Written by: APRO Team

Prediction markets are humanity's collective bets on uncertainty.

Prediction, one of humanity's oldest economic and social activities, is undergoing a complete reconstruction from its underlying logic to its superstructure, driven by the wave of blockchain technology. The prediction market sector has never been so close to its moment of destiny; it is no longer a DeFi branch or a compliant gambling platform, but an awakening super asset market—Internet Expectation Market (IEM).

IEM is not merely a game, probability prediction, or generalized gambling product. Its revolutionary significance lies in the fact that it standardizes and encapsulates event expectations (Expected Value, EV), which were previously difficult to standardize and financialize, into tradable, hedgeable, and combinable financial products in a more systematic way. This creates a new method of asset issuance that transcends traditional concepts like securities and tokens, allowing humanity's collective judgment of the future to become an independent, globally tradable asset class.

1. Overview of Prediction Markets: 2 Superpowers, 3 Strong Players, and 200+ Challengers

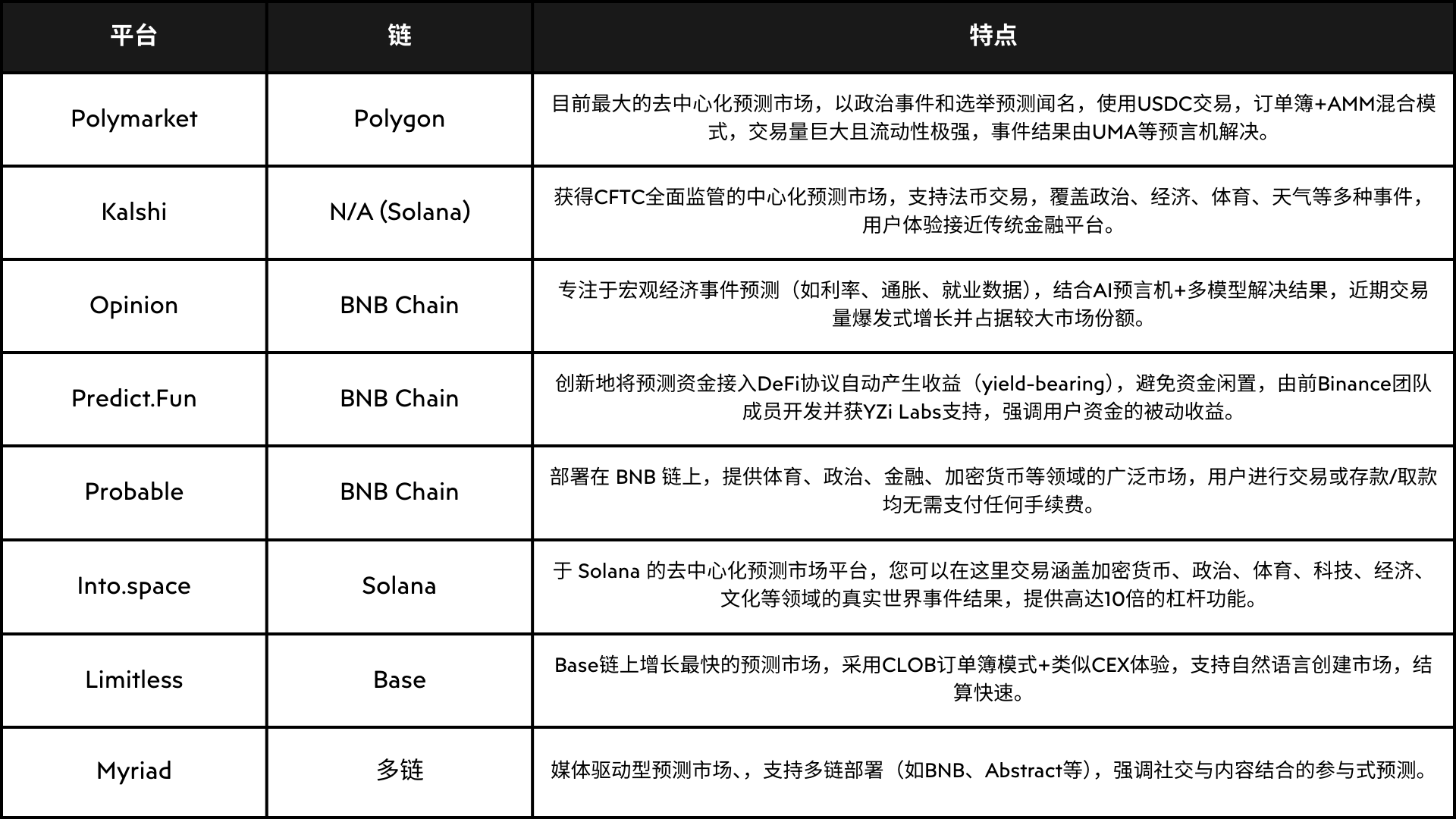

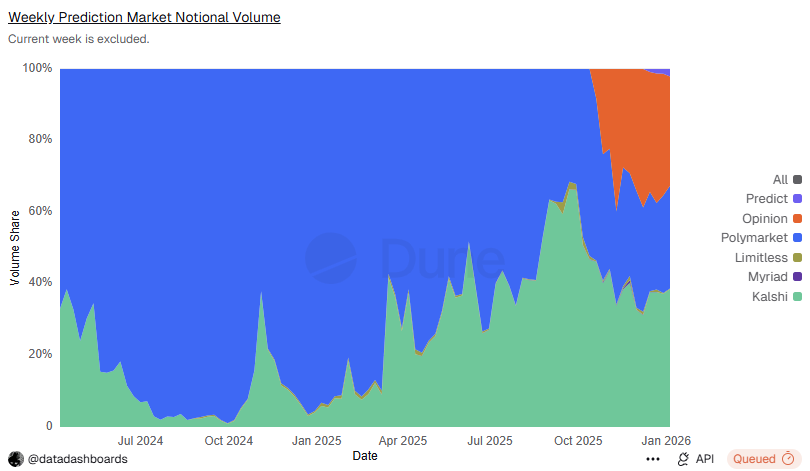

Prediction markets are entering a super cycle. According to Dune Analytics, the prediction market is shifting towards a high-speed growth phase with a phenomenal explosion expected in 2025. The duopoly of Polymarket and Kalshi, along with several strong competitors on BSC, is solidifying, with a cumulative trading volume exceeding $40 billion in 2025, and monthly peaks breaking $10 billion multiple times. By early 2026, weekly trading volumes are expected to remain in the tens of billions. In mainstream prediction markets, the trading activity of political, macroeconomic, and social event markets shows a strong positive correlation with the real-world event heat, validating its function as a "social sentiment barometer." More cross-chain prediction protocols, AI-enhanced prediction markets, and on-chain shared liquidity protocols may participate in the future.

Source: Public data compilation

According to PredictionIndex.xyz data, the total trading volume of the prediction market sector is expected to reach $50.25 billion in 2025, with both Polymarket and Kalshi exceeding $20 billion in trading volume. However, starting from Q4 2025, the trading volume of prediction markets on BNBChain, Base, and Solana began to grow rapidly, with Opinion averaging about $200 million in daily trading volume since 2026, approaching Polymarket and Kalshi.

