无惊无险的度过了周日,这一天都是在学习,从早晨醒来到凌晨几乎都是学习中度过的,连码字都没有来得及,这种充实的生活挺好的,周末最大的事件仍然是川普对于伊朗和委内瑞拉的态度,伊朗川普要接入的概率很大了,而委内瑞拉似乎已经谈好了石油的生意,不过今天美国使馆已经告知美国公民要离开委内瑞拉了。

而且川普好像还暂停了委内瑞拉对古巴石油的输送,看来委内瑞拉的石油被美国“控制”的概率还是挺大的,市场最关注的还是川普的这一系列行动的影响,从目前 $BTC 的价格走势来看,还是挺像上周同期马杜罗被抓的时候,尤其是在美国时间也有小幅上涨,市场处于买账的状态。

当然,现在并不好确定,几个小时以后美股期货开盘,亚洲投资者会先给出的自己的答卷,然后晚上看欧美投资者的答案才能确定。

回到 Bitcoin 的数据来看,周日的换手率是大幅降低了,已经低到最近几个月的最低值了,这也说明了在没有机构和量化干扰下,真实的投资者对于目前交易的兴趣还是很低的。

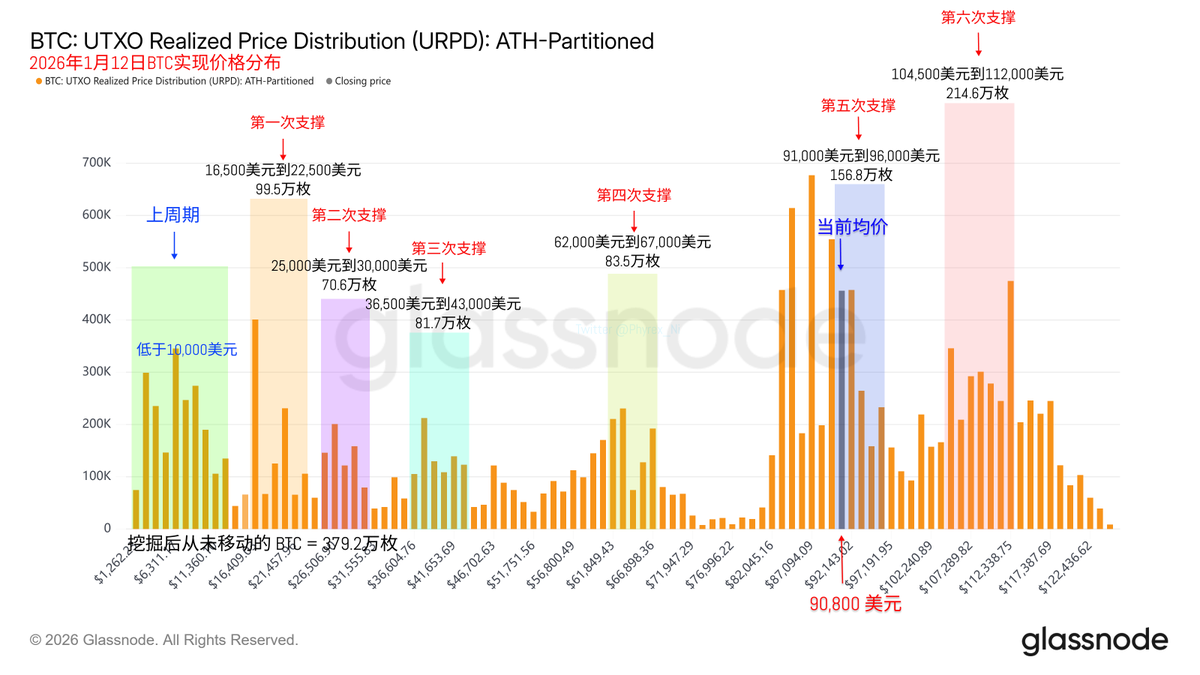

周末的筹码结构也没什么可说的,我现在就在等等看会不会重新出现在 90,000 美元筑底,还是从 83,000 美元筑底的情况,不过更上一层的亏损投资者仍然保持非常高的持仓,并未出现任何恐慌的迹象。

@bitget VIP,费率更低,福利更狠

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。