许多人认为美国总统唐纳德·特朗普对中央银行的口头攻击,以及针对鲍威尔的侮辱,构成了对美联储独立性的压力。根据福克斯商业频道的报道,马萨诸塞州民主党参议员伊丽莎白·沃伦表示,特朗普的计划是“安装另一个傀儡,以完成他对美国中央银行的腐败接管。”

尽管如此,一些声音在喧嚣中脱颖而出,认为美联储独立的概念只是虚构。在与彭博社的埃里克·巴尔丘纳斯和斯卡雷特·傅的对话中,著名美国投资经理罗布·阿诺特在《ETF IQ》的一集中提出了这一观点。

“我一直认为美联储的独立性有点神话化,”阿诺特说。“美联储的理事是由总统定期任命的,因此你会看到美联储被你选择的人慢慢接管。因此,美联储的独立性在任何总统任期内都很快消失。结果是,美联储一直是政治化的。”

Shapeshift和威尼斯AI的创始人埃里克·沃赫斯也呼应了美联储独立性是虚构的说法——而且他的表述更加直白。“美联储的‘独立性’是一个神话,一个故事,”沃赫斯在X上写道。“这是为其在世界上最重要的市场——货币——上所拥有的可怕的国家批准的近乎垄断权力提供的道德掩护。美联储从未‘独立’于银行体系。它是由银行、为银行而存在的。美联储是银行体系最大的成就。”

沃赫斯补充道:

“因为现代银行是国家的附属品,所以美联储也是其最强大的触手。没人真的应该关心美联储在建筑翻新上花了多少钱。这真是个分散注意力的事情!”

