Original | Odaily Planet Daily (@OdailyChina)

The booming prediction market is facing a real challenge.

On January 9, local time in the United States, the Tennessee Sports Wagering Council (SWC) issued a ban to prediction market platforms such as Kalshi, Polymarket, and Crypto.com, requiring these platforms to stop offering sports event prediction contracts to residents of the state, citing that these companies were engaging in illegal gambling activities without state government approval.

In the notice, the SWC accused the three companies of illegally providing sports betting products under the guise of "event contracts." Although these platforms are registered as designated contract markets with the U.S. Commodity Futures Trading Commission (CFTC), under Tennessee state law, any entity providing sports betting services in the state must hold a license issued by the SWC.

The SWC demanded that Kalshi, Polymarket, and Crypto.com cease all activities in the state by January 31, withdraw open contracts, and refund residents' deposits. Failure to comply on time could result in civil penalties of up to $25,000 per violation, and even criminal charges.

The Rapidly Growing Sports Betting Market

To understand why Tennessee is taking such a hard stance against prediction market platforms, we need to look at the current state of the sports betting market in the United States.

Since the U.S. Supreme Court overturned the federal law prohibiting commercial sports betting, the Professional and Amateur Sports Protection Act (PASPA), on May 14, 2018, states in the U.S. have gained the authority to decide whether to legalize sports betting within their jurisdictions. Currently, sports betting in the U.S. is regulated at the state level, with state regulatory agencies responsible for licensing, compliance, and enforcement. Each state can set its own tax structure, market entry thresholds, and liability requirements.

According to sports betting media Legal Sports Report, as of now, 38 states (including Washington D.C. and Puerto Rico) have allowed the legal operation of sports betting services (both online and offline), with 30 states permitting online sports betting services — Tennessee is one of them and is the first state to allow only online sports betting while prohibiting physical betting venues.

With popular leagues like the NFL, MLB, NBA, and NHL, the U.S. is undoubtedly a sports powerhouse, and sports betting is a gambling service clearly defined and heavily taxed by state governments.

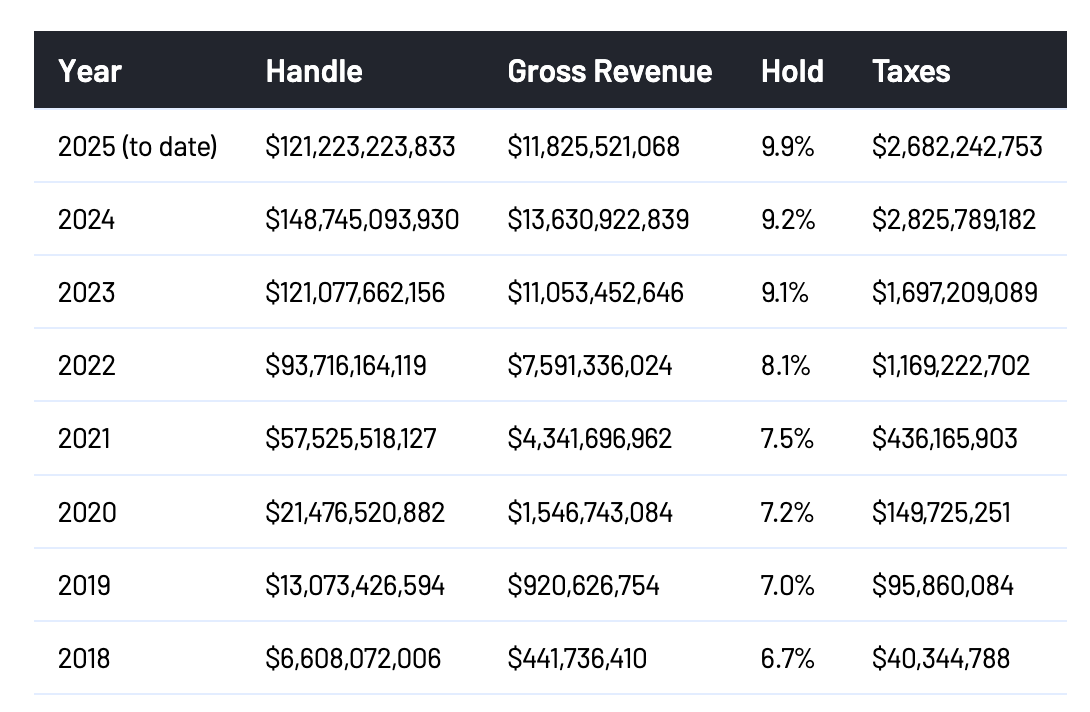

Another major sports betting media outlet, Sports Book Review, reports (as of August 2025) that since the regulatory relaxation in 2018, the total betting volume (Handle) and tax revenue from the U.S. sports betting market have shown an exaggerated growth trend — by 2024, the total market betting volume reached $148.74 billion, with tax contributions amounting to $2.82 billion; in the first eight months of 2025, the betting volume ($121.22 billion) and tax revenue ($2.68 billion) were already approaching the total levels of 2024.

