原创 | Odaily星球日报(@OdailyChina)

作者 | 叮当(@XiaMiPP)

继昨日 BTC 强势突破 95000 美元关键阻力位后,今日凌晨 BTC 延续上涨势头,最高触及 97924 美元,目前暂报 96484 美元;ETH 突破 3400 美元,目前暂报 3330 美元;SOL 价格最高上涨至 148 美元,目前暂报 145 美元。与 BTC 相比,ETH 和 SOL 仍徘徊在关键阻力区间,尚未形成明确的趋势性突破。

衍生品方面,根据 Coinglass 数据,昨日全网爆仓达 6.8 亿美元,其中空单爆仓 5.78 亿美元,多单爆仓 1.01 亿美元;Glassnode 发文表示,市场反弹导致空单清算规模创下自 “1011 崩盘 ”以来新高。

根据 msx.com 数据,美股收盘时三大股指普跌,但加密概念股却普涨,ALTS 涨超 30.94%,BNC 涨超 11.81%。这种情况并不多见,支撑加密市场如此强劲上涨的动力到底在哪?

ETF资金转向

资金层面,自 2025 年 10 月中旬以来,BTC 现货 ETF 整体处于净流出或小规模净流入的偏弱状态,市场缺乏明确的增量资金信号。然而,近一周在连续四个交易日净流出之后,BTC 现货 ETF 转为连续两日净流入,其中 1 月 13 日单日净流入规模高达 7.5 亿美元,成为阶段性的重要信号。相比之下,ETH 现货 ETF 仍然表现疲软。

从价格行为来看,一个值得关注的变化正在发生。比特币在北美交易时段的累计回报率约为 8%,而欧洲时段仅录得约 3% 的温和涨幅,亚洲交易时段甚至对整体表现形成拖累。

这一现象,与 2025 年底形成鲜明对比。当时,比特币在北美时段累计下跌高达 20%,价格一度回落至 8 万美元附近。第四季度,美国市场开盘时段往往伴随着抛售压力,而现货比特币 ETF 几乎每天都面临资金外流。

如今,最强劲的回报却恰恰出现在美股开盘后不久,而过去六个月,这段时间恰恰是比特币表现最疲软的时期。

宏观数据:没有坏消息,但也缺乏宽松催化

宏观层面,本周公布的 12 月 CPI 年同比维持在 2.7%(与前值持平,符合市场预期),核心 CPI 年同比小幅升至 2.7%(前值 2.6%,略高于部分预期),显示通胀压力仍具一定粘性;但 11 月 PPI 年同比意外升至 3.0%(高于预期的 2.7%),零售销售月环比也录得较强增长(超出市场预期),消费端数据表现强劲,这在一定程度上支持了经济增长仍有韧性的观点。

虽然 12 月 CPI 数据整体较为温和(月环比 0.3%符合预期,年率未进一步加速),但通胀尚未明显回落至美联储舒适区间,结合前期就业报告显示的劳动力市场韧性,市场普遍认为美联储在 1 月底的议息会议上继续维持利率不变的概率极高,几乎已无降息预期。这也意味着短期内政策宽松的催化剂仍较缺乏。据 CME“美联储观察”,美联储 1 月维持利率不变的概率达到 95%。

不过,2026 年降息预期值得期待,美联储理事米兰重申今年需要降息 150 个基点。

监管立法进展:CLARITY Act 成焦点

在短期行情之外,近期最值得关注的中长期变量是《CLARITY Act》的立法进展。该法案旨在为美国加密市场建立全面监管框架,主要目标包括:

- 厘清 SEC(证券型资产)和 CFTC(商品型数字资产)的监管边界;

- 明确数字资产分类(证券、商品、稳定币等);

- 引入更严格的信息披露、反洗钱和投资者保护要求,同时为创新预留空间。

随着参议院银行委员会修订并投票定于 1 月 15 日举行,美国加密立法正式进入“冲刺阶段”。委员会主席 Tim Scott(共和党)于 1 月 13 日公布了 278 页修订文本,该文本此前经历了数月的两党闭门谈判,并迅速引发超过 70 项(部分统计为 137 项)修正案提议,围绕稳定币收益与 DeFi 监管的分歧迅速升温,加密行业、银行游说团体与消费者保护组织全面介入。