Source: Dune.com

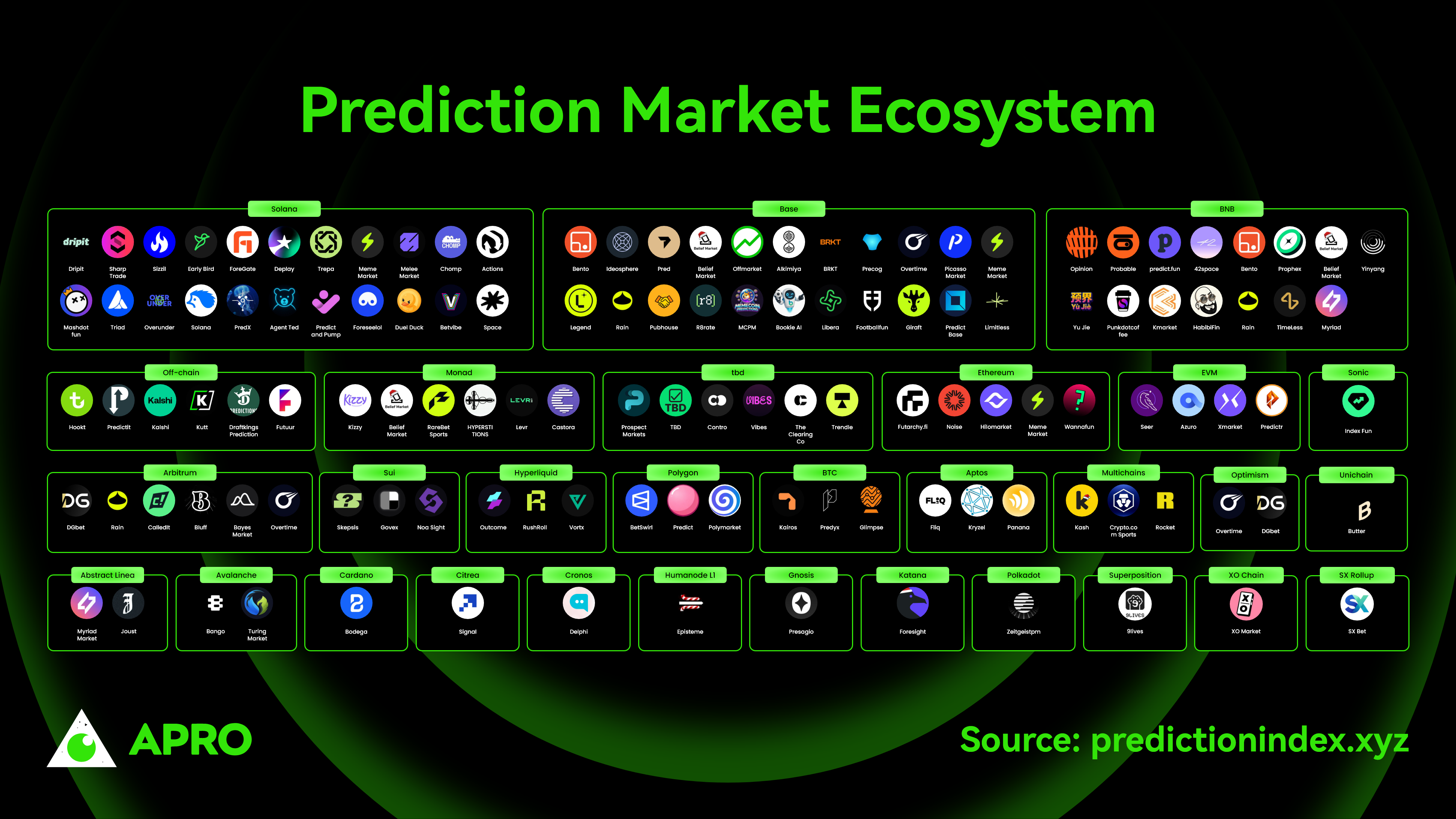

In addition to mainstream platforms, more small to medium-sized new prediction markets with unique features are continuously emerging. The total number of prediction market projects recorded by Rootdata has exceeded 200. In YZi Labs' EASY Residency Season 2, three prediction markets appeared: 42.space, Predict.fun, and Bento. APRO has compiled the current mainstream prediction markets:

Source: PredictionIndex.xyz

2. Prediction Markets are Naturally Evolving Towards Information Pricing and Asset Issuance

Since 2025, the growth drivers of prediction markets have quietly shifted, with the characteristics primarily driven by speculation gradually transforming to play a greater role in information pricing and the issuance and trading of non-standard assets. Prediction markets are migrating upstream in the information dissemination chain.

3. With the Support of Crypto and AI, the Potential of Prediction Markets Remains Significantly Underestimated.

As trading volumes explode and institutional/mainstream participants flood in, prediction markets are gradually moving away from being mere games or gambling, shifting towards a grander narrative—it is beginning to become the strongest collective expectation consensus, truth discovery, information dissemination, and asset issuance infrastructure of the internet era—we call it the Internet Expectation Market (IEM).