What Does Sports Betting Mean for Tennessee?

Now, let's focus on Tennessee, the main character in this event.

In 2019, Tennessee passed the Tennessee Sports Gaming Act, officially legalizing sports betting. Although then-Governor Bill Lee had reservations about gambling, he still allowed the bill to pass without exercising his veto power. Between 2021 and 2022, the Tennessee legislature established a dedicated regulatory council to oversee licensing and regulation, initially called the Sports Wagering Advisory Council, which was later renamed the Tennessee Sports Wagering Council, the same SWC that issued the ban to Kalshi, Polymarket, and Crypto.com.

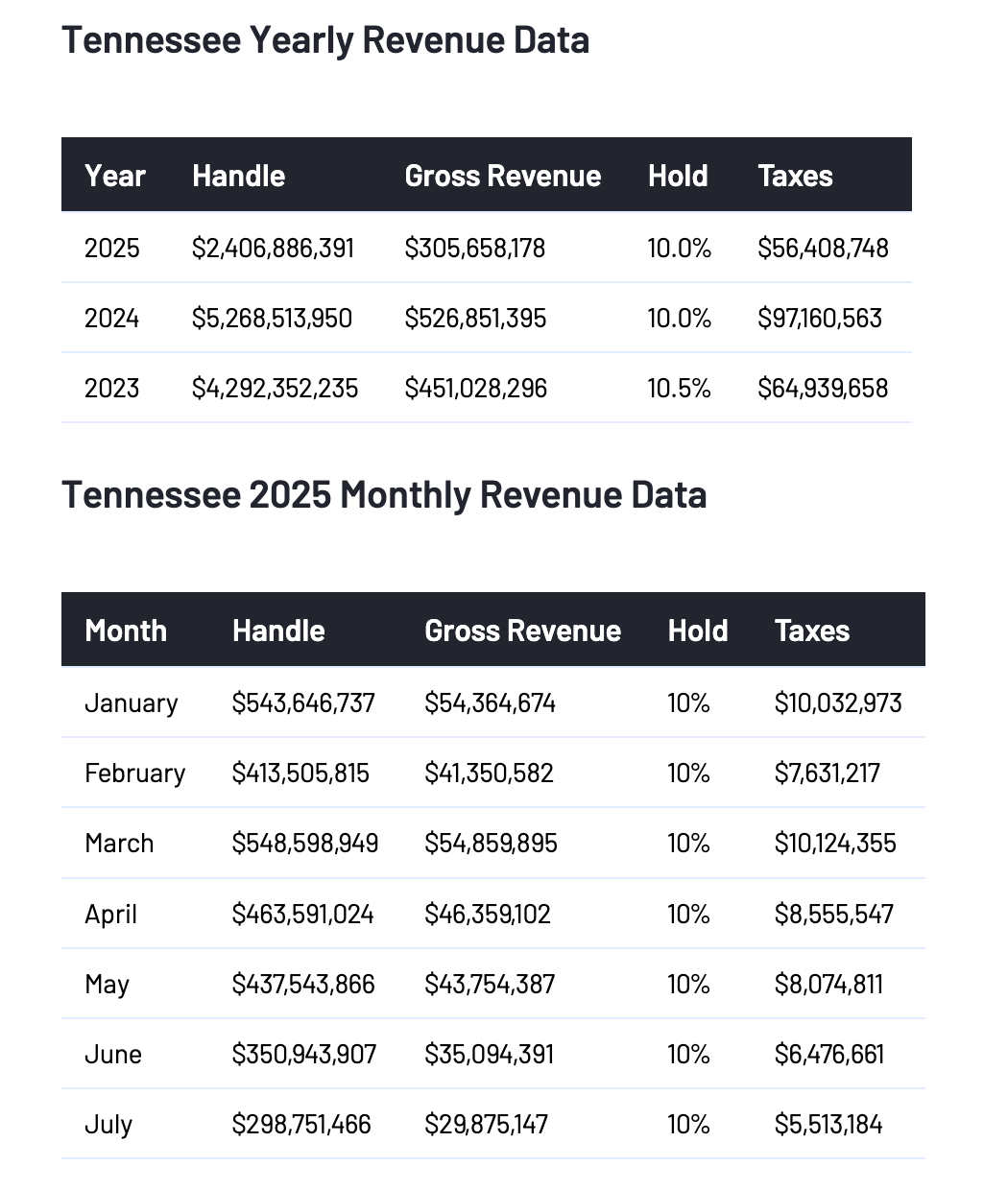

Currently, the SWC is the only regulatory body for sports betting in Tennessee, responsible for operating licenses, compliance supervision, rule-making, and enforcement. The SWC stipulates that all sports betting providers must obtain a license from the SWC to offer services in the state, and a total of 11 licenses have been issued (as shown in the image above); only residents aged 21 and over can access the relevant services, and they must pass geographic verification to ensure they are betting within the state; regarding tax rates, the state imposes a 1.85% tax based on total betting volume — previously, a revenue-based tax scheme was used, but it was changed to a total betting volume tax after 2023.

