysts bluntly pointed out: "Even if the overall numbers are healthy, buy-side investors clearly want to see more."

Has Microsoft Become a "Hardware Laborer"?

In this round of AI gold rush, although Microsoft is a leader, it resembles a "high-end foundry."

Behind astronomical investments lies extremely harsh pressure from hardware premiums. According to TrendForce's latest industry report as of January 2026, HBM (High Bandwidth Memory), which is a core component of Nvidia's B200 series, is experiencing an unprecedented "capacity hijacking."

Data monitoring shows that due to Micron and SK Hynix's HBM orders being generally booked until early 2027, the average price of HBM chips has risen by about 30% in the past two quarters. For Microsoft, this is akin to a "structural extortion." To ensure Azure AI's computing power does not lag, Microsoft must accept a premium of thousands of dollars per chip.

Comparison of core data from cloud giants (Q4 2025 – Q1 2026)

What does this mean?

The hundreds of billions of dollars Microsoft invests each quarter mostly flow to upstream hardware vendors. This means that the money Microsoft earns is handed over to Nvidia for graphics cards and to Micron for memory before it even warms up on the books. Although Microsoft is also developing its own Maia chips, it still heavily relies on external procurement. The result is harsh: the gross margin of Microsoft's cloud business has fallen from over 70% to around 67%.

In contrast, competitors like Amazon AWS have reduced their dependence on expensive hardware through self-developed chips (Trainium series) laid out in earlier years, maintaining an operating profit margin of 38%. Meanwhile, although Meta is also making significant investments, its stock price surged by 10% due to AI directly enhancing advertising conversion rates, as it "saw the receipts." In comparison, Microsoft seems more like it's "working for hardware manufacturers."

This "bleeding" investment not only failed to satisfy the market's appetite but also triggered a unique computing power "internal friction" at Microsoft. Due to supply constraints, Microsoft had to face a brutal balance: should it lease the top-tier computing power to external cloud customers for immediate profit, or reserve it for its own Copilot to secure future ecosystem growth? Microsoft chose the latter. While this "sacrifice external for internal" strategy stabilized product experience, it severely diluted Azure's profitability as a pure cloud platform in the short term.

Concentration Anxiety: OpenAI's "Single Point Dependency" Crisis

In this financial report, Microsoft disclosed a shocking figure for the first time: approximately 45% of its $625 billion future cloud contract book value comes from OpenAI.

This means Microsoft's cloud growth is highly tied to a single startup. Although CFO Amy Hood emphasized that $350 billion comes from other industry clients, investors remain concerned: if OpenAI stumbles in competition or shifts to proprietary hardware in the future, Microsoft's costly system will face serious "idle risk."

Erosion of the Moat: Open Source and Low-Cost Disruption

Moreover, the strong binding with OpenAI is facing a "cost-performance revolution" disruption.

With the rise of low-cost or open-source models like China's DeepSeek, a "price war" in the AI market has begun. When enterprise customers discover that a few cents' worth of open-source models can solve 90% of their problems, Microsoft's high-priced Copilot subscription model faces challenges.

The uncertainty of this business model makes Microsoft's high price-to-earnings (P/E) ratio appear precarious. If Microsoft cannot prove that its high computing costs can translate into equally high premium revenues, the moat it has built may be quietly eroded by the open-source wave.

In the face of declining stock prices, Nadella remains steadfast. He vigorously promoted his vision of "full-stack AI" during the analyst call: "When you think about our capital expenditures, don't just think about Azure; think about Copilot. We don't want to maximize just one business; we want to allocate capacity to build the best asset portfolio."

Conclusion

Despite the market's panic sell-off, this giant is stabilizing its footing through a series of complex capital operations.

In this quarter, Microsoft disclosed an accounting gain of $7.6 billion, all thanks to its early investment in OpenAI. As OpenAI restructured from a nonprofit organization to a traditional for-profit enterprise in October, its balance sheet has ballooned dramatically with multiple rounds of massive financing. Currently, Microsoft holds a 27% stake in this AI leader. As OpenAI seeks to raise funds in a new round at a valuation exceeding $750 billion, Microsoft's initial investment of $14 billion has yielded astonishing returns on paper.

This "ecological flywheel" of stepping on the left foot with the right foot is becoming increasingly complex: competitor Anthropic has just committed to purchasing $30 billion worth of Azure computing power in the future, and Microsoft plans to inject $5 billion into it. In this potential deal, the startup's valuation has been pushed up to $350 billion.

In summary, the $357 billion market value evaporated from Microsoft is a correction by the market regarding its "heavy capital, slow monetization" model. Although the paper gains from investments are extremely rich, what Wall Street truly cares about is not how much valuation premium Microsoft has earned as a "venture capital institution," but whether its core cloud business can genuinely recoup real money from global enterprises amid the erosion of hardware costs.

At this moment, the AI industry resembles a high-speed train: once the infrastructure is laid, it is hard to stop, and whether it can gradually achieve a commercial closed loop while maintaining speed will determine the market pricing logic in the next phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。