The difference between IEM and prediction markets is that IEM highly relies on Crypto and AI, possesses decentralized characteristics, and has unlimited expansion capabilities in depth and breadth. We envision a scenario where any user in the world with a smart device and internet can create a prediction market for any event or the expected outcome of that event, and trade without permission, 24/7, with any counterpart using Crypto.

Most people in the internet era are merely spectators: observing macro data, elections, markets, and others' judgments, but rarely participating—expressing zero-cost opinions with no consequences, leading to views that ultimately become noise. IEM will change all of this: opinions must be backed by real money—anyone can directly participate in pricing and bear the consequences. More importantly, it reassigns real value to the on-site perceptions of ordinary people (barbers, drivers, workers): these intuitive pieces of information were previously ignored and could not circulate; now they can be created, traded, and settled, and the "event expectation value" that could not enter capital markets becomes an independent new asset class for the first time.

Before the emergence of cryptocurrencies and the rise of AI, prediction markets had already appeared, but most were centralized and primarily experimental/academic, such as Iowa Electronic Markets and Good Judgment Open. They were limited by trust issues, regulatory barriers, low liquidity, and high operational costs, making large-scale adoption difficult. However, with the support of Crypto and AI, IEM has become a true "decentralized truth machine": it continuously produces high-value, tamper-proof data streams, providing reliable signals for insurance, derivatives, investment decisions, and even DAO governance, backed by economic incentives. IEM can be deconstructed into two equations:

Equation 1: Prediction Market + Crypto + AI = Internet Expectation Market

In IEM, Prediction Market highly relies on AI and Crypto, creating a new method of asset issuance that transcends securities, currencies, and tokens:

- Prediction Market

Prediction Market brings a price discovery mechanism of collective wisdom, allowing market prices to naturally converge the true beliefs and information of a vast number of participants, forming a probability consensus closest to the truth.

- Crypto

Crypto enables decentralized circulation, hedging, and global participation, liberating expected assets from geographical and institutional barriers, allowing anyone to trade, hedge risks, and participate in global event pricing instantly from anywhere.

- AI

AI enhances the analysis and automation of long-tail events, rapidly transforming vast fragmented, unstructured, and marginalized uncertainties into tradable contracts, significantly reducing creation and settlement costs, and increasing the breadth and depth of event coverage.

Equation 2: Internet Expectation Market = Information Market + Risk Market + Gambling Market

IEM is the validation of prediction markets. The prediction markets under the IEM framework will move away from speculation dominance while possessing the triple attributes of Information Market + Risk Market + Gambling Market:

