Original | Odaily Planet Daily (@OdailyChina)

On the evening of January 14, the official Solana account unexpectedly posted a mockery of Starknet, stating that it had "only 8 daily active users and 10 daily transactions, yet supports a circulating market value of 1 billion dollars and a maximum valuation of 15 billion dollars," bluntly suggesting that Starknet should go to zero.

An hour after the post, the official Starknet account quickly responded with an image of an ugly gorilla, retorting, "Who told this little brother Solana these data?" StarkWare's CEO even resorted to personal attacks, commenting under Eli Ben-Sasson's mocking post, "Solana has 8 marketing interns (all bald), posting 10 tweets a day." Solana co-founder Toly also posted, "This post has received a great response; the responsible marketing personnel should be promoted."

As tensions escalated between the two parties, some individuals in the crypto community began to mediate. He Yi posted saying, "Take a deep breath and relax, we are all friends, let's value harmony," but accompanied it with the caption "peanuts, sunflower seeds, mineral water," indicating a spectator's attitude. The Near official posted that Solana and Starknet should become friends again.

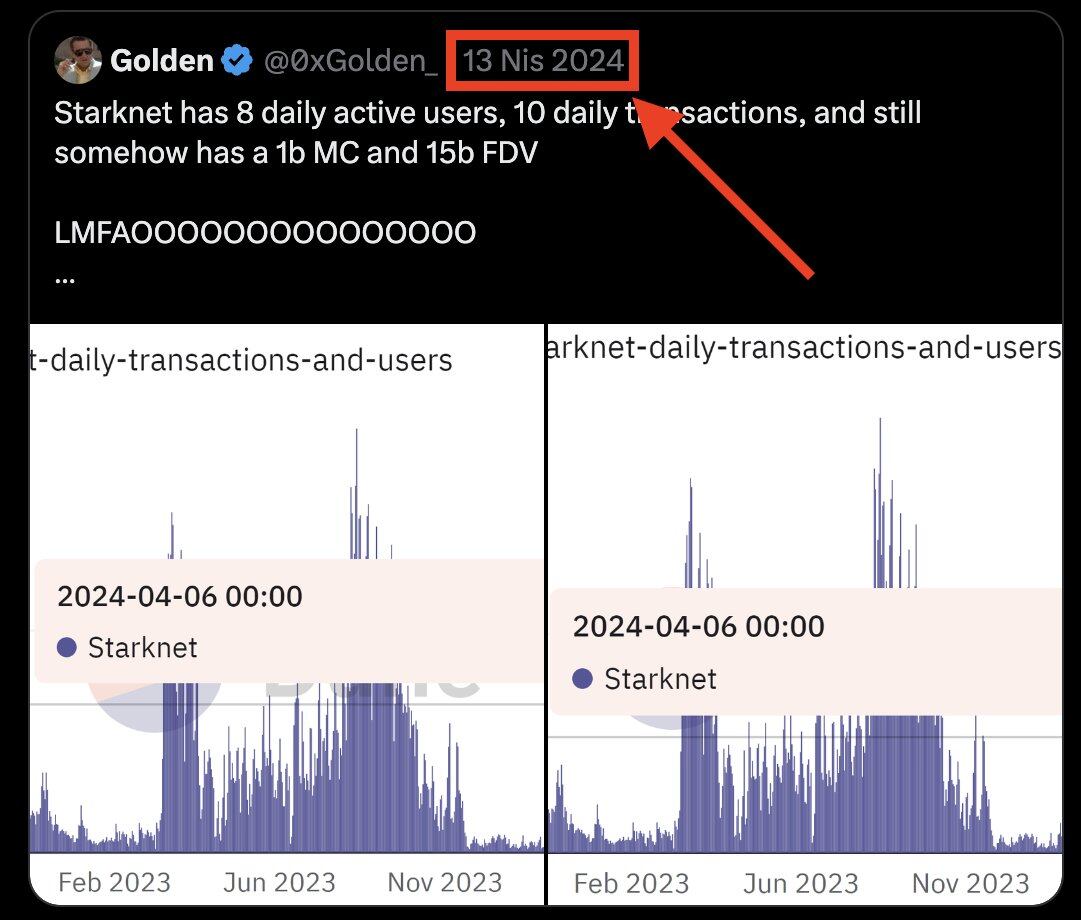

However, some opinions suggest that this was a deliberately orchestrated traffic exposure event by the officials to warm up for future cooperation between the two parties. Additionally, some netizens pointed out that Solana's post was not original, as a user had posted an identical tweet back in April 2024.

