Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

In the first week of work after New Year's Day, the A-share market had a strong start, with trading volume exceeding 3 trillion yuan, marking the fifth time in history that A-shares have surpassed this level. At the same time, the Shanghai Composite Index successfully broke through 4100 points. This Friday's U.S. December non-farm payroll report and the Supreme Court's ruling on the legality of tariffs, along with Saturday's decision on tariffs for critical minerals (which will significantly impact Comex silver and platinum group metal prices), together constitute the main uncertainties in the market in the short term. If the tariffs are overturned, while it may boost corporate profits, it could also put pressure on U.S. bonds due to concerns over the fiscal deficit.

The precious metals market is also experiencing increased volatility, with silver prices plunging early due to approximately $7 billion in selling pressure from the Bloomberg Commodity Index's annual rebalancing expectations. Despite this, Bawden Capital's founder has set an extremely high target of $200/ounce based on physical shortages and China's export restrictions. However, Citi pointed out that due to the U.S.'s heavy reliance on silver imports, if tariffs are not imposed, silver prices may temporarily pull back due to metal outflows from the U.S., while palladium is most likely to face high tariffs, with Citi estimating rates could be as high as 50%.

Bitcoin rebounded to a low of $89,311 after rising to nearly $95,000, and is currently consolidating around $91,000. Bullish representative cloakmk analyzed the weekly chart and believes the long-term bull market structure is solid, with prices supported by trend lines. Although there is a risk of short-term liquidation, the overall structure remains intact. Their technical analysis indicates that the 50-day moving average is at $88,000, the 200-day moving average is at $75,000, and the golden cross is still in place, with key support in the $85,000-$88,000 range. The mid-term target is seen at $110,000-$130,000, with an optimistic target of $150,000. Traders Sykodelic_ and VegetaCrypto1 also hold positive views, focusing on targets of $93,600 and $98,000-$100,000, respectively.

However, there are also bearish and cautious viewpoints. TaiBai believes that if the resistance level of $91,200-$91,500 cannot be broken, it presents a potential shorting opportunity. AshCrypto pointed out that there is still a CME gap at $88,200 that needs to be filled. Trader Roman maintains a bearish target of $76,000. On the institutional side, Grayscale is optimistic about reaching new highs in the first half of 2026, while JPMorgan analyst Nikolaos Panigirtzoglou believes that the recent sell-off may be nearing its end.

Ethereum also fell to around $3,000 after reaching $3,300. Lennaert Snyder maintains a bearish view, planning to short at a monthly opening price of $2,970, with a stop loss set at $3,190, and noted that they would only consider short-term operations if there is a failure to test the rebound during the day. Ash Crypto bluntly stated that if Ethereum cannot break its historical high in 2026, despite having an ETF, dominating DeFi, and a deflationary mechanism, the bull market logic for altcoins will completely collapse. After all, compared to Bitcoin's twofold rebound from the bottom, Ethereum's performance has clearly lagged, which may indicate increased risks for long-term holders of altcoins.

