Crypto rallied after a U.S. operation in Venezuela shifted risk appetite and lifted bitcoin and ether, the operation removed Nicolás Maduro from power on Jan. 3, 2026 and turned long‑shot Polymarket bets into big wins, Ledger confirmed a customer order‑record exposure traced to a third‑party breach, the Electric Coin Company Zcash development team resigned en masse after a governance dispute that rattled ZEC prices, and MSCI kept digital‑asset treasury companies in its indexes, easing an overhang and supporting a relief rally.

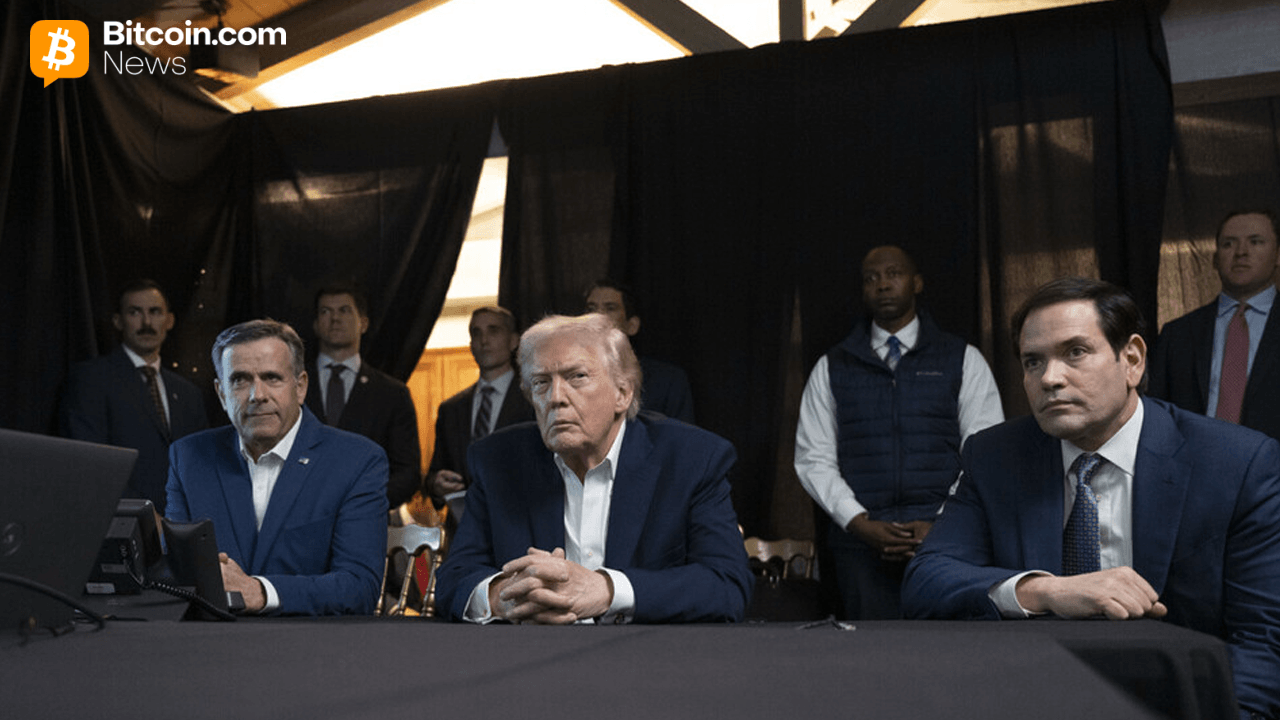

Crypto Rallies as Venezuela Shock Shifts Risk Mood

Bitcoin and ether pushed higher alongside global risk assets following a U.S. operation in Venezuela with options… read more.

Editor’s comment: Geopolitics takes center stage in the opening week of 2026, portending an outsized influence in the direction of the markets this year.

Maduro’s Fall Turns Long-Shot Polymarket Bets Into Overnight Wins

A U.S. military operation removed Venezuelan leader Nicolás Maduro from power early Jan. 3, 2026, abruptly resolving… read more.

Editor’s comment: U.S. authorities will be investigating this. I wouldn’t be surprised if the individual or individuals are already in custody for questioning.

Ledger Responds to Global-e Breach Impacting Customer Order Records

Ledger has confirmed that a recent data exposure affecting some customers originated from its third-party… read more.

Editor’s comment: Moving forward, it’s probably prudent to never buy a hardware wallet over the internet. Get it in person at a store or a conference, and pay in cash.

Zcash Development Team Resigns En Masse as Governance Dispute Rattles ZEC Price

All members of the Electric Coin Company team behind Zcash resigned on Jan. 7 following a governance dispute… read more.

Editor’s comment: Markets have reacted with uncertainty, but the fears seem overboard. In fact, a case could be made that this change is bullish.

MSCI Keeps Crypto Treasury Companies Alive in Indexes, Clearing the Path for a Relief Rally

MSCI’s decision to keep digital asset treasury companies in its global benchmarks lifted a major overhang for… read more.

Editor’s comment: In a surprising move, MSCI decided to keep DATs in indexes even when it seems there’s justifiable cause to remove them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。