Solana's mocking tweet of Starknet copied a user's tweet from 2024.

Regardless of the true reason behind Solana's editor's "sudden illness" in mocking Starknet, from a data perspective, Starknet is no longer the "ghost town on the chain" it once was.

A Thunder in Silence

In 2024, the competition in the L2 market is fierce, with a strong leader effect. Arbitrum and OP mainnet have already covered a large number of commonly used scenarios, so after Starknet's airdrop ended, users significantly dropped off, indeed becoming the target of criticism and mockery.

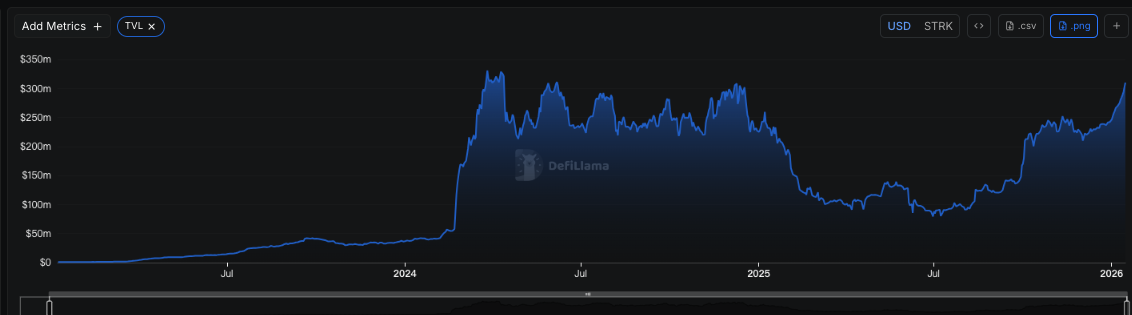

However, after more than a year of perseverance, Starknet is now able to compete with most L1s. According to DeFiLlama data, Starknet's TVL began to rebound in September 2025, currently exceeding 300 million dollars, returning to the levels of 2024. It ranks 22nd in blockchain rankings, surpassing many L1s and L2s such as Monad, Scroll, Linea, and Sei.

At the same time, its stablecoin market value, fee income, and ecological DEX trading volume have also started to rebound since September 2025. Starknet's daily fee income over the past four months has remained in the range of 5,000 to 10,000 dollars. Although it cannot compare to the daily fee income of 2023-2024 (averaging over 150,000 dollars per day), it still ranks among the top in many blockchains.

