Written by: DaiDai, MaiDian

When you were in elementary school, you must have encountered math problems like this: a swimming pool where the water pipe above is desperately filling it up, while the drain below is wide open, letting water out. When will the pool be full/empty?

Did you ever find this problem logically absurd? Interestingly, Microsoft's latest Q2 2026 financial report showcases this simple yet real capital game: on one side, there is $625 billion in RPO (Remaining Performance Obligations, locking future orders into a "safe"), and on the other side, there is $37.5 billion in CapEx this quarter (real money being poured into data centers and GPUs).

However, upon calm reflection, while the $625 billion in RPO demonstrates a terrifying potential for inflow, it is constrained by factors like the construction cycle of data centers, leading to delays in revenue recognition; meanwhile, the $37.5 billion in CapEx this quarter is a tangible outflow, resulting in a rather "counterintuitive" scene: despite beating earnings expectations and providing solid guidance, the stock price fell by about 6% in after-hours trading.

On the surface, Azure's growth rate of 39% and RPO doubling year-on-year to $625 billion seem very stable from the demand side; however, what truly concerns the market is that Microsoft is ramping up capacity at an almost "arms race" pace—this quarter's CapEx of $37.5 billion is up 66% year-on-year, and management is emphasizing that "demand exceeds supply."

Ultimately, the reason Wall Street chose to sell off despite the double beat in earnings is rooted in anxiety over the "water level" of this problem: if the inflow speed (revenue conversion) cannot cover the outflow speed (depreciation and expenses) in the short term, even if the pool is large, the buoyancy of valuation will decline.

### I. Performance Overview: "Top Growth" vs "Top Investment," Why is Wall Street in a Panic?

A key premise is that Microsoft is completing its transformation from a "software giant" to an "AI infrastructure powerhouse."

If we translate Nadella's statement during the conference call that "the scale of our AI business has surpassed some of our largest franchise businesses" into investor language, it becomes very straightforward: AI is no longer just a nice addition; it has usurped its position as the new main engine of growth and expenditure.

