The week opened with optimism and closed with caution. From Jan. 5 to Jan. 9 (ET), U.S. spot crypto exchange-traded funds (ETFs) reflected a market still searching for balance, rotating capital away from bitcoin and ether while selectively adding exposure to solana and XRP.

[bn_top-ad]

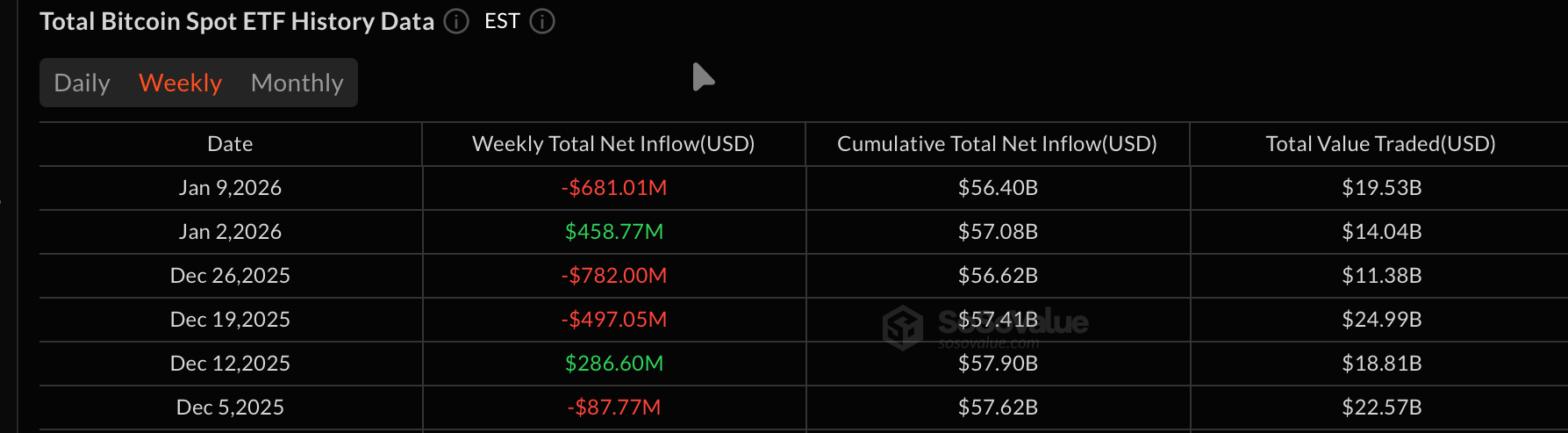

Bitcoin ETFs recorded a weekly net outflow of $681.01 million, reversing the strong start seen on Monday. Blackrock’s IBIT remained the most active fund on both sides of the tape. It pulled in $372.47 million on Jan. 5, followed by another $228.66 million on Jan. 6, but those gains were overwhelmed by heavy redemptions later in the week, including $129.96 million on Jan. 7, $193.34 million on Jan. 8, and $251.97 million on Jan. 9.

Fidelity’s FBTC was also a major contributor to the drag, swinging from a $191.19 million inflow on Monday to successive exits totaling more than $680 million across Tuesday through Thursday alone with a marginal $7.8 million inflow on Friday doing little to reverse course. Grayscale’s GBTC and Bitcoin Mini Trust continued their structural bleed, together shedding well over $200 million for the week, while Ark & 21Shares’ ARKB, Bitwise’s BITB, and Vaneck’s HODL also closed firmly negative.

Bitcoin ETFs have only recorded 2 green weeks over the past six weeks, highlighting the caution still prevalent in the market.

Ether ETFs fared better, but still finished with a net outflow of $68.57 million. The week began with strength as ETHA absorbed $102.90 million on Jan. 5 and followed with a massive $198.80 million inflow on Jan. 6. That momentum faded quickly with combined outflows of $198.07 million for the rest of the week.

Grayscale’s ETHE and Ether Mini Trust resumed persistent outflows midweek, combining for over $195 million in exits across Jan. 6 and Jan. 8. Fidelity’s FETH and Bitwise’s ETHW also slipped modestly, leaving the category slightly underwater by week’s end despite early optimism.

Solana ETFs were a clear bright spot, posting a weekly net inflow of $41.08 million. Bitwise’s BSOL led consistently, including $12.47 million on Jan. 5, $7.79 million on Jan. 8, and steady additions midweek. Fidelity’s FSOL and Grayscale’s GSOL also contributed incremental inflows, keeping total net assets above the $1 billion threshold and reinforcing Solana’s post-launch traction.

Read more: ETF Weekly Recap: Bitcoin and Ether Rebound to Start 2026 Strong

XRP ETFs extended their young but resilient streak, recording a $38.07 million weekly inflow. Strong contributions from Bitwise’s XRP, Franklin’s XRPZ, and Grayscale’s GXRP earlier in the week more than offset XRP’s first-ever daily outflow on Jan. 7, which was driven by a single large redemption from 21Shares’ TOXR. By Friday, inflows had stabilized, keeping cumulative demand intact.

Overall, the week highlighted a market in rotation rather than retreat. Bitcoin and ether absorbed profit-taking and positioning resets, while solana and XRP benefited from more targeted conviction, an early signal that 2026 may reward selectivity over broad exposure.

• What defined crypto ETF flows in early January?

Investors rotated out of bitcoin and ether while selectively adding Solana and XRP exposure.

• Why did bitcoin ETFs end the week in outflows?

Early inflows were overwhelmed by heavy mid-to-late-week redemptions as risk appetite narrowed.

• How did solana ETFs perform compared to others?

Solana ETFs led the market with steady inflows, keeping assets above $1 billion.

• What does XRP’s performance signal for 2026?

Despite brief volatility, consistent inflows point to growing conviction in XRP products.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。