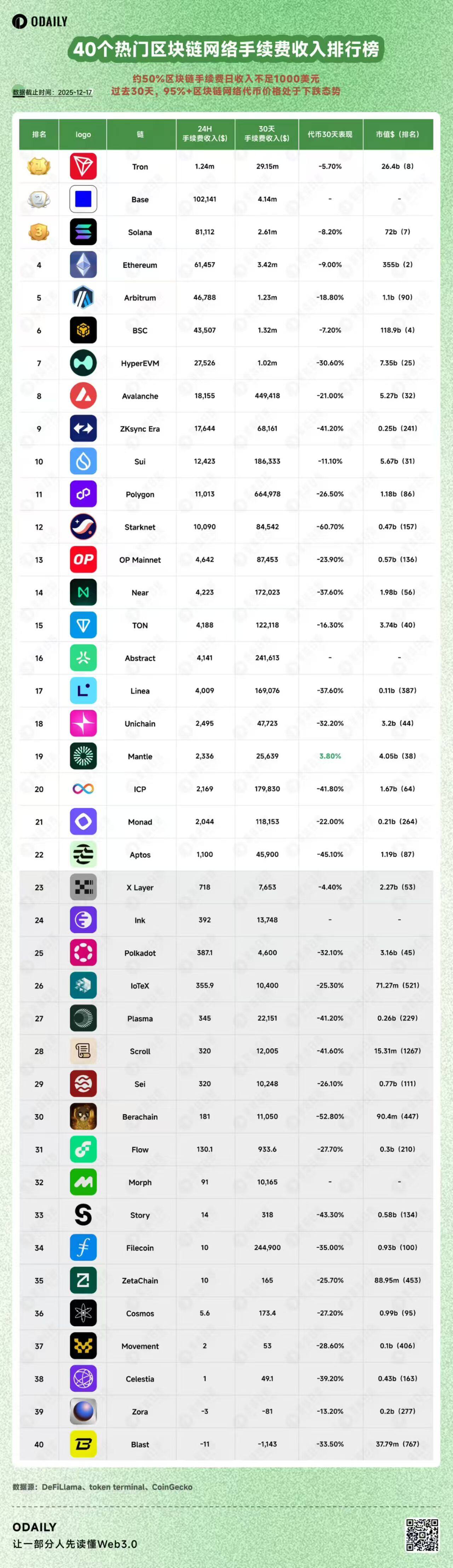

Odaily Planet Daily reported in mid-December that Starknet ranked among the top 15 in daily fee income among 40 mainstream blockchains, surpassing Monad, TON, and others.

In terms of on-chain activity, Starknet has finally cultivated a group of truly loyal users (rather than just pure profit-seekers). According to the Dune data dashboard created by the Starknet Foundation, Starknet currently maintains daily active users between 2,000 and 4,000 (unique addresses), with daily transaction counts exceeding 240,000.

Compared to Starknet's peak daily active users of over 100,000 (in 2023), its current daily active users are indeed still insignificant. However, in terms of transaction counts, the frequency of transactions from these addresses, which are less than 2% of the previous year's, has reached about 1/3 of the level from that year (with daily transaction counts exceeding 600,000 in 2023). This data indicates that the users currently remaining on Starknet are high-quality users with genuine trading needs, contributing most of the network's fee income.

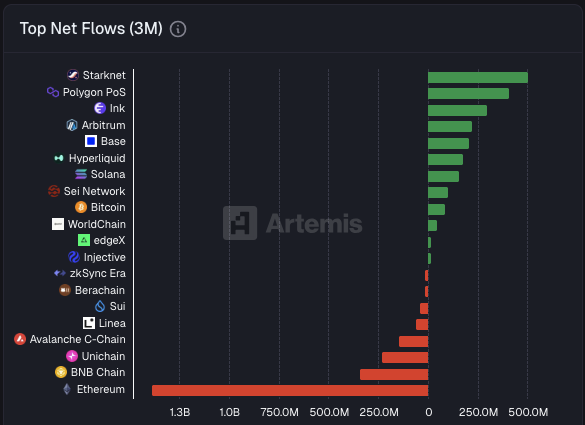

Do not simply view Starknet as a gathering place for "niche enthusiasts" in the blockchain; in fact, Starknet has gained external funding favor and has a high retention rate. According to Artemis data, Starknet's net capital inflow over three months reached 504.2 million dollars, ranking first among blockchains, with the second place, Polygon, trailing by 100 million dollars, far ahead of blockchains like Solana and BSC.

Breaking Free from the Ethereum L2 Label, All in BTCFi

The reason Starknet can make a comeback is quite simple: it does not compete with blockchains like Solana, BSC, and Base in memes or trending narratives, but instead goes all in on BTCFi.

Starknet is now shedding the Ethereum L2 label, and its official account has added a note (BTCFi arc) after the Starknet name. In March 2025, Starknet's parent company, StarkWare, announced the establishment of a "strategic Bitcoin reserve." Initially, outsiders thought this was just a publicity stunt, but it turned out Starknet was serious. By the end of September 2025, after more than six months of development, Starknet announced the launch of BTC Staking and 100 million STRK incentives, allowing users to earn staking rewards and STRK incentives by staking BTC on Starknet.

As of now, BTCFi has been live on Starknet for over three months, and the launch of this product is highly correlated with the recovery of Starknet's on-chain data.

According to Dune data, the Bitcoin currently staked on Starknet is valued at over 214 million dollars, accounting for about 70% of Starknet's total TVL (300 million dollars); approximately 50% of the deposited assets are native BTC, with the remainder being various wrapped BTC, primarily SolvBTC and WBTC.

