Bitcoin surged past $97,000 on Jan. 14, catalyzed by a volatile mix of judicial delays and record-breaking institutional investment. The digital currency’s rally intensified shortly after the U.S. Supreme Court deferred, for the second time in a week, its ruling on the legality of President Donald Trump’s reciprocal tariffs. After breaking through the $95,000 resistance level during the previous 24-hour session, bitcoin parlayed its late-session momentum into a nearly 5% climb to reach a peak of $97,797.

The latest surge brought the cryptocurrency’s seven-day gains to nearly 7% and propelled its market capitalization to $1.95 trillion. Now within striking distance of the $100,000 psychological milestone, bitcoin’s resurgence fueled a broader appetite for risk. Most major altcoins saw gains between 3% and 6%, while the total crypto economy’s market capitalization rose 4% to approximately $3.4 trillion.

The price jump triggered a massive squeeze in the derivatives market, resulting in the liquidation of more than $372 million in short positions, compared to just $28 million in long bets wiped out over 24 hours. Overall, nearly $850 million in leveraged positions were liquidated, with shorts accounting for a disproportionate share of the losses.

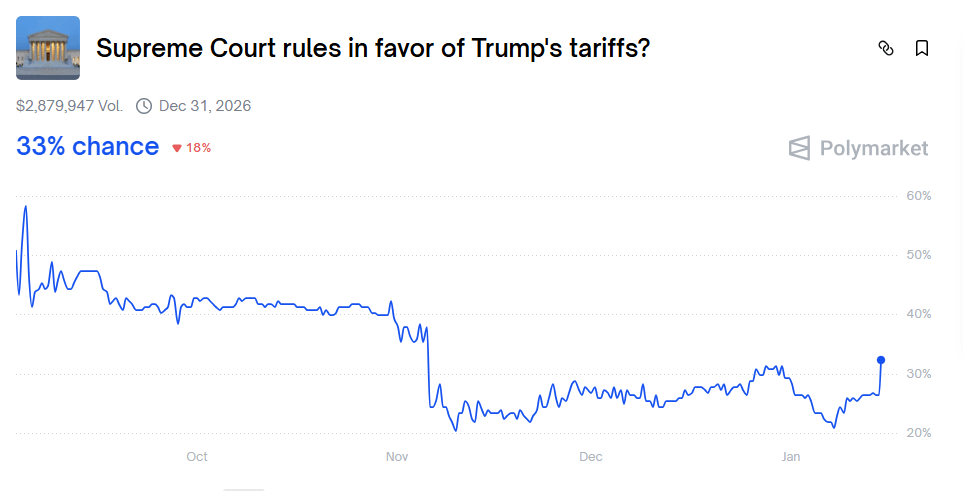

While the Supreme Court released three opinions on Wednesday, its decision to avoid the tariff challenge fueled speculation among investors that the bench may be leaning against striking down the administration’s trade policies. On the prediction market Polymarket, the odds of the court ruling in favor of Trump have increased by 12 percentage points since Jan. 7, including a 6-percentage-point jump following today’s postponement.

Institutional demand also provided a significant tailwind. Reports indicated that spot exchange-traded funds saw $753.8 million in net inflows on Jan. 13, the largest single-day haul since their launch. Among the top-performing funds, Fidelity’s FBTC recorded $351.4 million in net inflows, while Blackrock’s IBIT posted $126.3 million. The massive inflows signal a reversal of the lackluster institutional interest seen in the final weeks of 2026.

Read more: Bitcoin ETFs Surge With $754 Million Inflow as Crypto ETFs Register Broad Gains

Macroeconomic friction further bolstered the digital gold narrative. President Trump’s recent attacks on Federal Reserve Chairman Jerome Powell during a speech celebrating third-quarter GDP growth fueled concerns that the administration is seeking to undermine the central bank’s independence. These comments came just days after reports emerged that the U.S. Department of Justice is investigating the Federal Reserve.

The convergence of tariff ruling uncertainty, record-breaking ETF inflows, and unprecedented executive pressure on the Federal Reserve has engineered a “perfect storm” for the cryptocurrency market. With bullish momentum accelerating, bitcoin appears increasingly likely to secure its first double-digit weekly gain of 2026 while reclaiming the $100,000 mark.

- Why did bitcoin surge past $97K? Judicial delays and record ETF inflows fueled the rally.

- How much has bitcoin gained this week? Nearly 7%, lifting its market cap to $1.95 trillion.

- What impact did derivatives see? Over $850M in leveraged positions were liquidated, mostly shorts.

- Is bitcoin close to $100K? Yes, momentum puts the milestone within striking distance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。