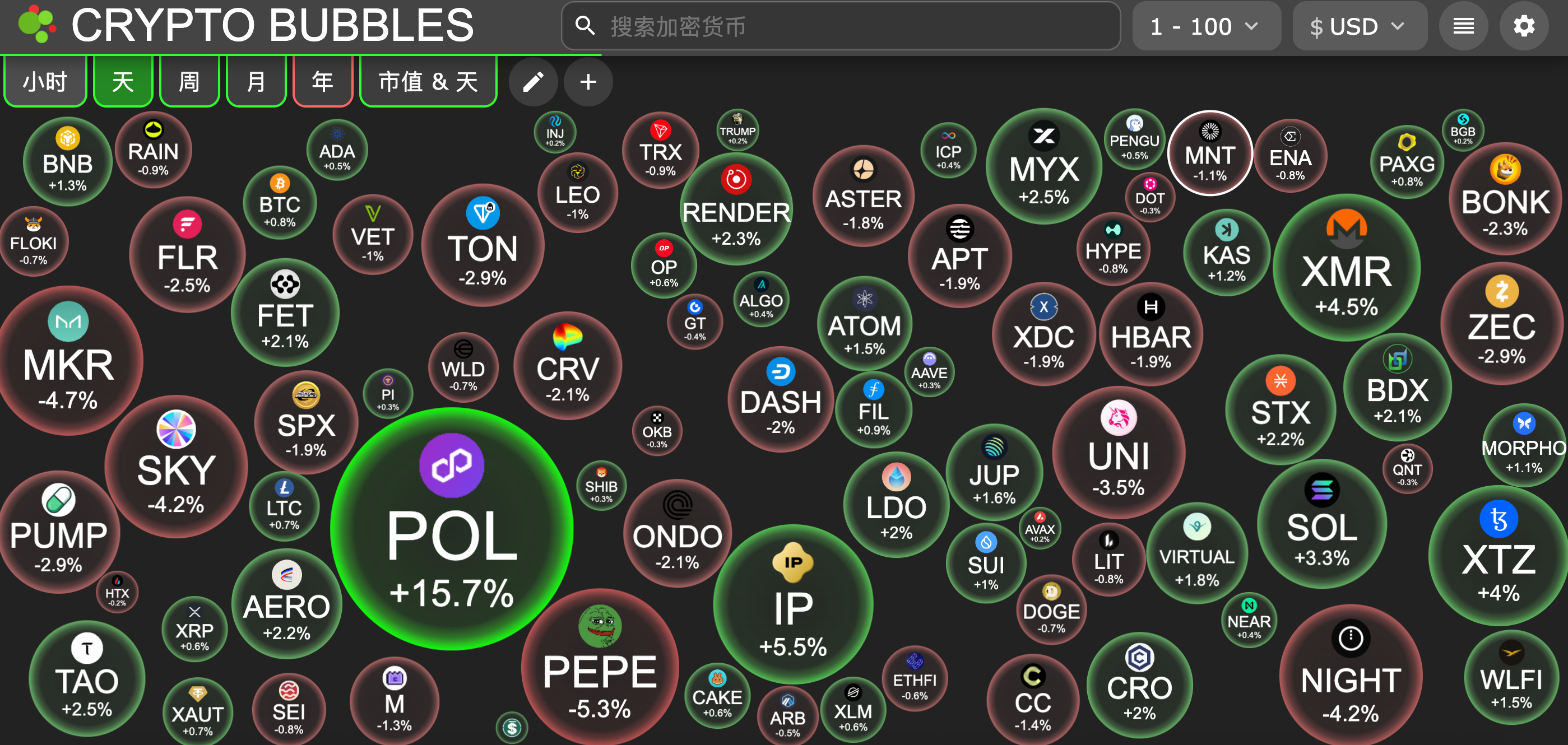

Public chain projects in the altcoin market have recently shown some improvement, with Solana being viewed as the strongest mainstream coin by well-known trader Eugene, targeting $160. If Bitcoin can rebound to $100,000, then SOL could also reach $200, currently rebounding above $140. Additionally, Polygon (POL) rose 15% in a single day due to the launch of the Open Money Stack technology framework and nearing completion of the acquisition of Bitcoin ATM company Coinme (with a transaction amount expected to be between $100 million and $125 million), with a nearly 50% increase for the month. Although Optimism (OP) proposed to use 50% of Superchain revenue for token buybacks starting in February, its price did not rebound due to this positive news. The operation of relying on buybacks to drive token prices up may have already failed under the trial and error of Jupiter's $70 million JUP buyback. (Related reading: Jupiter's $10 million "down the drain," what will save the token price after the buyback fails?) In contrast, the privacy coin Zcash (ZEC) experienced a governance turmoil due to the departure of its development team, causing its price to plummet by 20% to $381. Although the Zcash Foundation clarified that the network's operation is unaffected and the price has rebounded, analysts still provided a pessimistic target of $200-$300. Additionally, the Truebit protocol suffered an attack resulting in a loss of 8,535 ETH, and currently, according to CoinGecko, the token TRU's price has nearly reached zero.

The speculation in the Chinese Meme sector restarted after Binance announced the launch of "Binance Life" spot trading on January 7. On January 8, "I’m Coming" surged 400% after being listed on Binance Alpha, with its market cap once reaching $17 million, but it has now dropped to around $12 million. Related Chinese Meme coins like "Haqimi" have risen over 20%. Furthermore, He Yi's tweet about "Mom" has sparked social media attention on the similarly named token, which surged 300% within 6 hours, currently valued at around $1.3 million. Additionally, a series of related Chinese Meme coins about "Dad," "Son," "Grandson," etc., have emerged in the market. At the same time, the intrinsic value surrounding these Chinese memes has generated significant controversy within the community. (*Note: Content is for reference only, not investment advice, please conduct your own research.)

2. Key Data (as of January 9, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $90,858 (YTD +7.8%), daily spot trading volume $42.95 billion

Ethereum: $3,110 (YTD +4.3%), daily spot trading volume $25.22 billion

Fear and Greed Index: 27 (Fear)

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

Market share: BTC 58.7%, ETH 12.1%

Upbit 24-hour trading volume ranking: XRP, ETH, BTC, MED, ZKP

24-hour BTC long-short ratio: 49.77% / 50.23%

Sector performance: The crypto sector generally declined, with the RWA sector leading the decline by nearly 5%

