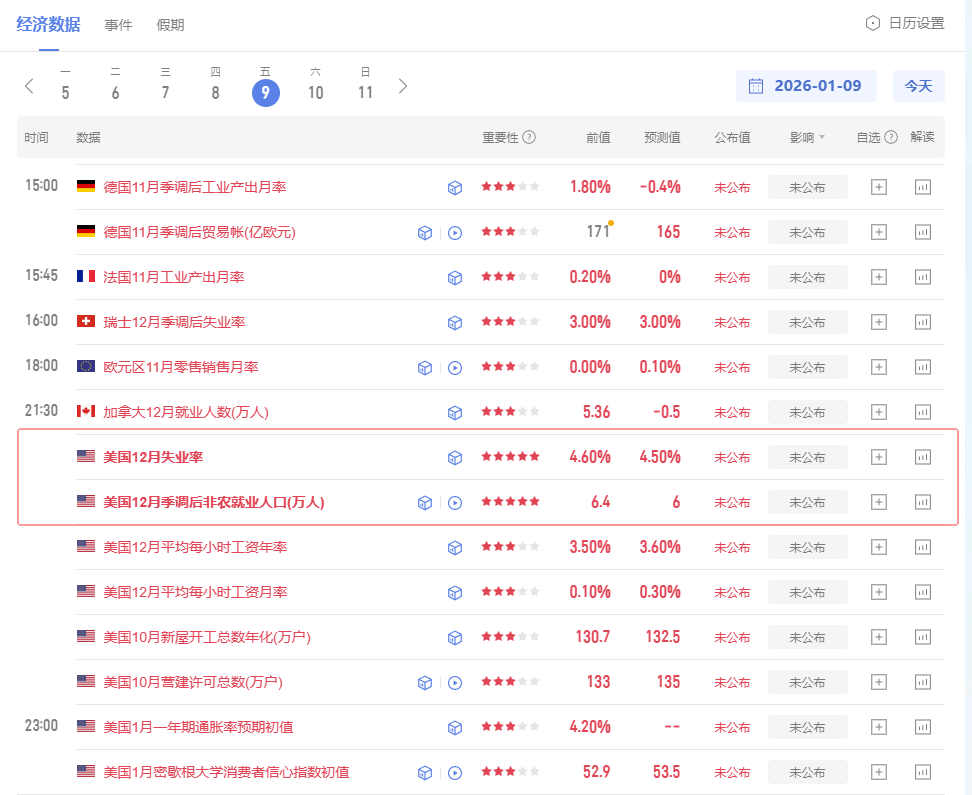

The cryptocurrency market experienced a rollercoaster, with Bitcoin testing the 90,000 mark and Ethereum the 3,100 mark in a thrilling game of "loss and recovery." The selling pressure triggered by initial jobless claims data falling short of expectations was alleviated by significant interest rate cut signals from Federal Reserve officials and the U.S. Treasury Secretary, leading to a rapid rebound for both cryptocurrencies, reclaiming key levels. However, it is important to be cautious as the current rebound momentum is not yet solidified. Tonight's U.S. non-farm payroll report will be the core variable determining the short-term trend, and both cryptocurrencies will face an ultimate test of their key support levels.

Yesterday, the market showed significant fluctuations. The initial jobless claims data released in the evening fell short of expectations, reinforcing market concerns about weak economic recovery, but did not boost rate cut sentiment as anticipated, instead leading to a slow decline in the cryptocurrency market. Bitcoin dipped to around 89,200, while Ethereum fell to the 3,050 area, nearly erasing the gains accumulated at the beginning of the week, causing a slight increase in market panic.

A turning point emerged with intensive policy statements in the evening. U.S. Treasury Secretary Janet Yellen publicly expressed the government's urgent need to lower interest rates and explicitly urged the Federal Reserve to implement further rate cuts; at the same time, Federal Reserve official Neel Kashkari reiterated the call for significant easing, suggesting a 150 basis point cut by 2026 to boost the job market. The concentrated calls for rate cuts from these two key figures significantly strengthened market expectations for easing, effectively alleviating the previous selling pressure, and funds quickly flowed back into the cryptocurrency market. As a result, Bitcoin rapidly rebounded, reclaiming the 90,000 mark and continuing to rise above 91,000 in the early hours; Ethereum also rebounded, returning above the critical 3,100 mark, temporarily warming market sentiment.

From a technical perspective, both cryptocurrencies' rebounds relied on key support levels, but the overall weak pattern has not completely reversed. For Bitcoin, the price received effective support after touching the mid-line of the daily chart and began to rebound; however, the daily RSI indicator remains in a bearish crossover state, indicating ongoing medium to long-term pressure. The four-hour chart shows positive signals, with the RSI indicator turning upward from the oversold zone and the MACD bearish volume continuing to shrink, indicating that short-term correction momentum is waning; however, the hourly chart shows signs of weakening rebound momentum, suggesting a high probability of a rebound repair demand during the day. Under the overall weak tone, caution is needed regarding the risk of insufficient correction repair strength. For intraday operations, the short-term resistance to watch above is the mid-line of the four-hour chart at 92,000 and the 93,000 area, while support remains focused on the 90,000 mark and the previous low around 89,000.

Ethereum's movement is highly synchronized with Bitcoin. After a weak decline yesterday, it found support around 3,050 (the mid-line of the daily chart) and quickly rebounded, returning above 3,100, but the rebound momentum was insufficient in the early hours, peaking only around 3,140 before stagnating. The technical indicators also show a divergence between bulls and bears: the daily RSI and MACD indicators still indicate a bearish advantage, with medium to long-term pressure unchanged; although the four-hour chart shows signs of a volume-reducing correction, the hourly chart performance is weak, raising doubts about the sustainability of the rebound. Today, it is crucial to focus on the rhythm of the correction repair, with the 3,050 area as the core defensive level for short-term corrections, and the 3,000 mark as an important psychological barrier; the short-term resistance above is at the upper line of the hourly chart at 3,160 and the mid-line of the four-hour chart at 3,200. If buying pressure continues to strengthen, pushing the price to break through resistance, there may be an opportunity to test the 3,230-3,250 area.

In summary, the current market rebound is more driven by expectations of policy easing, with insufficient internal momentum, likely focusing on rebound repair during the day. The market's core focus is entirely on tonight's U.S. non-farm payroll report, as the data performance will directly impact market expectations for the Federal Reserve's rate cut pace, leading to significant market volatility. It is advisable to remain cautious in operations, avoiding blind chasing of price increases or decreases, and to focus on the gains and losses of key support and resistance levels for both cryptocurrencies, waiting for the non-farm data to clarify the operational direction.

This article is exclusively contributed by Jane Crypto (WeChat public account: Jane Crypto) and represents personal views only. Due to the timing of the article's release, the above views or suggestions may not be timely and are for reference only; risks are borne by the reader. Trade with reasonable position control, and avoid heavy or full positions. Developing good investment habits is essential for a positive cycle!

Market fluctuations are time-sensitive; feel free to scan the QR code to follow the public account for daily market information and real-time communication.

Friendly reminder: This article is solely owned by the column public account (as shown above) of Jane Crypto, and any other advertisements at the end of the article or in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity, and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。