热点要闻|

1:【美国加密市场结构法案谈判遇阻:DeFi 监管与稳定币收益成主要分歧】

2:【日本债市抛售潮在新年继续延续】

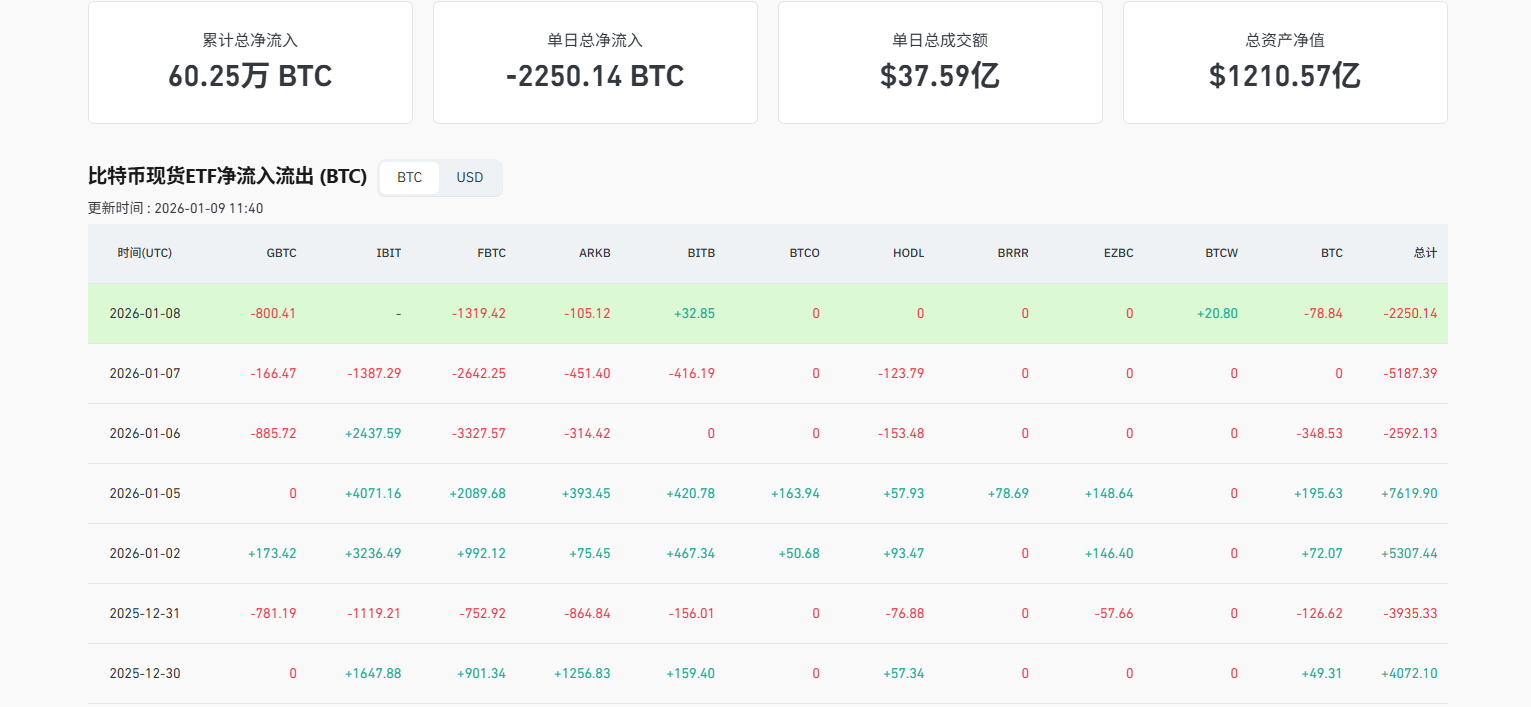

比特币以太坊今日怎么看,比特币的开门红表演或已结束,反弹95000止步回调下跌还在继续延续,从本周的盘面来看大饼的现货ETF依旧是处于持续流出.

我们先说一个关于micro strategy的事儿,Strategy作为比特币的第一期公司呢,它主要业务就是屯币,前段时间它的股票,是一直下跌,之前都跌到MSI指数。常言说是要剔除这个股票在他的整个指数列表中,但是,就在昨天MSCI忽然表示说,我暂时先不把你剔除了,这话音一落,Strategy的股票,就盘后上涨涨了6%,那目前来看,就只能说明strategy暂时没有那么危险了,但是从长期的角度来讲,它的风险还没有消失,而且即便如此,经过这么一折腾,市场上对他的信心是又大打折扣。

另外再说一下昨天的初请失业金数据,前值20;预测值21,公布值20.8.数值相差不大,所以影响不大,最重要的,还是要等今晚的非农,所以今天的行情,可能会比较平淡,周五才会有一些数据性推动的大的变盘,,

BTC:大饼昨天早盘经过一轮快速下跌后,晚间数据公布后插针最低至89100附近,也就是在1月3号的第一波机构进场的成本平台位,1小时线处于一个周期性的二次回踩确认支撑,虽然目前没有有效跌破89000一线的支撑,但是从4小时 12小时的量价关系来看,依旧处于一个下跌通道的空头趋势,大饼目前处于一个多空博弈的窄幅震荡区间,多头确认看91500能否站稳,站稳了第二波的发力才能有延续性,下方空头90400.跌破就会去89000-85700的底部强支撑。

ETH:以太坊的支撑区域在3050-3030.压力区在3150-3180.所以以太坊今天的操作也是同步大饼,在整理阶段,结构性的震荡收窄行情下,没有强烈的突破信号,回踩到支撑位没有继续突破就可以低吸做多,反弹到压力位没有继续突破,量能跟不上就先减仓,等待二次回踩在继续低吸。

一句话总结今天的日内操作 。白盘缺少流动性,等待晚上的数据公布。白盘窄幅震荡,吃一点就走,不要贪杯哦。避免被这种横盘来回洗,等到新的趋势方向爆发的时候我们才不会慌。 所以回踩支撑做多,反弹到压力做空吃一点就好,是今天最稳的节奏了。

过去的这轮牛市,我反复强调的一点是我认为现在加密市场的底层逻辑已经变了,决定市场走势的要素会比以前更加复杂,而这种复杂性是以前的牛熊市中投资者未曾经历过的。 我是汤米,一个边交易边修行的B圈陪跑人,想要实时的进场关键点位和私人定制策略的,点击我的主页,加入社群。 我们有专业的实盘交易老师全天候的陪跑,帮你稳住心态,不要自己一个人硬扛。

点位有时效性,帖子发送有延迟,所以具体请以实时行情为准。 最后大家还是要记住我上一篇文章中提到的本周的两个重点,短线以试仓为主,一旦脱离我们的目标区间就是年底前吃大肉的最后上车机会 我是K线人生汤米 你的加密实时管家更多相关币种解析请详情关注公众号添加了解。↓

主要面向现货、合约、BTC/ETH/ETC

擅长风格:K线交易

独创成交量交易战法.

短线波段高低位,中长线趋势单,日线极限回踩,周K顶部预测,月线头部预测

公众号二维码(K线人生汤米)

温馨提示:文末只有微信公众号是笔者本人所创!!

请大家谨慎辨别真假,感谢阅读!!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。