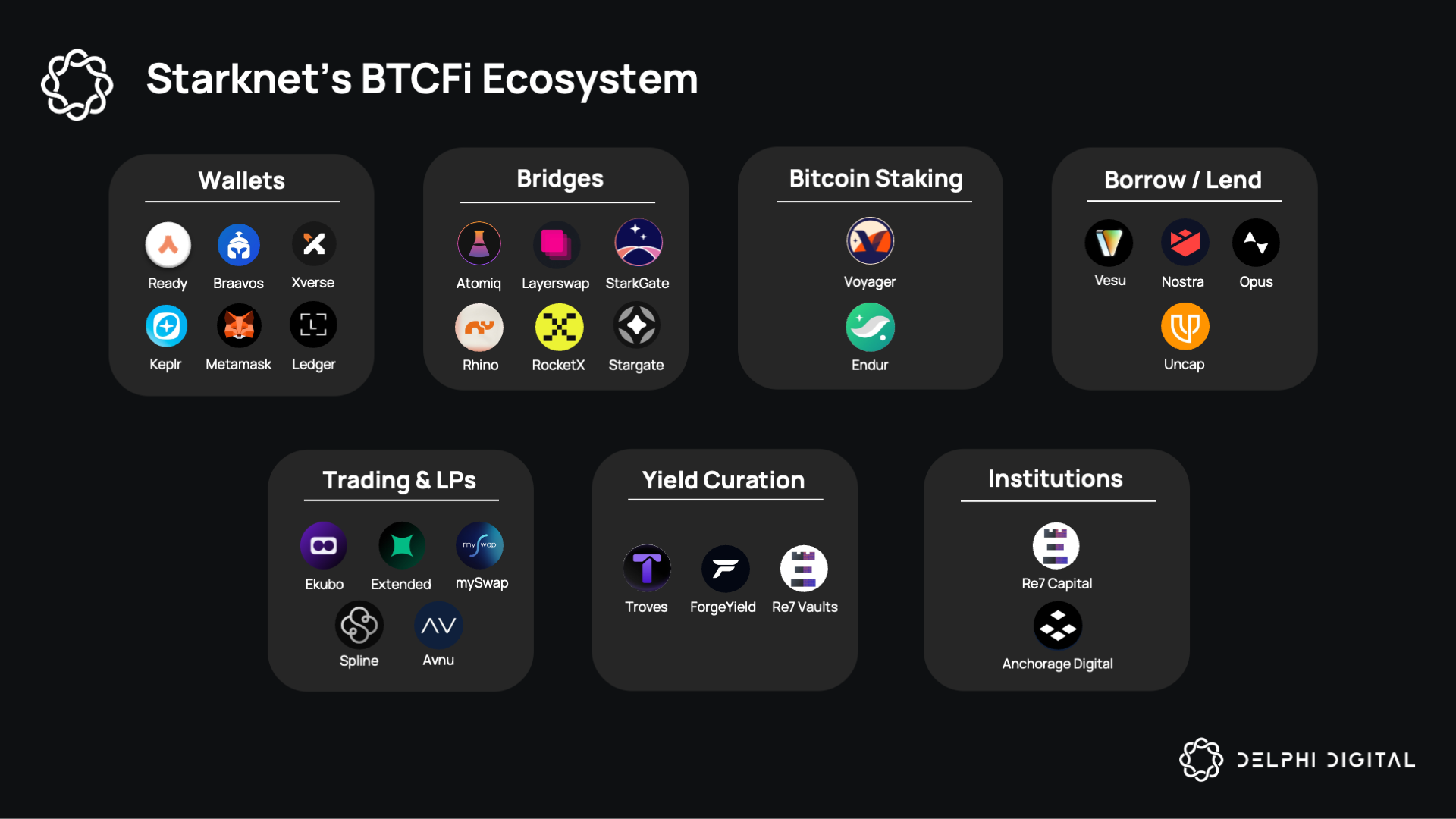

The Bitcoin ecosystem on Starknet has also gradually improved, encompassing everything from wallets to cross-chain bridges and staking, to lending and yield protocols, with all functionalities being operational.

Starknet BTCFi Ecosystem Map

Users can stake Bitcoin on the Endur and Voyager platforms and delegate it to validators. In return, stakers can earn STRK tokens (the current APY for Endur, priced in STRK, is about 2.09%). The earned LST tokens can then be deposited into lending protocols like Vesu for interest. For institutional investors, Re7 Capital can also create customized yield plans for them.

As for why Starknet dares to go all in on BTCFi, it may be related to the personal experiences of its founder. Long before Starknet was born in 2013, Eli Ben-Sasson was already researching the use of zero-knowledge proofs to improve Bitcoin, and this research eventually became one of Starknet's core technologies (STARK cryptography). Therefore, fully embracing BTCFi today can be seen as a return to its original intention.

Although the blockchain world does not always reward idealists and diligent workers, without the "kidnapping" of airdrops, Starknet's steps have become lighter and more stable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。