The record influx of funds into global stock ETFs coincides with a temporary calm in the cryptocurrency market, as a report from JPMorgan reveals key signals of a shift in market sentiment.

Bitcoin and Ethereum ETFs are showing "signs of bottoming out" in fund flows, while perpetual contracts and CME Bitcoin futures positions indicate that selling pressure is easing.

On January 9, 2026, an analysis team led by JPMorgan Managing Director Nikolaos Panigirtzoglou released a report, clearly stating that the previous "de-risking" process in the crypto market may be nearing its end.

The report specifically noted that MSCI's decision not to exclude Bitcoin and crypto asset reserve companies from the global stock index in its February 2026 index review provides "at least a temporary relief" for the market.

01 Market Turning Point

● JPMorgan's latest analysis report reveals a key market turning signal. The report points out that despite outflows from Bitcoin and Ethereum ETFs in December 2025, several indicators began to show signs of improvement as January 2026 began.

● Global stock ETFs recorded a historic monthly net inflow of $235 billion during the same period, creating a stark contrast. This divergence in fund flows indicates that investors are readjusting their asset allocation strategies.

● The report emphasizes that fund flows from Bitcoin and Ethereum ETFs have shown "signs of bottoming out." At the same time, the positions in perpetual contracts and CME Bitcoin futures indicate that market selling pressure is significantly easing.

● The JPMorgan analysis team believes that the phase of retail and institutional investors synchronously reducing positions during the fourth quarter of 2025 has "likely ended." This judgment is based on a comprehensive analysis of market participants and trading data.

02 De-risking Process

According to JPMorgan's report, the recent pullback in the crypto market is not due to deteriorating liquidity but rather triggered by systematic de-risking operations prompted by specific events.

● The real trigger was MSCI's statement regarding MicroStrategy's index status on October 10, 2025. This statement raised concerns in the market about the potential exclusion of crypto asset-related companies from major stock indices.

● This concern led to a series of chain reactions, prompting investors to systematically reduce their risk exposure related to cryptocurrencies. This de-risking operation covered a wide range of market participants, from retail to institutional investors.

● Current market signs indicate that this event-driven de-risking process "is essentially complete." The phase of panic selling in the market has passed, and investor sentiment is gradually stabilizing.

03 ETF Fund Flows

● The fund flow situation of crypto market ETFs has become an important window for observing market sentiment. In December 2025, Bitcoin and Ethereum ETFs experienced a significant outflow phase, contrasting sharply with the record inflows into global stock ETFs.

● JPMorgan's report notes that this divergence phenomenon showed signs of change in January 2026. The outflow rate from Bitcoin and Ethereum ETFs slowed, indicating stabilization signals. This change is closely related to MSCI's latest decision. In the February 2026 index review, MSCI decided not to exclude Bitcoin and crypto asset reserve companies from the global stock index.

● This decision provides important psychological support for the market, especially for companies like Strategy (formerly MicroStrategy) that hold large amounts of Bitcoin. The response of institutional investors to this decision will be a key influencing factor for future fund flows.

04 Institutional Outlook Consensus

In addition to JPMorgan's judgment, several top financial institutions have formed a rare consensus on the 2026 crypto market. More than 30 institutions believe that the crypto industry is entering an "industrialization phase" driven by ETFs, stablecoins, RWA, and AI infrastructure.

● Institutions such as a16z, BlackRock, Coinbase, and Grayscale unanimously believe in their 2026 outlook that the traditional "four-year cycle" of Bitcoin is becoming ineffective. The structural changes among market participants are the main reason behind this trend.

● With the popularization of spot ETFs and the improvement of compliance frameworks, systematic fund flows based on asset allocation models from institutional investors are replacing the previously volatile cycles dominated by retail sentiment and halving narratives.

● GATE's analysis report indicates that this phase is professionally referred to as the "industrialization phase," marking a historic transition for the crypto asset industry from "youthful restlessness" to "adult stability."

