Written by: Nancy, PANews

It's already 2026, and by now, the story of NFTs should have turned a new page.

Once auctioned for astronomical prices, most NFTs have now become little images that no one cares about; many NFT projects are struggling to pivot, sell, or shut down; the once top-tier event NFT Paris recently announced its cancellation and even fell into refund disputes.

In a continuous downtrend over the past few years, with hot money exiting and narratives failing, "NFTs are dead" seems to have become a market consensus.

However, in the week of 2026, the NFT market unexpectedly showed signs of recovery, with prices rising and trading volumes warming up. Are NFTs really back? What are the players who still remain in the market currently engaging in?

A New Year’s Opening with Price Increases "Feels Like a Different Era"

Entering 2026, the long-silent NFT market finally stirred with a hint of long-lost ripples.

According to CoinGecko data, since the beginning of 2026, the overall market value of NFTs has increased by over $220 million in the past week. Data from NFT Price Floor further indicates that in the past week, hundreds of NFT projects have seen price increases, with some projects even recording gains in the three to four-digit range. For players who have endured several years of downtrends, the fantasy has long been shattered, and this market situation feels like a different era.

Although this is just a drop in the bucket compared to historical highs, compared to the freezing point at the end of 2025, the long-awaited green market is still enough to provide some comfort to the players who have held on.

However, peeling back the veil of rising prices, the current market recovery seems more like a game of existing funds within a very small scope, rather than a true revival brought about by new funds. The extreme lack of liquidity is a fatal flaw that the current market cannot ignore.

From the weekly transaction volume perspective, among over 1,700 NFT projects, only 6 reached the million-dollar transaction level, 14 had transaction volumes in the hundreds of thousands, and only 72 were in the tens of thousands range. Overall, this is very scarce. Even for the higher-volume leading projects, the number of actively traded NFTs accounts for only a single-digit percentage of the total supply, with the vast majority of NFTs having transaction numbers in the single digits or even zero.

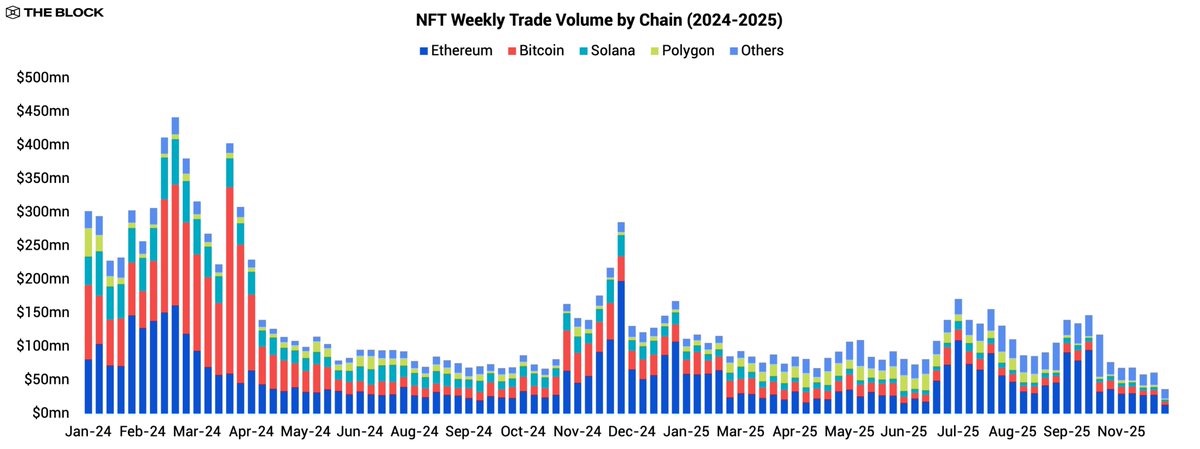

In fact, The Block's 2025 report also showed that there was no strong influx of re-entry funds into the NFT market throughout the year, speculative enthusiasm significantly cooled, and the multi-chain flourishing pattern returned to Ethereum's dominance. The total transaction volume for that year dropped to $5.5 billion, a decrease of about 37% compared to 2024; the total market value of NFTs shrank dramatically from about $9 billion to around $2.4 billion.

These data indicate that the so-called recovery has not changed the fact that NFTs have long extinguished. Today's NFTs have already become "old assets," with only old players trapped within, while new funds have long ceased to be interested.