The sports betting market has contributed significant tax revenue to Tennessee. According to Sports Book Review (as of July 2025), the total betting volume in Tennessee's sports betting market reached $5.268 billion in 2024, with tax contributions amounting to $97.16 million; in the first seven months of 2025, the total betting volume reached $2.4 billion, with tax contributions reaching $56.4 million.

However, this large and still-growing pie is now being gradually eaten away by platforms like Polymarket.

How Prediction Markets Are Undermining the Old World?

On December 3, 2025, Polymarket announced that it had obtained CFTC approval and would return to the U.S. market after nearly four years; even earlier, Kalshi and the prediction market platform Truth Predict under Crypto.com had opened their doors to U.S. users under CFTC approval.

The current regulatory situation is that sports betting is explicitly classified as a gambling service, with regulatory authority belonging to the states, but platforms like Polymarket are generally viewed as new entities providing "event contract" trading services, and "event contracts" are considered financial derivatives in terms of asset nature, falling under the CFTC's regulatory scope. This allows prediction markets to bypass the stringent regulatory restrictions of gambling services — no need to obtain state-level licenses, no need to comply with user protection regulations like addiction control, and no need to pay high gambling taxes to the states; yet they can still offer betting services on sports event outcomes similar to gambling, objectively creating a certain "regulatory arbitrage."