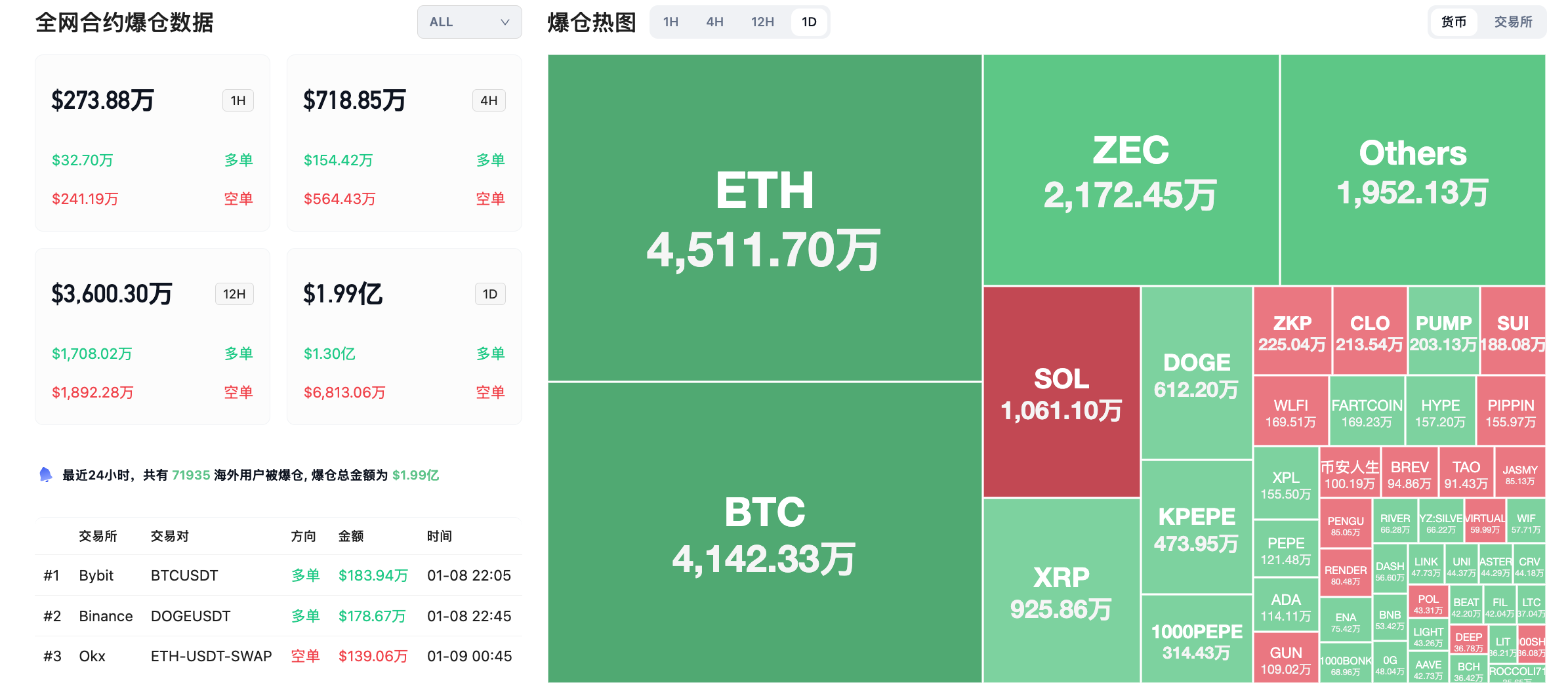

24-hour liquidation data: A total of 71,935 people were liquidated globally, with a total liquidation amount of $199 million, including $41.42 million in BTC, $45.12 million in ETH, and $21.72 million in ZEC.

3. ETF Flows (as of January 8)

Bitcoin ETF: -$400 million, net outflow for three consecutive days

Ethereum ETF: -$159 million, with BlackRock ETHA accounting for over 60%

XRP ETF: +$8.72 million

SOL ETF: +$13.64 million

4. Today's Outlook

Binance Alpha will launch DeepNode (DN) airdrop on January 9

Binance will delist multiple spot trading pairs including 1000SATS/FDUSD, AEVO/BTC on January 9

The U.S. Supreme Court may rule on tariff issues (January 9)

U.S. December unemployment rate: expected 4.5%, previous 4.6% (January 9, 21:30)

U.S. December non-farm payroll change (10,000): expected 6.5%, previous 6.4 (January 9, 21:30)

The results of the U.S. 232 tariff investigation may be released on January 10

Movement (MOVE) will unlock approximately 164 million tokens at 8 PM Beijing time on January 9, with a circulation ratio of 5.77%, valued at approximately $6.1 million;

Linea (LINEA) will unlock approximately 1.38 billion tokens at 7 PM Beijing time on January 10, with a circulation ratio of 6.34%, valued at approximately $9.8 million;

Aptos (APT) will unlock approximately 11.31 million tokens at 10 AM Beijing time on January 11, with a circulation ratio of 0.70%, valued at approximately $21.6 million;

The largest gainers among the top 100 cryptocurrencies today: POL up 15.7%, Story up 5.5%, Monero up 4.5%, Tezos up 4%, Solana up 3.3%

5. Hot News

Bitmine stakes over 1 million ETH, accounting for a quarter of its total holdings

The long position scale of "Strategy's counterparty" exceeds $200 million

Morgan Stanley plans to launch a digital wallet this year to support tokenized assets

Optimism proposes to use 50% of Superchain revenue for OP token buybacks

ZEC falls over 18% in a day, following the collective departure of the ECC team supporting Zcash

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。