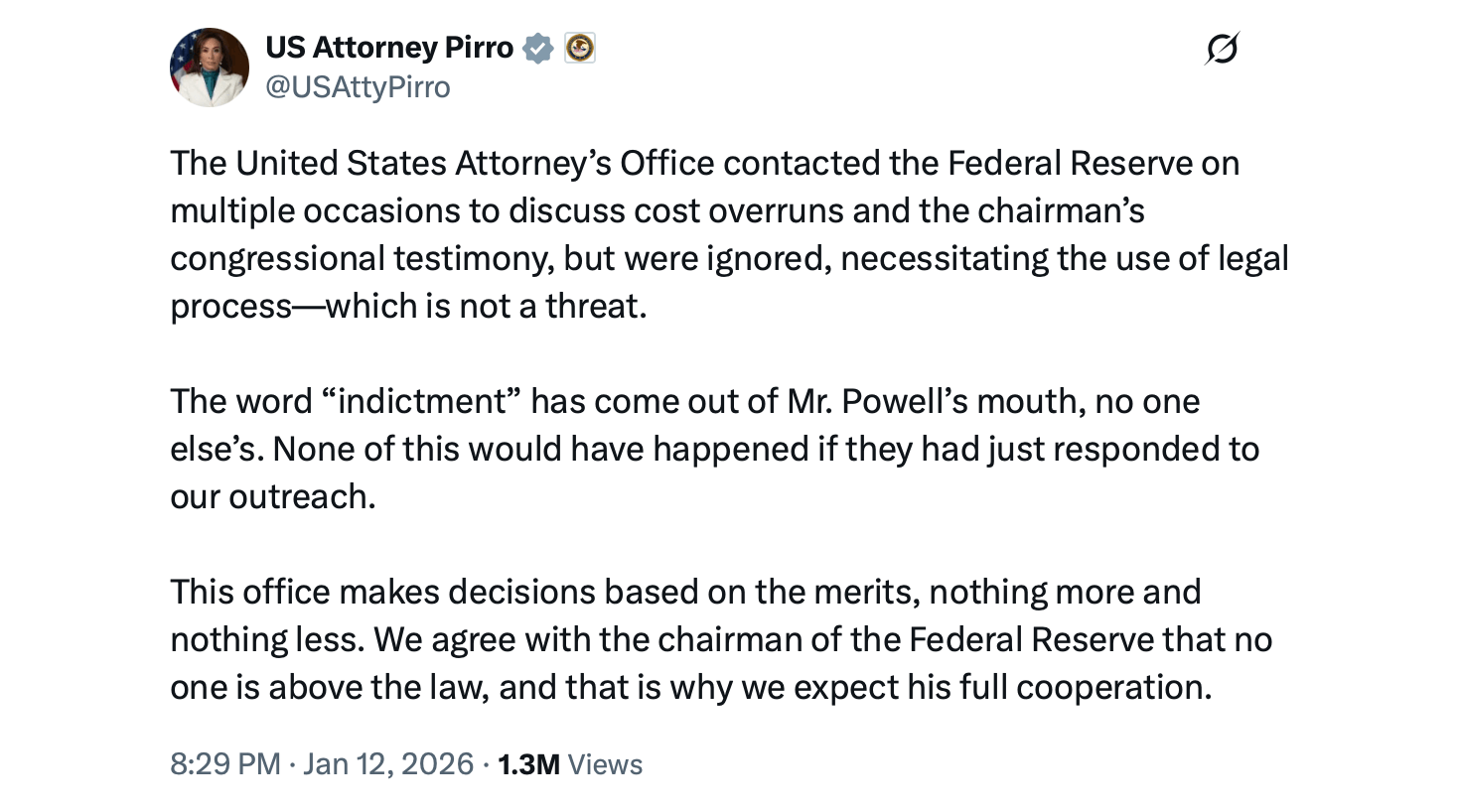

威灵顿-阿尔图斯私人财富首席市场策略师詹姆斯·E·索恩表示,鲍威尔主席将一次例行的司法部监督审查包装成更戏剧化的事情——所谓对美联储独立性的威胁。在他看来,司法部只是询问了关于成本超支和国会证词的问题,而在非正式接触无果后,关于即将到来的刑事案件的想法直接来自鲍威尔自己的框架。

“在看起来像是经过剧本编排的回应中,华尔街的所有美联储追随者都大声抗议;他们完全相信了,”索恩强调。“这一切都不符合常理。美联储是否高于美国宪法?为什么鲍威尔选择公开并采用这样的框架?为什么主流媒体和所谓的客观评论员没有进行任何客观分析?在我看来,这像是‘俄罗斯俄罗斯俄罗斯’骗局策略的元素。”

一系列研究和分析支持了美联储独立性在纸面上看起来比现实更好的观点。莱维经济研究所2025年的政策说明明确将美联储描述为“国会的产物”,而不是一个真正自主的机构。去年在Econofact上发布的研究追踪了全球中央银行独立性的下降,而美国在这个故事中占有重要地位。

另请阅读: 美联储遭司法部调查,鲍威尔主席声称美联储的独立性岌岌可危

此外,2020年在《经济学与政治》上发表的一项研究(更新至2024年)显示,美国在全球中央银行独立性方面位于底部四分之一。更早之前,在《反对美联储的案例》及其更广泛的著作中,奥地利经济学家穆雷·罗斯巴德认为,美联储并不是独立存在的,而是紧密融入国家机器之中。

罗斯巴德的分析——以及许多其他奥地利经济学家的分析——明确认为,任何关于美联储“独立性”的说法都不过是精心包装的公关,而不是对现实的诚实描述。例如,美联储的起源就讲述了这个故事:它于1913年由国会创建,依据法定权力运作,实际上赋予了它对发行法定货币的政府支持垄断权。

历史上——尤其是在战争时期和金融危机期间——美联储与美国财政部密切合作,以货币化政府债务并引导宏观经济政策。此外,总统选择美联储主席和理事会,参议院的确认使这一过程得以完成。从这个角度来看,“独立性”模糊了问责制,并支撑了技术官僚的表象,而美联储在实践中则作为国家权力和财富再分配的工具运作。

即使在其创建之时,伍德罗·威尔逊总统也推动政府控制,同时与“货币信托”紧密合作——这是一个由强大的华尔街金融家和机构组成的紧密圈子,他们在20世纪初统治了美国金融,正如普乔委员会的众议院小组调查所揭示的那样。人们可以轻易地争辩说,从一开始,美联储就是由国家与一小圈银行家共同建立的,而这些银行家迄今为止的表现极其糟糕,几乎不具备独立性。

关于翻新调查及其周围的政治戏剧似乎重新开启了一个更古老的争论,而不是揭示任何新事物。来自学术界、经济学和哲学的批评者们长期以来一直认为,美联储的结构、任命过程和历史行为将其牢牢置于政府权力的轨道之内。从这个角度来看,目前的争论与其说是关于独立性的突然侵蚀,不如说是关于一个始终如一的系统——受政治激励、机构联盟和华盛顿内部优先事项变化的影响。

- 为什么美联储的独立性现在受到质疑?

一项司法部调查和重新出现的政治批评重新激活了关于美联储是否真正独立于政府权力的长期辩论。 - 总统在美联储领导中扮演什么角色?

总统任命美联储主席和理事会,经过参议院确认,使选举官员对中央银行具有重要影响。 - 批评者对美联储的起源有什么看法?

批评者认为,美联储是于1913年由国会与强大的银行利益共同创建的,从一开始就嵌入了政治和金融影响。 - 为什么一些经济学家称美联储的独立性是一个神话?

他们指出其法律结构、危机时期与财政部的协调以及与政府政策的历史联系,作为其并非完全自主的证据。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。