XRP年初的反弹在1月8日遇到了一个显著的技术障碍,令该代币回落至2.10美元的支撑位以下。这一波动与XRP现货交易所交易基金(ETF)自2025年末首次推出以来首次记录的净流出相吻合,流出总额约为4100万美元。

阅读更多:比特币ETF流出4.86亿美元,XRP首次出现流出

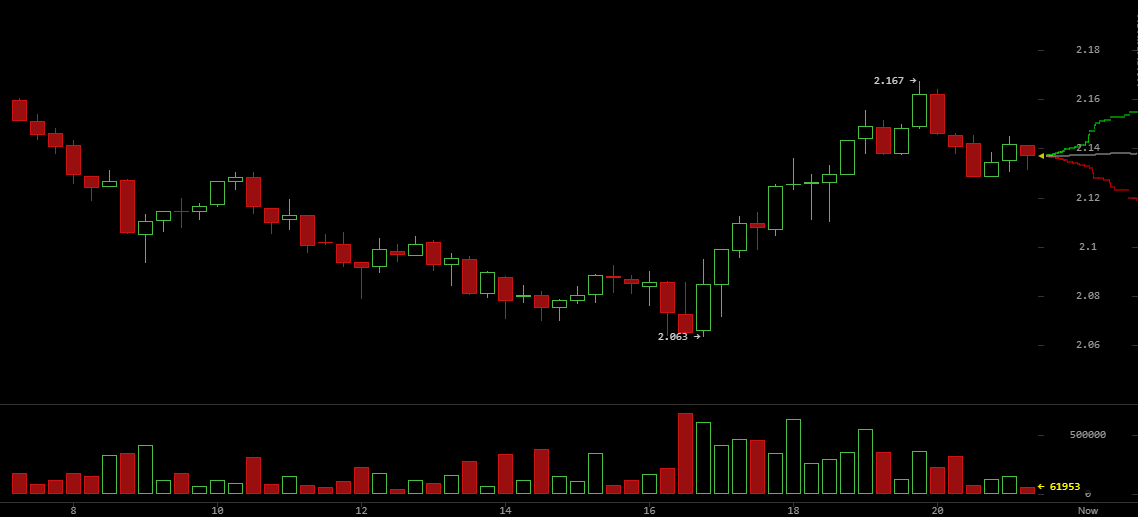

根据Bitstamp的数据,该资产在东部标准时间上午9:45建立了2.06美元的日内底部,随后小幅反弹回到2.10美元的水平,标志着2026年前六天所定义的看涨情绪的急剧减缓。

这一修正发生在两天前,当时XRP的价格达到了约2.41美元,这是自2025年11月中旬以来的最高估值。在这一高峰时,XRP的市值膨胀至1440亿美元,成为推动整个加密经济突破3.3万亿美元里程碑的主要催化剂。

然而,这一势头证明是短暂的。该资产随后屈服于更广泛的市场修正,抹去了大部分年初至今的涨幅。随着这一最新的价格走势,XRP距离其心理支撑位2美元仅一步之遥,这一情景在1月6日的高点时显得极不可能。从2.41美元的高峰急剧回落,实际上将短期动能从看涨转变为修正或看跌阶段。

相对强弱指数(RSI):14天RSI在1月8日暴跌至28.43。虽然这将该资产牢牢置于超卖区域——通常是反弹的前兆——但它确认了当前市场上看跌压力的主导地位。

移动平均收敛发散(MACD):MACD发出了卖出信号,值为-0.038。在较短的时间框架内,MACD失去了看涨的背离,进入负区间,表明下行趋势正在增强。

移动平均线:数据显示,XRP在多个日内图表上已跌破其200期移动平均线,这一举动通常被交易者解读为结构性弱点的信号。此外,14天简单移动平均线(SMA)现在作为动态的上方阻力,价格走势显著低于近期平均水平。

底线:整体技术展望目前呈看跌至中性。尽管2026年的整体结构性上升趋势在技术上仍然完好,但前所未有的ETF流出和200期指数移动平均线(EMA)的突破有效地中和了“新年反弹”的狂热。

- 是什么导致XRP跌破2.10美元? ETF流出和技术弱势将代币推至关键支撑位以下。

- ETF流出有多大? XRP现货ETF在1月8日出现约4100万美元的净提款。

- XRP在哪里找到日内支撑? Bitstamp数据显示,价格在2.06美元处找到底部,然后反弹至2.10美元。

- 这对全球市场有什么重要性? 这一反转抹去了年初的涨幅,并在XRP市值达到1440亿美元后冷却了动能。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。