该推出于1月28日上线,通过与受商品期货交易委员会监管的预测市场运营商Kalshi的合作,将基于事件的交易直接整合到Coinbase应用中。Coinbase表示,此举扩展了其成为多资产金融平台的雄心,而不仅仅是一个加密货币交易所。

预测市场允许用户买卖与特定结果相关的“是”或“否”合约,价格反映市场的隐含概率。例如,价格为65美分的合约表明交易者认为该事件发生的概率大约为65%。

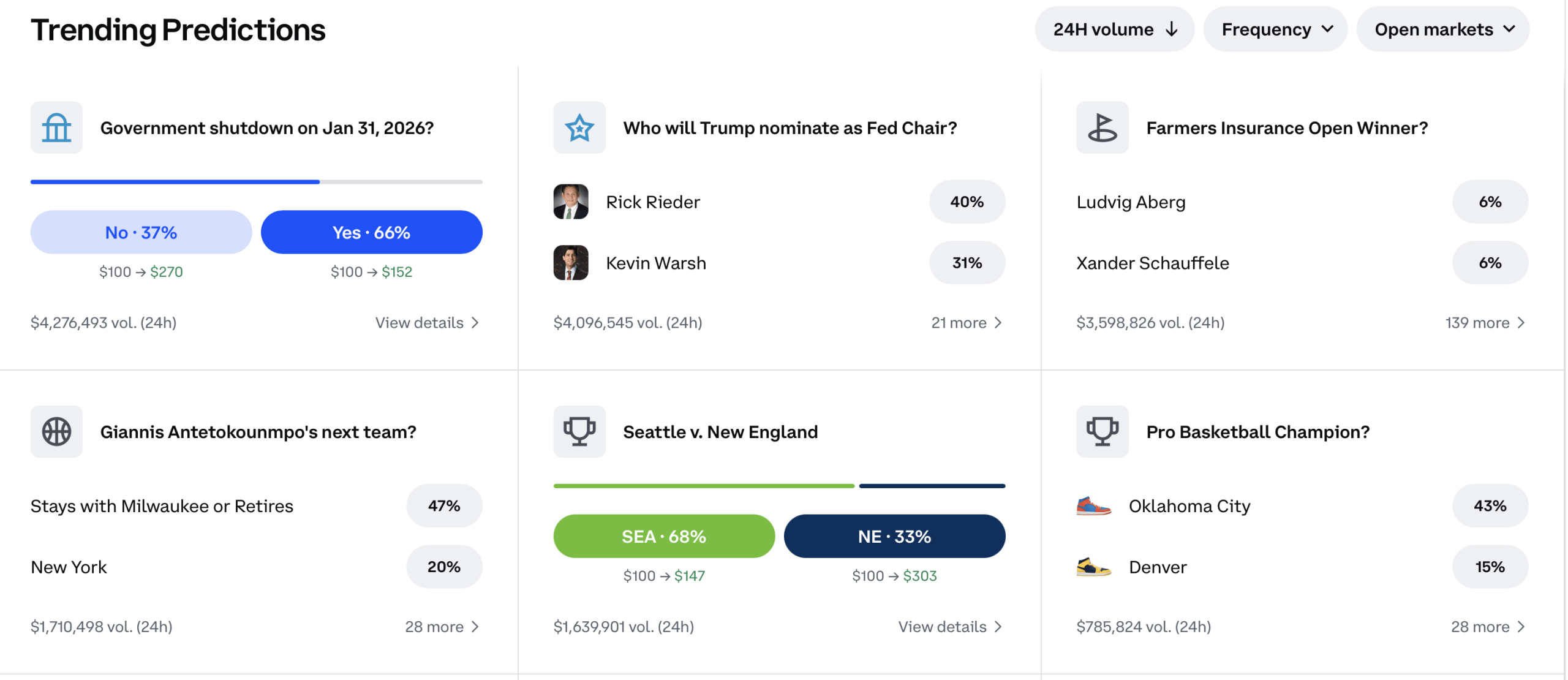

在推出时,Coinbase用户可以访问涵盖加密货币、政治、体育、经济、文化、天气和娱乐等领域的数十个活跃市场。Bitcoin.com分析了42个不同的开放市场,范围从每日比特币价格阈值到网球比赛、大学篮球比赛、政府停摆的概率,甚至是纽约市的降雪总量。

2026年1月29日的Coinbase预测市场。

仅在这42个市场中,24小时的交易总量约为1830万美元。各个市场的每日交易量通常在18万美元到420万美元之间,政治和宏观经济合约的活动最为频繁。

与加密货币相关的合约仍然是最受关注的。每日比特币价格市场询问比特币是否会在特定时间(如东部时间下午5点)交易超过特定阈值——例如$85,750或$86,250——每个市场的24小时交易量均超过28万美元到36万美元,突显了交易者对短期定位的需求。