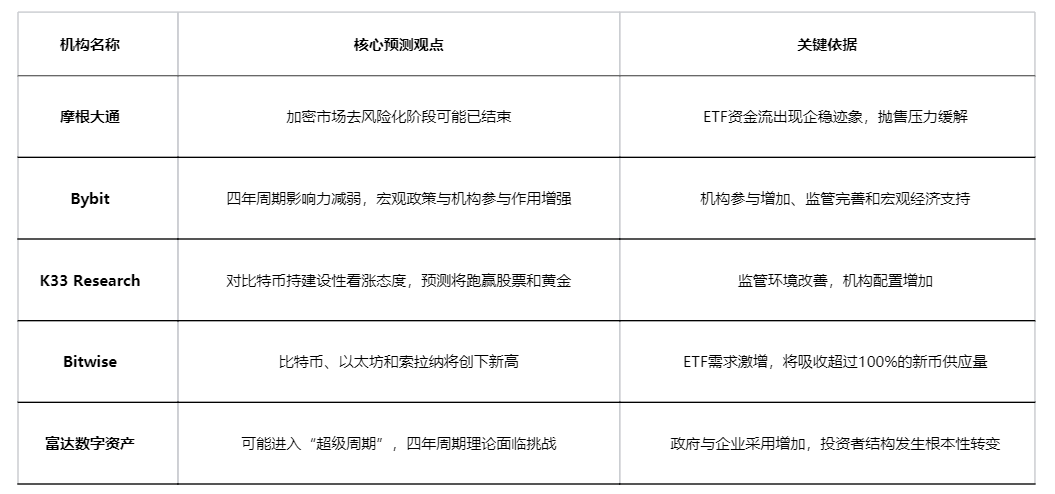

05 Diverse Market Predictions

● Different institutions provide diverse perspectives and specific predictions for the development of the 2026 crypto market. Bybit's 2026 crypto outlook report states that while historical cycles still hold reference value, their influence may weaken with the evolution of macroeconomic policies, institutional participation, and market structure.

● K33 Research holds a constructive bullish attitude for 2026, predicting that Bitcoin will outperform stock indices and gold. They believe that the benefits brought by regulatory victories will outweigh the impact of capital allocation, expecting broader crypto legislation to be signed at the beginning of the year through the Clarity Act.

● Bitwise predicts that Bitcoin, Ethereum, and Solana will reach new highs before 2026. The company expects ETFs to purchase more than 100% of the new issuance of Bitcoin, Ethereum, and Solana, while the growth of stablecoins and tokenization will guide institutional capital flows on-chain.

● Fidelity Digital Assets Research Vice President Chris Kuiper proposed the possibility of a "super cycle," suggesting that we may be entering a phase of a bull market that could last for years. He also noted that while the four-year cycle may weaken, the fear and greed emotions that trigger them have not disappeared.

The table below summarizes the core predictions of various institutions for the 2026 crypto market:

06 Structural Transformation

The 2026 crypto market is undergoing profound structural transformations that may redefine the future trajectory of the industry. Stablecoins and Real World Assets (RWA) are becoming focal areas of institutional attention.

● a16z crypto defines stablecoins as the future "internet-based settlement layer," expecting them to completely surpass their role as mere intermediaries for trading pairs. Data shows that stablecoin trading volume reached $9 trillion in 2025, rivaling Visa and PayPal.

● In the RWA sector, Grayscale predicts that regulated and institution-driven tokenized assets will see a 1000-fold growth by the 2030s. Coinbase has proposed the concept of "Tokenization 2.0," emphasizing the value of "atomic-level composability."

● The integration of artificial intelligence and blockchain has entered a new phase. a16z crypto views the "agent economy" as a core trend for 2026, proposing a new compliance framework of "Know Your Agent" (KYA). Blockchain will become the financial track for AI agents, supporting their autonomous trading and payment needs.