The Great Escape and Survival Stories, Funds Flowing to New Battlefields

In this prolonged deep winter cold wave, from infrastructure to blue-chip projects, various forms of survival stories are unfolding.

For example, the trading leader OpenSea is no longer fixated on JPEG images but is transforming its token trading business through airdrop incentives; the once mainstream NFT blockchain Flow is beginning to explore DeFi growth points; Zora has abandoned the traditional NFT model and shifted to a new track of "content as tokens"; even the iconic NFT Paris event was canceled due to depleted funds and has been reported to be unable to refund sponsorship fees, highlighting the industry's predicament.

Even those leading NFTs that still show some vitality have fallen into the strange loop of "getting applause but not sales," where successful brand influence has not translated into a price moat. For instance, while Pudgy Penguins has successfully raised IP awareness in the mainstream world and physical toys are selling well, it still cannot escape the gravitational pull of floor price and token price declines.

Moreover, the decisive exit of Web2 giants like Reddit halting NFT services and Nike selling its RTFKT further shatters the last fantasies of mainstream adoption.

However, the decline of NFTs does not mean the disappearance of collecting and speculative demand; the funds have simply shifted to a new battlefield. Compared to virtual images on-chain, the physical markets for trendy toys, cards, and others are still being heated up, such as Pokémon TCG with trading volumes exceeding $1 billion and revenues over $100 million.

Not only ordinary collectors but even crypto elites are starting to vote with their feet, returning to physical assets and top collectibles.

For example, crypto artist Beeple has turned his attention to creating physical robots, with his Elon Musk and other celebrity robot dogs selling out; Wintermute co-founder Yoann Turpin jointly invested $5 million to purchase dinosaur fossils; Animoca founder Yat Siu splurged $9 million on a Stradivarius violin; and Tron founder Justin Sun bought the high-priced banana artwork "Comedian" for $6.2 million.

In the current market environment, ordinary investors need to face the reality of NFT liquidity exhaustion.

Goodbye to the Logic of Little Images, These NFTs Are More Popular

After experiencing the baptism of a bubble burst, the NFT market has not fallen into a complete liquidity drought but has shifted towards targets with high risk-reward ratios or clear value support.

- Speculative and Arbitrage Demand: Some players believe the market has hit bottom and are buying to capture price mismatches for short-term trading; this behavior has a high risk-reward ratio.

- "Golden Shovel" Attribute: These are currently the NFTs with the highest market participation and liquidity. Essentially, these NFTs are no longer collectibles but financial certificates for obtaining future token airdrops, mostly meaning gaining airdrop/whitelist eligibility. However, the expectation of landing often becomes a negative factor; once the snapshot is completed or the airdrop is issued, if the project does not empower the NFT with new capabilities, the floor price often plummets rapidly, even to zero. Therefore, these NFTs are more suitable as short-term investments or arbitrage tools rather than long-term value storage.

- Celebrity/Top Project Endorsements: The value of these NFTs is driven by attention economics, and endorsements from celebrities or top projects often significantly enhance visibility and liquidity, creating short-term premiums. For example, the leading DEX HyperLiquid's earlier airdrop NFT series Hypurr NFT surged after its launch; Ethereum founder Vitalik Buterin's recent change of profile picture to a Milady NFT led to a noticeable increase in its floor price.

- Top IPs: These NFTs have often moved beyond simple speculation, with investment logic leaning more towards cultural recognition and collectible value, making their prices relatively resistant to declines and providing long-term value storage functions. For instance, CryptoPunks was officially included in the permanent collection of the Museum of Modern Art (MoMA) at the end of last year.

- Acquisition Narratives: When a project is acquired by more powerful investors, the market will reprice, expecting its IP monetization ability and brand moat to strengthen, thus driving prices up. For example, Pudgy Penguins and Moonbirds both saw significant price increases after being acquired.

- Integration with Real-World Assets: By bringing real assets on-chain, NFTs can gain clear physical value support, while reducing downside risks and enhancing their ability to reach outside the circle. For instance, the recently popular Pokémon card tokenization platforms Collector Crypt and Courtyard allow users to trade ownership of cards/items on-chain, with the physical items being held by the platform.

- Utility Functions: NFTs are returning to their tool attributes, serving specific application scenarios. For example, NFT ticketing, as voting rights for DAO decisions, and AI on-chain identities (such as Ethereum's ERC-8004 introducing NFT-based AI agent identities) etc.

From this perspective, compared to chasing meaningless little images, NFTs with practical utility or clear upward expectations are gradually becoming the focus of funds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。