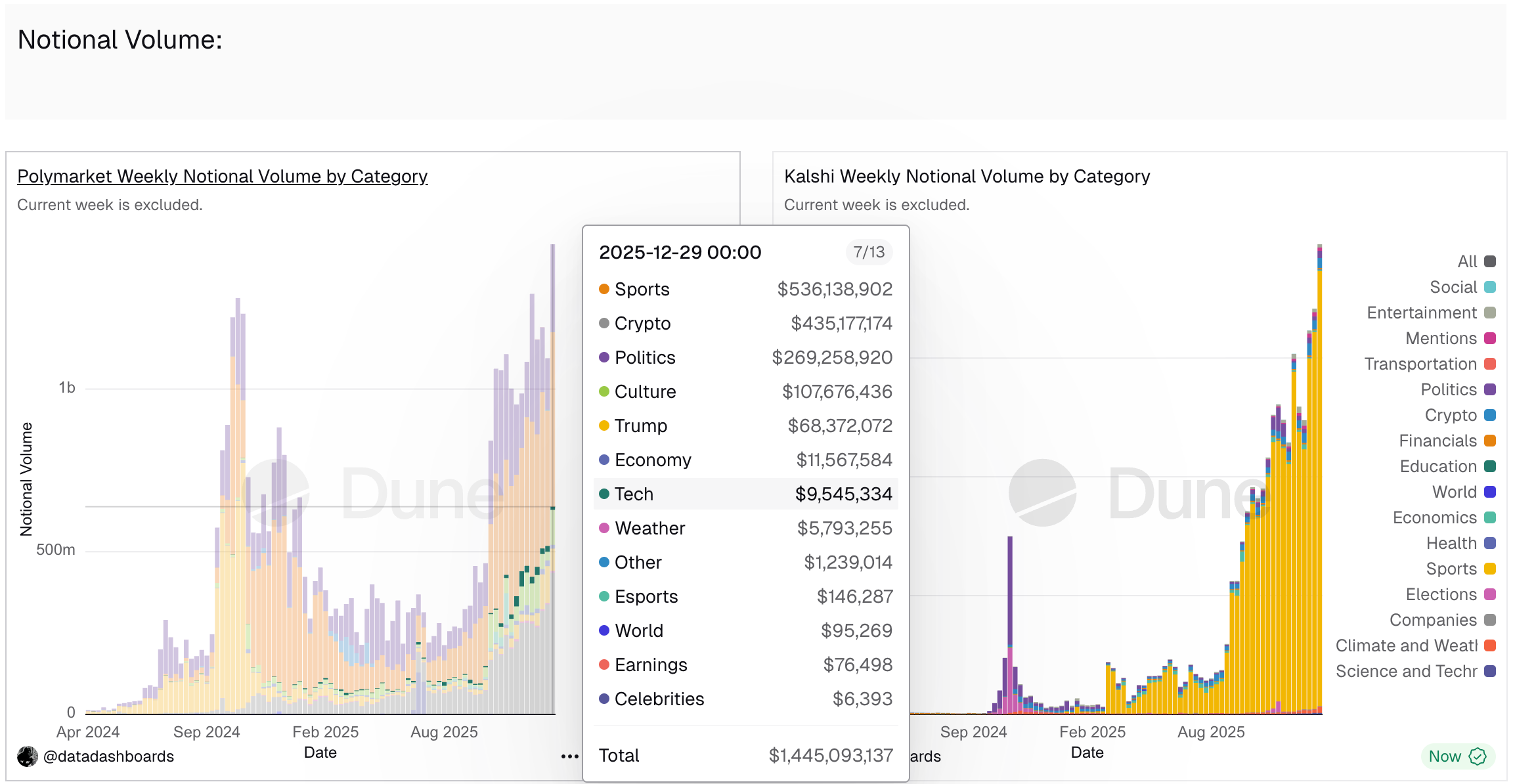

If prediction markets were merely small experimental fields, it might be acceptable, but the reality is that the growth rate of prediction markets is even more outrageous than the already exaggerated sports betting market — in 2025, the total trading volume of prediction markets is expected to be around $40 billion, a nearly 400% increase from $9 billion in 2024. Data Dashboards shows in the data dashboard created on Dune (as shown below) that sports-related event contracts have already become the category with the highest trading volume in prediction markets.

The capital market has long sensed the growing threat that Polymarket poses to traditional sports betting services. The two major giants in the sports betting market, DraftKings and Flutter Entertainment, recorded declines of 11.7% and 16.1% respectively over the past year — during the same period, the U.S. stock market was experiencing a bull run, with the Dow Jones increasing by 12.97% for the year, the Nasdaq rising by 20.36%, and the S&P 500 gaining 16.39%; and the sports betting market has continued its upward trend for eight years.

Whether it is Tennessee, which needs sports betting as a source of tax revenue, or the capital forces behind the sports betting market, it is difficult for them to agree to the new role of prediction markets coming in to take a share.

Frictions Are Not Isolated, How Do Prediction Markets Fight Back?

In fact, Tennessee's ban on prediction markets is not an isolated case; Maryland, Ohio, Illinois, New Jersey, Nevada, Montana, Michigan, and Connecticut have all imposed strict measures against prediction markets for similar reasons. Since Polymarket only returned to the U.S. market last December, Kalshi has faced more regulatory backlash.

In response, Kalshi has filed lawsuits against Nevada, New Jersey, and Maryland, arguing that "it has complied with higher-priority federal regulations and does not need to comply with state regulations," but the outcomes have not been favorable.

- The lawsuit in Nevada began to progress first, with the district court initially supporting Kalshi, but then in November of last year, it ruled against Kalshi. Judge Andrew Gordon determined that Kalshi's sports event contracts were very similar to sports betting, thus falling under the regulatory scope of Nevada's gambling laws. Kalshi has appealed to the U.S. Court of Appeals for the Ninth Circuit;

- In New Jersey, the district court chose to support Kalshi, but the state's gambling regulatory agency has appealed to the U.S. Court of Appeals for the Third Circuit;

- In Maryland, the district court sided with the gambling regulatory agency's request. Judge Adam B. ruled that Kalshi failed to prove that "Congress has clearly and unmistakably intended to deprive states of the power to regulate gambling." Kalshi has appealed this decision to the U.S. Court of Appeals for the Fourth Circuit.

The law firm Benesch commented that, as the national debate continues, similar discrepancies are expected to arise at the appellate court level, which will lay the groundwork for the Supreme Court to resolve this issue in the coming years… If the appellate courts happen to consistently support Kalshi's position, other prediction markets may follow its model and begin to advance similar businesses before the Supreme Court hears the case; however, if the appellate courts reach different conclusions, similarly situated companies may wait for clearer legal signals before taking action. In any case, Kalshi's lawsuit will create a precedent that will have a direct and profound impact on the national sports betting and gambling industry.

In summary, whether prediction markets need to comply with state gambling regulatory laws remains an unresolved issue, and the fundamental contradiction lies in the similarity of product service providers between prediction markets and sports betting, as well as the differences in regulatory requirements.

This is a tug-of-war over institutional adaptation. Until the appellate courts or even the Supreme Court provide a final ruling, the gray area between prediction markets and sports betting will continue to exist for a long time, and regulatory conflicts will be difficult to avoid. In the short term, states may continue to defend their regulatory authority and tax base through enforcement and litigation; while prediction market platforms will attempt to use federal compliance and innovative narratives as a shield to seek greater survival space.

Recommended Reading:

“Why Prediction Markets Are Not Gambling Platforms”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。