(1) Information Market

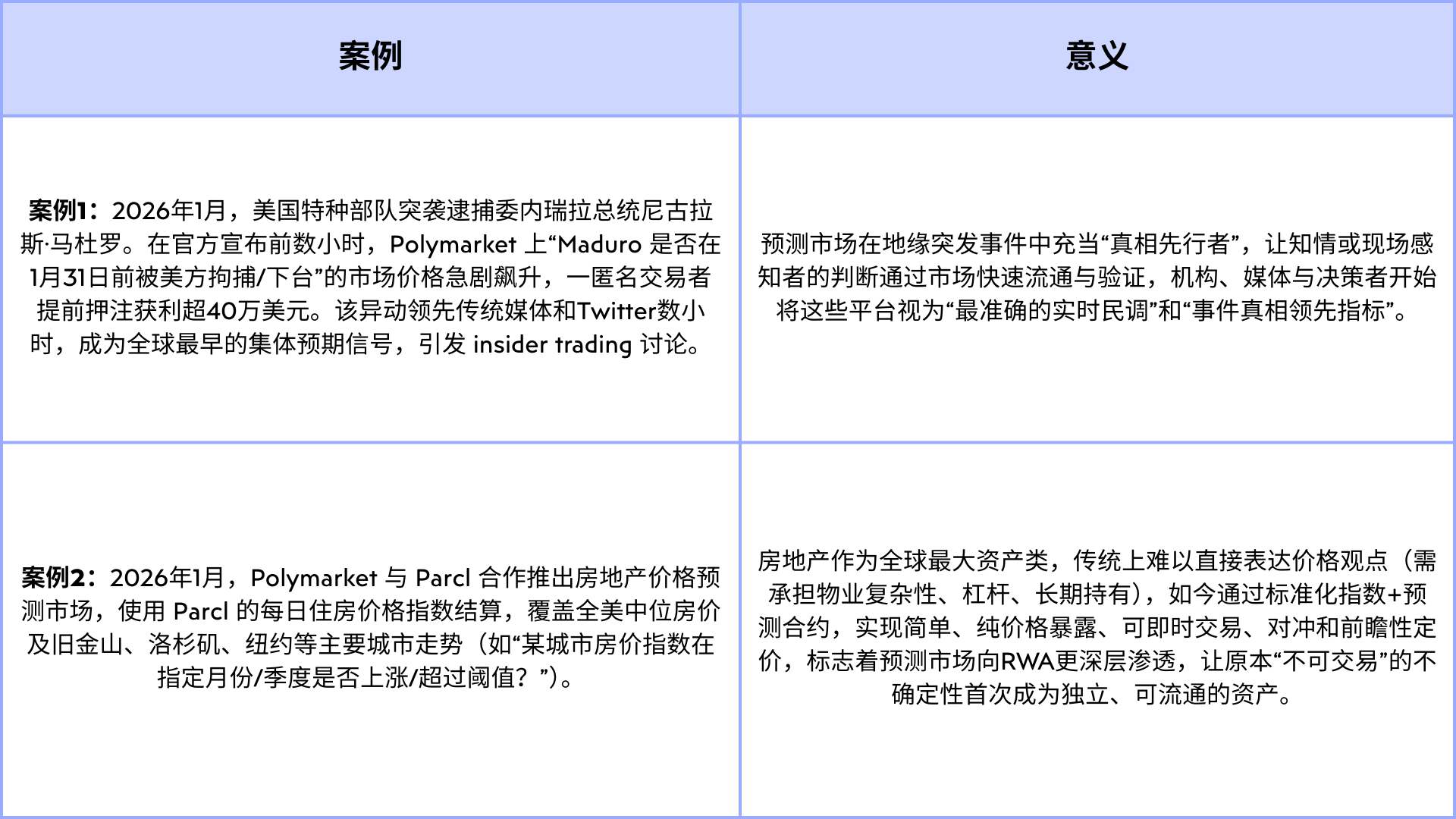

The most profound aspect of IEM lies in its role as a distributed information aggregation and truth discovery mechanism. Prices reflect the dynamic adjustments of collective expected EV in real-time, and trading behavior itself is a process of information dissemination and verification. Actions by informed individuals lead to significant price fluctuations, often becoming the earliest public signals of the truth.

In November 2025, Google announced a strategic partnership with Polymarket (and Kalshi), integrating Polymarket's real-time odds and probabilities directly into Google Search and Google Finance. Users searching for queries like "Will the U.S. enter a recession in 2025?" or "2026 GDP growth expectations" can see the market's implied probabilities alongside traditional financial data. In January 2026, Polymarket reached an exclusive data-sharing agreement with Dow Jones (which includes The Wall Street Journal, Barron’s, MarketWatch, etc.). Media outlets like WSJ will embed Polymarket's real-time probability modules in digital platforms and some print editions, such as launching a "Market Implied Earnings Expectation Calendar," directly displaying the collective expected probabilities for company earnings reports, rather than relying solely on analyst opinions.

These events indicate that prediction markets have officially entered the mainstream information ecosystem from the margins, with the world's largest search engine and traditional financial media beginning to treat "market prices" as one of the authoritative signals of collective expectations, helping users capture hidden truths more quickly. In the future, media will cite "prediction markets indicate…" to verify news, and individuals, businesses, and nations may use these signals to assist governance and optimize strategic decisions. This attribute allows IEM to transcend financial tools, becoming the most powerful collective intelligence system of the internet era, and its trading will also produce more forms of change.

(2) Risk Market

In the eyes of professional players, IEM is a global, barrier-free risk hedging infrastructure. It encapsulates the expected outcomes of uncertain events in macroeconomics, geopolitics, climate, technology, and other areas that are difficult to standardize into tradable, combinable financial products, allowing users to trade and hedge instantly.