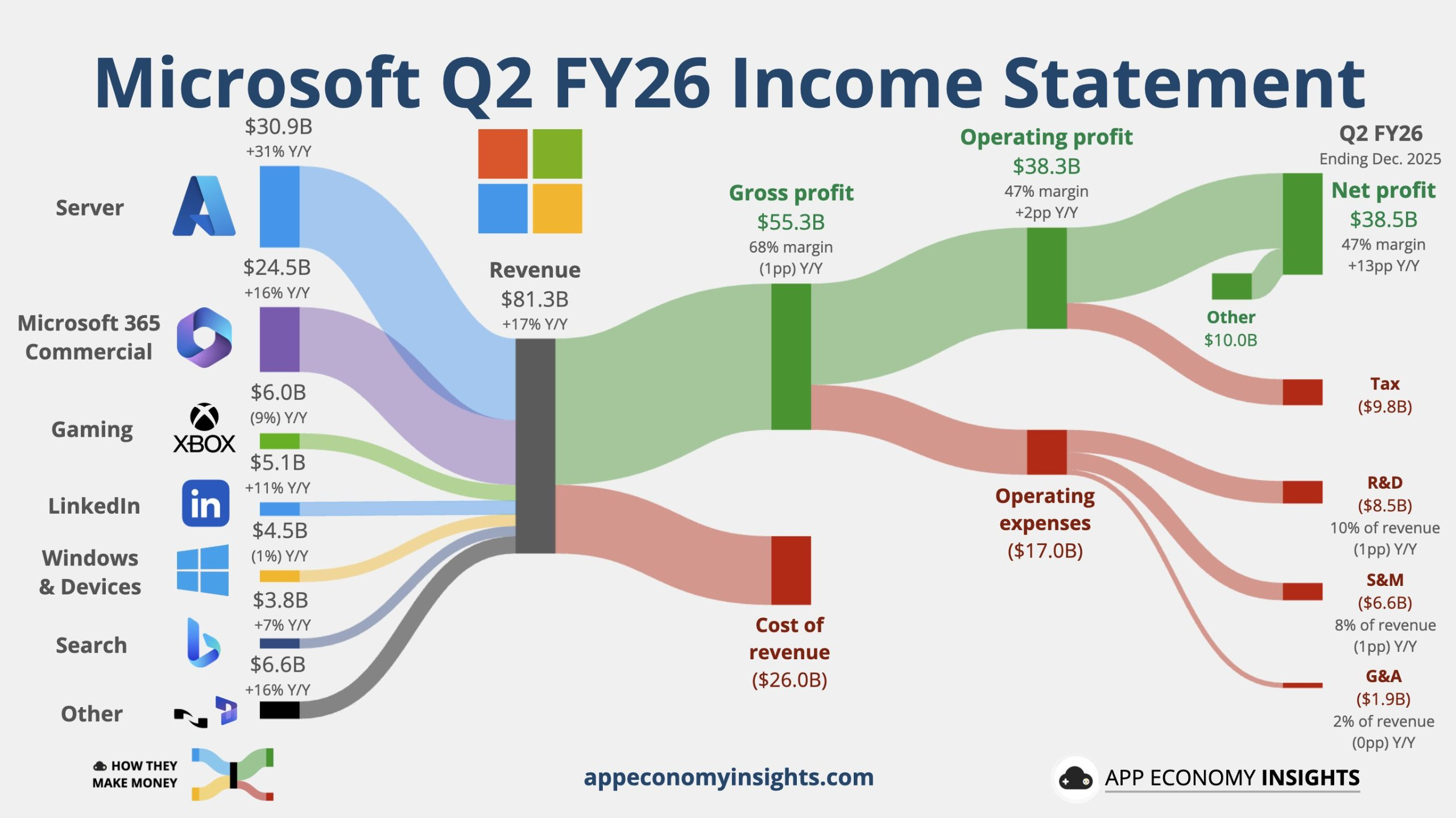

First, looking at the core financial data, Q2 revenue was $81.3 billion, a 17% year-on-year increase, exceeding analyst expectations of $80.31 billion; operating profit was $38.3 billion, a 21% year-on-year increase, also above analyst expectations; net profit according to GAAP was $38.5 billion, a 60% year-on-year increase, while on a non-GAAP basis, it was $30.9 billion, a 23% year-on-year increase (21% year-on-year increase at constant exchange rates).

Earnings per share (EPS) according to GAAP: diluted EPS was $5.16, a 60% year-on-year increase, exceeding analyst expectations of $3.92; on a non-GAAP basis: diluted EPS was $4.14, a 24% year-on-year increase (21% year-on-year increase at constant exchange rates); capital expenditures (CapEx) reached $37.5 billion, a 66% year-on-year increase, setting a record and also exceeding analyst expectations of $36.2 billion.

Source: ECONOMY INSIGHTS

Interestingly, Microsoft has introduced some "new elements" this time: Reuters mentioned that the company disclosed the core usage metrics of M365 Copilot for the first time, with CEO Nadella stating that there are currently 15 million annual users of M365 Copilot, which pushes the narrative that "AI is not just a concept; it is a paid product" forward.

It was precisely because the company's disclosed infrastructure spending exceeded expectations (including data center construction), while sales performance related to the gaming business fell short of expectations, that Microsoft's stock price dropped about 6% in after-hours trading.

MSFT Stock Chart

This after-hours drop feels more like the market is grappling with a question: "Growth is strong, but how much did it cost?"

The market is now focused not just on revenue, but on "the cost of generating revenue." Management repeatedly emphasizes that "it's not a lack of demand, but a supply shortage," which is why this quarter's CapEx surged to $37.5 billion, a staggering 66% year-on-year increase, with hints that it will rise further next quarter.

A subtle point: Azure's 39% growth is not bad, but in the context of "AI myth valuations," it may only be considered "just enough." Barron’s perspective is typical—while they beat expectations, Azure's growth rate slightly declined compared to the previous quarter (40%), and the company provided cautious guidance for the next quarter, which may lead traders who have already priced in optimistic expectations to pull back. The market is spooked by this cash-burning pace, fearing that before capacity is released, profit margins will be eroded by depreciation, leading to a severe mismatch in ROI.

Data center expansion has become a physical bottleneck constraining Azure's growth.

### II. B-Side Dominance, C-Side Mediocrity, Every Step of Growth Treads on "Expensive Ground"

Microsoft's current structure is highly fragmented: the B-side is extraordinarily strong, while the C-side is lackluster. This is not coincidental, but rather an inevitable resource tilt in the AI era—B-side opportunities are greater, but the costs are also higher.

