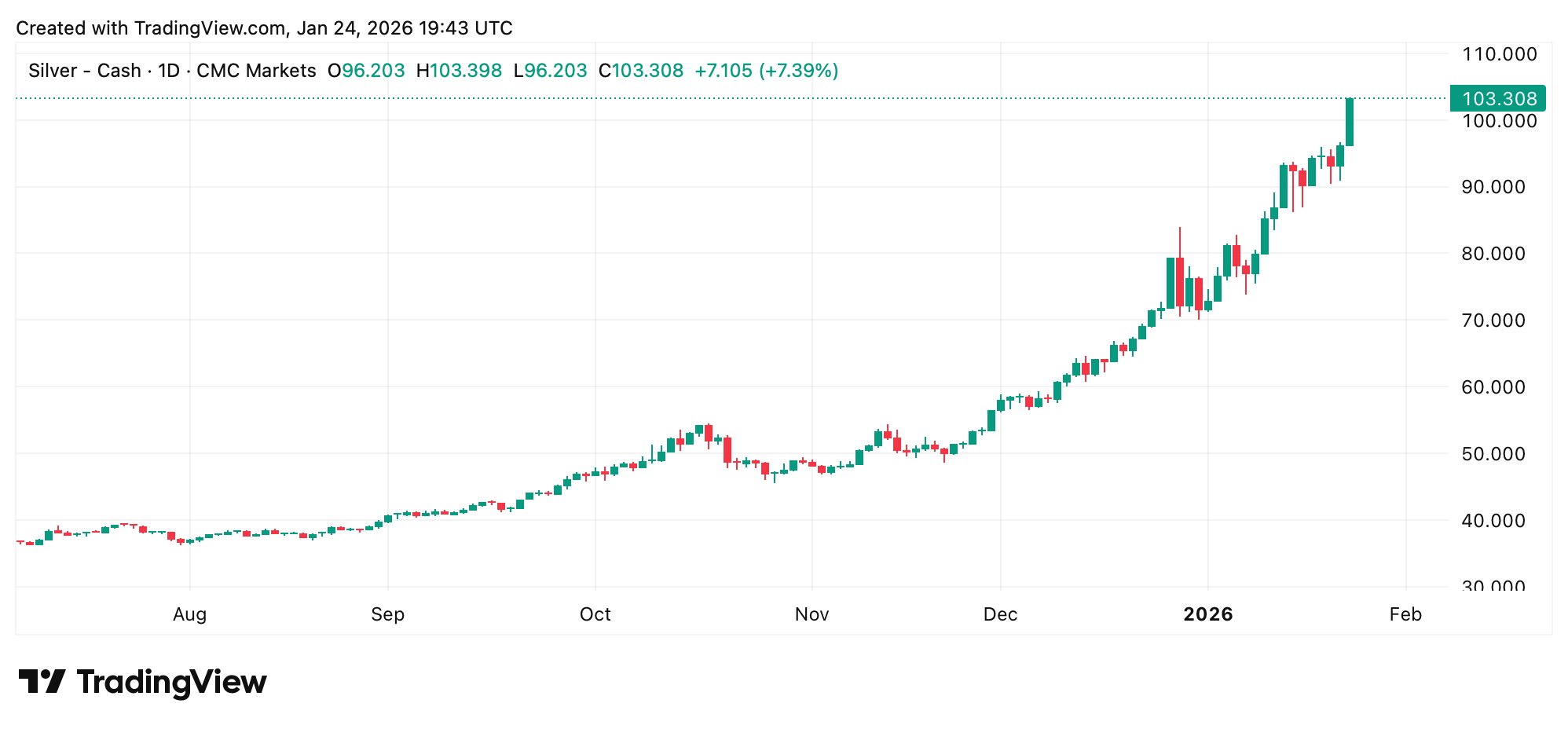

The price of one ounce of fine silver has climbed sharply in value, and the so-called “poor man’s gold” has stirred notable interest across financial markets alongside its yellow cousin. As of Saturday, Jan. 24, 2026, an ounce of .999 silver is priced at $103.30, marking its move into triple-digit territory for the first time on record.

On Friday, the X account Stoic Trader told his 46,900 followers he was struggling to offload silver holdings. “I’m sitting on 1,000 ounces of silver bars,” Stoic Trader wrote. “Bought physical, did what everyone says to do … tried to sell some last week, trying to sell it today—refineries won’t touch it, dealers lowballing 30% under spot, [and] banks look at me like I’m selling contraband.”

