The crypto-linked credit card in Argentina is evolving with a pioneering launch.

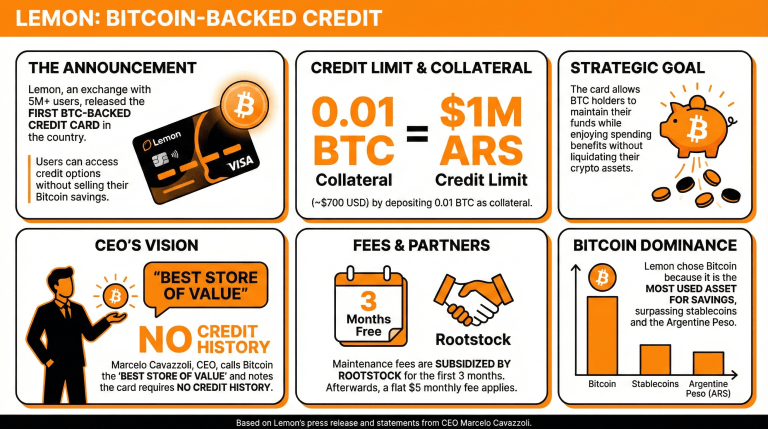

Lemon, a local exchange with over 5 million users, has announced its entry into the crypto credit market, releasing a bitcoin-backed card that will allow users to access credit options without selling their BTC.

In a press release, the exchange claimed that this would be the first BTC-backed credit card release in the country, allowing users to spend up to 1 million Argentine pesos (nearly $700) by depositing 0.01 BTC as collateral.

In a second phase, users will be able to set collateral and spending limit figures, making the card a more versatile savings and spending tool.

The objective of this Visa-issued card is to expand the options for BTC holders who want to maintain their funds and still enjoy benefits without spending their crypto savings.

Marcelo Cavazzoli, CEO of Lemon, reinforced the relevance of this initiative in a fiat-led financial system. He stated:

We created a simple way to access credit in pesos with Bitcoin as collateral, without the need for a credit history. Bitcoin is the best store of value ever created in the history of mankind and the fundamental building block for the new digital economy.”

Maintenance fees will be subsidized by Rootstock, a protocol that facilitates building apps on top of Bitcoin, during the first three months. After this, a monthly flat maintenance fee of $5 will be charged.

According to Lemon, Bitcoin is by far the most used digital asset for savings, surpassing even stablecoins and the Argentine peso. This is the reason for using bitcoin instead of another asset, opening this opportunity for most of its users.

Read more: Crypto Investments Get Red Hot in Argentina: Lemon Raises $20M to Bankroll Latam Expansion

What recent innovation has Lemon introduced in Argentina’s credit market? Lemon has launched Argentina’s first bitcoin-backed credit card, allowing users to access credit without selling their BTC.

How does the bitcoin-backed credit card work? Users can spend up to 1 million Argentine pesos (about $700) by depositing 0.01 BTC as collateral.

What are the future features of the card? In a later phase, users will be able to customize backup options and spending limits, enhancing functionality.

How does this initiative affect Bitcoin’s usage in Argentina? Lemon’s CEO stated that Bitcoin is the most popular digital asset for savings in Argentina, promoting this card as a key financial tool in a fiat-driven economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。