Modern platforms like Polymarket and Kalshi have inherited and greatly amplified this attribute: by achieving global/U.S. frictionless access through blockchain or CFTC regulatory frameworks, users can hedge against complex risks ranging from the Federal Reserve's interest rate path, escalation of geopolitical conflicts, and probabilities of climate disasters, to the implementation of AI regulations, corporate earnings exceeding expectations, and dramatic fluctuations in Crypto prices. For example, some Bitcoin holders/mining companies trade on Polymarket and Kalshi for markets like "Bitcoin will drop below $X in Q1 2026" or "Federal Reserve interest rate path," serving as a cheap alternative hedge for spot positions, more efficient and transparent than traditional put options.

(3) Gambling Market

In the eyes of ordinary users, prediction markets are the most accessible entry point for financial participation. High-profile events (such as elections, sports, and entertainment gossip) attract massive traffic, allowing users to start "playing" by expressing personal expectations through buying and selling contracts. It presents complex expected assets in the most intuitive way, enabling casual participants to gradually understand the deep value of circulation, trading, hedging, and combinability through entertainment.

For instance, Polymarket has become a prediction market partner for events like UFC and NHL, integrating real-time odds and brand exposure into related digital platforms. Fans can buy and sell contracts on "who will KO in the next round" during matches, experiencing the fun of "trading while watching." This shifts entertainment gossip from passive viewing to active participation—viewers naturally learn the logic of price discovery while following celebrities and debating on the red carpet, leading many to "addictively" expand into the sports market.

4. What Infrastructure Do Prediction Markets Need Under the IEM Narrative?

The prediction machine, as the final piece of the Internet Expectation Market, will benefit from the super cycle of prediction markets.