Silver spot prices on Jan. 24, 2026.

The post sparked a noisy backlash across social media, with one user dismissing it outright as nonsense. “That example was the biggest crap I’ve seen on X today,” the X user Stock Guru Trades shot back at Stoic Trader. “Any gold / silver shop will buy all of your silver for 96% of spot. 30% under spot? What a joke.” Stoic Trader, however, pushed back and said he would offer “5% of the sale if you can find me someone who is buying at that price.”

Stock Guru Trades’ reply on X drew about 1,400 likes, while Stoic Trader’s original post had accumulated roughly 6,000 likes by 2 p.m. Eastern time on Saturday. To test the accuracy of Stoic Trader’s claims, we contacted local precious-metals shops in four U.S. states: Massachusetts, Florida, Texas, and Connecticut. What we found was consistent across the board: every dealer was willing to buy silver, though many emphasized a clear preference for U.S.-minted Eagles, full tubes of 20 Eagles, and larger quantities rather than smaller, piecemeal sales.

On the left is a one-ounce American Eagle issued by the U.S. Mint, while the one on the right is a generic buffalo coin issued by a private mint. The one on the right is considered generic and may see a discount compared to the Eagle, depending on the dealer. American Silver Eagles benefit from U.S. government backing, instant global recognition, and easier resale.

One Florida dealer said the shop had effectively frozen purchases of bars and generic silver, limiting buying to U.S. Treasury-minted Eagles. American Silver Eagles benefit from U.S. government backing, immediate global recognition, and smoother resale even during periods of tight liquidity, sometimes earning premiums. We contacted three shops in Florida, and each favored Eagles or tubes of Eagles, with only one willing to buy generic silver at $90 an ounce, representing a 12.9% discount to the prevailing spot price.

That same dealer said it would pay $95 for one-ounce Silver Eagles, an 8.04% reduction from spot. All three Florida shops had no hesitation buying Eagles, though offers ranged from 8.04% to 12.9% below the $103 level. Dealers in Texas paid slightly less, as two shops quoted $85 to $87 per Eagle, translating to a 15.8% to 17.7% reduction versus spot. Two shops in Massachusetts were also contacted and said they would pay roughly 90% to 92% of spot, exclusively for Eagles.

Three Connecticut dealers quoted similar ranges to those in Massachusetts, with bullion buyers generally willing to pay about 90% to 92% of spot. Those Connecticut shops likewise stressed a preference for Eagles and larger- volume transactions. We did not contact refineries or banks, as traditional coin, jewelry, and pawn shops were all prepared to buy silver, and the idea of bringing bullion to a bank is an odd move. Based on our findings, Stoic Trader’s X post appears to lean a bit on hyperbole.

A holding of 1,000 ounces represents meaningful volume and would not, by itself, be a hurdle for any of the dealers we spoke with, though Stoic Trader did not specify whether his silver consisted of Eagles. Had the position been entirely generic silver, a discounted offer is plausible, but a 30% haircut seems a bit excessive.

Across all our calls, we found no bids below an 8% discount to spot, with Texas shops offering notably lower prices than those in the other three states. Taken together, the results suggest that sellers of physical silver should expect offers at least 8% below spot, with the exact discount varying by dealer and product type.

Also read: Stablecoin Market Loses $3.3 Billion a Week After Record High

In the end, the episode highlights the gap between claims and real-world liquidity. Physical silver remains sellable, but not frictionless, with pricing shaped by form, volume, and dealer appetite. Eagles command clearer bids, generics face steeper cuts and the greater possibility of testing for fake metals, and geography matters. For sellers, the takeaway is simple: expect discounts, shop around, and treat social media anecdotes with a grain of salt before acting in fast-moving precious metals markets today.

- Why are silver dealers paying below spot prices?

Dealers factor in resale risk, product type, and liquidity, which often results in offers below spot. - Are American Silver Eagles easier to sell than generic silver?

Yes, Eagles carry government backing and global recognition, making them more liquid for dealers. - What discount should sellers expect when selling physical silver?

Most dealers currently offer prices about 8% or more below spot, depending on the product and location. - Does location affect silver buyback prices?

Yes, dealer demand and regional market conditions can influence how much sellers are offered.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。