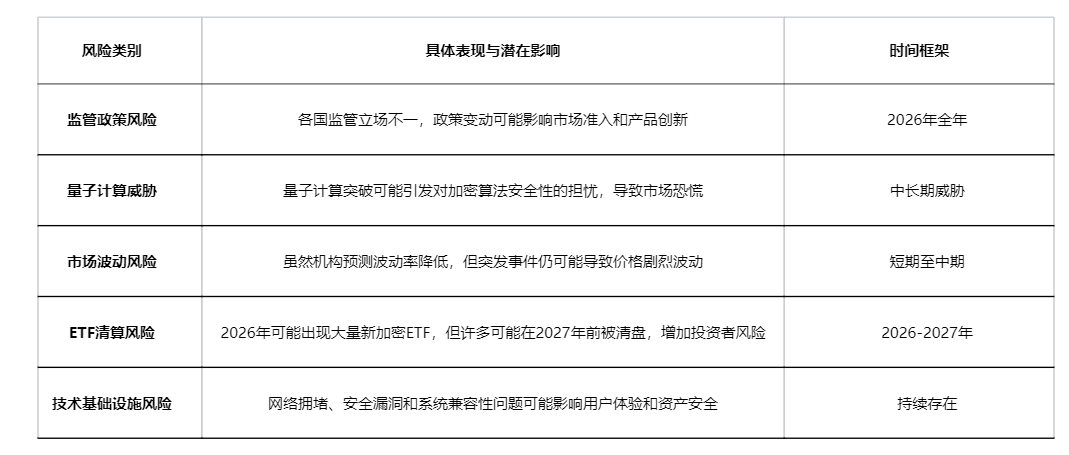

07 Risks and Challenges

Despite the optimistic market outlook, the 2026 crypto market still faces multiple risks and challenges. The uncertainty of regulatory policies is the primary concern, as countries' regulatory stances on crypto assets are still evolving.

● The development of quantum computing may pose a long-term threat. Pantera Capital has raised the possibility of "quantum panic," suggesting that the scientific community may achieve breakthroughs in error-correcting qubits in 2026, potentially triggering panic selling in the market. However, Coinbase believes this will only be noise in 2026 and will not affect valuations.

● Market volatility and liquidity risks still exist. Although institutions generally predict that volatility will decrease, unexpected events may still trigger severe market fluctuations. Meanwhile, Bloomberg analyst James Seyffart expects a surge in crypto ETF issuances in 2026, but many products may be liquidated or delisted before 2027.

Technical risks and infrastructure challenges cannot be overlooked. As blockchain application scenarios expand, issues such as network congestion, security concerns, and compatibility between old and new systems may become prominent.

08 Future Outlook

Looking ahead to 2026, the crypto market stands at a critical juncture of transitioning from fringe experimentation to mainstream financial infrastructure. JPMorgan's judgment on the end of the de-risking phase aligns with observations from multiple institutions regarding structural changes in the market, outlining a more mature and institution-driven market landscape.

● ETFs will continue to play an important role in the market, but the focus will shift from mere fund inflows to product quality and sustainability. As regulatory frameworks improve, compliance will become a basic requirement for market participants rather than a competitive advantage.

● Technological innovation will continue to drive market development, especially in the areas of stablecoins, RWA, and the integration of AI with blockchain. These technologies will not only create new investment opportunities but also push blockchain technology deeper into the real economy.

● Investors need to adapt to the new market environment, shifting from reliance on cyclical narratives to focusing on fundamentals, fund flows, and regulatory developments. In this "industrialization phase," long-term value and practical utility will become key indicators of project success.

The future of the crypto market will no longer be solely about price fluctuations but about how technology reshapes financial infrastructure, how assets achieve global liquidity, and how value is redefined in the digital age.

As JPMorgan analysts focus on fund flow data, determining that the most challenging de-risking phase of the crypto market may be ending, over 30 top global institutions are already planning the new landscape of crypto in the post-cycle era.

The pulse of the crypto market is changing its rhythm, shifting from the dramatic volatility driven by retail sentiment to the systematic flows of institutional capital allocation.

The four-year cycle theory is gradually fading in the wave of ETFs and the process of institutionalization, replaced by the steady development logic of the "industrialization phase." Market participants must recalibrate their expectations and strategies to adapt to the rhythm of this maturing new financial ecosystem.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。