而且,在加密行业内部也并未形成统一立场。1 月 14 日,Coinbase CEO Brian Armstrong 公开宣布撤回支持,称审阅文本后认为法案“在 DeFi 禁令、稳定币奖励机制扼杀、政府过度监控等方面问题太多,比现状更糟”。他强调 Stand With Crypto 将对周四修订投票进行评分,检验参议员是“站在银行利润一边,还是消费者/创新奖励一边”。业内知情人士认为,Coinbase 的公开反对“影响重大”,可能左右法案命运。

在 Coinbase 公开表示反对后,a16z、Circle、Kraken、Digital Chamber、Ripple、Coin Center 等多家头部机构和协会公开表态支持参议院共和党版本,认为“任何清晰规则都优于现状”,能为市场注入长期确定性,并定位美国为“全球加密之都”。(推荐阅读《CLARITY审议突遭推迟,为何业界分歧如此严重?》)

其它观察:以太坊质押需求走强与 Strategy 持续加码

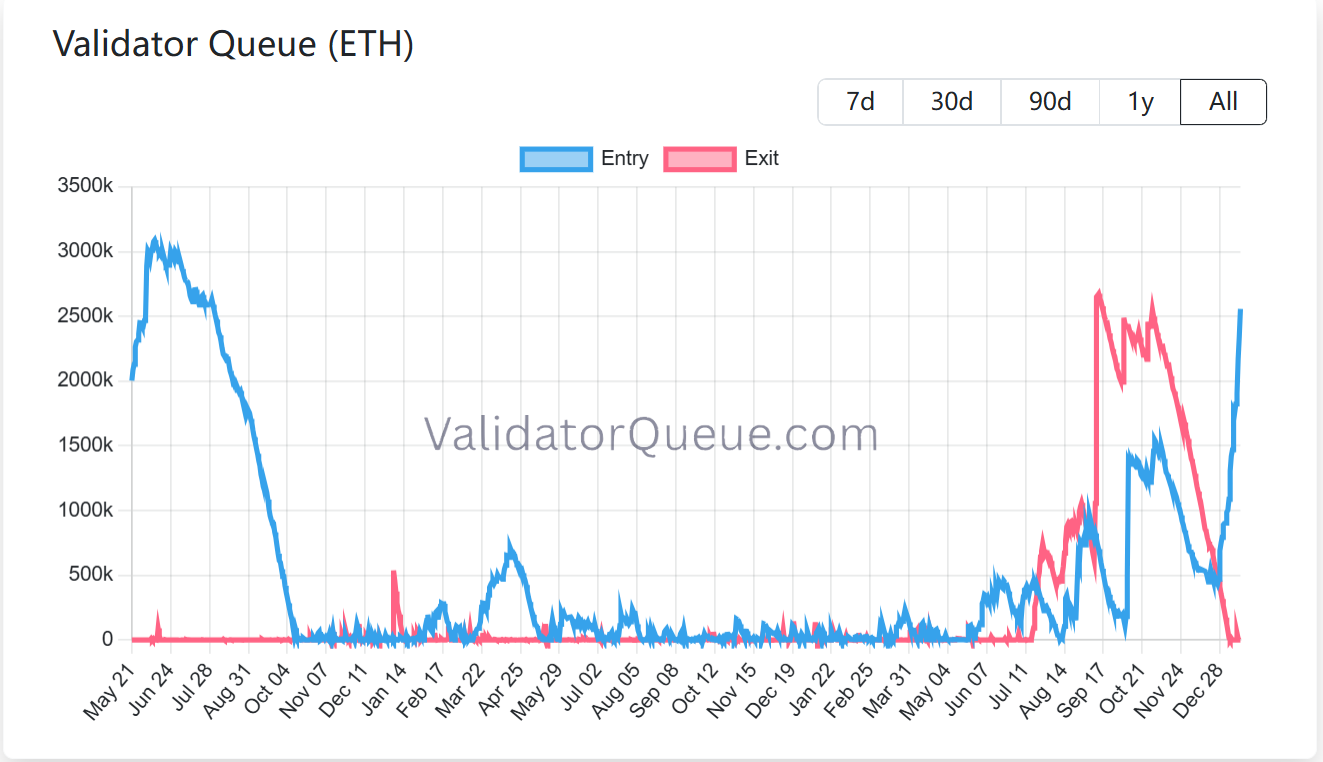

以太坊质押需求持续走强。当前,锁定在信标链中的 ETH 数量已超过 3,600 万枚,占网络流通供应量的近 30%,对应质押市值超过 1,180 亿美元,连续刷新历史新高。此前的最高占比为 29.54%,出现在 2025 年 7 月。以太坊网络目前约有 90 万个活跃验证者,同时仍有约 255 万枚 ETH 正在排队等待进入质押队列。这意味着,至少从链上行为层面观察,既有质押者的短期抛售意愿依然有限,网络整体更倾向于“锁定而非释放”。