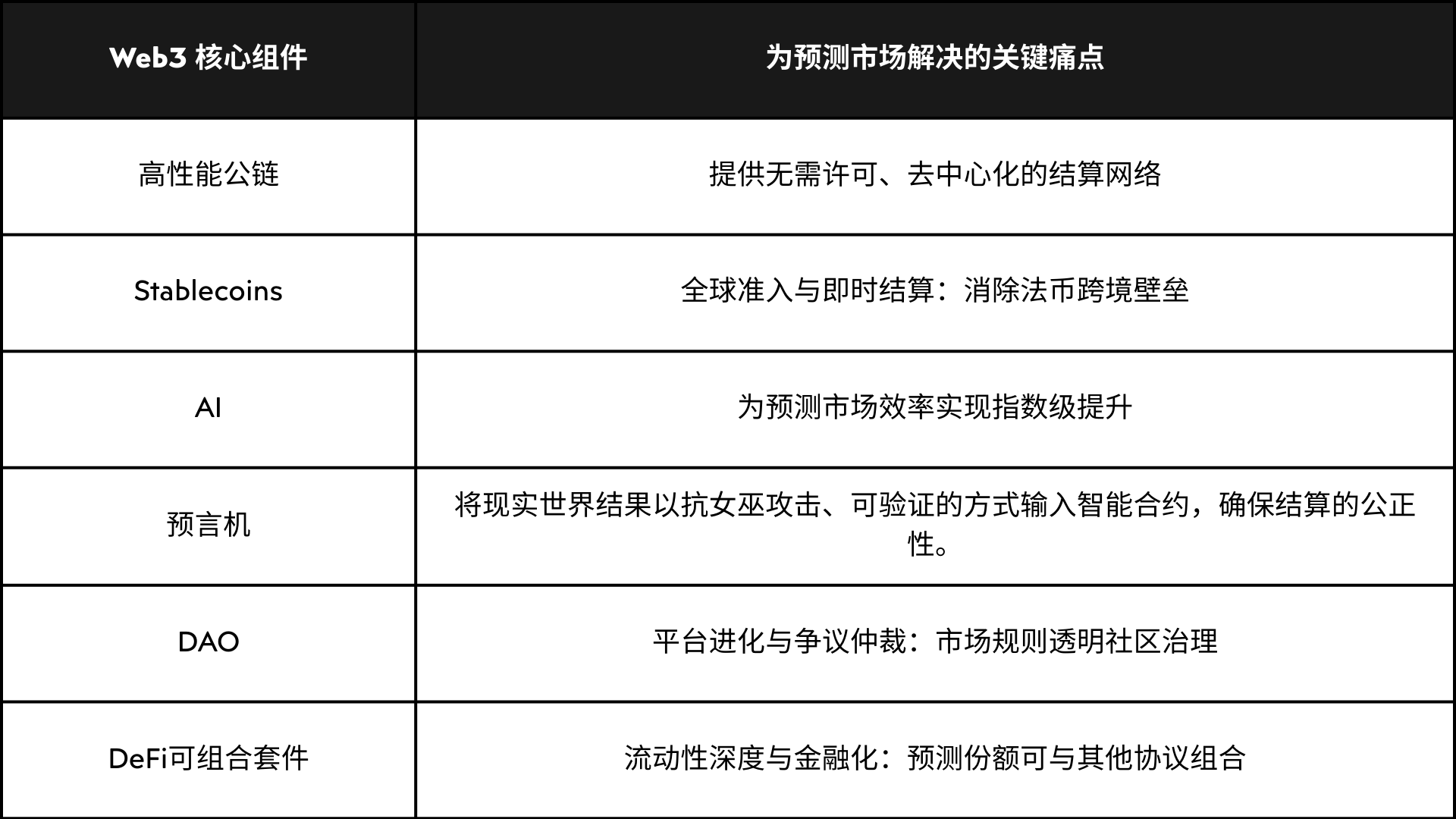

Prediction markets have long been constrained by trust, regulatory, and efficiency issues in the Web2 era, while Crypto and AI provide core support for prediction markets from the ground up. The decentralized characteristics of Crypto, the capabilities of smart contracts, and the global settlement capabilities of stablecoins, along with the productivity leap brought by AI, create an ideal technological and economic environment for prediction markets.

It is important to note that public chains (such as BNB Chain, Solana, Base, Ethereum) and stablecoins (USDT/USDC/USD1/U), as well as DeFi composable suites, are already very well-developed. AI and DAOs are also continuously evolving to meet the development needs of IEM. However, the last key piece in the entire structure—the prediction machine—is still in a rapid development phase.

The requirements for prediction machines in prediction markets differ significantly from those in DeFi or RWA fields, evolving from a simple data transfer role to a "complex event verification and understanding engine" that supports the credible settlement of expected assets. Its core evolution lies in the ability to aggregate and understand multi-source heterogeneous data (such as sports events, macroeconomic indicators, news events) and to perform semantic extraction and logical judgment on unstructured information using technologies like LLM, transforming it into programmable contract conditions. The next generation of prediction machines will tend to build modular data service platforms to meet the rapid creation and reliable settlement needs of prediction markets for long-tail, sudden, and diverse events.

A prediction machine that truly meets the high-speed growth demands of IEM needs to possess the following core characteristics:

- Performance must be fast enough to meet the real-time demands of rapidly changing markets (millisecond-level response, high throughput);

- Data breadth must be wide enough to adapt to the rapid growth in the complexity of prediction market targets (supporting multi-chain, multi-source, heterogeneous data);

- High integration with AI, capable of solving complex problems (using LLM for semantic understanding, logical reasoning, and programmable transformation);

- High integration with the ecosystem (such as chains and DeFi composable suites), achieving modular data services, seamless integration, and combinability.

In this context, many Web3 prediction machine projects are already demonstrating enhanced AI capabilities, moving beyond being mere price feeding tools to becoming true "complex event verification and understanding engines"—integrating millisecond-level responses, multi-source heterogeneous data breadth, AI semantic reasoning and logical judgment, programmable contract transformation, and high combinability with DeFi and prediction market ecosystems. By continuously expanding coverage in sports, macro, and event categories, strengthening multi-layer AI verification mechanisms, and providing modular services, we also look forward to seeing prediction machines evolve from data providers to full-stack infrastructures that support the credible settlement of any event's expected assets, gradually filling the last piece of the IEM puzzle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。