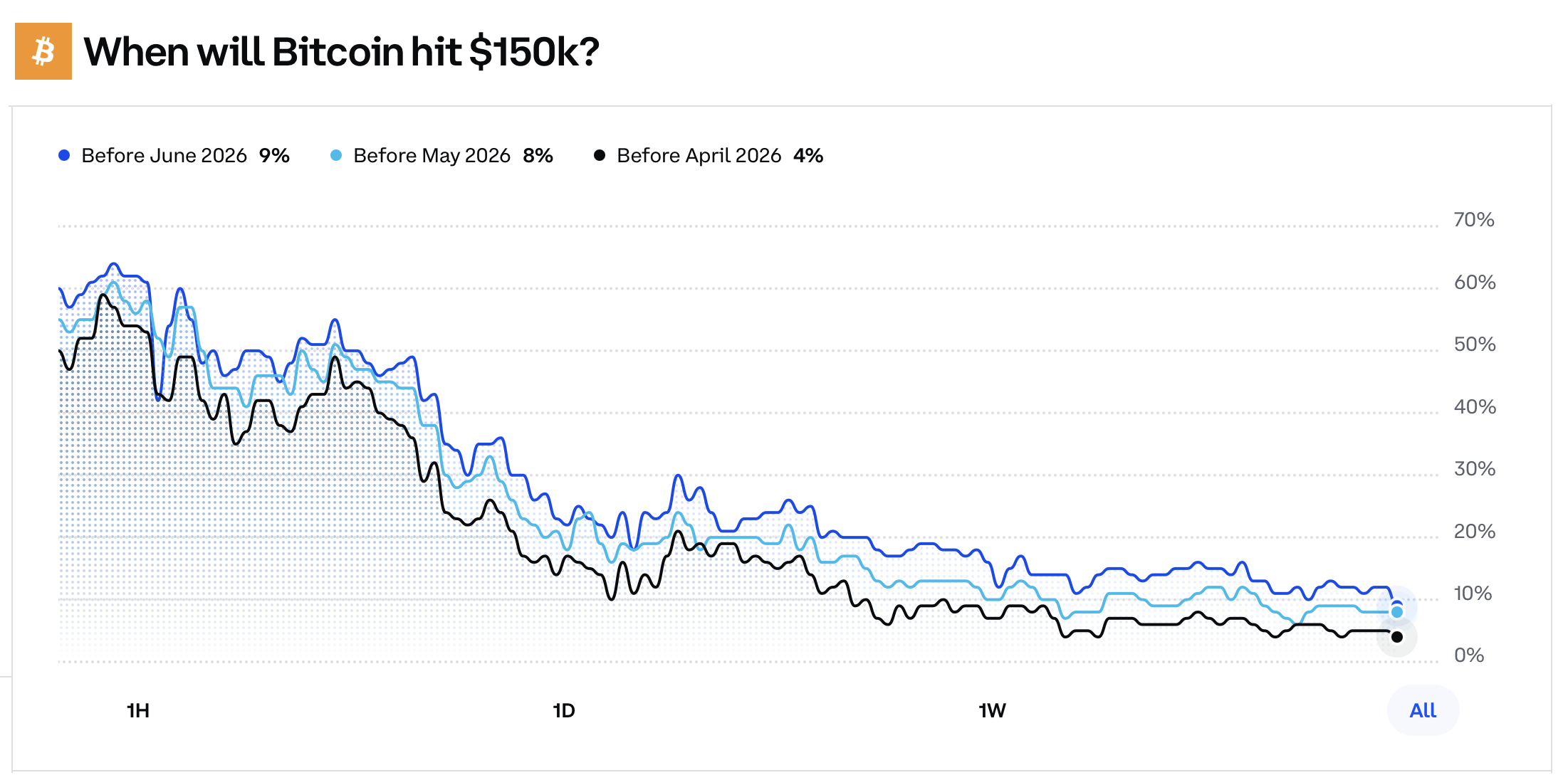

一个引起关注的长期加密市场提出了一个更简单但更重要的问题:比特币何时会达到$150,000? 该旗舰合约的结算基于CF Benchmarks的比特币实时指数,判断比特币是否在2026年5月31日之前交易超过$149,999.99。交易者目前对该结果赋予了大约11%的隐含概率,表明对比特币在接下来的四个月内达到$150,000的怀疑。

2026年1月29日的“比特币何时会达到$150,000?”合约。

仅该市场就吸引了近930万美元的未平仓合约,最近的每日交易量约为178,000美元,表明参与稳定而没有投机过剩。短期变体显示出更低的隐含概率,进一步强化了$150,000仍然是一个超出目标而非2026年初的基本预期的观点。

在加密货币之外,政治和宏观市场也获得了关注。涵盖美联储政策决策、新任美联储主席宣布时机以及美国政府停摆概率的合约,每个市场的每日交易量均吸引了数十万到数百万美元。体育市场——从职业足球和篮球锦标赛到网球比赛——丰富了产品线并提供了持续的流动性。

另请阅读: Metaplanet筹集1.37亿美元以继续收购比特币

Coinbase高管将预测市场描述为价格发现的工具,而非娱乐,认为金融激励比民意调查更能提供清晰的信号。该平台在Kalshi和Coinbase金融市场的联邦监管下运营,使其与离岸或未受监管的竞争对手区分开来。

更广泛的含义是显而易见的:Coinbase正在将预测市场定位为主流金融产品,而不是小众好奇心。无论交易者是在定价美联储的下一步行动、比特币的长期上限,还是今晚比赛的结果,该交易所都在押注市场,而不是评论员,将越来越多地塑造预期的形成方式。

- 什么是Coinbase预测市场?它们是受监管的基于事件的合约,让用户交易与现实世界事件相关的“是”或“否”结果。

- Coinbase的预测平台在全国范围内合法吗?是的,这些市场通过Kalshi的CFTC监管框架在所有50个州运营。

- 比特币在2026年5月之前达到$150,000的概率是多少?交易者目前对比特币在2026年5月31日之前交易超过$149,999.99的隐含概率约为11%。

- 目前已经发生了多少交易活动?可见市场的24小时交易总量约为1830万美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。