除此之外,以太坊上的开发者活动和稳定币交易量均创历史新高。推荐阅读《ETH 质押数据反转:退出清零 VS 进入激增 130 万枚,何时抄底?》

比特币储备公司 Strategy(原 MicroStrategy)本周继续执行其长期加码策略,斥资约 12.5 亿美元,以约 91,519 美元的价格购入 13,627 枚 BTC。由此,其比特币总持仓量已增至 687,410 枚,价值约 658.9 亿美元,整体持仓成本均价约为 75,353 美元。

投行 TD Cowen 近期将其一年期目标价从 500 美元下调至 440 美元,理由是持续发行普通股及优先股带来的稀释效应,令比特币收益率预期走弱。分析师预计,Strategy 在 2026 财年或将增持约 15.5 万枚比特币,高于此前预测,但更高的股权融资比例将压低单股比特币持有增长幅度。

TD Cowen 同时指出,尽管短期收益率承压,但随着比特币价格回升,2027 财年相关指标有望改善。报告亦强调,Strategy 在近期比特币价格回调阶段仍选择持续加码,且融资所得大多直接用于购入比特币,显示其战略目标并未发生动摇。整体而言,分析师仍对 Strategy 作为“比特币敞口工具”的长期价值持相对积极态度,并认为其部分优先股在收益与资本增值层面具备一定吸引力。至于指数纳入问题,MSCI 目前尚未将比特币储备类公司剔除出指数体系,这在短期内被视为利好因素,但中长期仍存在不确定性。

Arthur Hayes 也称,本季度其最核心的交易策略是做多 Strategy(MSTR)和 Metaplanet(3350),将此作为押注 BTC 重回涨势的杠杆标的。

市场展望:结构性变化与反弹条件

综合来看,加密市场正站在一个重要拐点之上,传统“四年周期”是否仍然有效,或将在未来数月内被揭晓。

加密市场做市商 Wintermute 在其最新的数字资产场外交易市场回顾中分析:2025 年,比特币并未展现出典型四年周期中应有的强势特征,而山寨币周期则几乎消失。这一现象在其看来,并非短期波动或节奏错位,而是一种更深层次的结构性变化。

在这一前提下,Wintermute 认为,2026 年若要出现真正意义上的强势反弹,其触发条件将明显高于以往周期,且不再依赖单一变量。具体而言,至少需要以下三种结果中的一种得到验证。

首先,ETF 与加密财库(DAT)公司的配置范围,必须从比特币和以太坊进一步向外扩展。目前,美国现货 BTC 与 ETH ETF 在客观上将大量新增流动性高度集中于少数大市值资产之上,这虽然提升了头部资产的稳定性,却也显著压缩了市场宽度,导致整体表现出现严重分化。只有当更多加密资产被纳入 ETF 产品或企业级资产负债表,市场才有可能重新获得更广泛的参与度与流动性基础。

其次,BTC、ETH 以及 BNB、SOL 等核心资产,需要再次出现具有持续性的强势上涨,并重新创造足够明显的财富效应。2025 年,传统意义上“比特币上涨—资金向山寨币扩散”的传导机制基本失效,山寨币的平均上涨周期被压缩至约 20 天(而前一年约为 60 天),大量代币在解锁抛压下持续走弱。在缺乏头部资产持续拉升的前提下,资金很难产生向下溢出的动力,山寨行情自然难以被激活。

第三,也是最具决定性的一点,散户注意力需要真正回流加密市场。尽管散户并未完全离场,但其新增资金目前更多流向标普 500、AI、机器人、量子计算等高增长主题。2022—2023 年的极端回撤、平台破产与强平记忆,叠加 2025 年加密资产整体跑输传统股市的现实,使得“加密=暴富”的叙事吸引力大幅削弱。只有当散户重新相信加密市场具备超额回报潜力,并以规模化方式回归,市场才有可能重新获得过去那种高度情绪化、近乎狂热的上行动能。

换言之,在结构性变化已然发生的背景下,未来的反弹不再是“是否会来”,而是“以何种条件、通过哪条路径被重新点燃”。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。