1. $625 Billion RPO: Is it a "Safe" for Performance or a "Stress Test" for Delivery?

The commercial RPO has doubled year-on-year to $625 billion, which for a company of Microsoft's size, is almost a vote of confidence from enterprise customers: AI and cloud budgets are no longer "pilot projects," but have entered a longer-term binding cycle. Correspondingly, Microsoft's business model is also changing—from one-time software revenue to a more continuous consumption-based revenue model akin to "computing power, utilities": the more load, the deeper the calls, the stronger the revenue stickiness.

However, the significance of this "locked order" is shifting from "growth certainty" to another perspective: RPO provides visibility into future revenue, but does not equate to certainty of current cash flow. The longer the contracts are signed, the longer the fulfillment chain becomes: supply of computing power, delivery rhythm, customer onboarding speed, and backend costs (depreciation/energy/chips) will all determine whether it ultimately serves as a "moat" or a "burden."

In other words, this anchor of RPO can prove demand, but cannot replace a more realistic question: with so many orders, can Microsoft timely ramp up capacity, convert contracts into recognizable revenue, and ensure profit margins are not consumed?

2. Three "Tightening Spells" Behind Growth

(1) Capacity as the Ceiling: Supply Shortage is Good News, but "Delivery Delays" are Hard Costs

Microsoft's Chairman and CEO Satya Nadella stated: "We are still in the early stages of AI diffusion, but Microsoft has built an AI business that exceeds some of our largest traditional businesses. We are continuously pushing the frontier of innovation across the entire AI technology stack to create new value for customers and partners."

Despite this, management still acknowledges that there are delays in order fulfillment, which may sound like a short-term issue, but in the long run signifies two things: first, revenue recognition is delayed, and second, competitors have a window to catch up. The construction cycle of data centers + GPU supply represents typical physical world constraints—no matter how strong the demand, it must first pass through the "powering up, racking, and going live" stages.

This is also why the market juxtaposes "strong demand" with "falling stock prices": when capacity becomes a bottleneck, the growth logic shifts from the "demand side" to the "supply side," and filling the supply side often means higher capital expenditures and heavier depreciation burdens.

Nadella, CEO of Microsoft. Image source: jason redmond/AFP/Getty Images

(2) Lack of Hedging on the C-Side: B-Side Carries the Flag, C-Side Struggles to Act as a Buffer

This quarter's structural differentiation is sharper: the B-side is driven by Azure/AI, while the C-side remains relatively flat—Xbox content revenue down 5%, Windows OEM only up 1%. This means that once the B-side's fulfillment rhythm slows down (even if just delayed), the company can hardly rely on the C-side to "hold the fort," and market sensitivity to a single main line will significantly increase.

To put it bluntly: as Microsoft increasingly resembles an "AI cloud infrastructure company," the volatility of its valuation will also increasingly resemble that of infrastructure stocks—looking at utilization, delivery, and capital expenditure return cycles, rather than just focusing on a single quarter's beat.

(3) Efficiency Audits Begin: It's Not That You Can't Burn Cash, But the Market Wants to See "Echoes"

This quarter's CapEx increased by 66% year-on-year, but Azure's growth rate was only slightly above guidance (you mentioned it was high by 2 percentage points). This is the core of the "counterintuitive" movement in after-hours trading: the market is not denying growth, but is re-pricing the speed of ROI realization.

The implicit questions in the current market are very realistic:

- How many more "375 billion" must be spent to maintain nearly 40% growth?

- Will this money lead to a sequence of "capacity release → revenue acceleration → profit recovery," or will it result in a mismatch of "depreciation first → profit pressure first → delayed realization"?

- Within this framework, Microsoft's valuation narrative is also changing: if high-intensity investment stretches over more quarters, it becomes harder for Microsoft to explain itself using the "light asset software company" logic, and instead aligns more closely with "heavy capital, long payback period" infrastructure pricing—growth is still valuable, but the discount rate will be higher.

### III. Ripping Off OpenAI's "76 Billion Paper Wealth," Four Key "Life and Death Indicators"

1. Excluding the $76 Billion Net Profit Noise: Is it "Accounting Revaluation" or "Operational Realization"?

This quarter, the jump in net profit according to GAAP is most prominently driven not by core business, but by net gains from the investment in OpenAI. Microsoft itself stated in the financial report that the net gains from the OpenAI investment increased net profit by approximately $7.6 billion and EPS by $1.02.

The issue is that this feels more like a "revaluation of accounting standards" rather than "products selling better." The media explains it more straightforwardly: a restructuring/recapitalization of OpenAI last year triggered Microsoft to recognize a one-time accounting gain under GAAP (GeekWire reported it as approximately $10 billion in accounting gains, about $7.6 billion after tax). This will inflate the GAAP profit figures but does not equate to a proportional improvement in operating cash flow.

2. Cutting Through the Noise: Four Key "Validation Lines" to Reconstruct Market Expectations

(1) Azure Growth Rate: Is it "Supply-Restricted," or is Demand Starting to Dull?

This quarter, Azure grew by 39% year-on-year (38% at constant exchange rates), which is a typical situation of "the numbers are good, but expectations are higher."

The key point is that the market is using the phrase "supply-restricted" to give Microsoft some leeway—meaning that sales are strong, but delivery is slow. Once you hear management repeatedly emphasize "supply constraints/capacity bottlenecks," any slowdown in growth will be more easily interpreted as "demand cooling off."

(2) $37.5 Billion Arms Race: Is it "Buying Out the Future," or "Overdrawing the Profit and Loss Statement"?

This quarter, CapEx reached $37.5 billion (up 66% year-on-year), with about two-thirds directed towards chips/computing hardware, even exceeding Visible Alpha's consensus estimate of $34.31 billion.

This is the core of the "counterintuitive" sell-off in after-hours trading: the market is not denying growth but is asking—your growth is strong, but is it "too expensive"?

Management stated that CapEx will slightly decrease next quarter, but more importantly, "will the release of capacity lead to a surge in revenue/order fulfillment?" Reuters also mentioned that the CFO indicated that memory chip costs would pressure cloud profit margins—this means the market will consider the "cost curve" as an equally important variable to track. Burning cash is not scary; what is scary is burning it for too long with weak returns.

(3) RPO Reservoir: How Solid is the $625 Billion?

Commercial RPO reached $625 billion, up 110% year-on-year, making it one of Microsoft's strongest foundational indicators: it proves that enterprise customers are willing to sign longer contracts and bind budgets to Microsoft.

Microsoft expects that the amount of customer commitments that will convert into actual sales in the coming years will more than double compared to the same period last year, primarily due to a new agreement with OpenAI worth $250 billion. Microsoft stated that its cloud business's backlog has more than doubled year-on-year to $625 billion. This scale surpasses Oracle's $523 billion announced in December. However, about 45% of the remaining performance obligations are contributed solely by OpenAI, highlighting Microsoft's high dependence on this startup. OpenAI previously committed to a total investment of approximately $1.4 trillion in the AI field but has not disclosed specific financing plans.

However, the market's interpretation of RPO this time is more "nuanced"—because about 45% of the RPO increase is believed to be driven by OpenAI. This shifts the narrative from "strong order locking ability" to another question: how much of your certainty comes from a single mega-client/single partner?

(4) OpenAI Monetization: Don't Listen to Valuation Stories, Listen to the "Incoming" Sounds

This quarter's $7.6 billion led many to mistakenly believe that "OpenAI contributes significantly to profits." But what truly needs to be tracked is whether it can continuously bring scalable commercial revenue and its impact on Microsoft's profit margins in terms of costs/revenue sharing—this will determine whether it is a "great teammate" or a "cash cow."

Valuation re-evaluation is a story; cash flow realization is the bill.

In Conclusion

Returning to that simplest and most brutal math problem: when both the inflow and outflow are turned up higher, whether the water level rises depends on which side slows down first.

From this financial report, Microsoft has clearly proven one thing—there is no issue on the inflow side, as the $625 billion in remaining performance obligations means that enterprise customers have already locked in their AI-related budgets for the coming years, and the certainty of demand is being continuously brought forward.

However, on the other side, the outflow remains wide open; the $37.5 billion in quarterly capital expenditure will not disappear immediately. It will continue to test the patience of the profit and loss statement through upcoming depreciation, energy, and delivery costs, which is why the market chose to hesitate after the double beat.

Microsoft still stands in the most advantageous position; as long as in the next few quarters, the inflow starts to outpace the outflow, that moment will make the change in water level self-explanatory.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。